by Calculated Risk on 1/23/2018 10:18:00 AM

Tuesday, January 23, 2018

BLS: Unemployment Rates Lower in 6 states in December; California, Hawaii and Mississippi at New Series Lows

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in December in 6 states and the District of Columbia, higher in 1 state, and stable in 43 states, the U.S. Bureau of Labor Statistics reported today. Twenty-five states had jobless rate decreases from a year earlier, 2 states had increases, and 23 states and the District had little or no change. The national unemployment rate was unchanged from November at 4.1 percent but was 0.6 percentage point lower than in December 2016.

...

Hawaii had the lowest unemployment rate in December, 2.0 percent. The rates in California (4.3 percent), Hawaii (2.0 percent), and Mississippi (4.6 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

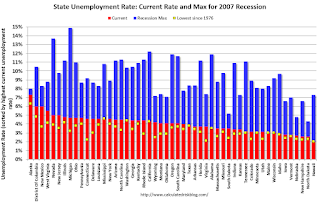

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Fourteen states have reached new all time lows since the end of the 2007 recession. These fourteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.3%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.3%) and New Mexico (6.0%). D.C. is at 6.0%.

Black Knight: National Mortgage Delinquency Rate increased in December due to Hurricanes

by Calculated Risk on 1/23/2018 09:22:00 AM

From Black Knight: Black Knight’s First Look at December 2017 Mortgage Data: 90-Day Delinquencies Jump Again as Hurricane Fallout Continues

• An additional 60,000 mortgages became 90 days delinquent in December, driven by both continued hurricane-related fallout as well as upward seasonal and calendar-related pressuresAccording to Black Knight's First Look report for December, the percent of loans delinquent increased 3.5% in December compared to November, and increased 6.5% year-over-year.

• There are now 142,700 90+ days delinquent loans attributed to Hurricanes Harvey and Irma, representing 20 percent of all severely delinquent loans nationwide

• 102,500 severely delinquent loans in affected areas of Florida and Georgia can be attributed to Hurricane Irma, while another 40,200 are the result of Hurricane Harvey in southeastern Texas

• The overall delinquency rate (representing loans 30 or more days past due, but not yet in active foreclosure) also rose another 3.47 percent to its highest level since early 2016

• December’s 6.54 percent year-over-year rise marked the fourth consecutive month of annual increases to the national delinquency rate

• The inventory of loans in active foreclosure continues to improve, falling 152,000 from last year for a 32 percent annual decline

The percent of loans in the foreclosure process declined 2.2% in December and were down 32% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.71% in December, up from 4.55% in November.

The percent of loans in the foreclosure process declined in December to 0.65%.

The number of delinquent properties, but not in foreclosure, is up 44,000 properties year-over-year, and the number of properties in the foreclosure process is down 152,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2017 | Nov 2017 | Dec 2016 | Dec 2015 | |

| Delinquent | 4.71% | 4.55% | 4.42% | 4.78% |

| In Foreclosure | 0.65% | 0.66% | 0.95% | 1.37% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,412,000 | 2,324,000 | 2,248,000 | 2,408,000 |

| Number of properties in foreclosure pre-sale inventory: | 331,000 | 337,000 | 483,000 | 689,000 |

| Total Properties | 2,743,000 | 2,661,000 | 2,731,000 | 3,097,000 |

Monday, January 22, 2018

"Mortgage Rates Set Another 9-Month High"

by Calculated Risk on 1/22/2018 05:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Set Another 9-Month High

Mortgage rates pushed up to yet another 9-month high today--something that's become all too common in the past few weeks. Just as troubling is the fact that 10yr Treasury yields--the bigger, more important neighbor that shares the street with mortgage rates--are operating at their highest levels since early 2014. Mortgage rates aren't directly tied to Treasury yields, but big momentum in Treasuries tends to spill over. [30YR FIXED - 4.25-4.375%]Tuesday:

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for January.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for December 2017 (might be delayed)

Bloomberg: "This Rare Bear Who Called the Crash Warns Housing Is Too Hot Again"

by Calculated Risk on 1/22/2018 01:54:00 PM

This article from Prashant Gopal at Bloomberg quotes me. But I'm NOT warning that "Housing is too hot again" (that is someone else). This Rare Bear Who Called the Crash Warns Housing Is Too Hot Again

Stack, 66, who manages $1.3 billion for people with a high net worth, predicted the housing crash in 2005, just before prices reached their peak. Now, from his perch in Whitefish, Montana, he says his “Housing Bubble Bellwether Barometer” of homebuilder and mortgage company stocks, which jumped 80 percent in the past year, once again is flashing red.Prices might be a little too high in some areas, but nothing like in 2005. And we aren't seeing the speculation and loose lending that was rampant in 2005.

“It is 2005 all over again in terms of the valuation extreme, the psychological excess and the denial,” said Stack, whose fireproof files of newspaper articles on bear markets date back to 1929. “People don’t believe housing is in a bubble and don’t want to hear talk about prices being a little bit bubblish.”

