by Calculated Risk on 12/04/2017 10:00:00 AM

Monday, December 04, 2017

Black Knight Mortgage Monitor: Tax Changes may Reduce Supply of Homes for Sale

Black Knight released their Mortgage Monitor report for October today. According to Black Knight, 4.44% of mortgages were delinquent in October, up from 4.35% in October 2016. Black Knight also reported that 0.68% of mortgages were in the foreclosure process, down from 0.99% a year ago.

This gives a total of 5.12% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Tax Reform Could Further Constrict Already Tight Housing Inventory, While Increasing Net Housing Expenses for Many Buyers

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of October 2017. Given the significant impact proposed changes to the tax code could have on the housing and mortgage markets, this month Black Knight explored the impact from the Senate and House versions of tax reform as currently written. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, proposed changes to the standard deduction, mortgage interest deduction (MID) and capital gains exemptions in particular could put even more pressure on already limited available housing inventory, with ramifications for both current homeowners and prospective buyers.

“Both tax reform proposals double the standard tax deduction, which may, in many cases, provide a greater benefit to renters than to homeowners,” said Graboske. “It may also reduce the tax incentive to purchase a home and generally make the MID less valuable to borrowers. We’ve observed in the past that positive tax incentives can certainly impact home buying decisions – the Black Knight Home Price Index showed clear evidence of this as a result of 2008’s first-time homebuyer tax credit. However, limited data is available to examine the effects of removing an existing tax incentive on borrowers’ purchase behavior. One thing that seems clear is that a reduction of the MID could further constrain available housing inventory, which itself has helped to push home prices even higher in many places. Almost 3 million active first-lien mortgages -- current mortgage holders -- have original balances exceeding $500K -- the cap proposed in the House version of the tax bill. These borrowers would be exempt from the limit. We’ve already seen signs of ‘interest rate lock’ on the market, as homeowners with low interest rate mortgages have a disincentive to sell in a rising rate environment. The question now becomes whether the proposed tax reform adds another layer of ‘tax deduction lock’ on the market. Do these homeowners now also have a disincentive to sell their home in order to keep their current interest rate deduction of up to $1 million? If so, this would potentially add new supply constraints.

“Lower-priced markets may see little effects from these changes, but the most recent Black Knight Home Price Index shows 22 markets nationwide where the median home price is over $500K. Mortgage originations at or above that point have increased by 350 percent since the bottom of the housing market. At the current rate of growth, we could see approximately 480,000 purchase originations in 2018 with original balances over $500K, with an estimated 2.9 million over the first five years of the tax plan. If home prices continue to rise and the cap is left in place, more families in the upper-middle income range could be impacted. Even if interest rates stayed steady around four percent, a $500K MID cap could cost the average homeowner with a larger mortgage an additional $2,600 - $4,200 per year depending on their tax bracket, representing a 6 to 10 percent increase in housing-related expenses as compared to the average annual principal and interest payment today.”

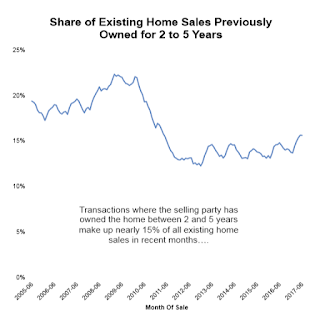

Black Knight also found that proposed changes to the capital gains exemption on profits from the sale of a home (requiring five years of continuous residence as compared to the current two) could impact approximately 750,000 home sellers per year, also potentially increasing pressure on available inventory. Leveraging the company’s SiteX property records database, Black Knight found that on average, over the past 24 months, more than 14 percent of property sales were by homeowners falling into that two-to-five-year window and who would no longer be exempt from capital gains taxation. On average, $60 billion in capital gains each year could be impacted, with a worst-case scenario (taxing the full amount under the highest tax bracket) putting the cost to home sellers at approximately $23 billion. If such homeowners choose to forego or delay selling to avoid a tax liability, this may also further reduce the supply of homes for sale.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graphic from Black Knight looks at the percentage of existing home sales owned from 2 to 5 years.

From Black Knight:

• Currently taxpayers filing jointly can 'exclude' up to $500K of capital gains from the sale of their primary residence (up to $250K for single filers) tax-free, provided they have lived in the property for two years of the preceding fiveThere is much more in the mortgage monitor.

