by Calculated Risk on 12/26/2017 09:14:00 AM

Tuesday, December 26, 2017

Case-Shiller: National House Price Index increased 6.2% year-over-year in October

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: October S&P CoreLogic Case-Shiller National Home Price NSA Index Continues Steady Gains in October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in October, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.0%, up from 5.7% the previous month. The 20-City Composite posted a 6.4% year-over-year gain, up from 6.2% the previous month.

Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In October, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with a 10.2% increase, and San Diego with an 8.1% increase. Nine cities reported greater price increases in the year ending October 2017 versus the year ending September 2017

...

Before seasonal adjustment, the National Index, 10-City and 20-City Composites all posted a monthover-month gain of 0.2% in October. After seasonal adjustment, the National Index, 10-City and 20-City Composites all recorded a 0.7% month-over-month increase in October. Eleven of 20 cities reported increases in October before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continue their climb supported by low inventories and increasing sales,” says David M. Blitzer, Managing Director & Chairman of the Index Committee at S&P Dow Jones Indices. “Nationally, home prices are up 6.2% in the 12 months to October, three times the rate of inflation. Sales of existing homes dropped 6.1% from March through September; they have since rebounded 8.4% in November. Inventories measured by months-supply of homes for sale dropped from the tight level of 4.2 months last summer to only 3.4 months in November.

“Underlying the rising prices for both new and existing homes are low interest rates, low unemployment and continuing economic growth. Some of these favorable factors may shift in 2018. The Fed is widely expected to raise the Fed funds rate three more times to reach 2% by the end of the New Year. Since home prices are rising faster than wages, salaries, and inflation, some areas could see potential home buyers compelled to look at renting. Data published by the Urban Institute suggests that in some West coast cities with rapidly rising home prices, renting is more attractive than buying.”

emphasis added

Click on graph for larger image.

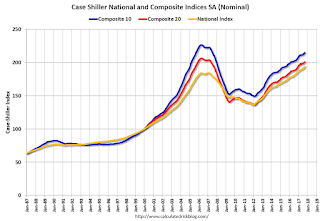

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 4.4% from the peak, and up 0.7% in October (SA).

The Composite 20 index is off 1.7% from the peak, and up 0.7% (SA) in October.

The National index is 5.7% above the bubble peak (SA), and up 0.7% (SA) in October. The National index is up 43.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.0% compared to October 2016. The Composite 20 SA is up 6.4% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, December 25, 2017

Monday Night Futures

by Calculated Risk on 12/25/2017 09:27:00 PM

Weekend:

• Schedule for Week of Dec 24, 2017

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October (note: Some sites show this released on Wednesday during the Holidays) The consensus is for a 6.2% year-over-year increase in the Comp 20 index for October.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for December. This is the last of the regional surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 1, and DOW futures are down 34 (fair value).

Oil prices were up over the last week with WTI futures at $58.52 per barrel and Brent at $65.31 per barrel. A year ago, WTI was at $52, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.44 per gallon. A year ago prices were at $2.28 per gallon - so gasoline prices are up 16 cents per gallon year-over-year.

Happy Holidays!

by Calculated Risk on 12/25/2017 10:34:00 AM

Happy Holidays and Merry Christmas to All!

Whose woods these are I think I know."Stopping by Woods on a Snowy Evening" by Robert Frost

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

There is no snow or even rain in California. Oh well.

Enjoy the season!

Sunday, December 24, 2017

Oil Rigs "A modest gain in horizontal oil rigs"

by Calculated Risk on 12/24/2017 05:45:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Dec 22, 2017:

• Total US oil rigs were flat at 747

• Horizontal oil rigs, however, were up 1 to 655

• Horizontal rigs saw quite a bit of shuffling, with the major basins +10 and the minor basins -9. This probably reflects redeployment at this point and should be considered a tactical, rather than strategic, development

...

• We expect the rig count to surge upward in the next four weeks, with some weeks exceeding +10 horizontal oil rigs

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Hotel Occupancy Rate Increased Year-over-Year, 2017 will be Record Occupancy Year

by Calculated Risk on 12/24/2017 11:00:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 16 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 10-16 December 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 December 2016, the industry recorded the following:

• Occupancy: +4.5% to 56.4%

• Average daily rate (ADR): +3.5% to US$115.67

• Revenue per available room (RevPAR): +8.1% to US$65.24

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).This is seasonally the weakest time of the year for hotel occupancy.

