by Calculated Risk on 11/02/2017 10:00:00 AM

Thursday, November 02, 2017

October Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for October. A key question is how much did hurricanes Harvey and Irma impact employment in September - and how much will employment bounce back in October. Merrill Lynch economists expect the following:

We forecast that nonfarm payrolls increased by 350k in October fully reversing the decline owing to hurricanes in September. We look for the unemployment rate to edge back up to 4.3% after an unexpected drop in September. On wages, we expect average hourly earnings to increase by 0.3% mom bringing the year over year rate to 2.8%.The consensus, according to Bloomberg, is for an increase of 325,000 non-farm payroll jobs in October (with a range of estimates between 200,000 to 371,000), and for the unemployment rate to be unchanged at 4.2%.

The BLS reported 33,000 jobs lost in October.

Here is a summary of recent data:

• The ADP employment report showed an increase of 235,000 private sector payroll jobs in October. This was above consensus expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to or above expectations.

• The ISM manufacturing employment index decreased in October to 59.8%%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 35,000 in October. The ADP report indicated manufacturing jobs increased 22,000 in October.

The ISM non-manufacturing employment index for October has not been released yet.

• Initial weekly unemployment claims averaged 232,500 in October, down sharply from 267,000 in September. For the BLS reference week (includes the 12th of the month), initial claims were at 223,000, down from 260,000 during the reference week in September.

The decrease during the reference week suggests a much stronger employment report in October than in September.

• The final October University of Michigan consumer sentiment index increased to 100.7 from the September reading of 95.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: The ADP report and weekly claims suggest a strong employment report. My guess is the employment report is strong (well over 200,000), but might fall short of the consensus.

Note: The revisions to October will be interesting. In September 2005, after hurricane Katrina, the BLS initially reported 35,000 jobs lost (that was later revised up to a gain of 67,000 jobs). As I noted in The Record Job Streak: A couple of Comments, the record job streak might still be ongoing, if employment in October is revised up enough.

Weekly Initial Unemployment Claims decrease to 229,000

by Calculated Risk on 11/02/2017 08:33:00 AM

The DOL reported:

In the week ending October 28, the advance figure for seasonally adjusted initial claims was 229,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The 4-week moving average was 232,500, a decrease of 7,250 from the previous week's revised average. This is the lowest level for this average since April 7, 1973 when it was 232,250. The previous week's average was revised up by 250 from 239,500 to 239,750.The previous week was revised up.

Claims taking procedures continue to be severely disrupted in the Virgin Islands. The ability to take claims has improved in Puerto Rico and they are now processing backlogged claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 232,500 - the lowest since 1973..

This was below the consensus forecast.

Wednesday, November 01, 2017

Bloomberg: Jerome Powell to be named Next Fed Chair

by Calculated Risk on 11/01/2017 07:01:00 PM

From Bloomberg: Trump Selects Powell for Fed Chairman, Replacing Yellen

President Donald Trump plans to nominate Federal Reserve Governor Jerome Powell to the top job at the U.S. central bank, three people familiar with the decision said.A few comments:

Trump, who has said he’ll announce his pick Thursday, would be choosing a former private-equity executive who favors continuing gradual interest-rate increases and sympathizes with White House calls to ease financial regulations.

1) Dr. Janet Yellen has done an outstanding job as Fed Chair.

2) This breaks the historical pattern of setting politics aside and reappointing the Fed Chair (a shameful break in precedent).

3) I hope Dr. Yellen stays on the Fed until her term as governor expires in 2024. Please stay!

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 233 thousand the previous week.

U.S. Light Vehicle Sales at 18.0 million annual rate in October

by Calculated Risk on 11/01/2017 03:38:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 18.0 million SAAR in October.

From WardsAuto:

Another month ended well beyond expectations, as replacement sales and inventory clear-out boosted the daily sales rate to a 15-year high.That is up 1% from October 2016, and down 2.6% from last month.

U.S. automakers sold 1.35 million vehicles in October, resulting in a daily sales rate of 53,945, 2.6% above prior-year.

A 18.00 million SAAR was ahead of year-ago’s 17.80 million and behind prior-month’s exceptionally high 18.48 million mark.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 18.0 million SAAR mostly from WardsAuto).

This was above the consensus forecast of 17.5 million for October (Note: Hurricane Harvey pushed down sales at the end of August - and this was part of the bounce back).

Still, after two consecutive years of record sales, vehicle sales will be down in year-over-year in 2017.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

Fannie Mae: Mortgage Serious Delinquency rate increased in September

by Calculated Risk on 11/01/2017 02:42:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate increased to 1.01% in September, from 0.99% in August. The serious delinquency rate is down from 1.24% in September 2016.

