by Calculated Risk on 1/03/2018 07:02:00 PM

Wednesday, January 03, 2018

Thursday: Unemployment Claims, ADP Employment

A brief excerpt from a note by Goldman Sachs economists Daan Struyven and Marty Young:

Without consideration of tax reform, we would be constructive on US house prices. Taking tax reform into account, we expect house price appreciation to decelerate from last year’s strong 6%. We still look for homeownership rates and single-family starts to grow but see some modest downside risk from tax reform.Thursday:

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in December, down from 190,000 added in November.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

• Early, Reis Q4 2017 Mall Survey of rents and vacancy rates.

U.S. Light Vehicle Sales at 17.79 million annual rate in December

by Calculated Risk on 1/03/2018 03:19:00 PM

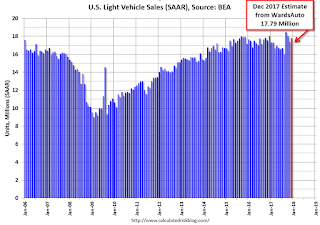

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.79 million SAAR in December.

That is down 1.5% from December 2016, and up 2.2% from last month.

This puts annual sales 17.14 million, down from 17.46 million in 2016.

The top five years for auto sales are (2017 is fourth overall).

| Top 5 Year Light Vehicle Sales | ||

|---|---|---|

| Year | Sales (000s) | |

| 2016 | 17,464.8 | |

| 2015 | 17,396.3 | |

| 2000 | 17,349.7 | |

| 20171 | 17,135.4 | |

| 2001 | 17,122.4 | |

| 1Includes estimate for Dec 2017 | ||

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 17.79 million SAAR from WardsAuto).

This was above the consensus forecast of 17.5 million for December.

Still - even with the bump in sales following the hurricanes - vehicle sales were down year-over-year in 2017, following two consecutive years of record sales.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

FOMC Minutes: New Tax Law "would likely provide a modest boost to capital spending"

by Calculated Risk on 1/03/2018 02:08:00 PM

A couple of excerpts, the first on the economic impact of the new tax law, and the second on the yield curve.

From the Fed: Minutes of the Federal Open Market Committee, December 12-13, 2017:

Many participants judged that the proposed changes in business taxes, if enacted, would likely provide a modest boost to capital spending, although the magnitude of the effects was uncertain. The resulting increase in the capital stock could contribute to positive supply-side effects, including an expansion of potential output over the next few years. However, some business contacts and respondents to business surveys suggested that firms were cautious about expanding capital spending in response to the proposed tax changes or noted that the increase in cash flow that would result from corporate tax cuts was more likely to be used for mergers and acquisitions or for debt reduction and stock buybacks.

...

Meeting participants also discussed the recent narrowing of the gap between the yields on long- and short-maturity nominal Treasury securities, which had resulted in a flatter profile of the term structure of interest rates. Among the factors contributing to the flattening, participants pointed to recent increases in the target range for the federal funds rate, reductions in investors' estimates of the longer-run neutral real interest rate, lower longer-term inflation expectations, and lower term premiums. They generally agreed that the current degree of flatness of the yield curve was not unusual by historical standards. However, several participants thought that it would be important to continue to monitor the slope of the yield curve. Some expressed concern that a possible future inversion of the yield curve, with short-term yields rising above those on longer-term Treasury securities, could portend an economic slowdown, noting that inversions have preceded recessions over the past several decades, or that a protracted yield curve inversion could adversely affect the financial condition of banks and other financial institutions and pose risks to financial stability. A couple of other participants viewed the flattening of the yield curve as an expected consequence of increases in the Committee's target range for the federal funds rate, and judged that a yield curve inversion under such circumstances would not necessarily foreshadow or cause an economic downturn. It was also noted that contacts in the financial sector generally did not express concern about the recent flattening of the term structure.

emphasis added

Construction Spending increased in November

by Calculated Risk on 1/03/2018 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in November:

Construction spending during November 2017 was estimated at a seasonally adjusted annual rate of $1,257.0 billion, 0.8 percent above the revised October estimate of $1,247.1 billion. The November figure is 2.4 percent above the November 2016 estimate of $1,227.0 billion.Both private and public spending increased in November:

Spending on private construction was at a seasonally adjusted annual rate of $964.3 billion, 1.0 percent above the revised October estimate of $955.1 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $292.7 billion, 0.2 percent above the revised October estimate of $292.0 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 22% below the bubble peak.

