by Calculated Risk on 10/17/2017 10:06:00 AM

Tuesday, October 17, 2017

NAHB: Builder Confidence increased to 68 in October

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in October, up from 64 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Rises Four Points in October

Builder confidence in the market for newly-built single-family homes rose four points to a level of 68 in October on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This was the highest reading since May.

“This month’s report shows that home builders are rebounding from the initial shock of the hurricanes,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “However, builders need to be mindful of long-term repercussions from the storms, such as intensified material price increases and labor shortages.”

“It is encouraging to see builder confidence return to the high 60s levels we saw in the spring and summer,” said NAHB Chief Economist Robert Dietz. “With a tight inventory of existing homes and promising growth in household formation, we can expect the new home market continue to strengthen at a modest rate in the months ahead.”

...

All three HMI components posted gains in October. The component gauging current sales conditions rose five points to 75 and the index charting sales expectations in the next six months increased five points to 78. Meanwhile, the component measuring buyer traffic ticked up a single point to 48.

Looking at the three-month moving averages for regional HMI scores, the South rose two points to 68 and the Northeast rose one point to 50. Both the West and Midwest remained unchanged at 77 and 63, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Industrial Production Increased 0.3% in September

by Calculated Risk on 10/17/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.3 percent in September. The rates of change for July and August were notably revised; the current estimate for July, a decrease of 0.1 percent, was 0.5 percentage point lower than previously reported, while the estimate for August, a decrease of 0.7 percent, was 0.2 percentage point higher than before. The estimates for manufacturing, mining, and utilities were each revised lower in July. The continued effects of Hurricane Harvey and, to a lesser degree, the effects of Hurricane Irma combined to hold down the growth in total production in September by 1/4 percentage point.[1] For the third quarter as a whole, industrial production fell 1.5 percent at an annual rate; excluding the effects of the hurricanes, the index would have risen at least 1/2 percent. Manufacturing output edged up 0.1 percent in September but fell 2.2 percent at an annual rate in the third quarter. The indexes for mining and utilities in September rose 0.4 percent and 1.5 percent, respectively. At 104.6 percent of its 2012 average, total industrial production in September was 1.6 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in September to 76.0 percent, a rate that is 3.9 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.0% is 3.9% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in September to 104.6. This is 20.1% above the recession low, and close to the pre-recession peak.

The hurricanes are still impacting this data.

Monday, October 16, 2017

Tuesday: Industrial Production, Homebuilder Confidence

by Calculated Risk on 10/16/2017 06:46:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates were sideways to slightly higher today, depending on the lender. Underlying bond markets suggested a bit more movement, and that will likely be reflected in tomorrow morning's rate sheets unless bonds improve overnight. [30YR FIXED - 3.875-4.0%]Tuesday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 76.2%.

• At 10:00 AM, The October NAHB homebuilder survey. The consensus is for a reading of 64, unchanged from 64 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

Housing Starts and the Unemployment Rate

by Calculated Risk on 10/16/2017 02:49:00 PM

By request, here is an update to a graph I haven't posted in several years ...

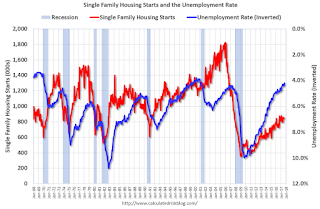

The graph below shows single family housing starts (red) and the unemployment rate (blue, inverted) through September 2017. Note: Of course there are many other factors impacting the unemployment rate, but housing is a key sector.

Usually when single family housing starts are increasing, then the unemployment rate is falling (with a lag).

You can see both the correlation and the lag. Housing starts fall (or increase) first, followed by the unemployment rate. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Here is what I wrote when I first posted this graph in 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.That is exactly what happened.

Usually near the end of a recession, residential investment1 (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the 2007 recession, with the huge overhang of existing housing units, this key sector didn't participate for a few years.

Currently I expect single family housing starts to continue to increase (still historically low), and for the unemployment rate to fall further.

1 RI is mostly new home sales and home improvement.

Phoenix Real Estate in September: Sales up slightly, Inventory down 10% YoY

by Calculated Risk on 10/16/2017 11:03:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in September were up 0.9% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 10.4% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the eleventh consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (3.1% through July or 5.4% annual rate).

| September Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Sept-08 | 6,179 | --- | 1,041 | 16.8% | 54,4271 | --- |

| Sept-09 | 7,907 | 28.0% | 2,776 | 35.1% | 38,340 | -29.6% |

| Sept-10 | 6,762 | -14.5% | 2,904 | 42.9% | 45,202 | 17.9% |

| Sept-11 | 7,892 | 16.7% | 3,470 | 44.0% | 26,950 | -40.4% |

| Sept-12 | 6,478 | -17.9% | 2,849 | 44.0% | 21,703 | -19.5% |

| Sept-13 | 6,313 | -2.5% | 2,106 | 33.4% | 23,405 | 7.8% |

| Sept-14 | 6,252 | -1.0% | 1,609 | 25.7% | 26,492 | 13.2% |

| Sept-15 | 6,980 | 11.6% | 1,573 | 22.5% | 23,396 | -11.7% |

| Sept-16 | 7,421 | 6.3% | 1,499 | 20.2% | 24,195 | 3.4% |

| Sept-17 | 7,485 | 0.9% | 1,592 | 21.3% | 21,680 | -10.4% |

| 1 September 2008 probably includes pending listings | ||||||

NY Fed: Manufacturing Activity "grew at a robust pace" in October

by Calculated Risk on 10/16/2017 08:44:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew at a robust pace in New York State, according to firms responding to the October 2017 Empire State Manufacturing Survey. The headline general business conditions index climbed six points to 30.2, its highest level in three years. The new orders index came in at 18.0 and the shipments index rose eleven points to 27.5—readings that pointed to ongoing solid gains in orders and shipments. ...This was well above the consensus forecast of a reading of 20.0.

