by Calculated Risk on 11/22/2017 10:49:00 AM

Wednesday, November 22, 2017

Philly Fed: State Coincident Indexes increased in 41 states in October

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2017. Over the past three months, the indexes increased in 40 states, decreased in nine, and remained stable in one, for a three-month diffusion index of 62. In the past month, the indexes increased in 41 states, decreased in seven, and remained stable in two, for a one-month diffusion index of 68.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Recently several states have turned red.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In October, 42 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the mid-2017 sharp decrease in the number of states with increasing activity is unclear.

MBA: Mortgage Applications Increase Slightly in Latest Weekly Survey

by Calculated Risk on 11/22/2017 09:39:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Surve

Mortgage applications increased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 17, 2017.

... The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.20 percent from 4.18 percent, with points increasing to 0.42 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

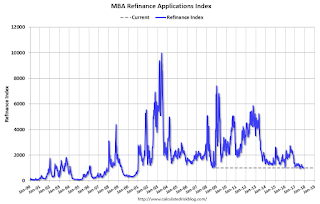

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 4% year-over-year.

Weekly Initial Unemployment Claims decrease to 239,000

by Calculated Risk on 11/22/2017 08:33:00 AM

The DOL reported:

In the week ending November 18, the advance figure for seasonally adjusted initial claims was 239,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 249,000 to 252,000. The 4-week moving average was 239,750, an increase of 1,250 from the previous week's revised average. The previous week's average was revised up by 750 from 237,750 to 238,500.The previous week was revised up.

Claims taking procedures continue to be disrupted in the Virgin Islands. The ability to take claims has improved in Puerto Rico.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 239,750.

This was close to the consensus forecast. The low level of claims suggest relatively few layoffs.

Tuesday, November 21, 2017

Wednesday: Durable Goods, Unemployment Claims, FOMC Minutes

by Calculated Risk on 11/21/2017 07:19:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 249 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 97.9, up from the preliminary reading 97.8.

• At 2:00 PM, FOMC Minutes, Meeting of October 31- November 1, 2017

NYU Stern's "In Conversation with Mervyn King" Series Presents Janet Yellen, Tuesday, November 21, 2017

Chemical Activity Barometer Increased in November

by Calculated Risk on 11/21/2017 04:57:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues Solid Gains Into 3rd Quarter

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), notched another solid increase over October’s reading both on a three-month moving average (3MMA) basis and an unadjusted basis. The CAB was up 0.4 percent and 0.3 percent, respectively. The increases continued a bounce back from the effects of Hurricanes Harvey and Irma. Compared to a year earlier, the CAB is up 3.3 percent on a 3MMA basis, a pace that continues to suggest further gains in U.S. commercial and industrial activity into 2nd quarter 2018.

...

pplying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production. The year-over-year increase in the CAB has slowed recently, but this still suggests further gains in industrial production in 2018.

FDIC: Fewer Problem banks, Residential REO Declined in Q3

by Calculated Risk on 11/21/2017 02:45:00 PM

The FDIC released the Quarterly Banking Profile for Q3 today:

Higher net interest income, reflecting modest growth in interest-bearing assets and wider net interest margins, helped earnings increase in the third quarter. Quarterly net income at the 5,737 commercial banks and savings institutions insured by the FDIC rose to $47.9 billion, an increase of $2.4 billion (5.2 percent) from third quarter 2016.1 The average return on assets (ROA) rose to 1.12 percent from 1.10 percent a year earlier. More than two out of every three banks—67.3 percent—reported year-over-year increases in earnings, and 59.8 percent reported higher quarterly ROAs. Only 3.9 percent of banks reported net losses for the quarter, compared with 4.6 percent in third quarter 2016.

...

The Deposit Insurance Fund (DIF) balance increased by $2.9 billion, to $90.5 billion, during the third quarter. ... The DIF’s reserve ratio (the fund balance as a percent of estimated insured deposits) rose to 1.28 percent on September 30, 2017, from 1.24 percent at June 30, 2017, and 1.18 percent four quarters ago. The September 30, 2017, reserve ratio is the highest for the DIF since June 30, 2005, when the reserve ratio was also 1.28 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined slightly:

During the third quarter, mergers absorbed 50 insured institutions. Two new charters were added during the third quarter, and there were no bank failures. ... The number of banks on the FDIC’s “Problem Bank List” declined from 105 to 104 during the third quarter. Total assets of “problem” banks fell from $17.2 billion to $16 billion.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $3.30 billion in Q2 2017 to $3.08 billion in Q3. This is the lowest level of REOs since Q4 2006.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $3.30 billion in Q2 2017 to $3.08 billion in Q3. This is the lowest level of REOs since Q4 2006.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, it is unlikely FDIC institution REOs will get back to the $2.0 to $2.5 billion range back that happened in 2003 to 2005. FDIC REOs will probably bottom close to the current level.

