by Calculated Risk on 10/26/2017 10:06:00 AM

Thursday, October 26, 2017

NAR: Pending Home Sales Index unchanged in September, Down 3.5% Year-over-year

From the NAR: Pending Home Sales Flatten in September

Pending home sales were unchanged in September, but activity declined on an annual basis both nationally and in all major regions, according to the National Association of Realtors®.This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, was at 106.0 in September (unchanged from a downwardly revised August figure). The index is now at its lowest reading since January 2015 (104.7), is 3.5 percent below a year ago, and has fallen on an annual basis in five of the past six months

...

The PHSI in the Northeast rose 1.2 percent to 94.5 in September, but is still 2.4 percent below a year ago. In the Midwest the index climbed 1.4 percent to 102.9 in September, but remains 2.5 percent lower than September 2016.

Pending home sales in the South decreased 2.3 percent to an index of 115.9 in September and are now 5.0 percent below last September. The index in the West grew 1.9 percent in September to 102.7, but is 2.9 percent below a year ago.

emphasis added

Weekly Initial Unemployment Claims increase to 233,000

by Calculated Risk on 10/26/2017 08:34:00 AM

The DOL reported:

In the week ending October 21, the advance figure for seasonally adjusted initial claims was 233,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 239,500, a decrease of 9,000 from the previous week's revised average. The previous week's average was revised up by 250 from 248,250 to 248,500.The previous week was revised up.

Claims taking procedures continue to be severely disrupted in Puerto Rico and the Virgin Islands as a result of power outages and infrastructure damage caused by Hurricanes Irma and Maria.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 239,500.

This was close to the consensus forecast.

Wednesday, October 25, 2017

Thursday: Unemployment Claims, Pending Home Sales

by Calculated Risk on 10/25/2017 08:02:00 PM

From Matthew Graham at Mortgage News Daily: Rates Now Up an Eighth of a Point From Last Week

Mortgage rates continued higher at a relatively fast pace today, pushing farther into the highest levels since early July. As of this afternoon, the average lender is right in line with those rate offerings from July. Any higher and we'd have to go back another 2 months to see comparable rates.Thursday:

...

In fact, for many lenders, the cost of offering a 30yr fixed rate of 3.875% last week now matches the cost of a 4.0% rate this week. Clients who'd seen quotes of 4.0% are now seeing 4.125%. The average is somewhere in between for top tier scenarios.

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 222 thousand the previous week.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is for a 0.5% increase in the index.

Philly Fed: State Coincident Indexes increased in 38 states in September

by Calculated Risk on 10/25/2017 02:49:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2017. Over the past three months, the indexes increased in 37 states and decreased in 13, for a three-month diffusion index of 48. In the past month, the indexes increased in 38 states, decreased in 10, and remained stable in two, for a one-month diffusion index of 56.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 39 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the recent sharp decrease in the number of states with increasing activity is unclear.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.Recently several states have turned red.

Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

A few Comments on September New Home Sales

by Calculated Risk on 10/25/2017 12:28:00 PM

New home sales for September were reported at 667,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the highest sales rate since October 2007. The three previous months were revised up slightly.

There was clearly some rebound following hurricane Harvey. Sales in the South were up sharply from August, and at the highest level since July 2007. Some contracts in the South, that would have been signed in August, were probably delayed until September. Also some people who lost homes might have signed contracts for new homes in September (New home sales are counted when contracts are signed).

Sales were up 17.0% year-over-year in September.

Earlier: New Home Sales increase to 667,000 Annual Rate in September.

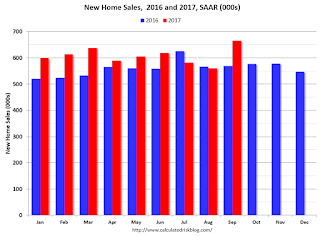

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate).

For the first nine months of 2017, new home sales are up 8.6% compared to the same period in 2016.

This was a solid year-over-year increase through September.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 667,000 Annual Rate in September

by Calculated Risk on 10/25/2017 10:16:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 667 thousand.

The previous three months combined were revised up slightly.

"Sales of new single-family houses in September 2017 were at a seasonally adjusted annual rate of 667,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 18.9 percent above the revised August rate of 561,000 and is 17.0 percent above the September 2016 estimate of 570,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in September to 5.0 months from 6.0 month in August.

The months of supply decreased in September to 5.0 months from 6.0 month in August. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of September was 279,000. This represents a supply of 5.0 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2017 (red column), 52 thousand new homes were sold (NSA). Last year, 44 thousand homes were sold in September.

The all time high for September was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was well above expectations of 555,000 sales SAAR, and the previous months were revised up slightly. Some of the pickup was probably hurricane related (delayed signings). I'll have more later today.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 10/25/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 20, 2017. The previous week’s results included an adjustment for the Columbus Day holiday.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.14 percent from 4.16 percent, with points remaining unchanged at 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

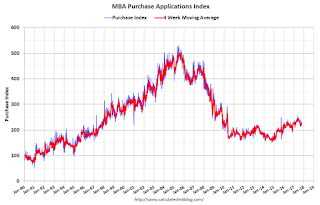

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, October 24, 2017

Wednesday: New Home Sales, Durable Goods

by Calculated Risk on 10/24/2017 08:35:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

• At 9:00 AM, FHFA House Price Index for August 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for 555 thousand SAAR, down from 560 thousand in August.

Freddie Mac: Mortgage Serious Delinquency rate increased in September

by Calculated Risk on 10/24/2017 05:09:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in September was at 0.86%, up from 0.84% in August. Freddie's rate is down from 1.02% in September 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the highest serious delinquency rate since May of this year.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

In the short term - over the next several months - the rate will probably increase slightly due to the hurricanes.

After the hurricane bump, maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for September soon.

Vehicle Forecast: Sales Expected to Exceed 17 million SAAR in October

by Calculated Risk on 10/24/2017 04:38:00 PM

The automakers will report October vehicle sales on Wednesday, Nov 1st.

Note: There are 25 selling days in October 2017, there were 26 selling days in October 2016.

From WardsAuto: U.S. Forecast: October Auto Sales Rate Flat with Prior-Year

A WardsAuto forecast calls for U.S. automakers to deliver 1.31 million light vehicles in October. A daily sales rate of 52,579 units over 25 days is nearly equivalent to like-2016’s 52,584 units for 26 days.Sales had been below 17 million SAAR for six consecutive months, until September, when sales spiked due to buying following Hurricane Harvey. Sales in October were probably also elevated due to the hurricanes.

...

The report puts the seasonally adjusted annual rate of sales for October at 17.55 million units, behind year-ago’s 17.80 million and prior-month’s 18.48 million mark.

emphasis added