by Calculated Risk on 12/22/2017 08:37:00 AM

Friday, December 22, 2017

Personal Income increased 0.3% in November, Spending increased 0.6%

The BEA released the Personal Income and Outlays report for November:

Personal income increased $54.0 billion (0.3 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $50.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $87.1 billion (0.6 percent).The November PCE price index increased 1.8 percent year-over-year and the November PCE price index (up from 1.6 percent YoY in October), excluding food and energy, increased 1.5 percent year-over-year (up from 1.4 percent YoY in October).

Real DPI increased 0.1 percent in November and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly below expectations, and the increase in PCE was slightly above expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 3.2% annual rate in Q4 2017. (using the mid-month method, PCE was increasing 4.2%). This suggests solid PCE growth in Q4.

Thursday, December 21, 2017

Friday: New Home Sales, Personal Income and Outlays, Durable Goods and More

by Calculated Risk on 12/21/2017 09:08:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM ET: New Home Sales for November from the Census Bureau. The consensus is for 650 thousand SAAR, down from 685 thousand in October.

• Also at 10:00 AM: University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 97.0, up from the preliminary reading 96.8.

• Also at 10:00 AM: State Employment and Unemployment (Monthly) for November 2017

• At 11:00 AM: the Kansas City Fed manufacturing survey for December.

Goldman on "Fiscal Boost"

by Calculated Risk on 12/21/2017 04:32:00 PM

A few excerpts from a note by Goldman Sachs economist Alec Phillips:

Overall, the legislation is somewhat more front-loaded than the earlier Senate version, and as a result we expect it will boost growth slightly more in 2018. We estimate a positive impulse from the tax bill of 0.3pp in 2018 and 0.3pp in 2019.

...

We are adjusting our forecasts to reflect the final details of the tax bill, as well as the incremental easing in financial conditions and continued strong economic momentum to end the year. We are increasing our GDP forecasts for 2018 and 2019 by 0.3pp and 0.2pp, respectively, on a Q4/Q4 basis (to 2.6% and 1.7%). We are also lowering our year-end 2018 unemployment rate forecast by two tenths to 3.5%, mainly reflecting a modestly higher expected pace of job growth. We now expect the unemployment rate to bottom in this cycle at 3.3%, at the end of 2019. ...

With more fiscal stimulus comes larger deficits, and we are increasing our deficit projection somewhat to take the recent tax legislation into account, as well as upcoming spending legislation. We expect the deficit to rise to 3.7% of GDP in FY2018 and to 5% of GDP in 2019 ...

Black Knight: National Mortgage Delinquency Rate increased in November due to Hurricanes

by Calculated Risk on 12/21/2017 12:46:00 PM

From Black Knight: Black Knight’s First Look at November 2017 Mortgage Data: Continued Hurricane-Driven Effects Lead to Largest 90-Day Delinquency Increase in Nine Years

• 90-day delinquent mortgage inventory spiked 13 percent in November, the largest monthly increase since 2008 as the financial crisis began to unfoldAccording to Black Knight's First Look report for November, the percent of loans delinquent increased 2.5% in November compared to October, and increased 2.0% year-over-year.

• While 90-day delinquency increases are common in November, the volumes seen this year are noteworthy

• Over 85 percent -- approximately 66,000 -- of the month’s 77,000 new severely delinquent loans can be attributed to hurricanes Harvey and Irma

• As a result, the current estimate of 90-day delinquencies resulting from Harvey and Irma totals over 85,000

The percent of loans in the foreclosure process declined 3.2% in November and were down 33% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.55% in November, up from 4.44% in October.

The percent of loans in the foreclosure process declined in November to 0.66%.

The number of delinquent properties, but not in foreclosure, is up 61,000 properties year-over-year, and the number of properties in the foreclosure process is down 161,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2017 | Oct 2017 | Nov 2016 | Nov 2015 | |

| Delinquent | 4.55% | 4.44% | 4.46% | 4.92% |

| In Foreclosure | 0.66% | 0.68% | 0.98% | 1.38% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,324,000 | 2,262,000 | 2,263,000 | 2,491,000 |

| Number of properties in foreclosure pre-sale inventory: | 337,000 | 348,000 | 498,000 | 698,000 |