Non-residential spending has been declining over the last year, but is 5% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 10% below the peak in March 2009, and 11% above the austerity low in February 2014.

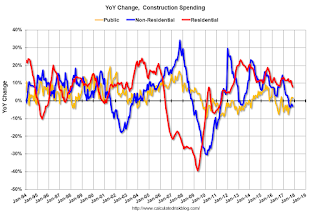

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 8%. Non-residential spending is down 3% year-over-year. Public spending is up 2% year-over-year.

This was above the consensus forecast of a 0.6% increase for November.

ISM Manufacturing index increased to 59.7 in December

by Calculated Risk on 1/03/2018 10:04:00 AM

The ISM manufacturing index indicated expansion in December. The PMI was at 59.7% in December, up from 58.2% in November. The employment index was at 57.0%, down from 59.7% last month, and the new orders index was at 69.4%, up from 64.0%.

From the Institute for Supply Management: December 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in December, and the overall economy grew for the 103rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report on Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The December PMI® registered 59.7 percent, an increase of 1.5 percentage points from the November reading of 58.2 percent. The New Orders Index registered 69.4 percent, an increase of 5.4 percentage points from the November reading of 64 percent. The Production Index registered 65.8 percent, a 1.9 percentage point increase compared to the November reading of 63.9 percent. The Employment Index registered 57 percent, a decrease of 2.7 percentage points from the November reading of 59.7 percent. The Supplier Deliveries Index registered 57.9 percent, a 1.4 percentage point increase from the November reading of 56.5 percent. The Inventories Index registered 48.5 percent, an increase of 1.5 percentage points from the November reading of 47 percent. The Prices Index registered 69 percent in December, a 3.5 percentage point increase from the November reading of 65.5 percent, indicating higher raw materials prices for the 22nd consecutive month. Comments from the panel reflect expanding business conditions, with new orders and production leading gains; employment expanding at a slower rate; order backlogs expanding at a faster rate; and export orders and imports continuing to grow in December. Supplier deliveries continued to slow (improving) at a faster rate, and inventories continued to contract at a slower rate during the period. Price increases continued at a faster rate. The Customers’ Inventories Index declined and remains at low levels.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 58.0%, and suggests manufacturing expanded at a faster pace in December than in November.

A strong report.

Reis: Office Vacancy Rate unchanged in Q4 at 16.3%

by Calculated Risk on 1/03/2018 09:32:00 AM

Reis released their Q4 2017 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 16.3% in Q4, from 16.3% in Q3. This is up from 16.1% in Q4 2016, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

Maintaining a steady balance between added supply and positive net absorption, the office market recorded no change in vacancy for the third quarter in a row. Currently at 16.3%, the national office vacancy rate has held steady most of the year climbing from a low of 16.1% at year-end 2016. Construction fell to 7.0 million square feet from 8.3 million last quarter and 10.7 million in the fourth quarter of 2016. Net absorption, or occupancy growth, was in line with construction at 5.2 million. Last quarter’s net absorption was 5.3 million square feet, while the fourth quarter of 2016 saw net absorption of 12.9 million square feet. Indeed, the fourth quarter generally sees the highest completion and net absorption numbers in the year; thus, this quarter’s lackluster results were especially noteworthy.

...

The sluggish occupancy growth numbers have kept a lid on rent growth. Although office rents increased 0.6% in the quarter – higher than previous quarters growth rates of 0.4% – asking and effective rents have both only increased 1.8% since the fourth quarter of 2016. This is the third straight quarter that saw a year-over-year effective rent growth rate below 2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.3% in Q4. The office vacancy rate is moving sideways at an elevated level.

Office vacancy data courtesy of Reis.

MBA: Mortgage Applications Decrease over Previous Two Weeks

by Calculated Risk on 1/03/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease Over Two Week Period in Latest MBA Survey

Mortgage applications decreased 2.8 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 29, 2017. The results include adjustments to account for the Christmas holiday.

