by Calculated Risk on 11/27/2017 10:12:00 AM

Monday, November 27, 2017

New Home Sales increase to 685,000 Annual Rate in October

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 685 thousand.

The previous three months combined were revised down.

"Sales of new single-family houses in October 2017 were at a seasonally adjusted annual rate of 685,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.2 percent above the revised September rate of 645,000 and is 18.7 percent above the October 2016 estimate of 577,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in October to 4.9 months from 5.2 month in September.

The months of supply decreased in October to 4.9 months from 5.2 month in September. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of October was 282,000. This represents a supply of 4.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

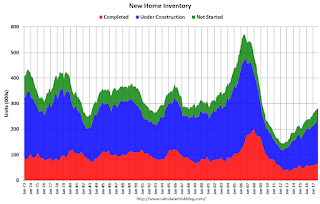

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2017 (red column), 55 thousand new homes were sold (NSA). Last year, 46 thousand homes were sold in October.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was well above expectations of 620,000 sales SAAR, however the previous months were revised down, combined. Some of the recent pickup might be hurricane related (delayed signings). I'll have more later today.

Sunday, November 26, 2017

Monday: New Home Sales

by Calculated Risk on 11/26/2017 06:34:00 PM

Weekend:

• Schedule for Week of Nov 26, 2017

Monday:

• At 10:00 AM ET, New Home Sales for October from the Census Bureau. The consensus is for 620 thousand SAAR, down from 667 thousand in September.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for November.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up slightly, and DOW futures are up 10 (fair value).

Oil prices were up over the last week with WTI futures at $58.87 per barrel and Brent at $63.79 per barrel. A year ago, WTI was at $47, and Brent was at $46 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.50 per gallon. A year ago prices were at $2.13 per gallon - so gasoline prices are up 37 cents per gallon year-over-year.

Q4 GDP Forecasts

by Calculated Risk on 11/26/2017 08:38:00 AM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.4 percent on November 22, unchanged from November 17.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast for 2017:Q4 stands at 3.7%.From Merrill Lynch:

We continue to track 2.3% for 4Q.From Goldman Sachs:

We revised up our Q4 GDP tracking estimate by a total of three tenths to 2.6% (qoq ar) over the last weekCR Note: These forecasts are for Q4. The second estimate of Q3 GDP will be released this week, and the consensus is that real GDP increased 3.3% annualized in Q3, up from 3.0% in the advance report.

Saturday, November 25, 2017

Schedule for Week of Nov 26, 2017

by Calculated Risk on 11/25/2017 08:11:00 AM

The key economic reports this week are the second estimate of Q3 GDP, and New Home sales for October.

Other key indicators include Case-Shiller house prices for September, the November ISM manufacturing index, and November auto sales.

10:00 AM ET: New Home Sales for October from the Census Bureau.

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for 620 thousand SAAR, down from 667 thousand in September.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November.

9:00 AM ET: FHFA House Price Index for September 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

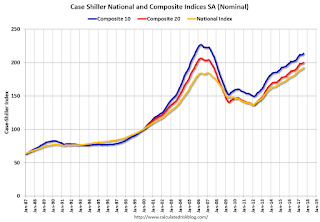

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for September.

9:45 AM: Testimony, Fed Governor Jerome Powell, Nomination Hearing, Committee on Banking, Housing, and Urban Affairs, U.S. Senate

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional surveys for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 3rd quarter 2017 (Second estimate). The consensus is that real GDP increased 3.3% annualized in Q3, up from 3.0% in the advance report.

10:00 AM: Testimony, Fed Chair Janet Yellen, Economic Outlook, Joint Economic Committee, U.S. Congress

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 64.0, down from 66.2 in October.

