by Calculated Risk on 11/03/2017 06:43:00 PM

Friday, November 03, 2017

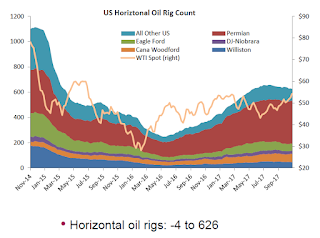

Oil Rigs "Rigs counts were off this week"

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Nov 3, 2017:

• Rigs counts were off this week

• Total US oil rigs were down, -8 to 729

• Horizontal oil rigs fell, -4 to 626, the lowest since May

...

• Oil rigs will begin to see a marked recovery heading into December

• The gap between Brent and WTI continues above $6 / barrel, with WTI now at $55 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 11/03/2017 03:23:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just nine months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,510,000 under President G.H.W. Bush (light purple), and 11,756,000 under President Obama (dark blue).

During the first nine months of Mr. Trump's term, the economy has added 1,419,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first nine months of Mr. Trump's term, the economy has added 50,000 public sector jobs.

After nine months of Mr. Trump's presidency, the economy has added 1,469,000 jobs, about 406,000 behind the projection.

Earlier: ISM Non-Manufacturing Index increased to 60.1% in October

by Calculated Risk on 11/03/2017 01:03:00 PM

Earlier: The October ISM Non-manufacturing index was at 60.1%, up from 59.8% in September. The employment index increased in October to 57.5%, from 56.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 94th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 60.1 percent, which is 0.3 percentage point higher than the September reading of 59.8 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. This is the highest NMI® reading since the index’s debut in 2008. The highest reading among pre-2008 composite index calculations is 61.3 percent in August 2005. The Non-Manufacturing Business Activity Index increased to 62.2 percent, 0.9 percentage point higher than the September reading of 61.3 percent, reflecting growth for the 99th consecutive month, at a slightly faster rate in October. The New Orders Index registered 62.8 percent, 0.2 percentage point lower than the reading of 63 percent in September. The Employment Index increased 0.7 percentage point in October to 57.5 percent from the September reading of 56.8 percent. The Prices Index decreased by 3.6 percentage points from the September reading of 66.3 percent to 62.7 percent, indicating prices increased in October for the fifth consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector has reflected the third consecutive month of strong growth. Respondent comments continue to indicate a positive outlook for business conditions, and the economy as we begin the fourth quarter."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in October than in September.

Trade Deficit at $43.5 Billion in September

by Calculated Risk on 11/03/2017 11:11:00 AM

Earlier from the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.5 billion in September, up $0.7 billion from $42.8 billion in August, revised. September exports were $196.8 billion, $2.1 billion more than August exports. September imports were $240.3 billion, $2.8 billion more than August imports.

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in September.

Exports are 19% above the pre-recession peak and up 5% compared to September 2016; imports are 3% above the pre-recession peak, and up 6% compared to September 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $45.16 in September, up from $44.11 in August, and up from $39.01 in September 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $34.6 billion in September, from $32.5 billion in September 2016.

Comment on Employment Report: Hurricane Bounce Back, Record Job Streak Still Alive!

by Calculated Risk on 11/03/2017 09:55:00 AM

The headline jobs number was strong at 261 thousand - due to a bounce back from the hurricanes - but below expectations. However a key reason for the "disappointing" headline number was that the previous two months were revised up by a combined 90 thousand jobs.

The upward revision to the September jobs report keeps the record job streak alive at 85 consecutive months (92 months if we remove the decennial Census hiring and firing). This was a strong possibility that I discussed last month, see: The Record Job Streak: A couple of Comments

Earlier: October Employment Report: 261,000 Jobs Added, 4.1% Unemployment Rate

In October, the year-over-year change was 2.004 million jobs. This is still trending down (excluding the hurricane related drop last month).

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.4% YoY in October.

Wage growth has generally been trending up, and wages in October were probably impacted by low wage jobs returning following the hurricanes.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 369,000 to 4.8 million in October. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find full-time jobs. Over the past 12 months, the number of involuntary part-time workers has decreased by 1.1 million.The number of persons working part time for economic reasons decreased in October. This is the lowest level since December 2007. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 7.9% in October. This is the lowest level for U-6 since December 2006, and matches the low of the previous cycle.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.621 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.73 million in September.

This is trending down, but still a little elevated.

The headline jobs number was solid (including revisions), the unemployment rate down, and U-6 the lowest since 2006 - all positive signs. Wage growth was disappointing, but that might be hurricane related.

October Employment Report: 261,000 Jobs Added, 4.1% Unemployment Rate

by Calculated Risk on 11/03/2017 08:43:00 AM

From the BLS:

Total nonfarm payroll employment rose by 261,000 in October, and the unemployment rate edged down to 4.1 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for August was revised up from +169,000 to +208,000, and the change for September was revised up from -33,000 to +18,000. With these revisions, employment was 90,000 higher than previously reported.

...

Average hourly earnings for all employees on private nonfarm payrolls, at $26.53, were little changed in October (-1 cent), after rising by 12 cents in September. Over the past 12 months, average hourly earnings have increased by 63 cents, or 2.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 261 thousand in October (private payrolls increased 252 thousand).

Payrolls for August and September were revised up by a combined 90 thousand. The upward revision to the September report keeps the record job streak alive!

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October the year-over-year change was 2.04 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased in October to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate decreased in October to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio decreased to 60.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in October to 4.1%.