• Both the House and Senate proposals lengthen the ownership requirement to five of the preceding eight years, and homeowners could only use the tax-free provision once every five years

• Black Knight found that over the past 24 months, more than 14 percent of property sales were by homeowners falling into that two-to-five-year window and who would no longer be exempt from capital gains taxation

• On average, $60 billion in capital gains each year could be affected, with a worst-case scenario (taxing the full amount under the highest tax bracket) putting the cost to home sellers at approximately $23 billion

• If such homeowners choose to forego or delay selling their home due to tax liability this may also further reduce the supply of homes for sale

Sunday, December 03, 2017

Sunday Night Futures

by Calculated Risk on 12/03/2017 08:13:00 PM

Weekend:

• Schedule for Week of Dec 3, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 18, and DOW futures are up 218 (fair value).

Oil prices were down slightly over the last week with WTI futures at $58.16 per barrel and Brent at $63.53 per barrel. A year ago, WTI was at $52, and Brent was at $52 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.46 per gallon. A year ago prices were at $2.18 per gallon - so gasoline prices are up 28 cents per gallon year-over-year.

Year-to-Date Performance: Employment, Vehicle Sales, New Home Sales

by Calculated Risk on 12/03/2017 08:12:00 AM

Here are three tables showing year-to-date performance for three key economic metrics: Employment, Vehicle Sales, and New Home Sales.

Each table shows measurements through the most recent report (October for Employment and New home Sales, and November for Vehicle sales), full year, and percent change from the previous year.

As expected, employment growth has slowed in 2017, vehicle sales are down year-over-year, and new home sales are up.

Note: All data is based on monthly NSA data. Employment from the BLS, vehicle sales from BEA (with an estimate for November), and new home sales from Census.

| Employment Gains (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 951 | 951 | |

| 2011 | 1,917 | 2,077 | 118.4% |

| 2012 | 1,931 | 2,246 | 8.1% |

| 2013 | 2,055 | 2,328 | 3.7% |

| 2014 | 2,574 | 3,035 | 30.4% |

| 2015 | 2,318 | 2,736 | -9.9% |

| 2016 | 1,906 | 2,095 | -23.4% |

| 2017 | 1,848 | NA | -3.0%1 |

| 1Year-over-year change for 2017 based on data through October. | |||

| Vehicle Sales (000s) | |||

|---|---|---|---|

| Year | Through November | Full Year | YoY Change |

| 2010 | 10,415 | 11,555 | |

| 2011 | 11,507 | 12,742 | 10.3% |

| 2012 | 13,090 | 14,433 | 13.3% |

| 2013 | 14,182 | 15,530 | 7.6% |

| 2014 | 14,956 | 16,452 | 5.9% |

| 2015 | 15,766 | 17,396 | 5.7% |

| 2016 | 15,783 | 17,465 | 0.4% |

| 2017 | 15,532 | NA | -1.6%1 |

| 1Year-over-year change for 2017 based on data through November. | |||

| New Home Sales (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 279 | 322 | |

| 2011 | 258 | 305 | -5.3% |

| 2012 | 313 | 369 | 21.0% |

| 2013 | 366 | 429 | 16.3% |

| 2014 | 373 | 439 | 2.3% |

| 2015 | 427 | 501 | 14.1% |

| 2016 | 482 | 561 | 12.0% |

| 2017 | 524 | NA | 8.7%1 |

| 1Year-over-year change for 2017 based on data through October. | |||

Saturday, December 02, 2017

Schedule for Week of Dec 3, 2017

by Calculated Risk on 12/02/2017 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the October Trade deficit, and the November ISM non-manufacturing index.

No major economic releases scheduled.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through September. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $47.1 billion in October from $43.5 billion in September.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for index to decrease to 59.0 from 60.1 in October.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 192,000 payroll jobs added in November, down from 235,000 added in October.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand the previous week.

10:00 AM: The Q3 Quarterly Services Report from the Census Bureau.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.0 billion in October.

8:30 AM: Employment Report for November. The consensus is for an increase of 185,000 non-farm payroll jobs added in November, down from the 261,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to be unchanged at 4.1%.

The consensus is for the unemployment rate to be unchanged at 4.1%.This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.04 million jobs.

A key will be the change in wages.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 98.8, up from 98.5 in November.

Friday, December 01, 2017

Oil Rigs "Rigs continue to move ahead"

by Calculated Risk on 12/01/2017 07:35:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Dec 1, 2017:

• Total US oil rigs were up 2 to 749, and up 20 over the last four weeks

• Horizontal oil rigs were up 3 to 648, up 22 in the last four weeks

...

• Once again, WTI appears to be closing on Brent from below, suggesting US excess inventories are thinning.

• The oil price direction remains firmly upward

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

U.S. Light Vehicle Sales at 17.35 million annual rate in November

by Calculated Risk on 12/01/2017 02:58:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.35 million SAAR in November.