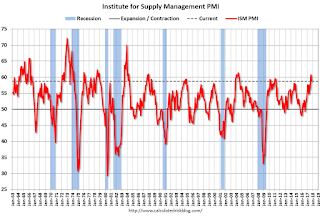

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 58.4, down from 58.7 in September.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 58.4, down from 58.7 in September.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in October. The PMI was at 58.4% in October, the employment index was at 59.8%, and the new orders index was at 63.4%.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to be 17.6 million SAAR in November, down from 18.0 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to be 17.6 million SAAR in November, down from 18.0 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

Friday, November 24, 2017

November 2017: Unofficial Problem Bank list declines to 108 Institutions

by Calculated Risk on 11/24/2017 03:53:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2017. The list declined by three to 108 banks after four removals and one addition. Aggregate assets dropped by $1.1 billion to $25.5 billion, with the drop including $105 million from asset shrinkage using updated third quarter figures. A year ago, the list held 173 institutions with assets of $59.9 billion.

Actions were terminated against Pacific Valley Bank, Salinas, CA ($256 million Ticker: PVBK); Grand Bank, National Association, Hamilton, NJ ($210 million); and First Trust & Savings Bank of Albany, Illinois , Albany, IL ($193 million). First National Bank, Waupaca, WI ($429 million) found its way off the list through a merger partner.

Joining the list this month is Citizens Savings Bank and Trust Company, Nashville, TN ($108 million).

This week the FDIC released their official Problem Bank figures for the end of the third quarter of 2017. The FDIC official list holds 104 institutions with assets of $16.0 billion, which equates to an average asset size of about $154 million. Last quarter, the FDIC said the official list had 105 institutions with assets of $17.2 billion, which equated to an average asset size of $164 million. Thus, during the third quarter of 2017, the FDIC had a net change of one institution and removed $1.2 billion of assets from their official list.

Las Vegas: On Pace for Record Convention Attendance in 2017

by Calculated Risk on 11/24/2017 11:15:00 AM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to new record highs.

As of September, visitor traffic is running slightly behind the record set in 2016 and on pace to be 8% above the pre-recession peak.

And convention attendance is now at record levels too. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

At this pace, convention attendance will set a new record in 2017, and be 2% above the pre-recession peak set in 2006.

There were many housing related conventions during the housing bubble, so it took some time for convention attendance to recover. But attendance has really picked up over the last three years.

Hotel Occupancy Rate Increased Year-over-Year, On Pace for Record Year

by Calculated Risk on 11/24/2017 08:09:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 18 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 12-18 November 2017, according to data from STR.Note: The hurricanes continues to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 13-19 November 2016, the industry recorded the following:

• Occupancy: +0.8% to 66.1%

• Average daily rate (ADR): +1.9% to US$124.65

• Revenue per available room (RevPAR): +2.6% to US$82.42

Among the Top 25 Markets, Houston, Texas, reported the largest increase in all three key performance metrics: occupancy (+27.0% to 80.3%), ADR (+11.0% to US$117.82) and RevPAR (+40.9% to US$94.60).

Miami/Hialeah, Florida, posted the second-highest increase in RevPAR (+22.5% to US$155.08), due primarily to the second-largest increase in occupancy (+11.9% to 83.4%)

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will probably push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, November 23, 2017

Five Economic Reasons to be Thankful

by Calculated Risk on 11/23/2017 08:19:00 AM

With a Hat Tip to Neil Irwin (he started doing this several years ago) ... here are five economic reasons to be thankful this Thanksgiving ...

1) Low unemployment rate.

The unemployment rate declined to 4.1% in October. The unemployment rate is down from 4.8% in October 2016 (a year ago), and is down from the cycle peak of 10.0% in October 2009.

This is the lowest level for the unemployment rate since December 2000.

Also, this is the largest decline in the unemployment rate, from cycle peak-to-trough, since the BLS started tracking the unemployment rate in 1948. (In the early '80s, the unemployment rate declined from 10.8% to 5.0%; a decline of 5.8 percentage points. The current decline from 10.0% to 4.1% is 5.9 percentage points!)

2) Low unemployment claims.

Here is a graph of initial weekly unemployment claims.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims is at 239,750.

The low level of claims suggests relatively few layoffs.

3) Job Openings Near Record Levels.

There were 6.09 million job openings in September. This is close to the record high of 6.14 million in July 2017.

Job openings (yellow) have been above 5 million for 33 consecutive months.

