by Calculated Risk on 12/30/2017 08:09:00 AM

Saturday, December 30, 2017

Schedule for Week of December 31st

Happy New Year!

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing and non-manufacturing indexes, the November trade deficit, and December auto sales.

Also the Q4 quarterly Reis surveys for office and malls will be released this week.

All US markets will be closed in observance of the New Year's Day Holiday.

10:00 AM: Corelogic House Price index for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q4 2017 Office Survey of rents and vacancy rates.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 58.2 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 58.2 in November.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in October. The PMI was at 58.2% in November, the employment index was at 59.7%, and the new orders index was at 64.0%.

10:00 AM: Construction Spending for November. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.5 million SAAR in December, up from 17.4 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.5 million SAAR in December, up from 17.4 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

2:00 PM: FOMC Minutes, Meeting of December 12 - 13, 2017

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in December, down from 190,000 added in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

Early: Reis Q4 2017 Mall Survey of rents and vacancy rates.

8:30 AM: Employment Report for December. The consensus is for an increase of 190,000 non-farm payroll jobs added in December, down from the 228,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to be unchanged at 4.1%.

The consensus is for the unemployment rate to be unchanged at 4.1%.This graph shows the year-over-year change in total non-farm employment since 1968.

In November the year-over-year change was 2.07 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $48.3 billion in November from $48.7 billion in October.

10:00 AM: the ISM non-Manufacturing Index for December. The consensus is for index to increase to 57.6 from 57.4 in November.

Friday, December 29, 2017

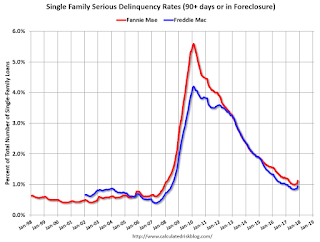

Fannie Mae: Mortgage Serious Delinquency rate increased in November due to Hurricanes

by Calculated Risk on 12/29/2017 04:30:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate increased to 1.12% in November, up from 1.01% in October. The serious delinquency rate is down from 1.23% in November 2016.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 3.05% are seriously delinquent. For loans made in 2005 through 2008 (7% of portfolio), 6.26% are seriously delinquent, For recent loans, originated in 2009 through 2017 (89% of portfolio), only 0.42% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

This increase in the delinquency rate was due to the hurricanes - and we might see a further increase over the next month (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline another 0.5 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Freddie Mac reported earlier.

Question #8 for 2018: What will happen with house prices in 2018?

by Calculated Risk on 12/29/2017 03:58:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up over 6% in 2017. What will happen with house prices in 2018?

The following graph shows the year-over-year change through October 2017, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 6.0% compared to October 2016, the Composite 20 SA was up 6.4% and the National index SA was up 6.2% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-17 | 6.4% |

| Case-Shiller National | Oct-17 | 6.2% |

| CoreLogic | Oct-17 | 7.0% |

| Black Knight | Oct-17 | 6.5% |

| FHFA Purchase Only | Oct-17 | 6.2% |

Most analysts are forecasting prices will increase in the 3% to 5% range in 2017.

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #9 for 2018: Will housing inventory increase or decrease in 2018?

by Calculated Risk on 12/29/2017 10:01:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

9) Housing Inventory: Housing inventory declined in 2015, 2016 and 2017. Will inventory increase or decrease in 2018?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2017.

According to the NAR, inventory decreased to 1.67 million in November from 1.80 million in October.

Inventory has steadily been decreasing over the last few years.

This was the lowest level for the month of November since 2000.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 9.7% year-over-year in November compared to November 2016. Months of supply was at 3.4 months in November.

Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been negative since mid-2015.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we have seen a surge in home improvement spending, and this is also limiting supply.

The recent change in the tax law might lead to more inventory in certain areas, and I'll be tracking that over the course of the year.

I was wrong on inventory last year (and the previous year), but right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent changes to the tax law.

If correct, this will keep house price increases down in 2018 (probably lower than the 6% or so gains in 2017).

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Chicago PMI "Rises" in December "to Six-and-a-Half Year High"

by Calculated Risk on 12/29/2017 09:33:00 AM

From the Chicago PMI: December Chicago Business Barometer Rises to 67.6

The MNI Chicago Business Barometer rose to 67.6 in December, up from 63.9 in November, closing the year at the highest level since March 2011.This was well above the consensus forecast of 61.8, and a strong reading.

On a calendar quarter basis, the Barometer rose to 65.9 in Q4 from 61.0 in Q3, the best quarterly performance since Q1 2011, only the second time in the last decade there have been three consecutive above-60 readings in the Oct-Dec period.

...

“Sentiment among businesses started 2017 in good shape and only impressed more as the year progressed. December’s result secured the MNI Chicago Business Barometer’s first full year of expansion since 2014 and with New Orders ending the quarter in fine shape there is every chance this form could be carried over into 2018,” said Jamie Satchi, Economist at MNI Indicators.

emphasis added

Thursday, December 28, 2017

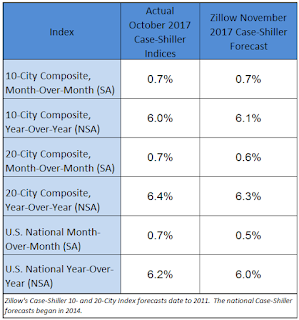

Zillow Case-Shiller Forecast: More Solid House Price Gains in November

by Calculated Risk on 12/28/2017 06:43:00 PM

Friday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for December. The consensus is for a reading of 61.8, down from 63.9 in November.