... The Refinance Index decreased 7 percent from two weeks ago. The seasonally adjusted Purchase Index increased 1 percent from two weeks earlier. The unadjusted Purchase Index decreased 40 percent compared with two weeks ago and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.16 percent from 4.20 percent, with points decreasing to 0.35 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, January 02, 2018

Wednesday: ISM Mfg, Construciton Spending, Vehicle Sales, FOMC Minutes and More

by Calculated Risk on 1/02/2018 07:29:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Begin New Year Under Pressure

Bond markets weakened somewhat quickly, thus raising the risk that early 2018 would indeed follow-through on the promise that's been broken time and again when the average 30yr fixed rate has attempted to move up from the 4% level. [30YR FIXED - 4.0%-4.125%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q4 2017 Office Survey of rents and vacancy rates.

• At 10:00 AM, ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0. The ISM manufacturing index was at 58.2% in November, the employment index was at 59.7%, and the new orders index was at 64.0%.

• At 10:00 AM, Construction Spending for November. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for December. The consensus is for light vehicle sales to be 17.5 million SAAR in December, up from 17.4 million in November (Seasonally Adjusted Annual Rate).

• At 2:00 PM, FOMC Minutes, Meeting of December 12 - 13, 2017

Update: Ten Economic Questions for 2018 #wdym

by Calculated Risk on 1/02/2018 04:00:00 PM

Note: I'll be on Bloomberg's #wdym today.

Here is a review of the Ten Economic Questions for 2017.

Here are my ten questions for 2018. See links at bottom for a follow up, with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2018, and - when there are surprises - to adjust my thinking.

1) Economic growth: Heading into 2018, most analysts are pretty sanguine and expecting some pickup in growth due to the recent tax cuts. From Goldman Sachs:

"We are adjusting our forecasts to reflect the final details of the tax bill, as well as the incremental easing in financial conditions and continued strong economic momentum to end the year. We are increasing our GDP forecasts for 2018 and 2019 by 0.3pp and 0.2pp, respectively, on a Q4/Q4 basis (to 2.6% and 1.7%)."How much will the economy grow in 2018?

2) Employment: Through November, the economy has added just over 1,900,000 jobs this year, or 174,000 per month. As expected, this was down from the 187 thousand per month in 2016. Will job creation in 2018 be as strong as in 2017? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2018?

3) Unemployment Rate: The unemployment rate was at 4.1% in November, down 0.5 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.7% to 4.0% range in Q4 2018. What will the unemployment rate be in December 2018?

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

5) Monetary Policy: The Fed raised rates three times in 2017 and started to reduce their balance sheet. The Fed is forecasting three more rate hikes in 2018. Some analysts think there will be more, from Goldman Sachs:

"We expect the next rate hike to come in March with subjective odds of 75%, and we continue to expect a total of four hikes in 2018."Will the Fed raise rates in 2018, and if so, by how much?

6) Real Wage Growth: Wage growth picked up in 2016 (up 2.9%), but slowed in 2017 (up 2.5% year-over-year in November). How much will wages increase in 2018?

7) Residential Investment: Residential investment (RI) was sluggish in 2017, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2018? How about housing starts and new home sales in 2018?

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up over 6% in 2017. What will happen with house prices in 2018?

9) Housing Inventory: Housing inventory declined in 2015, 2016 and 2017. Will inventory increase or decrease in 2018?

10) Housing and Taxes A key change in the new tax law is limiting the deductibility of State and Local Taxes (SALT) and property taxes to $10,000. Many analysts think this will hit certain segments of the housing market in states like New York, New Jersey and California. The NAR noted their forecast today:

"Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas."Relative to the overall market, will sales slow, inventory increase, and price growth slow in these states?

There are other important questions, but these are the ones I'm focused on right now.

Here is some discussion and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Hotels: Strong Finish to 2017, Record Occupancy due to Hurricanes

by Calculated Risk on 1/02/2018 02:14:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 23 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 17-23 December 2017, according to data from STR.Note: The hurricanes continue to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 18-24 December 2016, the industry recorded the following:

• Occupancy: +7.1% to 45.1%

• Average daily rate (ADR): +0.5% to US$106.97

• Revenue per available room (RevPAR): +7.6% to US$48.28

Among the Top 25 Markets, Houston, Texas, reported the largest increase in each of the three key performance metrics: occupancy (+33.5% to 50.9%), ADR (+17.3% to US$92.28) and RevPAR (+56.7% to US$47.00).

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (now 2nd best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (now 2nd best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com