by Calculated Risk on 11/14/2017 02:18:00 PM

Tuesday, November 14, 2017

LA area Port Traffic: Imports increased YoY, Exports decreased YoY in October

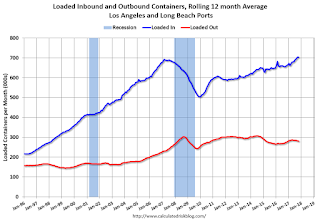

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.1% compared to the rolling 12 months ending in September. Outbound traffic was down 0.7% compared to the rolling 12 months ending in September.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

This was the 2nd highest level of imports ever for the month of October - following record imports in July, August and September - suggesting the retailers are optimistic about the Christmas Holiday shopping season.

In general imports have been increasing, and exports are mostly moving sideways to down recently.

A few random thoughts on Taxes

by Calculated Risk on 11/14/2017 12:54:00 PM

A few random thoughts ...

Income and corporate taxes are just part of the tax system. Americans pay a wide variety of taxes. These include sales, property, payroll, state and Federal income and corporate taxes, and more. Many of these taxes are regressive, meaning that lower income families pay a higher percentage of their income for these taxes. Sales taxes and payroll taxes are example of regressive taxes.

There are some "hidden" taxes, such as resource extraction taxes (severance tax "imposed on the removal of non-renewable natural resources") and state lotteries. The severance tax is borne primarily by consumers, and is therefore regressive - and lotteries are also regressive.

The main non-regressive taxes are income and corporate taxes. Higher income families generally pay a higher percentage of their income for these taxes. So when there is a discussion of reducing corporate and income taxes - and "broadening the base" for income taxes - this makes the entire tax system more regressive.

To make the system more progressive (where higher income families pay a higher percentage of their income in taxes), the discussion would be about decreasing regressive taxes (like the payroll tax), or increasing income and corporate taxes.

Why change the tax code? There could be many reasons to change the code: to make it simpler, to encourage certain activities (homeownership, investment, education, etc.), or to remove existing tax preferences, to spur growth, to reduce the deficit, to change the balance of who pays taxes.

As an example, to spur growth we could look for ways to lower income and wealth inequality (this is slowing growth in the US), and also ways to put more money in the hands of low to middle income families (people who tend to spend additional money). Examples of policies to spur growth in the short term would be reducing the payroll tax, and for growth in the longer term, increase the estate tax (and make it unavoidable).

What about the business cycle? If we look at the business cycle and the deficit, economic theory suggests that the government should increase the deficit during economic downturns, and work down the deficit during expansions. The economy is currently in the mid-to-late stage of a recovery, so decreasing the deficit makes sense now.

Conclusion: Right now it might make sense to reduce the payroll tax, increase income taxes - especially the estate tax (and make it unavoidable) - and reduce the deficit. Basically the opposite of the current proposal that reduces the burden on high income earners, offset by more debt and increasing the burden on low-to-middle income families.

NFIB: Small Business Optimism Index "inches up" in October

by Calculated Risk on 11/14/2017 09:22:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Index inches up in October in October

The October Index rose to 103.8, up from 103 the previous month. The historically strong performance extends the streak of positive months dating back to last November, when it shot up immediately following the election.

Four of the Index components rose last month. Five declined slightly, while one remained unchanged. Outlook for expansion and sales expectations each jumped six points, while job openings increased by five points.

The tight labor market got tighter for small business owners last month, continuing a year-long trend. Fifty-nine percent of owners said they tried to hire in October, with 88 percent of them reporting no or few qualified applicants. Hiring activity was particularly high in Florida and Georgia, as construction firms are still trying to meet higher demand caused by the recent hurricane.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased slightly to 103.8 in October.

Monday, November 13, 2017

"Mortgage Rates Sideways to Slightly Higher"

by Calculated Risk on 11/13/2017 05:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates were unchanged to slightly higher today, keeping them in line with their highest levels in more than 2 weeks, depending on the lender [30YR FIXED - 4.0%]. Bond markets (which underlie mortgage rates) were in slightly better shape this morning, but that failed to translate to rate sheet improvements due to bond market weakness on Friday afternoon.Tuesday:

There were no significant economic reports or market moving headlines for bonds/rates today, but that will quickly change as the week progresses. Wednesday brings a key inflation report--the Consumer Price Index (CPI). Markets are also interested in any meaningful tax bill headlines, including the vote scheduled for the House version of the bill on Thursday.

