by Calculated Risk on 1/02/2018 11:59:00 AM

Tuesday, January 02, 2018

Framing Lumber Prices Up Sharply Year-over-year, Looks like Record Prices in 2018

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices finished 2017 near the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through December 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and will probably exceed the housing bubble highs in the Spring of 2018. Note: CME prices hit an all time high briefly in November.

Right now Random Lengths prices are up 20% from a year ago, and CME futures are up about 43% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

It looks like we will see record prices in the Spring of 2018.

CoreLogic: House Prices up 7.0% Year-over-year in November

by Calculated Risk on 1/02/2018 09:45:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Fourth Consecutive Month with More Than 6 Percent Year-Over-Year Home Price Growth in November

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2017, which shows home prices are up both year over year and month over month. Home prices nationally increased year over year by 7 percent from November 2016 to November 2017, and on a month-over-month basis home prices increased by 1 percent in November 2017 compared with October 2017,* according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 4.2 percent on a year-over-year basis from November 2017 to November 2018, and on a month-over-month basis home prices are expected to decrease by 0.4 percent from November 2017 to December 2017. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Rising home prices are good news for home sellers, but add to the challenges that home buyers face,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Growing numbers of first-time buyers find limited for-sale inventory for lower-priced homes, leading to both higher rates of price growth for ‘starter’ homes and further erosion of affordability.”

emphasis added

The year-over-year comparison has been positive for almost six consecutive years since turning positive year-over-year in February 2012.

Monday, January 01, 2018

Monday Night Futures

by Calculated Risk on 1/01/2018 09:20:00 PM

Happy New Year!

Weekend:

• Schedule for Week of Dec 31, 2017

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Tuesday:

• At 10:00 AM. Corelogic House Price index for November.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5, and DOW futures are up 48 (fair value).

Oil prices were up over the last week with WTI futures at $60.23 per barrel and Brent at $66.87 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.48 per gallon. A year ago prices were at $2.34 per gallon - so gasoline prices are up 14 cents per gallon year-over-year.

Question #1 for 2018: How much will the economy grow in 2018?

by Calculated Risk on 1/01/2018 07:25:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I've added some thoughts, and a few predictions for each question.

1) Economic growth: Heading into 2018, most analysts are pretty sanguine and expecting some pickup in growth due to the recent tax cuts. From Goldman Sachs:

"We are adjusting our forecasts to reflect the final details of the tax bill, as well as the incremental easing in financial conditions and continued strong economic momentum to end the year. We are increasing our GDP forecasts for 2018 and 2019 by 0.3pp and 0.2pp, respectively, on a Q4/Q4 basis (to 2.6% and 1.7%)."How much will the economy grow in 2018?

First, since I'm always asked, I don't see a recession in 2018.

Note: The Trump administration projected 3.5% annual real growth over Mr. Trump's term: "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate." (now removed from Trump website).

Here is a table of the annual change in real GDP since 2005. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%.

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). In the quote above, Goldman Sachs economists are comparing Q4 over the previous Q4 (a slightly different calculation). For 2017, I used a 3.0% annual growth rate in Q4 2017 (this gives 2.6% Q4 over Q4 or 2.3% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.3% | 3.0% |

| 2006 | 2.7% | 2.4% |

| 2007 | 1.8% | 1.9% |

| 2008 | -0.3% | -2.8% |

| 2009 | -2.8% | -0.2% |

| 2010 | 2.5% | 2.7% |

| 2011 | 1.6% | 1.7% |

| 2012 | 2.2% | 1.3% |

| 2013 | 1.7% | 2.7% |

| 2014 | 2.6% | 2.7% |

| 2015 | 2.9% | 2.0% |

| 2016 | 1.5% | 1.8% |

| 20171 | 2.3% | 2.6% |

| 1 2017 estimate based on 3.0% Q4 annualized real growth rate | ||

It is possible that there will be a pickup in growth in 2018 due to a combination of factors.

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #2 for 2018: Will job creation slow further in 2018?

by Calculated Risk on 1/01/2018 01:01:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: Through November, the economy has added just over 1,900,000 jobs this year, or 174,000 per month. As expected, this was down from the 187 thousand per month in 2016. Will job creation in 2018 be as strong as in 2017? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2018?

