by Calculated Risk on 12/18/2017 03:57:00 PM

Monday, December 18, 2017

Update from Lawler: Early Read on Existing Home Sales in November

From housing economist Tom Lawler (same estimate, more discussion):

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.77 million in November, up 5.3% from October’s preliminary estimate and up 3.0% from last November’s seasonally adjusted pace.

On the inventory front, realtor/MLS data suggest that inventories in November were down YOY by about the same amount was the case in October. How that will translate into the NAR’s estimate is tricky, however, as the NAR’s inventory estimate for October showed a larger YOY drop that realtor/MLS data would have suggested.

Finally, realtor/MLS data suggest the the NAR’s estimate for the median existing home sales price in November will be up by about 6.4% from last November.

CR Note: Existing home sales for November are scheduled to be released Wednesday. The consensus is for sales of 5.52 million SAAR. Take the over on Wednesday!

A few comments: Housing and Policy

by Calculated Risk on 12/18/2017 01:12:00 PM

A few brief comments on tax policy changes ...

There are a several policy changes that might impact housing: the reduction in the Mortgage Interest Deduction (MID), double taxation on certain income (elimination of State and Local income tax deduction), a $10,000 limit on property tax deduction and SALT, and corporate tax cuts (and other tax cuts that mostly benefit high income earners and the wealthy).

First, I think the impact of reducing the MID from a maximum of $1 million in mortgage debt to $750 thousand in mortgage debt will have very little impact on the housing market. Overall I think the MID is poor policy, and the impact on housing is overstated. The maximum has been capped at $1 million since 1986, and there has been little impact on high cost housing areas. The impact of the reduction in the MID should be small.

The double taxation on SALT (there is a cap of a $10,000 deduction on SALT and property taxes), will have an impact on housing in some areas. At the margin, some people might choose to live in one state over another (if they have a choice), based on taxation. So this could impact demand in certain states - especially for the middle and upper-middle class homeowners.

On the other hand, the corporate tax cuts (and other tax cuts) will mostly benefit the wealthy, and this will be a positive for high end real estate.

Overall I think there will be some negative impact based on double taxation in some areas, but overall I think the impact of these policy changes on housing will be minimal.

NAHB: Builder Confidence increased to 74 in December

by Calculated Risk on 12/18/2017 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 74 in December, up from 69 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builders Confident as Market Primed to Expand in 2018

Builder confidence in the market for newly-built single-family homes increased five points to a level of 74 in December on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) after a downwardly revised November reading. This was the highest report since July 1999, over 18 years ago.

“Housing market conditions are improving partially because of new policies aimed at providing regulatory relief to the business community,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas.

“The HMI measure of home buyer traffic rose eight points, showing that demand for housing is on the rise,” said NAHB Chief Economist Robert Dietz. “With low unemployment rates, favorable demographics and a tight supply of existing home inventory, we can expect continued upward movement of the single-family construction sector next year.”

...

All three HMI components registered gains in December. The component measuring buyer traffic jumped eight points to 58, the index gauging current sales conditions rose four points to 81 and the index charting sales expectations in the next six months increased three points to 79.

Looking at the three-month moving averages for regional HMI scores, the Midwest climbed six points to 69, the South rose three points to 72, the West increased two points to 79 and Northeast inched up a single point to 54.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Sunday, December 17, 2017

Sunday Night Futures

by Calculated Risk on 12/17/2017 08:06:00 PM

Weekend:

• Schedule for Week of Dec 17, 2017

Monday:

• 10:00 AM ET, The December NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 9, and DOW futures are up 96 (fair value).

Oil prices were up over the last week with WTI futures at $57.35 per barrel and Brent at $63.25 per barrel. A year ago, WTI was at $52, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.41 per gallon. A year ago prices were at $2.25 per gallon - so gasoline prices are up 16 cents per gallon year-over-year.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 12/17/2017 11:01:00 AM

The NAR is scheduled to report November Existing Home Sales on Wednesday, December 20th at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.52 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.77 million on a seasonally adjusted annual rate (SAAR) basis.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 142 thousand, and Lawler's average miss was 68 thousand.