...

The index for number of employees rose five points to 15.6, suggesting that employment expanded more strongly this month, while the average workweek index registered zero, indicating that the average workweek held steady. ...

Indexes assessing the six-month outlook suggested that firms continued to be optimistic about future conditions. The index for future business conditions climbed six points to 44.8, and the index for future new orders also came in at 44.8. Employment was expected to increase modestly.

emphasis added

Sunday, October 15, 2017

Sunday Night Futures

by Calculated Risk on 10/15/2017 08:00:00 PM

Weekend:

• Schedule for Week of Oct 15, 2017

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 20.0, down from 24.4.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 future are up 4 and DOW futures are up 30 (fair value).

Oil prices were up over the last week with WTI futures at $51.80 per barrel and Brent at $57.72 per barrel. A year ago, WTI was at $50, and Brent was at $49 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.45 per gallon. A year ago prices were at $2.25 per gallon - so gasoline prices are up 20 cents per gallon year-over-year.

Fed Chair Janet Yellen "The Economy and Monetary Policy"

by Calculated Risk on 10/15/2017 09:06:00 AM

From Fed Chair Janet Yellen: The Economy and Monetary Policy. A few excerpts on inflation:

Inflation readings over the past several months have been surprisingly soft, however, and the 12-month change in core PCE prices has fallen to 1.3 percent. The recent softness seems to have been exaggerated by what look like one-off reductions in some categories of prices, especially a large decline in quality-adjusted prices for wireless telephone services. More generally, it is common to see movements in inflation of a few tenths of a percentage point that are hard to explain, and such "surprises" should not really be surprising. My best guess is that these soft readings will not persist, and with the ongoing strengthening of labor markets, I expect inflation to move higher next year. Most of my colleagues on the FOMC agree. In the latest Summary of Economic Projections, my colleagues and I project inflation to move higher next year and to reach 2 percent by 2019.

To be sure, our understanding of the forces that drive inflation is imperfect, and we recognize that this year's low inflation could reflect something more persistent than is reflected in our baseline projections. The fact that a number of other advanced economies are also experiencing persistently low inflation understandably adds to the sense among many analysts that something more structural may be going on. Let me mention a few possibilities of more fundamental influences.

First, given that estimates of the natural rate of unemployment are so uncertain, it is possible that there is more slack in U.S. labor markets than is commonly recognized, which may be true for some other advanced economies as well. If so, some further tightening in the labor market might be needed to lift inflation back to 2 percent.

Second, some measures of longer-term inflation expectations have edged lower over the past few years in several major economies, and it remains an open question whether these measures might be reflecting a true decline in expectations that is broad enough to be affecting actual inflation outcomes.

Third, our framework for understanding inflation dynamics could be misspecified in some way. For example, global developments--perhaps technological in nature, such as the tremendous growth of online shopping--could be helping to hold down inflation in a persistent way in many countries. Or there could be sector-specific developments--such as the subdued rise in medical prices in the United States in recent years--that are not typically included in aggregate inflation equations but which have contributed to lower inflation. Such global and sectoral developments could continue to be important restraining influences on inflation. Of course, there are also risks that could unexpectedly boost inflation more rapidly than expected, such as resource utilization having a stronger influence when the economy is running closer to full capacity.

In this economic environment, with ongoing improvements in labor market conditions and softness in inflation that is expected to be temporary, the FOMC has continued its policy of gradual policy normalization.

Saturday, October 14, 2017

Schedule for Week of Oct 15, 2017

by Calculated Risk on 10/14/2017 08:09:00 AM

The key economic reports this week are September housing starts and existing home sales.

For manufacturing, September industrial production, and the October New York Fed and Philly Fed manufacturing surveys, will be released this week.

This week is bookended by two speeches by Fed Chair Janet Yellen (on Sunday, and then on Friday night).

At 9:00 AM ET, Speech by Fed Chair Janet Yellen, The Economy and Monetary Policy, At the 32nd Annual G30 International Banking Seminar, Washington, D.C.

8:30 AM: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 20.0, down from 24.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 76.2%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 64, unchanged from 64 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for September. The consensus is for 1.170 million SAAR, down from the August rate of 1.180 million.

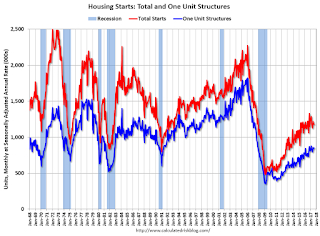

8:30 AM: Housing Starts for September. The consensus is for 1.170 million SAAR, down from the August rate of 1.180 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 243 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.2, down from 23.8.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.35 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.35 million in August.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2017

At 7:30 PM, Speech by Fed Chair Janet Yellen, Monetary Policy Since the Financial Crisis, At the National Economists Club Herbert Stein Memorial Lecture and Annual Dinner, Washington, D.C

Friday, October 13, 2017

Oil Rigs "The US oil rig count eased back again"

by Calculated Risk on 10/13/2017 06:07:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Oct 13, 2017:

• The US oil rig count eased back again

• Total US oil rigs were down 5 to 743

• Horizontal oil rigs were down 3 to 638

...

• In May, $50 WTI would have brought forth a gain of nearly 10 rigs per week. Today, $50 oil at best will hold rig counts steady.

• To regain upward momentum, our model suggests WTI would have to reach about $56 / barrel. WTI was trading at $51.40 today.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.