Phoenix Real Estate in December: Sales up slightly, Inventory down 13% YoY

by Calculated Risk on 1/22/2018 11:54:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in December were up 0.7% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 12.6% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the fourteenth consecutive month with a YoY decrease in inventory, and prices are rising a little faster in 2017 (4.9% through October or 5.9% annual rate).

| December Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Dec-08 | 5,524 | --- | 1,665 | 30.1% | 53,7921 | --- |

| Dec-09 | 7,661 | 38.7% | 3,008 | 39.3% | 39,709 | -26.2%1 |

| Dec-10 | 8,401 | 9.7% | 3,939 | 46.9% | 42,463 | 6.9% |

| Dec-11 | 7,843 | -6.6% | 3,635 | 46.3% | 24,712 | -41.8% |

| Dec-12 | 7,071 | -9.8% | 3,211 | 45.4% | 21,095 | -14.6% |

| Dec-13 | 5,930 | -16.1% | 2,053 | 34.6% | 25,511 | 20.9% |

| Dec-14 | 6,475 | 9.2% | 1,893 | 29.2% | 25,052 | -1.8% |

| Dec-15 | 6,756 | 4.3% | 1,617 | 23.9% | 23,053 | -8.0% |

| Dec-16 | 7,154 | 5.9% | 1,655 | 23.1% | 22,388 | -2.9% |

| Dec-17 | 7,204 | 0.7% | 1,626 | 22.6% | 19,570 | -12.6% |

| 1 December 2008 probably includes pending listings | ||||||

Chicago Fed "Index Points to a Pickup in Economic Growth in December"

by Calculated Risk on 1/22/2018 09:53:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in December

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up to +0.27 in December from +0.11 in November. Two of the four broad categories of indicators that make up the index increased from November, and three of the four categories made positive contributions to the index in December. The index’s three-month moving average, CFNAI-MA3, ticked down to +0.42 in December from +0.43 in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in December (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, January 21, 2018

Sunday Night Futures

by Calculated Risk on 1/21/2018 08:58:00 PM

We might see a short term continuing resolution tonight to end the government shutdown.

Weekend:

• Schedule for Week of Jan 21, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for December. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 3, and DOW futures are down 50 (fair value).

Oil prices were up over the last week with WTI futures at $63.47 per barrel and Brent at $68.70 per barrel. A year ago, WTI was at $52, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.53 per gallon. A year ago prices were at $2.31 per gallon - so gasoline prices are up 22 cents per gallon year-over-year.

Data and the #TrumpShutdown

by Calculated Risk on 1/21/2018 12:11:00 PM

If the shutdown doesn't end quickly, several agencies will probably not release regular government reports. For the coming week, the December new home sales, the durable goods, and advance Q4 GDP reports will probably be delayed.

If the shutdown continues, the following week the January employment report will be delayed (fortunately the data has already been gathered).

Private data - like the existing home sales report this week - will still be released. All Federal Reserve data will continue to be released (separate funding).

Also, the DOL will continue to process unemployment claims and release the weekly initial unemployment claims report.

If the shutdown lasts through this week, we should a spike in claims in the report released the following week.

The following graph shows the 4-week moving average of weekly claims since January 2000 with various event driven spikes labeled.

Note the spike related to the 2013 government shutdown. Weekly claims jumped 66,000 in the week following the shutdown in 2013. We will probably see a similar spike in the report released the week of January 28th (if the shutdown does not end quickly).

Another impact from the shutdown will be on mortgage lending.

In 2013, the IRS stopped processing 4506-T forms (the required two years of tax returns for mortgage lending). For loans ready to close, this will not be a problem. And lenders can still accept applications, but this could slow closings a few weeks depending on the duration of the shutdown.

There are many other impacts from the shutdown, and hopefully it will be resolved soon.

Saturday, January 20, 2018

Schedule for Week of Jan 21, 2018

by Calculated Risk on 1/20/2018 08:09:00 AM

Note: If the government is shut down, some of these releases will probably be delayed (Q4 GDP, New Home sales, etc.)

The key economic reports this week are the advance estimate of Q4 GDP, and December new home sales and existing home sales.

For manufacturing, the January Richmond Fed and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: State Employment and Unemployment (Monthly) for December 2017

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM ET: FHFA House Price Index for November 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.75 million SAAR, down from 5.81 million in November.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.75 million SAAR, down from 5.81 million in November.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.66 million SAAR for December.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 220 thousand the previous week.

10:00 AM ET: New Home Sales for December from the Census Bureau.

10:00 AM ET: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for 683 thousand SAAR, down from 733 thousand in November.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.9% annualized in Q4, down from 3.2% in Q3.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

Friday, January 19, 2018

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/19/2018 04:15:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.66 million in December, down 2.6% from November’s preliminary pace and up 2.7% from last month’s seasonally adjusted pace. Unadjusted sales last month should be down slightly from a year ago, with the “SA/NSA” gap reflecting this year’s lower business day count compared to last year’s.

On the inventory front, realtor/MLS data suggest that inventories in December were down YOY by about a little more than was the case in November, and my “best guess” is that the NAR’s inventory estimate for December will be 1.48 million, down 11.4% from November’s estimate and down 10.3% from last December.

Finally, realtor/MLS data suggest the the NAR’s estimate for the median existing home sales price in November will be up by about 6.5% from last December.

CR Note: Existing home sales for December are scheduled to be released on Wednesday, January 24th. The consensus is for sales of 5.68 million SAAR.