by Calculated Risk on 12/08/2017 08:30:00 AM

Friday, December 08, 2017

November Employment Report: 228,000 Jobs Added, 4.1% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 228,000 in November, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. ... The unemployment rate held at 4.1 percent in November, and the number of unemployed persons was essentially unchanged at 6.6 million.

...

The change in total nonfarm payroll employment for September was revised up from +18,000 to +38,000, and the change for October was revised down from +261,000 to +244,000. With these revisions, employment gains in September and October combined were 3,000 more than previously reported.

...

In November, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $26.55. Over the year, average hourly earnings have risen by 64 cents, or 2.5 percent.

emphasis added

Click on graph for larger image.

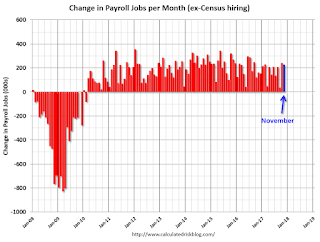

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 228 thousand in November (private payrolls increased 221 thousand).

Payrolls for September and October were revised up by a combined 3 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November the year-over-year change was 2.07 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in November at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate was unchanged in November at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio decreased to 60.1% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in October at 4.1%.

This was above expectations of 185,000 jobs, and the previous two months combined were revised up slightly.

I'll have much more later ...

Thursday, December 07, 2017

Friday: Employment Report

by Calculated Risk on 12/07/2017 08:17:00 PM

My November Employment Preview

and Goldman: November Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for November. The consensus is for an increase of 185,000 non-farm payroll jobs added in November, down from the 261,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to be unchanged at 4.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 98.8, up from 98.5 in November.

Leading Index for Commercial Real Estate "Remains Strong" in November

by Calculated Risk on 12/07/2017 05:28:00 PM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Remains Strong in November

The Dodge Momentum Index surged again in November, climbing 13.9% to 149.5 (2000=100) from the revised October reading of 131.3. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The November increase was the second month of strong gains after a four-month period of softness. November’s advance was the result of healthy gains in both the commercial and institutional sectors. From October to November, the commercial portion of the Momentum Index advanced 19.6%, while the institutional portion grew 5.5%. On a year-over-year basis, the Momentum Index is now nearly 21% higher, with the commercial portion up 24% and the institutional side up 17%. The turnaround in October and November suggest that building activity should continue to expand in 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 149.6 in November, up from 131.3 in October.

The index is up 21% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth into 2018.

Goldman: November Payrolls Preview

by Calculated Risk on 12/07/2017 02:54:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 225k in November, above consensus of +195k. In addition to a firm pace of underlying job growth, our forecast reflects some additional normalization in hurricane-affected regions, as well as above-trend retail job growth associated with the early Thanksgiving. The arrival of over 200k Puerto Ricans in Florida may also boost payroll growth this month.

We estimate the unemployment rate remained unchanged at 4.1%, as the brisk downtrend in recent months seems due a pause. For average hourly earnings, we estimate +0.3% month-over-month (+2.7% yoy) with risks skewed to the upside, reflecting a boost from unwinding hurricane distortions and somewhat favorable calendar effects.

emphasis added

November Employment Preview

by Calculated Risk on 12/07/2017 01:46:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for November. Merrill Lynch economists expect the following:

We forecast that nonfarm payrolls increased by an above-trend 210k in November. While nonfarm payrolls rebounded ... in October, it was well short of offsetting the decline seen in September and therefore we expect a further rebound in job growth in November. ... Elsewhere, we expect the unemployment rate to tick up to 4.2% from 4.1%. The unemployment rate declined in October as the labor force participation rate and household employment dropped sharply, potentially due to noise in the household survey. On wages, with labor market conditions continuing to tighten, we look for average hourly earnings growth to rebound to 0.3% mom in November after a flat reading in October. If realized, the yoy rate should jump to 2.7% from 2.4%, previously.The consensus, according to Bloomberg, is for an increase of 190,000 non-farm payroll jobs in November (with a range of estimates between 153,000 to 250,000), and for the unemployment rate to be unchanged at 4.1%.

The BLS reported 261,000 jobs added in October.

Here is a summary of recent data:

• The ADP employment report showed an increase of 190,000 private sector payroll jobs in November. This was above consensus expectations of 186,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to or above expectations.

• The ISM manufacturing employment index decreased in November to 59.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 34,000 in October. The ADP report indicated manufacturing jobs increased 40,000 in November.

The ISM non-manufacturing employment index decreased in November to 55.3%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 215,000 in November.

Combined, the ISM indexes suggests employment gains of about 249,000. This suggests employment growth above expectations.

• Initial weekly unemployment claims averaged 241,500 in November, up from 232,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 240,000, up from 223,000 during the reference week in October.