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/13/2017 01:20:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

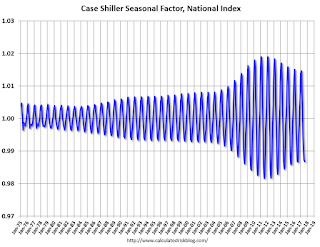

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through August 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

U.S. Heavy Truck Sales up Year-over-year in October

by Calculated Risk on 11/13/2017 09:27:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2017 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 364 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 411 thousand SAAR in October 2017, down from 440 thousand in September, and up from 364 thousand in October 2016.

Sunday, November 12, 2017

Sunday Night Futures

by Calculated Risk on 11/12/2017 07:19:00 PM

Weekend:

• Schedule for Week of Nov 12, 2017

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 4, and DOW futures are up 44 (fair value).

Oil prices were up over the last week with WTI futures at $56.88 per barrel and Brent at $64.65 per barrel. A year ago, WTI was at $43, and Brent was at $42 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.56 per gallon. A year ago prices were at $2.17 per gallon - so gasoline prices are up 39 cents per gallon year-over-year.

Port of Long Beach: Another Record Month in October

by Calculated Risk on 11/12/2017 08:09:00 AM

From the Port of Long Beach: Port Sets Record for October Cargo, Long Beach on pace for highest-ever volumes in 2017

A year of records continues at the Port of Long Beach, where this October was the busiest in history, as container volumes surged 15 percent compared to the same month a year ago.CR Note: I'll have more on port traffic soon.

Trade has been growing so rapidly in 2017 that the record-setting October — at 669,218 twenty-foot-equivalent units (TEUs), one of the Port’s strongest all-time results — was only the fourth-busiest month of the year behind July, September and August.

“October used to be the industry’s busiest month of the year, with retailers preparing for Christmas,” said Port of Long Beach Executive Director Mario Cordero. “Now, with other popular shopping seasons like back-to-school, Halloween and Black Friday, ocean carriers are spreading shipments across more months to maximize the services we have developed to serve them.”

Inbound containers destined for retailers jumped 14.3 percent to 339,013 TEUs. Export boxes decreased slightly, 0.5 percent, to 126,150 containers. Empty containers sent overseas to be refilled with goods increased 28.9 percent, to 204,055 TEUs.

...

Through the first 10 months of the year, 6,234,930 TEUs have been moved through the Port, a 9.5 percent increase over the same period in 2016.

Saturday, November 11, 2017

Schedule for Week of Nov 12, 2017

by Calculated Risk on 11/11/2017 08:11:00 AM

The key economic reports this week are October housing starts, retail sales and the Consumer Price Index (CPI).

For manufacturing, October industrial production, and the November New York Fed, Philly Fed and Kansas City Fed manufacturing surveys, will be released this week.

No economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for October.

8:30 AM: The Producer Price Index for October from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: Retail sales for October be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for October be released. The consensus is for a 0.1% increase in retail sales.This graph shows retail sales since 1992 through September 2017.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 26.0, down from 30.2.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.1% increase in inventories.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, down from 239 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 25.0, down from 27.9.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 76.2%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 67, down from 68 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for October. The consensus is for 1.188 million SAAR, up from the September rate of 1.127 million.

8:30 AM: Housing Starts for October. The consensus is for 1.188 million SAAR, up from the September rate of 1.127 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

10:00 AM: State Employment and Unemployment (Monthly) for October 2017

11:00 AM: the Kansas City Fed manufacturing survey for November.

Friday, November 10, 2017

Oil Rigs "A Sharp Rebound in the Rig Count"

by Calculated Risk on 11/10/2017 04:01:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Nov 10, 2017:

• Rigs counts rebounded sharply this week, essentially reversing last week’s losses

• Total US oil rigs were up +9 to 738

• Horizontal oil rigs rose, +11 to 637, the highest in a the last month

...

• The gap between Brent and WTI continues above $6 / barrel, with WTI now near $57 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.