by Calculated Risk on 10/24/2017 12:48:00 PM

Tuesday, October 24, 2017

Chemical Activity Barometer "Bounces Back" in October

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Bounces Back, Following Historic September Storms

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), notched an increase over September’s reading both on a three-month moving average (3MMA) basis and an unadjusted basis. The CAB was up 0.2 percent and 0.7 percent, respectively. The increases reflected a bounce back from the effects of Hurricanes Harvey and Irma. Compared to a year earlier, the CAB is up 3.0 percent on a 3MMA basis, a slower pace than the previous nine months, but one that continues to suggest further gains in U.S. business activity into 2018.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production. The year-over-year increase in the CAB has slowed recently, but this still suggests further gains in industrial production in 2018.

Richmond Fed: "Manufacturing Activity Remained Positive in October"

by Calculated Risk on 10/24/2017 10:03:00 AM

From the Richmond Fed: Reports on Fifth District Manufacturing Activity Remained Positive in October

Reports on Fifth District manufacturing activity remained positive in October, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index dropped, affected by a notable decline in the shipments index, which fell from 22 to 9, but it remained positive across all components, indicating continued growth. While most manufacturing indexes fell in October, the wage index increased from 17 to 24, which is the highest it has been since May of 2000.This suggests decent growth in October.

Manufacturing firms remained optimistic about growth in the next six months. Most expectations indexes rose, with the exception of employment and average workweek, which both remained positive and were well above current values.

emphasis added

Monday, October 23, 2017

"Mortgage Rates Holding Recent Highs to Begin Week"

by Calculated Risk on 10/23/2017 06:46:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Holding Recent Highs to Begin Week

Mortgage rates were generally unchanged today despite slight improvements in underlying bond markets. As of last Friday, the average lender was quoting rates at or near the highest levels in more than 2 months, meaning today earns the same dubious distinction. The saving grace is that in relative terms, the past 2-3 months have been historically less volatile than normal, and conventional 30yr fixed rates at 4% (or just under) are still widely available for top tier scenarios.Tuesday:

emphasis added

• At 10:00 AM ET, 10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

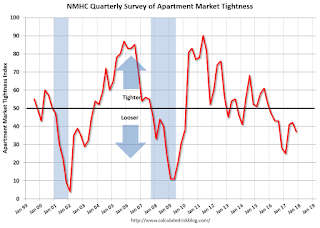

NMHC: Apartment Market Tightness Index remained negative for Eighth Consecutive Quarter

by Calculated Risk on 10/23/2017 02:19:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Markets Decline Slightly in the October NMHC Quarterly Survey

Market conditions for the apartment industry remained soft in the National Multifamily Housing Council’s (NMHC) October Quarterly Survey of Apartment Market Conditions. While the Market Tightness (37), Sales Volume (45) and Equity Finance (46) Indexes remained below the breakeven level of 50 – with the Debt Financing Index (51) edging just above 50 – there was little change compared with three months earlier.

“The apartment market is headed into a seasonally slow leasing period with new deliveries easing upward pressure on rents and occupancy rates in many markets around the country,” said NMHC Chief Economist Mark Obrinsky. “The big increase in multifamily starts in 2015 and 2016 is finally filtering through to the marketplace on a broad basis.”

“Leasing activity appears to have picked up in Texas and Florida in the aftermath of Hurricanes Harvey and Irma. Some respondents also noted that fires on the West Coast may be pushing occupancy rates up,” said Obrinsky. “Elsewhere, new deliveries are leading to concessions becoming more commonplace.”

The Market Tightness Index decreased from 42 to 37, marking the eighth consecutive quarter of overall declining conditions. Forty percent of respondents reported looser conditions than three months prior, compared to just 14 percent who reported tighter conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the eighth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Duy's FedWatch: In Defense of the conventional Wisdom

by Calculated Risk on 10/23/2017 02:05:00 PM

From Tim Duy at FedWatch: In Defense of the conventional Wisdom. Excerpt:

Altogether, looking at the history of the past sixty years or so, I think it is reasonable for a policymaker to conclude that while they may not yet have a perfect model to guide policy, they have a reasonable approximation to a perfect model that delivers outcomes that are generally consistent with their mandates. Moreover, are the potential gains of adopting a new framework such as, for example a nominal GDP target, worth the potential costs of abandoning the conventional wisdom? I think that is a reasonable question.

In short, while many, including myself, have criticized the Fed for living in the past and continuously re-fighting the inflation wars of the 1970s, I can argue that those criticisms fail to acknowledge the improvement of outcomes since the 1970s. We argue about 50bp of inflation, for example, when the real gains were made in the first 500bp. This issue is worth considering before dismissing the validity of the conventional wisdom among monetary policymakers. They have good reasons for maintaining that wisdom.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 10/23/2017 11:48:00 AM

Note: This is a repeat of a June post with updated statistics and graph.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 13.3% under Mr. Trump compared to up 34.3% under Mr. Obama for the same number of market days.

Chicago Fed "Index Points to a Pickup in Economic Growth in September"

by Calculated Risk on 10/23/2017 09:04:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in September

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up to +0.17 in September from –0.37 in August. All four broad categories of indicators that make up the index increased from August, and three of the four categories made positive contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, was unchanged at –0.16 in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in September (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, October 22, 2017

Sunday Night Futures

by Calculated Risk on 10/22/2017 07:48:00 PM

Weekend:

• Schedule for Week of Oct 22, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 future are up 3 and DOW futures are up 22 (fair value).

Oil prices were up over the last week with WTI futures at $52.15 per barrel and Brent at $58.01 per barrel. A year ago, WTI was at $50, and Brent was at $50 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.44 per gallon. A year ago prices were at $2.22 per gallon - so gasoline prices are up 22 cents per gallon year-over-year.

Hotel Occupancy Rate increases YoY, Just behind Record Year

by Calculated Risk on 10/22/2017 09:53:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 14 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 8-14 October 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 9-15 October 2016, the industry recorded the following:

• Occupancy: +2.4% to 72.3%

• Average daily rate (ADR): +5.3% to US$130.83

• Revenue per available room (RevPAR): +7.8% to US$94.58

STR analysts note that U.S. performance growth was lifted due to a comparison with a Jewish holiday time period last year.

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in occupancy (+37.3% to 85.2%) and RevPAR (+57.0% to US$99.76).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of last year, and just behind the record year in 2015. The hurricanes might push the annual occupancy rate to a new record.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, October 21, 2017

Schedule for Week of Oct 22, 2017

by Calculated Risk on 10/21/2017 08:11:00 AM

The key economic reports this week are the advance estimate of Q3 GDP, and New Home sales for September.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

9:00 AM ET: FHFA House Price Index for August 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: New Home Sales for September from the Census Bureau.

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for 555 thousand SAAR, down from 560 thousand in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 222 thousand the previous week.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 0.5% increase in the index.

8:30 AM: Gross Domestic Product, 3rd quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.5% annualized in Q3.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 101.1, unchanged from the preliminary reading 101.1.