Note that Quits are up 4% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

More job openings, and rising quits, are positive signs for the labor market.

4) Household Debt burdens are near record lows.

Household debt burdens have declined sharply over the last several years.

The Household debt service ratio was at 13.2% in 2007, and has fallen to under 10% now.

The overall Debt Service Ratio increased slightly in Q2 2017, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) was unchanged in Q2 and is also near a record low (not shown).

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests aggregate household cash flow has improved.

5) New Home Sales are increasing - and will probably increase more.

New home sales were at 667 thousand SAAR (Seasonally Adjusted Annual Rate) in September, up from 570 thousand SAAR in September 2016, and up from the cycle low of 270 thousand SAAR in February 2011. This was the highest sales rate since October 2007.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically and will probably increase over the next couple of years.

There are still problems, some people have not participated in the current expansion, wage growth has stalled in 2017 after picking up in 2015 and 2016, wealth and income inequality are at record extremes, and climate change is posing a real threat to the economy in the future - but there are economic reasons to be thankful this Thanksgiving.

Happy Thanksgiving to All!

Wednesday, November 22, 2017

FOMC Minutes: Several Participants Worried about "A sharp reversal in asset Prices"

by Calculated Risk on 11/22/2017 03:04:00 PM

A couple of key excerpts, the first on asset prices, and the second that low inflation might "prove more persistent".

From the Fed: Minutes of the Federal Open Market Committee, October 31-November 1, 2017:

In their comments regarding financial markets, participants generally judged that financial conditions remained accommodative despite the recent increases in the exchange value of the dollar and Treasury yields. In light of elevated asset valuations and low financial market volatility, several participants expressed concerns about a potential buildup of financial imbalances. They worried that a sharp reversal in asset prices could have damaging effects on the economy. It was noted, however, that elevated asset prices could be partly explained by a low neutral rate of interest. It was also observed that regulatory changes had contributed to an appreciable strengthening of capital and liquidity positions in the financial sector over recent years, increasing the resilience of the financial system to potential reversals in valuations.

...

Many participants observed, however, that continued low readings on inflation, which had occurred even as the labor market tightened, might reflect not only transitory factors, but also the influence of developments that could prove more persistent. A number of these participants were worried that a decline in longer-term inflation expectations would make it more challenging for the Committee to promote a return of inflation to 2 percent over the medium term. These participants' concerns were sharpened by the apparently weak responsiveness of inflation to resource utilization and the low level of the neutral interest rate, and such considerations suggested that the removal of policy accommodation should be quite gradual. In contrast, some other participants were concerned about upside risks to inflation in an environment in which the economy had reached full employment and the labor market was projected to tighten further, or about still very accommodative financial conditions. They cautioned that waiting too long to remove accommodation, or removing accommodation too slowly, could result in a substantial overshoot of the maximum sustainable level of employment that would likely be costly to reverse or could lead to increased risks to financial stability. A few of these participants emphasized that the lags in the response of inflation to tightening resource utilization implied that there could be increasing upside risks to inflation as the labor market tightened further.

emphasis added

Vehicle Forecast: Sales Expected to Exceed 17 million SAAR Again in November

by Calculated Risk on 11/22/2017 12:17:00 PM

The automakers will report November vehicle sales on Friday, Dec 1st.

Note: There are 25 selling days in November 2017, there were also 25 selling days in November 2016.

From WardsAuto: November U.S. Forecast: Post Sales-Surge Market Will Hit 17.1 Million SAAR

A WardsAuto forecast calls for U.S. automakers to deliver 1.36 million light vehicles in November.Sales had been below 17 million SAAR (Seasonally Adjusted Annual Rate) for six consecutive months, until September (18.5 million SAAR) and October (18.0 million SAAR), when sales spiked due to buying following Hurricane Harvey. Sales in November were probably also a little elevated due to the hurricanes.

...

The report puts the seasonally adjusted annual rate of sales for the month at 17.1 million units, below last year’s 17.6 million and last month’s exceptionally high 18.0 million.

emphasis added

Even with the pickup in sales in September and October, sales are still down about 2% through October compared to the same period in 2006.