by Calculated Risk on 1/14/2018 08:09:00 AM

Sunday, January 14, 2018

Bank Failures by Year

In 2017, eight FDIC insured banks failed. This was up from 5 in 2016.

The great recession / housing bust / financial crisis related failures are behind us.

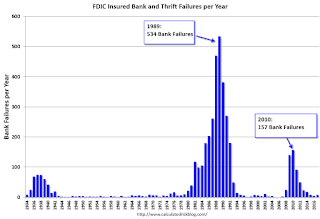

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year, so the 8 failures in 2017 was close to normal.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. Also, a large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s then during the recent crisis, the recent financial crisis was much worse (larger banks failed and were bailed out).

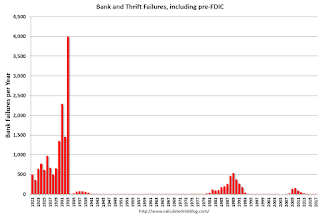

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Saturday, January 13, 2018

Schedule for Week of Jan 14, 2018

by Calculated Risk on 1/13/2018 08:11:00 AM

The key economic report this week is December Housing Starts.

For manufacturing, December industrial production, and the January New York, and Philly Fed manufacturing surveys, will be released this week.

All US markets will be closed in observance of Martin Luther King Jr. Day

8:30 AM ET: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 18.6, up from 18.0.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.3%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 73, down from 74 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 261 thousand the previous week.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and total housing starts since 1968.

The consensus is for 1.280 million SAAR, down from 1.297 million SAAR in November.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 25.0, down from 26.2.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for January). The consensus is for a reading of 97.0, up from 95.9.

Friday, January 12, 2018

Oil Rigs "Total US oil rigs were up 10 to 752 this week"

by Calculated Risk on 1/12/2018 02:48:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Jan 12, 2017:

• Total US oil rigs were up 10 to 752 this week

• Horizontal oil rigs were up 4 to 654

• We have expected rig counts to rise sharply in recent weeks, and we saw some – but still insufficient – vindication this week.

...

• Incredible price action again this week, with WTI breaching the $64 threshold, but with the Brent spread falling below $6.00.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Key Measures Show Inflation Increased in December

by Calculated Risk on 1/12/2018 11:16:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.5% annualized rate) in December. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for December here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in December. The CPI less food and energy rose 0.3% (3.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.8%. Core PCE is for November and increased 1.5% year-over-year.

On a monthly basis, median CPI was at 3.5% annualized, trimmed-mean CPI was at 2.8% annualized, and core CPI was at 3.4% annualized.

Using these measures, inflation picked up a little year-over-year in December. Overall, these measures are close, but still mostly below, the Fed's 2% target (Median CPI is slightly above).

Retail Sales increased 0.4% in December

by Calculated Risk on 1/12/2018 08:43:00 AM

On a monthly basis, retail sales increased 0.8 percent from November to December (seasonally adjusted), and sales were up 5.4 percent from December 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $495.4 billion, an increase of 0.4 percent from the previous month, and 5.4 percent above December 2016. ... The October 2017 to November 2017 percent change was revised from up 0.8 percent to up 0.9 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.4% in December.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.The increase in December was slightly below expectations, however sales in October and November were revised up. A solid report.

Thursday, January 11, 2018

Friday: Retail Sales, CPI

by Calculated Risk on 1/11/2018 08:22:00 PM

Friday:

• At 8:30 AM ET: Retail sales for December will be released. The consensus is for a 0.5% increase in retail sales.

• Also at 8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

Oil Prices Higher, Up 19% Year-over-year

by Calculated Risk on 1/11/2018 01:40:00 PM

From Bloomberg: Crude Oil Prices Are Up 49%, and It’s Not All Thanks to OPEC

The bottom line: A 49 percent surge in benchmark North American crude futures since late June, putting prices at a three-year high.

...

"We expect inventories are going to build this year -- slightly,” said Michael Cohen, Barclays Head of Oil Markets Research, in an interview on Bloomberg TV. "You’re going to see a bunch of new crude supply coming on to the market this year from the U.S. So all in all, on a balanced basis, we don’t see the kind of shortage to bring us to $80 for a sustainable basis."

Click on graph for larger image

Click on graph for larger imageThe first graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI is at $64.29 per barrel today, and Brent is at $69.66.

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Now, with the global economy stronger and less domestic production, oil prices are rising.

The second graph shows the year-over-year change in WTI based on data from the EIA.

The second graph shows the year-over-year change in WTI based on data from the EIA.Six times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Currently WTI is up about 19% year-over-year.

Sacramento Housing in December: Sales down 8% YoY, Active Inventory up 8% YoY

by Calculated Risk on 1/11/2018 11:34:00 AM

Note: I'm going to retire the graph below. The purpose was to see when the market shifted from distressed sales to more conventional sales. For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales. Now almost all of the sales are conventional equity sales.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In December, total sales were down 8.0% from December 2016, and conventional equity sales were down 3.8% compared to the same month last year.

In December, 2.9% of all resales were distressed sales. This was up from 2.3% last month, and down from 4.8% in December 2016.

Sacramento Realtor Press Release: 2017 closes with less sales, less inventory, higher sales price

December recorded 1,408 closed escrows, a .9% increase from November(1,396 sales) and an 8% decrease from last year (1,530 sales).Here are the statistics.

...

Active Listing Inventory decreased, dropping 28.9% from 2,216 to 1,575. The Months of Inventory also decreased, dropping 31.3% from 1.6 Months to 1.1. A year ago the Months of inventory was 1 and Active Listing Inventory stood at 1,458 listings (7.4% below the current figure).

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 8.0% year-over-year (YoY) in November. This is the third consecutive month with a YoY inventory increase, following 29 consecutive months with a YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.9% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory. Keep an eye on inventory - this might be a change in trend.

Weekly Initial Unemployment Claims increase to 261,000

by Calculated Risk on 1/11/2018 09:20:00 AM

The DOL reported:

In the week ending January 6, the advance figure for seasonally adjusted initial claims was 261,000, an increase of 11,000 from the previous week's unrevised level of 250,000. The 4-week moving average was 250,750, an increase of 9,000 from the previous week's unrevised average of 241,750.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 250,750.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, January 10, 2018

Thursday: Unemployment Claims, PPI

by Calculated Risk on 1/10/2018 07:32:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, down from 250 thousand the previous week.

• Also at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.