The increase in September is probably due to the hurricanes.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 2.75% are seriously delinquent. For loans made in 2005 through 2008 (7% of portfolio), 5.83% are seriously delinquent, For recent loans, originated in 2009 through 2017 (89% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

In the short term - over the next several months - the delinquency rate will probably increase slightly due to the hurricanes. After the hurricane bump, maybe the rate will decline another 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Freddie Mac reported earlier.

FOMC Statement: No Change to Policy

by Calculated Risk on 11/01/2017 02:02:00 PM

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate despite hurricane-related disruptions. Although the hurricanes caused a drop in payroll employment in September, the unemployment rate declined further. Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters. Gasoline prices rose in the aftermath of the hurricanes, boosting overall inflation in September; however, inflation for items other than food and energy remained soft. On a 12-month basis, both inflation measures have declined this year and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Hurricane-related disruptions and rebuilding will continue to affect economic activity, employment, and inflation in the near term, but past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term. Consequently, the Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further. Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The balance sheet normalization program initiated in October 2017 is proceeding.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Jerome H. Powell; and Randal K. Quarles.

emphasis added

Construction Spending increased in September

by Calculated Risk on 11/01/2017 11:24:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in September:

Construction spending during September 2017 was estimated at a seasonally adjusted annual rate of $1,219.5 billion, 0.3 percent above the revised August estimate of $1,216.0 billion. The September figure is 2.0 percent above the September 2016 estimate of $1,195.6 billion.Private spending decreased, and public spending increased, in September:

Spending on private construction was at a seasonally adjusted annual rate of $942.7 billion, 0.4 percent below the revised August estimate of $946.2 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $276.8 billion, 2.6 percent above the revised August estimate of $269.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 24% below the bubble peak.

Non-residential spending is now 3% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009, and 5% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 10%. Non-residential spending is down 4% year-over-year. Public spending is down 2% year-over-year.

This was above the consensus forecast of a 0.1% increase for September, however private spending for previous months was revised down slightly - and public spending revised up.

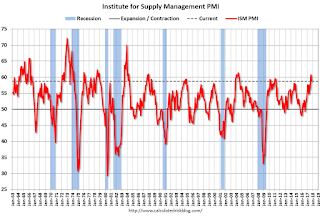

ISM Manufacturing index decreased to 58.7 in October

by Calculated Risk on 11/01/2017 10:04:00 AM

The ISM manufacturing index indicated expansion in October. The PMI was at 58.7% in October, down from 60.8% in September. The employment index was at 59.8%, down from 60.3% last month, and the new orders index was at 63.4%, down from 64.6%.

From the Institute for Supply Management: October 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October, and the overall economy grew for the 101st consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The October PMI® registered 58.7 percent, a decrease of 2.1 percentage points from the September reading of 60.8 percent. The New Orders Index registered 63.4 percent, a decrease of 1.2 percentage points from the September reading of 64.6 percent. The Production Index registered 61 percent, a 1.2 percentage point decrease compared to the September reading of 62.2 percent. The Employment Index registered 59.8 percent, a decrease of 0.5 percentage point from the September reading of 60.3 percent. The Supplier Deliveries Index registered 61.4 percent, a 3 percentage point decrease from the September reading of 64.4 percent. The Inventories Index registered 48 percent, a decrease of 4.5 percentage points from the September reading of 52.5 percent. The Prices Index registered 68.5 percent in October, a 3 percentage point decrease from the September level of 71.5, indicating higher raw materials prices for the 20th consecutive month. Comments from the panel reflect expanding business conditions, with new orders, production, employment, order backlogs and export orders all continuing to grow in October, supplier deliveries continuing to slow (improving) and inventories contracting during the period. Prices continue to remain under pressure. The Customers’ Inventories Index remains at low levels."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 59.5%, and suggests manufacturing expanded at a slower pace in October than in September.

Still a strong report.

ADP: Private Employment increased 235,000 in October

by Calculated Risk on 11/01/2017 08:21:00 AM

Private sector employment increased by 235,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

“The job market remains healthy and hiring bounced back with one of the best performances we’ve seen all year,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although the service providing sector was hard hit last month due to the weather, we saw significant growth in professional services, especially in the higher paid professional technical jobs. Additionally, small businesses rebounded well from the impact of Hurricanes Harvey and Irma, posting very strong gains.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market rebounded strongly from the hit it took from Hurricanes Harvey and Irma. Resurgence in construction jobs shows the rebuilding is already in full swing. Looking through the hurricane-created volatility, job growth is robust.”

The BLS report for October will be released Friday, and the consensus is for 323,000 non-farm payroll jobs added in September.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/01/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 27, 2017.

... The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to its highest level since July 2017, 4.22 percent, from 4.18 percent, with points increasing to 0.43 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.