That is down 1% from November 2016, and down 3.6% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 17.35 million SAAR from WardsAuto).

This was below the consensus forecast of 17.6 million for November (Note: Hurricane Harvey pushed down sales at the end of August, and sales bounced back in September, October and November).

Still - even with the recent bump in sales - vehicle sales will be down year-over-year in 2017, following two consecutive years of record sales.

Note: dashed line is current estimated sales rate.

Construction Spending increased in October

by Calculated Risk on 12/01/2017 11:22:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in October:

Construction spending during October 2017 was estimated at a seasonally adjusted annual rate of $1,241.5 billion, 1.4 percent above the revised September estimate of $1,224.6 billion. The October figure is 2.9 percent above the October 2016 estimate of $1,206.6 billion.Both private and public spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $949.9 billion, 0.6 percent above the revised September estimate of $943.8 billion ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $291.6 billion, 3.9 percent above the revised September estimate of $280.7 billion.

emphasis added

Click on graph for larger image.

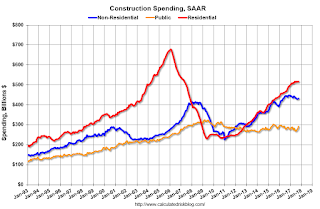

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 24% below the bubble peak.

Non-residential spending has been declining over the last year, but is 4% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 10% below the peak in March 2009, and 11% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 7%. Non-residential spending is down 1% year-over-year. Public spending is up 2% year-over-year.

This was above the consensus forecast of a 0.5% increase for October, and public spending for the previous two months was revised up.

ISM Manufacturing index decreased to 58.2 in November

by Calculated Risk on 12/01/2017 10:03:00 AM

The ISM manufacturing index indicated expansion in November. The PMI was at 58.2% in November, down from 58.7% in October. The employment index was at 59.7%, down from 59.8% last month, and the new orders index was at 64.0%, up from 63.4%.

From the Institute for Supply Management: November 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 102nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The November PMI® registered 58.2 percent, a decrease of 0.5 percentage point from the October reading of 58.7 percent. The New Orders Index registered 64 percent, an increase of 0.6 percentage point from the October reading of 63.4 percent. The Production Index registered 63.9 percent, a 2.9 percentage point increase compared to the October reading of 61 percent. The Employment Index registered 59.7 percent, a decrease of 0.1 percentage point from the October reading of 59.8 percent. The Supplier Deliveries Index registered 56.5 percent, a 4.9 percentage point decrease from the October reading of 61.4 percent. The Inventories Index registered 47 percent, a decrease of 1 percentage point from the October reading of 48 percent. The Prices Index registered 65.5 percent in November, a 3 percentage point decrease from the October level of 68.5, indicating higher raw materials prices for the 21st consecutive month. Comments from the panel reflect expanding business conditions, with New Orders and Production leading gains, employment expanding at a slower rate, order backlogs stable and expanding, and export orders all continuing to grow in November. Supplier deliveries continued to slow (improving), but at slower rates, and inventories continued to contract during the period. Price increases continued, but at a slower rate. The Customers’ Inventories Index improved but remains at low levels."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 58.4%, and suggests manufacturing expanded at a slower pace in November than in October.

Still a solid report.

Thursday, November 30, 2017

Friday: Vehicle Sales, ISM Mfg Index, Construction Spending

by Calculated Risk on 11/30/2017 07:47:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit 1-Month Highs

Mortgage rates actually continued higher today at the same quicker pace seen yesterday. Due to the relatively narrow range during November, rates are now in line with their highest levels in more than a month whereas they were at 2-week lows just 2 days ago. The average lender is now quoting conventional 30yr fixed rates of 4.0% on top tier scenarios, with a few outliers at 3.875% and 4.125%. A few days ago, 3.875% was nearly as prevalent.Tuesday:

• At 10:00 AM ET, ISM Manufacturing Index for November. The consensus is for the ISM to be at 58.4, down from 58.7 in October. In October, the employment index was at 59.8%, and the new orders index was at 63.4%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for November. The consensus is for light vehicle sales to be 17.6 million SAAR in November, down from 18.0 million in October (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate unchanged in October

by Calculated Risk on 11/30/2017 04:18:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 1.01% in October, from 1.01% in September. The serious delinquency rate is down from 1.21% in October 2016.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 2.82% are seriously delinquent. For loans made in 2005 through 2008 (7% of portfolio), 5.91% are seriously delinquent, For recent loans, originated in 2009 through 2017 (89% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

In the short term - over the next couple of months - the delinquency rate will probably increase slightly due to the hurricanes. After the hurricane bump, maybe the rate will decline another 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Freddie Mac reported earlier.