by Calculated Risk on 2/13/2018 08:56:00 PM

Tuesday, February 13, 2018

Wednesday: CPI, Retail Sales

Wednesday:

• At 7:00 AM ET,The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for January will be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.2% increase in inventories.

NY Fed Q4 Report: "Household Debt Increased, Fifth Consecutive Year Of Positive Annual Growth"

by Calculated Risk on 2/13/2018 03:11:00 PM

From the NY Fed: Household Debt Jumps as 2017 Marks the Fifth Consecutive Year Of Positive Annual Growth Since Post-Recession Deleveraging

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit,which reported that total household debt increased by $193 billion (1.5%) to $13.15 trillion in the fourth quarter of 2017. This report marks the fifth consecutive year of positive annual household debt growth. There were increases in mortgage, student, auto, and credit card debt (increasing by 1.6%, 1.5%, 0.7% and 3.2% respectively) and another modest decline in home equity line of credit (HELOC) balances (decreasing by 0.9%). The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Mortgages are the largest form of household debt and their increase of $139 billion was the most substantial increase seen in several quarters. Unlike overall debt balances, which last year surpassed their previous peak reached in the third quarter of 2008, mortgage balances remain 4.4% below it. The New York Fed issued an accompanying blog post to examine the regional differences in mortgage debt growth since the previous peak.

...

Bankruptcy notations decreased for the second consecutive quarter. ... Foreclosure notations remained essentially unchanged at the lowest levels observed in the New York Fed’s data.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Mortgage balances, the largest component of household debt, increased substantially during the fourth quarter. Mortgage balances shown on consumer credit reports on December 31 stood at $8.88 trillion, an increase of $139 billion from the third quarter of 2017. Balances on home equity lines of credit (HELOC) declined again, by $4 billion and now stand at $444 billion. Non-housing balances, which have been increasing steadily for nearly 6 years overall, saw a $58 billion increase in the fourth quarter. Auto loans grew by $8 billion and credit card balances increased by $26 billion, while student loans saw a $21 billion increase.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate decreased in Q4. From the NY Fed:

Aggregate delinquency rates improved in the fourth quarter of 2017. As of December 31, 4.7% of outstanding debt was in some stage of delinquency. Of the $619 billion of debt that is delinquent, $406 billion is seriously delinquent (at least 90 days late or “severely derogatory”). The flow into 90+ days delinquency for credit card balances has been increasing notably from the last year and the flow into 90+ days delinquency for auto loan balances has been slowly increasing since 2012.There is much more in the report.

Demographics and GDP: 2% is the new 4%

by Calculated Risk on 2/13/2018 12:19:00 PM

Three years ago, I wrote Demographics and GDP: 2% is the new 4%. In that post I pointed out that due to demographics, slower GDP growth should have been expected over the last decade (contrary to political nonsense).

Yesterday, Greg Ip at the WSJ noted: Mulvaney: "People thought we were crazy" to forecast 2.3% 2017 growth. "We blew that out of the water." (Referring to John "Mick" Mulvaney, Director of the Office of Management and Budget).

What was real GDP growth in 2017? 2.3% according to the BEA. Too funny. (Maybe he meant Q4 over Q4, but that was only 2.5% - not exactly blown "out of the water".

This give me an excuse to update my graphs from my post three years ago. Overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis.

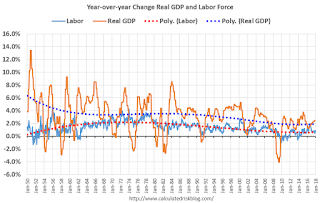

One simple way to look at the change in GDP is as the change in the labor force, times the change in productivity. If the labor force is growing quickly, GDP will be higher with the same gains in productivity. And the opposite is true.

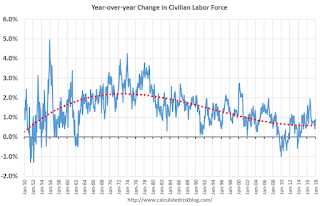

So here is a graph of the year-over-year change in the labor force since 1950 (data from the BLS).

The data is noisy - because of changes in population controls and the business cycle - but the pattern is clear as indicated by the dashed red trend line. The labor force has been growing slowly after declining for some time.