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total and private employment gains, 2014 and 2015 were the best years since the '90s, however it appears job growth peaked in 2014.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,408 | 3,213 | 195 |

| 1998 | 3,047 | 2,734 | 313 |

| 1999 | 3,180 | 2,719 | 461 |

| 2000 | 1,950 | 1,686 | 264 |

| 2001 | -1,727 | -2,278 | 551 |

| 2002 | -500 | -733 | 233 |

| 2003 | 115 | 157 | -42 |

| 2004 | 2,040 | 1,893 | 147 |

| 2005 | 2,515 | 2,329 | 186 |

| 2006 | 2,092 | 1,883 | 209 |

| 2007 | 1,147 | 859 | 288 |

| 2008 | -3,567 | -3,747 | 180 |

| 2009 | -5,068 | -4,994 | -74 |

| 2010 | 1,061 | 1,277 | -216 |

| 2011 | 2,091 | 2,403 | -312 |

| 2012 | 2,142 | 2,209 | -67 |

| 2013 | 2,302 | 2,370 | -68 |

| 2014 | 2,998 | 2,871 | 127 |

| 2015 | 2,713 | 2,561 | 152 |

| 2016 | 2,240 | 2,039 | 201 |

| 20171 | 2,071 | 2,024 | 47 |

| 12017 is Year-over-year job gains through November | |||

The good news is the economy still has solid momentum heading into 2018.

The bad news - for job growth - is that a combination of demographics and a labor market nearing full employment suggests fewer jobs will be added in 2018. Hopefully that will be good news for wages.

Note: There has been a large migration of families and workers from Puerto Rico to the mainland U.S., and that has increased the U.S. labor force.

Too many people compare to the '80s and '90s, without thinking about changing demographics. The prime working age population (25 to 54 years old) was growing 2.2% per year in the '80s, and 1.3% per year in the '90s. The prime working age population has actually declined slightly this decade. Note: The prime working age population is now growing slowly again, and growth will pick up the 2020s.

The second table shows the change in construction and manufacturing payrolls starting in 2006.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1,047 | -1,375 |

| 2010 | -187 | 120 |

| 2011 | 144 | 207 |

| 2012 | 113 | 158 |

| 2013 | 209 | 126 |

| 2014 | 359 | 208 |

| 2015 | 336 | 68 |

| 2016 | 155 | -16 |

| 20171 | 184 | 189 |

| 12017 is Year-over-year job gains through November | ||

Energy related construction and manufacturing hiring increased in 2017, and will probably increase further in 2018 since oil prices have increased. However, for manufacturing, there will probably be little or no growth in the auto sector in 2018.

So my forecast is for gains of around 150,000 to 167,000 payroll jobs per month in 2018 (about 1.8 million to 2.0 million year-over-year) . Lower than in 2017, but another solid year for employment gains given current demographics.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #3 for 2018: What will the unemployment rate be in December 2018?

by Calculated Risk on 1/01/2018 08:09:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

3) Unemployment Rate: The unemployment rate was at 4.1% in November, down 0.5 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.7% to 4.0% range in Q4 2018. What will the unemployment rate be in December 2018?

This first graph shows the unemployment rate since 1960.

The unemployment rate has declined steadily after peaking at 10% following the great recession.

The current unemployment rate (4.1%) is below the low for the previous cycle (4.4%), and close to the low (3.8%) at the end of the '90s expansion.

As I've mentioned before, current demographics share some similarities to the '60s, and the unemployment rate bottomed at 3.4% in the '60s - and we might see the unemployment rate that low again this cycle. If we look further back in time, the unemployment rate was as low as 2.5% in the 1950s.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate.

On participation: We can be pretty certain that the participation rate will decline over the next decade or longer based on demographic trends. However, over the last several years, the participation rate has been fairly steady as the strong labor market offset the long term trend.

The participation increased significantly starting in the late 60s as the Boomer generation entered the workforce and women participated at a much higher rate.

Since 2000, the participation rate has generally declined, mostly due to demographics.

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.7% | -0.2 | 5.6% |

| 2015 | 62.7% | 0.0 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 20171 | 62.7% | 0.0 | 4.1% |

| 12017 is for November 2017. | |||

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the high 3's by December 2018 from the current 4.1%. My guess is based on the participation rate declining about 0.2 percentage points in 2018, and for decent job growth in 2018, but less than in 2017.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Sunday, December 31, 2017

Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

by Calculated Risk on 12/31/2017 08:57:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

First, Tim Duy discusses the Fed's view of inflation: 5 Questions for the Fed in 2018

Inflation is always just a year away in the Fed’s forecast, and this year is no exception to that rule. In general, central bankers maintain that temporary factors such as declining mobile-phone service costs accounted for this year’s inflation shortfall. Hence, policy makers expect core inflation to accelerate to 1.9 percent in 2018 as those factors dissipate. Another inflation disappointment in 2018, however, would increase chatter at the central bank that maybe inflation expectations are declining and need to be bolstered with a more gradual path of tightening.This is a key question: Was inflation soft in 2017 due to transitory factors? Or was soft inflation more structural? I'm not going to discuss the possible structural reasons for low inflation, but there are several possible reasons including demographics, globalization, online buying, wealth inequality and more.