The Case-Shiller house price indexes for October were released on Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: Case-Shiller October Results and November Forecast: Still Defying Gravity

The last few months of 2017 have clearly demonstrated the extent to which the housing market refuses to be knocked off its stride. Sales of existing homes have risen strongly and unexpectedly, despite a severe and worsening shortage of homes actually available to buy. To cope, buyers simply linger longer on the market, even into the slower winter months if needed.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in November than in October. Zillow is forecasting a larger year-over-year increase for the 10-city index, and a smaller increase for the 20-city index in November.

The Case-Shiller National Index of home prices for October climbed 6.2 percent year-over-year, while its gain from September was 0.7 percent.

The 10-City Composite Index increased 6.0 percent year-over-year and 0.7 percent from September, while the 20-City Composite Index grew 6.4 percent year-over-year and 0.7 percent from September. Seattle, Las Vegas and San Diego continued to post the strongest annual gains among the 20 cities, with increases of 12.7 percent, 10.2 percent and 8.1 percent, respectively.

Home builders have managed to start construction on more homes than at any point since prior to the recession, despite high and rising land, labor and materials costs. An economy that keeps adding jobs and wages that continue to grow both have consumers feeling confident. And they’re boosted by mortgage interest rates that remain near all-time lows, defying expectations and conventional wisdom alike that both say – and have been saying for years – that rates have to begin rising at some point.

Freddie Mac: Mortgage Serious Delinquency rate up sharply in November

by Calculated Risk on 12/28/2017 04:07:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in November was at 0.95%, up sharply from 0.86% in October. Freddie's rate is down from 1.03% in November 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This increase in the delinquency rate was due to the hurricanes - and we might see a further increase over the next month (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline another 0.2 to 0.4 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for November soon.

Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

by Calculated Risk on 12/28/2017 02:07:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

10) Housing and Taxes A key change in the new tax law is limiting the deductibility of State and Local Taxes (SALT) and property taxes to $10,000. Many analysts think this will hit certain segments of the housing market in states like New York, New Jersey and California. The NAR noted their forecast today:

"Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas."Relative to the overall market, will sales slow, inventory increase, and price growth slow in these states?

First, to track the impact over the course of the year, I'll follow certain markets and compare to the overall market (possibly in California, New York and New Jersey).

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

There could be a ripple effect. If the upper-mid-range slows, that could impact some of the purchases in the next higher range. This is my current guess on the impact.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

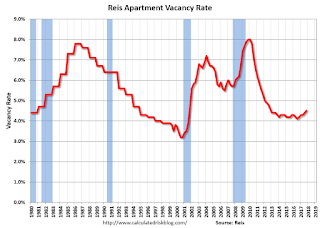

Reis: Apartment Vacancy Rate increased in Q4 to 4.5%

by Calculated Risk on 12/28/2017 11:03:00 AM

Reis reported that the apartment vacancy rate was at 4.5% in Q4 2017, up from 4.4% in Q3, and up from 4.2% in Q4 2016. This is the highest vacancy rate since Q4 2012 (although the increase has been small). The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment market continued to face pressure from added supply in the fourth quarter as the national vacancy rate increased 10 basis points to 4.5% in the quarter. Asking rents increased 0.4% in the fourth quarter, while effective rents grew 0.3%. Effective rents net out landlord concessions. Over the year, asking rents increased 3.9% while effective rents grew by 3.3%. These growth rates reflect a deceleration in apartment market fundamentals compared to recent years, due in part to the large amount of new supply coming online. New construction totaled 43,769 units in the fourth quarter, raising the year-end total to 213,802 units. The national apartment market has not seen new completions in excess of 200,000 since 1986.

At 4.5%, the national vacancy rate increased 10 basis points from 4.4% in the third quarter. This represents a 30 basis point increase in year-over-year vacancy (the year-end vacancy rate in 2016 was 4.2%); vacancies have more or less been on an upward march since the middle of 2016. The net change in occupied stock, or net absorption, was 31,554 units, lower than new supply. With supply growth outstripping demand, vacancies were pushed upwards this quarter.

At $1,364, the average asking rent grew 0.4% in the quarter. This is well below the 0.9% average quarterly growth rate for the prior six quarters. Effective rent growth was 0.3% in the quarter, also below the 0.8% average quarterly effective rent growth for the prior six quarters. Overall, these statistics reflect a distinct pullback in the national apartment market, especially when compared to 2015. However, the gap between asking rent growth and effective rent growth remained within a 10 basis point range. This suggests that landlords’ offers of free rent were less aggressive – implying that demand remains relatively robust.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However it appears the vacancy rate has bottomed and is starting to increase. With more supply coming on line next year - and less favorable demographics - the vacancy rate will probably continue to increase in 2018.

Apartment vacancy data courtesy of Reis.

Weekly Initial Unemployment Claims unchanged at 245,000

by Calculated Risk on 12/28/2017 08:34:00 AM

The DOL reported:

In the week ending December 23, the advance figure for seasonally adjusted initial claims was 245,000, unchanged from the previous week's unrevised level of 245,000. The 4-week moving average was 237,750, an increase of 1,750 from the previous week's unrevised average of 236,000.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 237,750.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.