We could also look at just the prime working age population - I've pointed out before the that prime working age population has started growing again.

Now here is a look at GDP for the same period.

GDP was high in the early 50s - and early-to-mid 60s because of government spending (Korean and Vietnam wars). As in example, in 1951, national defense added added 6.5 percentage points to GDP. Of course we don't want another war ...

Now lets put the two graphs together.

The good news is that the working age population will be growing faster going forward. The bad news is the political hacks will continue to ignore demographics.

However, due to demographics, 2% GDP growth is the new 4%. (Note: with improving demographics, maybe 2.5% is the new 4% now)

Goldman: "The 2018 Inflation Rebound"

by Calculated Risk on 2/13/2018 10:58:00 AM

A few brief excerpts from a note by Goldman Sachs economist Daan Struyven: The 2018 Inflation Rebound

Using our top-down and bottom-up core PCE models, we project that both macroeconomic fundamentals as well as sector-specific factors are likely to push core inflation meaningfully higher this year.CR Note: The central tendency for core inflation in the December FOMC projections was 1.7% to 1.9%. So this is in line with current FOMC projections, and still below the Fed target of 2%.

...

We highlight three key drivers of the core PCE acceleration to 1.8% by end-2018 in our forecast: a 0.15pp boost from the pass-through from higher energy prices and a weaker dollar, a 0.1-0.15pp lift from a tighter labor market, and a 0.1pp jump from the Verizon effect dropping out.

...

We ... now see the risks to our core PCE forecast of 1.8% by end-2018 as moderately tilted to the upside.

emphasis added

Small Business Optimism Index Increased in January, "Difficulty of finding qualified workers" is Top Problem

by Calculated Risk on 2/13/2018 08:57:00 AM

From the National Federation of Independent Business (NFIB): Record Number of Small Business Owners Say ‘Now is Good Time to Expand’

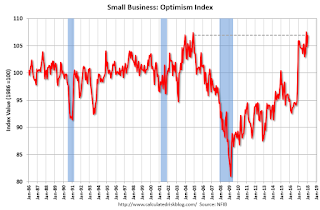

The Index of Small Business Optimism gained 2.0 points in January, rising to 106.9, again one of the strongest readings in the 45-year history of the NFIB surveys. The highest reading of 108.0 was reached in July 1983 and the lowest reading of 79.7 occurred in April 1980.

Job creation was solid in the small-business sector as owners reported a seasonally adjusted average employment change per firm of 0.23 workers, a strong showing. The lack of “qualified” workers is impeding growth in employment. ... Twenty-two percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 3 points), exceeding the percentage citing taxes or the cost of regulation as their top business problem.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 106.9 in December.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, February 12, 2018

"Mortgage Rates Steady at 4-Year Highs Despite Warning Shots"

by Calculated Risk on 2/12/2018 07:14:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady at 4-Year Highs Despite Warning Shots

Mortgage rates were generally in line with Friday's latest levels today. Unfortunately, those happened to be the highest in more than 4 years.Tuesday:

...

Although bond markets received another warning shot with respect to increased supply today due to the unveiling of Trumps's new budget, market participants didn't do much with that information. Bonds were mostly unchanged as they wait for bigger, more important news like Wednesday morning's Consumer Price Index (inflation data). [30YR FIXED - 4.5%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

AIA Forecast: 4% increase in Nonresidential Construction in 2018

by Calculated Risk on 2/12/2018 04:21:00 PM

Note: This does not include spending for oil and gas.

From the AIA: Pace of construction activity projected to accelerate through 2019

Despite labor shortages and rising material costs that continue to impact the construction sector, construction spending for nonresidential buildings is projected to increase 4% this year and continue at that pace of growth through 2019. The American Institute of Architects (AIA) semi-annual Consensus Construction Forecast indicates the commercial construction sectors will generate much of the expected gains this year, and by 2019 the industrial and institutional sectors will dominate the projected construction growth.

“Rebuilding after the record-breaking losses from natural disasters last year, the recently enacted tax reform bill, and the prospects of an infrastructure package are expected to provide opportunities for even more robust levels of activity within the industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The Architecture Billings Index (ABI) and other major leading indicators for the industry also point to an upturn in construction activity over the coming year.”

