by Calculated Risk on 1/30/2018 10:53:00 AM

Tuesday, January 30, 2018

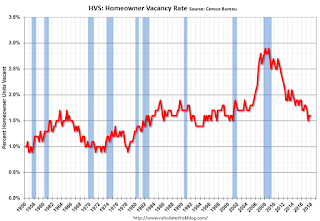

HVS: Q4 2017 Homeownership and Vacancy Rates

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2017.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 64.2% in Q4, from 63.9% in Q3.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Case-Shiller: National House Price Index increased 6.2% year-over-year in November

by Calculated Risk on 1/30/2018 09:12:00 AM

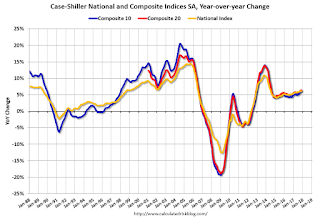

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Cities in the West: Seattle, Las Vegas and San Francisco Lead Gains in S&P Corelogic Case-Shiller Home Price Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in November, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.1%, up from 5.9% the previous month. The 20-City Composite posted a 6.4% year-over-year gain, up from 6.3% the previous month.

Seattle, Las Vegas, and San Francisco reported the highest year-over-year gains among the 20 cities. In November, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with a 10.6% increase, and San Francisco with a 9.1% increase. Six cities reported greater price increases in the year ending November 2017 versus the year ending October 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in November. The 10-City and 20-City Composites reported increases of 0.3% and 0.2%, respectively. After seasonal adjustment, the National Index recorded a 0.7% month-over-month increase in November. The 10-City and 20-City Composites posted 0.8% and 0.7% month-over-month increases, respectively. Ten of 20 cities reported increases in November before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continue to rise three times faster than the rate of inflation,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index year-over-year increases have been 5% or more for 16 months; the 20-City index has climbed at this pace for 28 months. Given slow population and income growth since the financial crisis, demand is not the primary factor in rising home prices. Construction costs, as measured by National Income and Product Accounts, recovered after the financial crisis, increasing between 2% and 4% annually, but do not explain all of the home price gains. From 2010 to the latest month of data, the construction of single family homes slowed, with single family home starts averaging 632,000 annually. This is less than the annual rate during the 2007-2009 financial crisis of 698,000, which is far less than the long-term average of slightly more than one million annually from 1959 to 2000 and 1.5 million during the 2001-2006 boom years. Without more supply, home prices may continue to substantially outpace inflation.”

“Looking across the 20 cities covered here, those that enjoyed the fastest price increases before the 2007-2009 financial crisis are again among those cities experiencing the largest gains. San Diego, Los Angeles, Miami and Las Vegas, price leaders in the boom before the crisis, are again seeing strong price gains. They have been joined by three cities where prices were above average during the financial crisis and continue to rise rapidly – Dallas, Portland OR, and Seattle.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 3.6% from the peak, and up 0.8% in November (SA).

The Composite 20 index is off slightly from the peak, and up 0.8% (SA) in November.

The National index is 6.4% above the bubble peak (SA), and up 0.7% (SA) in November. The National index is up 43.8% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.1% compared to November 2016. The Composite 20 SA is up 6.4% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, January 29, 2018

"Mortgage Rates Surge to Highest Levels in More Than 3 Years"

by Calculated Risk on 1/29/2018 07:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Surge to Highest Levels in More Than 3 Years

Mortgage rates are in trouble. This will come as no surprise to regular readers. For the past few weeks, rates made several successive runs up to the highest levels in more than 9 months. It was really only the spring of 2017 that stood in the way of rates being the highest since early 2014. After Friday marked another "highest in 9 months" day, it would only have taken a moderate movement to break into the "3+ year" territory. The move ended up being even bigger.Tuesday:

From a week and a half ago, most borrowers are now looking at another eighth of a percentage point higher in rate. In total, rates are up the better part of half a point since December 15th. [30YR FIXED - 4.375-4.5%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for November. The consensus is for a 6.4% year-over-year increase in the Comp 20 index for November.

• At 10:00 AM, Q4 Housing Vacancies and Homeownership from the Census Bureau.

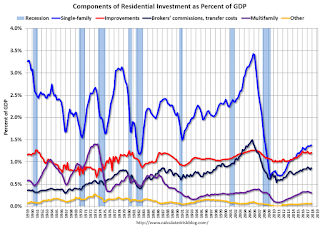

Q4 2017 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 1/29/2018 04:39:00 PM

The BEA has released the underlying details for the Q4 advance GDP report.

The BEA reported that investment in non-residential structures increased at a 6.8% annual pace in Q4. This is a turnaround from early last year when non-residential investment declined due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration increased substantially in Q4, from a $55 billion annual rate in Q4 2016 to a $107 billion annual rate in Q4 2017 - but is still down from a recent peak of $165 billion in Q4 2014.

Without the increase in petroleum and natural gas exploration, non-residential investment would be down year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q4, and is down 7% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was up 4% year-over-year in Q4. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q4, and lodging investment is up 5% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for the last four years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $272 billion (SAAR) (about 1.4% of GDP), and was up in Q4 compared to Q3.

Investment in home improvement was at a $238 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.2% of GDP). Home improvement spending has been solid.

NMHC: Apartment Market Tightness Index remained negative for Ninth Consecutive Quarter

by Calculated Risk on 1/29/2018 02:44:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Markets Remain Soft in the January NMHC Quarterly Survey

Apartment market conditions continued to soften according to results from the January National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The Market Tightness (36), Sales Volume (40) and Debt Financing (38) Indexes landed below the breakeven level of 50, while the Equity Financing Index increased to 58. In addition, the survey found that half of respondents expect green financing to increase in 2018.