| Total Properties | 2,661,000 | 2,610,000 | 2,761,000 | 3,189,000 |

Earlier: Philly Fed Manufacturing Survey showed "Solid Growth" in December

by Calculated Risk on 12/21/2017 11:15:00 AM

Earlier from the Philly Fed: December 2017 Manufacturing Business Outlook Survey

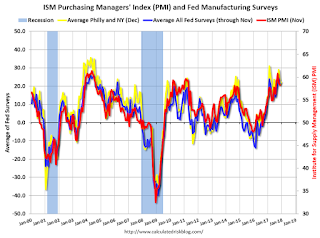

Results from the December Manufacturing Business Outlook Survey suggest that regional manufacturing conditions continued to improve. Indexes for general activity, new orders, and shipments were all positive this month and increased from their readings last month. The firms also reported continued expansion of employment. Most indicators reflecting expectations for the next six months suggest continued optimism.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The diffusion index for current general activity increased from a reading of 22.7 in November to 26.2 this month ... The firms continued to report increases in employment. The current employment index fell 5 points but remained in positive territory, where it has been for 13 consecutive months. More than 29 percent of the responding firms reported increases in employment, while 11 percent of the firms reported decreases this month. The average workweek index declined 3 points after being in positive territory for 14 consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

This suggests the ISM manufacturing index night increase slightly in December, and show solid expansion again.

Q3 GDP Revised down to 3.2% Annual Rate

by Calculated Risk on 12/21/2017 08:45:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2017 (Third Estimate)

eal gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2017, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 2.3% to 2.2%. Residential investment was revised up slightly from -5.1% to -4.7%. This was lower than the consensus forecast.

he GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.3 percent. With this third estimate for the third quarter, personal consumption expenditures increased less than previously estimated, but the general picture of economic growth remains the same ...

emphasis added

Weekly Initial Unemployment Claims increase to 245,000

by Calculated Risk on 12/21/2017 08:37:00 AM

The DOL reported:

In the week ending December 16, the advance figure for seasonally adjusted initial claims was 245,000, an increase of 20,000 from the previous week's unrevised level of 225,000. The 4-week moving average was 236,000, an increase of 1,250 from the previous week's unrevised average of 234,750.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 236,000.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, December 20, 2017

Thursday: GDP, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 12/20/2017 08:20:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 234 thousand initial claims, up from 225 thousand the previous week.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2017 (Third estimate). The consensus is that real GDP increased 3.3% annualized in Q3, unchanged from 3.3% in the second report.

• Also at 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 21.8, down from 22.7.

• Also at 8:30 AM, Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for October 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

Phoenix Real Estate in November: Sales up 4%, Inventory down 11% YoY

by Calculated Risk on 12/20/2017 04:00:00 PM

A little late this month ... but this is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in November were up 4.3% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 10.9% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the thirteenth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (4.6% through September or 6.1% annual rate).

| November Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Nov-08 | 4,417 | --- | 1,217 | 27.6% | 56,2271 | --- |

| Nov-09 | 7,494 | 69.7% | 2,572 | 34.3% | 40,372 | -28.2% |

| Nov-10 | 6,789 | -9.4% | 2,966 | 43.7% | 45,353 | 12.3% |

| Nov-11 | 7,147 | 5.3% | 3,245 | 45.4% | 26,798 | -40.9% |

| Nov-12 | 6,810 | -4.7% | 2,945 | 43.2% | 23,232 | -13.3% |

| Nov-13 | 5,181 | -23.9% | 1,761 | 34.0% | 26,762 | 15.2% |

| Nov-14 | 4,986 | -3.8% | 1,396 | 28.0% | 27,426 | 2.5% |

| Nov-15 | 5,308 | 6.5% | 1,542 | 29.1% | 25,022 | -8.8% |

| Nov-16 | 6,911 | 30.2% | 1,618 | 23.4% | 24,582 | -1.8% |

| Nov-17 | 7,209 | 4.3% | 1,650 | 22.9% | 21,898 | -10.9% |

| 1 November 2008 probably includes pending listings | ||||||

A Few Comments on November Existing Home Sales

by Calculated Risk on 12/20/2017 01:52:00 PM

Earlier: NAR: "Existing-Home Sales Soar 5.6 Percent in November"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in November. The consensus was for sales of 5.52 million SAAR in November. Lawler estimated 5.77 million, and the NAR reported 5.81 million.

""Based on what I've seen so far, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.77 million in November."2) There might have been some bounce back in November from the hurricanes.

3) Inventory is still very low and falling year-over-year (down 9.7% year-over-year in November). More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases. This was the 30th consecutive month with a year-over-year decline in inventory.

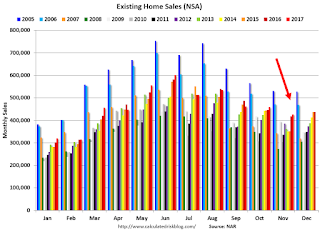

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in November (427,000, red column) were above sales in November 2016 (418,000, NSA) and at the highest level for November since 2006 (472,000).

Sales NSA are now slowing seasonally, and sales NSA will be lower through February.