The consensus is below Lawler's estimate this month, so I'd take the over.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, December 16, 2017

Schedule for Week of December 17th

by Calculated Risk on 12/16/2017 08:13:00 AM

The key economic reports this week are November housing starts, new home sales and existing home sales. Other key reports include the third estimate of Q3 GDP, and Personal Income & Outlays for November.

For manufacturing, the December Philly Fed and Kansas City Fed manufacturing surveys will be released this week.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for November. The consensus is for 1.240 million SAAR, down from the October rate of 1.290 million.

8:30 AM: Housing Starts for November. The consensus is for 1.240 million SAAR, down from the October rate of 1.290 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.52 million SAAR, up from 5.48 million in October.

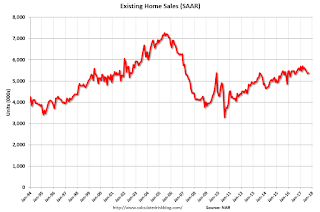

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.52 million SAAR, up from 5.48 million in October.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.77 million SAAR for November.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 234 thousand initial claims, up from 225 thousand the previous week.

8:30 AM: Gross Domestic Product, 3rd quarter 2017 (Third estimate). The consensus is that real GDP increased 3.3% annualized in Q3, unchanged from 3.3% in the second report.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 21.8, down from 22.7.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

9:00 AM ET: FHFA House Price Index for October 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM ET: New Home Sales for November from the Census Bureau.

10:00 AM ET: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for 650 thousand SAAR, down from 685 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 97.0, up from the preliminary reading 96.8.

10:00 AM: State Employment and Unemployment (Monthly) for November 2017

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 15, 2017

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/15/2017 05:42:00 PM

A short note from housing economist Tom Lawler:

"Based on what I've seen so far, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.77 million in November."

CR Note: Existing home sales for November are scheduled to be released next Wednesday. The consensus is for sales of 5.53 million SAAR. Take the over on Wednesday!

Oil Rigs "The Calm before the Storm"

by Calculated Risk on 12/15/2017 02:50:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Dec 15, 2017:

• Rigs overall continue in recovery mode

• Total US oil rigs were down 4 to 747

• Horizontal oil rigs, however, were up 2 to 654

...

• Expect the rig count to surge upward in the next four weeks, with some weeks exceeding +10 horizontal oil rigs

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q4 GDP Forecasts

by Calculated Risk on 12/15/2017 12:01:00 PM

From Merrill Lynch:

The strong retail sales data provided a 0.3pp boost to our 4Q GDP tracking estimate, bringing it up to 2.4%.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.3 percent on December 14, up from 2.9 percent on December 8. The forecast of fourth-quarter real consumer spending growth increased from 2.5 percent to 3.2 percent after [the] Consumer Price Index report from the U.S. Bureau of Labor Statistics and [the] retail sales release from the U.S. Census Bureau.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.0% for 2017:Q4 and 3.1% for 2018:Q1.CR Note: It looks likely that GDP will be over 3% again in Q4.

Industrial Production Increased 0.2% in November

by Calculated Risk on 12/15/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production moved up 0.2 percent in November after posting an upwardly revised increase of 1.2 percent in October. Manufacturing production also rose 0.2 percent in November, its third consecutive monthly gain. The output of utilities dropped 1.9 percent. The index for mining increased 2.0 percent, as oil and gas extraction returned to normal levels after being held down in October by Hurricane Nate. Excluding the post-hurricane rebound in oil and gas extraction, total industrial production would have been unchanged in November. Total industrial production was 106.4 percent of its 2012 average in November and was 3.4 percent above its year-earlier level. Capacity utilization for the industrial sector was 77.1 percent in November, a rate that is 2.8 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.1% is 2.8% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 106.4. This is 22.2% above the recession low, and 1% above the pre-recession peak.