The increase during the reference week suggests a weaker employment report in November than in October.

• The final November University of Michigan consumer sentiment index decreased to 98.5 from the October reading of 10000.7. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: The ISM reports suggest a strong report. The ADP report and weekly claims suggest a an employment report close to expectations. My guess is the employment report will be above the consensus.

Fed's Flow of Funds: Household Net Worth increased in Q3

by Calculated Risk on 12/07/2017 12:21:00 PM

The Federal Reserve released the Q3 2017 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q3 2017 compared to Q2 2017:

The net worth of households and nonprofits rose to $96.9 trillion during the third quarter of 2017. The value of directly and indirectly held corporate equities increased $1.1 trillion and the value of real estate increased $0.4 trillion.The Fed estimated that the value of household real estate increased to $24.2 trillion in Q3. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2017, household percent equity (of household real estate) was at 58.5% - up from Q3, and the highest since Q1 2006. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 58.5% equity - and about 2.5 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $85 billion in Q3.

Mortgage debt has declined by $0.7 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q3, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

CoreLogic: "2.5 million Homes still in negative equity" at end of Q3 2017

by Calculated Risk on 12/07/2017 09:51:00 AM

From CoreLogic: CoreLogic Reports Homeowner Equity Increased by Almost $871 Billion in Q3 2017

CoreLogic® ... today released its Q3 2017 home equity analysis which shows that U.S. homeowners with mortgages (roughly 63 percent of all homeowners*) have collectively seen their equity increase 11.8 percent year over year, representing a gain of $870.6 billion since Q3 2016.

Additionally, homeowners gained an average of $14,888 in home equity between Q3 2016 and Q3 2017. Western states led the increase, while no state experienced a decrease. Washington homeowners gaining an average of approximately $40,000 in home equity and California homeowners gaining an average of approximately $37,000 in home equity.

On a quarter-over-quarter basis, from Q2 2017 to Q3 2017, the total number of mortgaged homes in negative equity decreased 9 percent to 2.5 million homes, or 4.9 percent of all mortgaged properties. Year over year, negative equity decreased 22 percent from 3.2 million homes, or 6.3 percent of all mortgaged properties, from Q3 2016 to Q3 2017.

“Homeowner equity increased by almost $871 billion over the last 12 months, the largest increase in more than three years,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This increase is primarily a reflection of rising home prices, which drives up home values, leading to an increase in home equity positions and supporting consumer spending.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q3 2017 compared to Q2 2017.

For reference, about five years ago, in Q3 2012, almost 10% of residential properties had 25% or more negative equity.

A year ago, in Q3 2016, there were 3.2 million properties with negative equity - now there are 2.5 million. A significant change.

Weekly Initial Unemployment Claims decrease to 236,000

by Calculated Risk on 12/07/2017 08:37:00 AM

The DOL reported:

In the week ending December 2, the advance figure for seasonally adjusted initial claims was 236,000, a decrease of 2,000 from the previous week's unrevised level of 238,000. The 4-week moving average was 241,500, a decrease of 750 from the previous week's unrevised average of 242,250.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. Claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,500.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, December 06, 2017

Thursday: Unemployment Claims, Q3 Flow of Funds

by Calculated Risk on 12/06/2017 07:28:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand the previous week.

• At 10:00 AM, The Q3 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.0 billion in October.

2018 Housing Forecasts

by Calculated Risk on 12/06/2017 01:07:00 PM

Towards the end of each year I collect some housing forecasts for the following year. This is an update (I'll gather several more).

First a review of the previous five years ...

Here is a summary of forecasts for 2017. It is early (just nine months), but in 2017, new home sales will probably be around 615 thousand, and total housing starts will be around 1.200 to 1.210 million. Brad Hunter (HomeAdvisor) appears very close on New Home sales, and Merrill Lynch and NAR appear close on starts.

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2018:

From Fannie Mae: Housing Forecast: November 2017

From Freddie Mac: November 2017 Economic & Housing Market Forecas

From NAHB: NAHB’s housing and economic forecast

From NAR: Economic & Housing Outlook

Note: For comparison, new home sales in 2017 will probably be around 615 thousand, and total housing starts around 1.205 million.

| Housing Forecasts for 2018 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| CoreLogic | 4.2%6 | |||

| Fannie Mae | 651 | 905 | 1,250 | 5.1%2 |

| Freddie Mac | 1,300 | 5.7%2 | ||

| HomeAdvisor5 | 653 | 981 | 1,320 | 4.0% |

| NAHB | 656 | 911 | 1,255 | |

| NAR | 700 | 5.0%3 | ||

| Zillow | 3.0%4 | |||

| *** Still to come. 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices 4Zillow Home Prices 5Brad Hunter, chief economist, formerly of MetroStudy 6CoreLogic Index |

||||