“The latest survey results underscored the prevailing view at our recent Apartment Strategies Conference that we are late in the current cycle,” said NMHC Chief Economist Mark Obrinsky. “While some seasonality comes into play, the Market Tightness Index was a little below its long-term January average, indicating market conditions are slightly weaker than normal. Demand for apartments overall remains strong and equity capital still looks favorably on the apartment sector. However, many owners are satisfied with their holdings and more inclined to stand pat.”

The Market Tightness Index decreased one point to 36 – the ninth consecutive quarter of declining conditions. Just 14 percent reported tighter conditions compared to the previous three months, compared to 42 percent of senior executives who reported looser conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the ninth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Black Knight: House Price Index up 0.3% in November, Up 6.4% year-over-year

by Calculated Risk on 1/29/2018 12:36:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight HPI: Appreciation Remains Steady as U.S. Home Prices Gain 0.27 Percent in November, Up 6.44 Percent Year-Over-Year

• After 67 consecutive months of annual appreciation, U.S. home prices reached another new peak at $283KOnce again, this index is Not seasonally adjusted, and seasonally declines in some states is expected (so don't read too much into any regional declines). The year-over-year increase in this index has been about the same for the last year (close to 6% range).

• At the national level, home prices have now gained 6.49 percent growth since the start of 2017

• New York led all states in monthly appreciation with home prices there rising 1.36 percent from October

...

• Home prices fell in six of the nation’s 20 largest states; Wisconsin saw the largest decline at -0.37 percent

• Ten of the 20 largest states and 12 of the 40 largest metros hit new home price peaks in November

Note also that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for November will be released tomorrow.

Dallas Fed: Manufacturing Expansion Solid in January

by Calculated Risk on 1/29/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to expand in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained elevated but retreated to 16.8 after surging to an 11-year high in December.This was the last of the regional Fed surveys for January.

Most other measures of manufacturing activity also pointed to somewhat slower growth in January after the rapid expansion seen in December. The new orders index moved down from 30.1 to 25.5, and the growth rate of orders index fell six points to 15.5. The capacity utilization index also stayed positive but declined, dropping 12 points to 14.5. Meanwhile, the shipments index rose six points to 27.1, indicating a pickup in growth.

Perceptions of broader business conditions remained highly positive in January. The general business activity index pushed up further to 33.4, its highest reading in more than 12 years. The company outlook index remained elevated but edged down to 27.8.

Labor market measures suggested a slight deceleration in employment growth and longer workweeks this month. The employment index came in at 15.2, down five points from December.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be strong again in January (to be released Thursday, Feb 1st).

Personal Income increased 0.4% in December, Spending increased 0.4%

by Calculated Risk on 1/29/2018 08:47:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $58.7 billion (0.4 percent) in December according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $48.0 billion (0.3 percent) and personal consumption expenditures (PCE) increased $54.2 billion (0.4 percent).The December PCE price index increased 1.7 percent year-over-year and the December PCE price index, excluding food and energy, increased 1.5 percent year-over-year.

...

Real PCE increased 0.3 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through December 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly above expectations, and the increase in PCE was slightly below expectations.

Sunday, January 28, 2018

Sunday Night Futures

by Calculated Risk on 1/28/2018 07:14:00 PM

Weekend:

• Schedule for Week of Jan 28, 2018

Monday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional surveys for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 2, and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $66.24 per barrel and Brent at $60.47 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.57 per gallon. A year ago prices were at $2.27 per gallon - so gasoline prices are up 30 cents per gallon year-over-year.

Vehicle Forecast: Sales Expected to Exceed 17 million SAAR Again in January

by Calculated Risk on 1/28/2018 11:06:00 AM

The automakers will report January vehicle sales on Thursday, Feb 1st.

Note: There are 25 selling days in January 2018, there were 24 selling days in January 2017.

From WardsAuto: U.S. Forecast: January Sets Stage for Anticipated Year-Over-Year Decline

The Wards Intelligence January forecast calls for 1.16 million LVs to be delivered over 25 selling days, resulting in a 46,430-unit daily sales rate compared with 47,442 in prior-year (24 days). The DSR is down 2.1% from like-2017.Sales had been below 17 million SAAR (Seasonally Adjusted Annual Rate) for six consecutive months last year, until September, when sales increased due to buying following Hurricane Harvey. If sales exceed 17 million SAAR in January, this will be the fifth consecutive month over 17 million SAAR. However, overall, it appears sales will be down again in 2018.

...

The resulting seasonally adjusted annual rate is 17.24 million units, below the 17.75 million in the previous month and 17.34 million year-ago.

emphasis added

Here is a table of light vehicle sales since 2000. The record year for sales was 2016, followed by 2015, both breaking the previous record set in 2000. Last year, 2017, was the fourth best year ever, just ahead of 2001.

| Light Vehicle Sales (000s) | ||

|---|---|---|

| Year | Sales | Change |

| 2000 | 17,350 | |

| 2001 | 17,122 | -1.3% |

| 2002 | 16,816 | -1.8% |

| 2003 | 16,639 | -1.1% |

| 2004 | 16,867 | 1.4% |

| 2005 | 16,948 | 0.5% |

| 2006 | 16,504 | -2.6% |

| 2007 | 16,089 | -2.5% |

| 2008 | 13,195 | -18.0% |

| 2009 | 10,402 | -21.2% |

| 2010 | 11,555 | 11.1% |

| 2011 | 12,742 | 10.3% |

| 2012 | 14,433 | 13.3% |

| 2013 | 15,530 | 7.6% |

| 2014 | 16,452 | 5.9% |

| 2015 | 17,396 | 5.7% |

| 2016 | 17,465 | 0.4% |

| 2017 | 17,135 | -1.9% |