A Few Comments on October Existing Home Sales

by Calculated Risk on 11/21/2017 12:43:00 PM

Earlier: NAR: "Existing-Home Sales Grow 2.0 Percent in October"

My view is a sales rate of 5.48 million is solid. In fact, I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Inventory is still very low and falling year-over-year (down 10.4% year-over-year in October). Inventory has declined year-over-year for 29 consecutive months. I started the year expecting inventory would be increasing year-over-year by the end of 2017. However it looks like 2017 will be another year of declining inventory.

Inventory is a key metric to watch. More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (458,000, red column) were above sales in October 2016 (445,000, NSA) and at the highest level for October since 2006.

Sales NSA are now slowing seasonally, and sales NSA will be lower through February.

NAR: "Existing-Home Sales Grow 2.0 Percent in October"

by Calculated Risk on 11/21/2017 10:00:00 AM

From the NAR: Existing-Home Sales Grow 2.0 Percent in October

Existing-home sales increased in October to their strongest pace since earlier this summer, but continual supply shortages led to fewer closings on an annual basis for the second straight month, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 2.0 percent to a seasonally adjusted annual rate of 5.48 million in October from a downwardly revised 5.37 million in September. After last month's increase, sales are at their strongest pace since June (5.51 million), but still remain 0.9 percent below a year ago.

...

Total housing inventory at the end of October decreased 3.2 percent to 1.80 million existing homes available for sale, and is now 10.4 percent lower than a year ago (2.01 million) and has fallen year-over-year for 29 consecutive months. Unsold inventory is at a 3.9-month supply at the current sales pace, which is down from 4.4 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.48 million SAAR) were 2.0% higher than last month, and were 0.9% below the October 2016 rate.

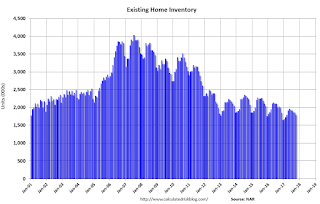

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.80 million in October from 1.86 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.80 million in October from 1.86 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 10.4% year-over-year in October compared to October 2016.

Inventory decreased 10.4% year-over-year in October compared to October 2016. Months of supply was at 3.9 months in October.

As expected by CR readers, sales were above the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Chicago Fed "Index Points to a Pickup in Economic Growth in October"

by Calculated Risk on 11/21/2017 08:39:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in October

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.65 in October from +0.36 in September. One of the four broad categories of indicators that make up the index increased from September, but three of the four categories made positive contributions to the index in October. The index’s three-month moving average, CFNAI-MA3, increased to +0.28 in October from +0.01 in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in October (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Black Knight: National Mortgage Delinquency Rate increased in October due to Hurricanes

by Calculated Risk on 11/21/2017 08:01:00 AM

From Black Knight: Black Knight’s First Look at October 2017 Mortgage Data: National Delinquency Rate Sees Second Consecutive Annual Rise as Impact from Hurricanes Continues

• October’s 4BPS increase in the national delinquency rate can be directly linked to continued hurricane impact, while delinquencies fell 14BPS in non-affected areasAccording to Black Knight's First Look report for October, the percent of loans delinquent increased 0.9% in October compared to September, and increased 2.0% year-over-year.

• Though delinquencies were down in all states except Texas and Florida, in FEMA-declared Hurricanes Harvey and Irma disaster areas, they rose another 24 percent (186BPS) in October

• The most notable increase was in Florida, where delinquencies spiked 36 percent from September in hurricane-affected areas

• Over 229,000 past-due mortgages can now be attributed to Hurricanes Irma (163,000) and Harvey (66,000)

• Total non-current inventories in Florida and Texas (all loans 30 or more days past due or in foreclosure) have risen 79 and 30 percent, respectively, over the past six months

...

• The inventory of loans in active foreclosure continues to improve, falling below 350,000 for the first time since 2006

The percent of loans in the foreclosure process declined 2.8% in October and were down 31.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.44% in October, up from 4.40% in September.

The percent of loans in the foreclosure process declined in October to 0.68%.

The number of delinquent properties, but not in foreclosure, is up 60,000 properties year-over-year, and the number of properties in the foreclosure process is down 156,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2017 | Sept 2017 | Oct 2016 | Oct 2015 | |

| Delinquent | 4.44% | 4.40% | 4.35% | 4.77% |

| In Foreclosure | 0.68% | 0.70% | 0.99% | 1.43% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,262,000 | 2,245,000 | 2,202,000 | 2,415,000 |

| Number of properties in foreclosure pre-sale inventory: | 348,000 | 358,000 | 504,000 | 721,000 |

| Total Properties | 2,610,000 | 2,603,000 | 2,706,000 | 3,136,000 |