Although there are different measure for inflation (including some private measures) they mostly show inflation a little below the Fed's 2% inflation target, especially Core PCE.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

Click on graph for larger image.

Click on graph for larger image.On a year-over-year basis in November, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for October and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized, trimmed-mean CPI was at 2.4% annualized, and core CPI was at 1.4% annualized.

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

by Calculated Risk on 12/31/2017 01:41:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

5) Monetary Policy: The Fed raised rates three times in 2017 and started to reduce their balance sheet. The Fed is forecasting three more rate hikes in 2018. Some analysts think there will be more, from Goldman Sachs:

"We expect the next rate hike to come in March with subjective odds of 75%, and we continue to expect a total of four hikes in 2018."Will the Fed raise rates in 2018, and if so, by how much?

For years, following the great recession, I made fun of those predicting an imminent Fed Funds rate increase. Based on high unemployment and low inflation, I argued it would be a "long time" before the first rate hike. A long time passed ... and in 2015 I finally argued a rate hike was likely.

The Fed raised rates once in 2015, and then once again in December 2016, and then three times in 2017. Currently the target range for the federal funds rate is 1-1/4 to 1‑1/2 percent.

There is a wide range of views on the FOMC. As of December, the FOMC members see the following number of rate hikes in 2018:

| 25bp Rate Hikes in 2018 | FOMC Members |

|---|---|

| One Rate Cut | 1 |

| No Hikes | 1 |

| One | 1 |

| Two | 3 |

| Three | 6 |

| Four | 3 |

| More than Four | 1 |

The main view of the FOMC is three rate hikes in 2018.

As the economy approaches full employment, and with the new tax law adding a little stimulus, it is possible that inflation will pick up a little in 2018 - and, if so, the Fed could hike more than expected.

Tim Duy wrote Thursday: 5 Questions for the Fed in 2018

Is this the year inflation begins to pick up?My current guess is the Fed will hike three times in 2018.

...

Will job growth slow as expected?

...

Are policy makers underestimating the impact of the tax cuts?

...

Should the Fed care about inverting the yield curve?

...

Will financial stability concerns affect rate policy?

...

... as we think about these issues, note that the Fed will be navigating these waters with a new captain as Chair Janet Yellen is succeeded by Governor Jerome Powell. Plus, there will be a new crew in the form of Randy Quarles and, if confirmed, Marvin Goodfriend. Moreover, the more dovish voting members of the Federal Open Market Committee such as December dissenters Kashkari and Charles Evans rotate off in favor of the more hawkish voices such as John Williams and Loretta Mester. On net, the Fed will find more reasons to hike rates than hold steady in 2018, leaving the current three hike projection as the best bet.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #6 for 2018: How much will wages increase in 2018?

by Calculated Risk on 12/31/2017 08:11:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

6) Real Wage Growth: Wage growth picked up in 2016 (up 2.9%), but slowed in 2017 (up 2.5% year-over-year in November). How much will wages increase in 2018?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015, and more in 2016.

However nominal wage growth was a little soft in 2017.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up in 2015.

Real wage growth trended down in 2017.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

![]() The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth close to 4% at the end of 2016, but only 3.2% in November 2017.

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Saturday, December 30, 2017

Question #7 for 2018: How much will Residential Investment increase?

by Calculated Risk on 12/30/2017 05:20:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

7) Residential Investment: Residential investment (RI) was sluggish in 2017, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2018? How about housing starts and new home sales in 2018?

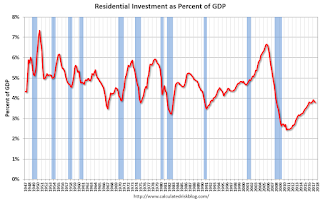

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2017:

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the start of the recovery was sluggish.

Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year since then.

RI as a percent of GDP is still low - close to the lows of previous recessions - and was sluggish in 2017.

Housing starts are on pace to increase close to 3% in 2017. The slower growth in 2017 was due to the weakness in the multi-family sector.

Even after the significant increase over the last several years, the approximately 1.21 million housing starts in 2017 will still be the 17th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

New home sales in 2017 were up about 9% compared to 2016 at close to 612 thousand.

Here is a table showing housing starts and new home sales since 2005. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That would suggest starts would increase close to 25% over the next few years from the 2017 level.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2068 | --- | 1,283 | --- |

| 2006 | 1801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1003 | 8.5% | 437 | 1.9% |

| 2015 | 1112 | 10.9% | 501 | 14.7% |

| 2016 | 1174 | 5.6% | 561 | 12.0% |

| 20171 | 1210 | 3.1% | 612 | 9.1% |

| 12017 estimated | ||||

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?