This was below expectations of 323,000 jobs, however the previous two months combined were revised up. The headline jobs number was strong - mostly due to a bounce back from the impact of the hurricanes - and the unemployment rate declined further. However wages were weak.

I'll have much more later ...

Thursday, November 02, 2017

Friday: Employment Report, Trade Deficit, ISM non-Mfg

by Calculated Risk on 11/02/2017 07:43:00 PM

My October Employment Preview

and Goldman: October Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for October. The consensus is for an increase of 323,000 non-farm payroll jobs added in October, up from the 33,000 non-farm payroll jobs lost in September. The consensus is for the unemployment rate to increase to 4.3%.

• Also at 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.4 billion in September from $42.4 billion in August.

• At 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 58.7 from 59.8 in September.

Is a Recession Imminent?

by Calculated Risk on 11/02/2017 02:43:00 PM

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

Last Friday I posted five economic questions I'm frequently asked. Earlier this week I discussed: Are house prices in a new bubble?

Another common question is: Is a recession imminent (within the next 12 months)? Once again my short answer was: No.

First, I use NBER to date recessions and expansions. The trough of the recent recession was in June 2009, and the current expansion has lasted for 101 months. This is already the 3rd longest expansion in NBER history (since mid-1800s), trailing only the '90s expansion (from March '91 to Mar '01), and the '60s (from Feb '61 to Dec '69).

However, just because this is a long expansion, doesn't mean the expansion will end soon. Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.

There are several reasons this has been a long expansion. Recoveries from a financial crisis tend to be slow since it takes years to resolve all the excesses. Also, there was an early pivot during the recovery to fiscal austerity that slowed the pace of recovery. Importantly, the Federal Reserve didn't overtighten like in the '30s (a lesson learned). And housing, always a key cyclical sector, didn't participate early in the recovery since there were so many foreclosures. This delayed the usual boost from housing, but housing now a key driver of the expansion.

Usually there is a clear reason for a recession. When I started this blog in January 2005, I was writing about the "housing bubble", and expressing concern that the then coming housing bust would lead the economy into a recession (and possibly a financial crisis). But I wasn't forecasting an immediate recession, and at the beginning of 2006, I thought it was too early to call for a recession. It wasn't until 2007 that I started forecasting a recession (just made it with the recession starting in December 2007).

This isn't to be self-congratulatory on my forecasting, but rather to point out there was a clear reason (housing bust), and that it took time for the housing bubble to burst, and more time for the bust to drag the economy into recession.

So what would be the reason now? Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably raise rates slowly.

I see analysts express concern about the yield curve, the debt, war with North Korea, hyperinflation and more. I don't think these are a concern.

Note: Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

If a recession happens quickly, it will probably be the result of an exogenous event, such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are extremely low that they will happen in the next few years or even decades - so I just ignore these possibilities.

So what am I watching? Housing. (Housing starts, New home sales, Residential Investment). I've written extensively about how housing is usually the best leading indicator for the economy.

The following graph shows Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

The arrows point to the peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. And to show that housing usually turns down prior to a recession.

Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

A key exception was the 2001 recession that was due to the bursting of the stock bubble and less business investment. But that was easy to understand and forecast.

Right now I don't see any reason for a recession in the near term (through at least 2018).

Goldman: October Payrolls Preview

by Calculated Risk on 11/02/2017 01:24:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 340k in October, above consensus of +310k and the 3-month average pace of +91k. Our forecast reflects solid underlying job growth and a sharp rebound in employment in hurricane-affected areas, as we estimate flooding and power outages reduced the level of September payrolls by approximately 180k.

We estimate the unemployment rate was unchanged at 4.2% ... we expect average hourly earnings to increase 0.2% month over month and 2.7% year over year.

emphasis added

October Employment Preview

by Calculated Risk on 11/02/2017 10:00:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for October. A key question is how much did hurricanes Harvey and Irma impact employment in September - and how much will employment bounce back in October. Merrill Lynch economists expect the following:

We forecast that nonfarm payrolls increased by 350k in October fully reversing the decline owing to hurricanes in September. We look for the unemployment rate to edge back up to 4.3% after an unexpected drop in September. On wages, we expect average hourly earnings to increase by 0.3% mom bringing the year over year rate to 2.8%.The consensus, according to Bloomberg, is for an increase of 325,000 non-farm payroll jobs in October (with a range of estimates between 200,000 to 371,000), and for the unemployment rate to be unchanged at 4.2%.

The BLS reported 33,000 jobs lost in October.

Here is a summary of recent data:

• The ADP employment report showed an increase of 235,000 private sector payroll jobs in October. This was above consensus expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to or above expectations.

• The ISM manufacturing employment index decreased in October to 59.8%%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 35,000 in October. The ADP report indicated manufacturing jobs increased 22,000 in October.

The ISM non-manufacturing employment index for October has not been released yet.

• Initial weekly unemployment claims averaged 232,500 in October, down sharply from 267,000 in September. For the BLS reference week (includes the 12th of the month), initial claims were at 223,000, down from 260,000 during the reference week in September.

The decrease during the reference week suggests a much stronger employment report in October than in September.

• The final October University of Michigan consumer sentiment index increased to 100.7 from the September reading of 95.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: The ADP report and weekly claims suggest a strong employment report. My guess is the employment report is strong (well over 200,000), but might fall short of the consensus.

Note: The revisions to October will be interesting. In September 2005, after hurricane Katrina, the BLS initially reported 35,000 jobs lost (that was later revised up to a gain of 67,000 jobs). As I noted in The Record Job Streak: A couple of Comments, the record job streak might still be ongoing, if employment in October is revised up enough.