Port of Long Beach: Record Port Traffic in January 2018

by Calculated Risk on 2/12/2018 01:12:00 PM

From the Port of Long Beach: Year Begins With Records in Long Beach

The new year brought a raft of records to the Port of Long Beach, where January container volumes reached an all-time high for the month.CR Notes: The timing of the Chinese New Year always impacts traffic I'll have more on the LA area port traffic once Los Angeles releases their January statistics.

Workers moved 657,830 twenty-foot equivalent units (TEUs) through the harbor in January, 12.9 percent more than the same month last year. The total marks the first time Long Beach has surpassed 600,000 containers in the month of January. The quick start to 2018 comes after officials recently announced that 2017 was the busiest year in the Port’s 107-year history, reaching 7.54 million TEUs.

“The pre-Lunar New Year surge is definitely here,” said Port of Long Beach Executive Director Mario Cordero, taking note of the upcoming two-week holiday period in Asia, the Port’s primary trading partner. “Since this year’s holiday begins Feb. 16, we anticipated a busy January and February, as cargo owners seek to get goods shipped ahead of the festivities.”

Lawler: Will Average Hourly Earnings Growth Decelerate Over the Next Two Months?

by Calculated Risk on 2/12/2018 09:47:00 AM

From housing economist Tom Lawler: Will Average Hourly Earnings Growth Decelerate Over the Next Two Months?

In its Employment Report for January the BLS reported that average hourly earnings of all private non-farm employees was $26.74 (seasonally adjusted) last month, up 2.9% from a year earlier. This year-over-year gain was up from 2.7% in December and 2.5% in November, and represented the higher YOY increase since May 2009 (though the January YOY gain was only trivially higher than the YOY increase in September of last year (2.832% vs. 2.886%). What few folks have mentioned, however, is that the YOY increase in average hourly earnings for production and non-supervisory workers in the non-farm sector last month was just 2.43%, virtually unchanged from December’s YOY gain.

Obviously, these data imply that the YOY increase in “supervisory” workers accelerated significantly last month, and in fact that was the case: the YOY increase in average hourly earnings of “supervisory” workers (which is not shown in the report but which can be derived) was 3.9% in January, up from 3.3% in December and 3.0% in November. (See chart below). This YOY increase was the highest “on record” though data are only available back to 2006. On a monthly basis the AHE of supervisory employees jumped by 0.8% (seasonally adjusted) in January and 0.5% in December, resulting in annualized growth over this two month period of 8.0%.

Prior to 2010 the BLS only reported average hourly earnings for production and non-supervisory workers in its monthly release. Since then it has become apparent that the AHE’s of supervisory workers are much more volatile than the AHE’s of production/non-supervisory employees (the standard deviation of monthly % changes in the former is more than twice as high as the latter). Moreover, “outsized” (significantly above trend) gains in the AHE’s of supervisory workers have tended to be followed by below-trend increases over the subsequent two months. If history is any guide, that will be the case in the next two monthly reports.

Supervisory workers accounted for about 17.6% of total non-farm payroll workers in January, so if the AHE of supervisory workers were unchanged from January to March (which would imply annualized growth of 3.9% over the four-month period ending in March), and the AHE of production/non-supervisory workers increased at an annualized pace of 2.5% over the next two months (slightly above the recent trend), then the YOY increase in the AHE for all non-farm payroll employees would decline to 2.7% in March from the “scary” 2.9% in January. (February is likely to see a year over year increase of about 2.7% as well).

Inquiring minds might like to know why I spent so much time on why the YOY increase in the AHE in January increased slightly to 2.9%. The reason is that so many “talking heads” have been citing the January “wage report” as one of the major catalysts for the recent turmoil in the stock market. That, of course, seem inane, but it was so widely cited that it got me looking into this.

Sunday, February 11, 2018

Sunday Night Futures

by Calculated Risk on 2/11/2018 09:13:00 PM

Weekend:

• Schedule for Week of Feb 11, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 14, and DOW futures are up 129 (fair value).

Oil prices were down over the last week with WTI futures at $59.73 per barrel and Brent at $63.25 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.57 per gallon. A year ago prices were at $2.28 per gallon - so gasoline prices are up 29 cents per gallon year-over-year.