With the year almost over, the annual occupancy rate is ahead of the previous record year in 2015. The strong finish to the year was due to the impact of the hurricanes.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, December 23, 2017

Schedule for Week of December 24th

by Calculated Risk on 12/23/2017 08:11:00 AM

This will be a light week for economic data.

Happy Holidays and Merry Christmas!

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM ET: S&P/Case-Shiller House Price Index for October (note: Some sites show this released on Wednesday during the Holidays)

9:00 AM ET: S&P/Case-Shiller House Price Index for October (note: Some sites show this released on Wednesday during the Holidays)This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the September 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December. This is the last of the regional surveys for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.8% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

Early: Reis Q4 2017 Apartment Survey of rents and vacancy rates.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 61.8, down from 63.9 in November.

Friday, December 22, 2017

Vehicle Forecast: Sales Expected to Exceed 17 million SAAR Again in December

by Calculated Risk on 12/22/2017 06:19:00 PM

The automakers will report December vehicle sales on Wednesday, Jan 3rd.

Note: There are 26 selling days in December 2017, there were 27 selling days in December 2016.

From WardsAuto: December U.S. Forecast: Market Will Hit 17.5 Million SAAR

The WardsAuto monthly forecast is calling for 1.57 million light vehicles to be delivered over 26 selling days in December.Sales had been below 17 million SAAR (Seasonally Adjusted Annual Rate) for six consecutive months, until September (18.5 million SAAR), October (18.0 million SAAR), and November (17.4 million SAAR) when sales spiked due to buying following Hurricane Harvey.

...

The forecast 17.53 million-unit seasonally adjusted annual rate is above November’s 17.40 million, but below December 2016’s 18.05 million.

emphasis added

Even with the pickup in sales over the last few months, sales were down 1.5% in 2017 through November compared to the same period in 2016.

BLS: Unemployment Rates Lower in 8 states in November; Alabama, California, Hawaii, Mississippi and Texas at New Series Lows

by Calculated Risk on 12/22/2017 04:03:00 PM

First, on migration from Puerto Rico, an except from analysis by Goldman Sachs economist Spencer Hill (this will have impacts on Puerto Rico, and on employment in the U.S. mainland):

A quarter of a million Puerto Ricans have already relocated to the continental United States in the aftermath of Hurricane Maria, and the ultimate scale of migration could be two or three times higher. While press coverage has appropriately focused on the continuing humanitarian crisis, the economic impact of these migration patterns is also significant.From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in November in 8 states, higher in 2 states, and stable in 40 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-three states had jobless rate decreases from a year earlier, 2 states had increases, and 25 states and the District had little or no change. The national unemployment rate was unchanged from October at 4.1 percent but was 0.5 percentage point lower than in November 2016.

...

Hawaii had the lowest unemployment rate in November, 2.0 percent. The rates in Alabama (3.5 percent), California (4.6 percent), Hawaii (2.0 percent), Mississippi (4.8 percent), and Texas (3.8 percent) set new series lows. ... Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Fourteen states have reached new all time lows since the end of the 2007 recession. These fourteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.2%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.2%) and New Mexico (6.1%). D.C. is at 6.4%.

A few Comments on November New Home Sales

by Calculated Risk on 12/22/2017 12:13:00 PM

New home sales for November were reported at 733,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the highest sales rate since July 2007. However the three previous months were revised down significantly (especially sales for October).

Looking at the regional data, the South saw a 32.5% year-over-year increase that might be related to the hurricanes (some sales might have been delayed).

Sales overall were up 26.6% year-over-year in November.

Earlier: New Home Sales increase to 733,000 Annual Rate in November.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate).

For the first eleven months of 2017, new home sales are up 9.1% compared to the same period in 2016.

This was a solid year-over-year increase through November.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Growth Continued at a Solid Pace" in December

by Calculated Risk on 12/22/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Growth Continued at a Solid Pace

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity continued at a solid pace, and optimism remained high.So far, all of the regional Fed surveys have been solid in December.

“Factories in our region remain upbeat about hiring and capital spending as we head into 2018, following strong growth in recent months,” said Wilkerson.

...

The month-over-month composite index was 14 in December, lower than 16 in November and 23 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Growth in factory activity moderated slightly at both durable and non-durable goods plants, particularly for chemicals and plastics products. Month-over-month indexes were mixed but remained generally solid. The shipments, new orders, and order backlog indexes all decreased somewhat. However, the production index edged up from 15 to 21, and the employment and new orders for exports indexes also rose. The finished goods inventory index dropped from 2 to -11, and the raw materials inventory index also decreased.

emphasis added