by Calculated Risk on 2/18/2018 08:02:00 PM

Sunday, February 18, 2018

Goldman: "Federal fiscal policy is entering uncharted territory"

A few excerpts from a note by Goldman Sachs economists: What’s Wrong with Fiscal Policy?

Federal fiscal policy is entering uncharted territory. ... While most of the recent fiscal expansion has not come as a surprise to us, this nevertheless raises new questions about the plan for US fiscal policy.CR Note: The Federal government is the only entity that can run counter cyclical fiscal policy during a recession (increase spending to offset the downturn). State and local governments cut spending during a recession, as do households. Standard policy would be to reduce the Federal deficit in the later stages of an expansion, and then increase the deficit during the next downturn. The opposite of the current fiscal policy.

The Treasury continues to borrow at low rates and it should be able to do so for a while even if market rates move higher in our view, thanks to a nearly 6-year average maturity of outstanding debt. ... In the past, as the economy strengthens and the debt burden increases, Congress has responded by raising taxes and cutting spending. This time around, the opposite has occurred. ...

While the continued growth of public debt raises eventual sustainability questions if left unchecked, we note that the level of debt at the moment is within the range of several other DM economies, albeit at the high end of the range. Where the US is more of an outlier is in its cyclically adjusted deficit.

The fiscal expansion should boost growth by around 0.7pp in 2018 and 0.6pp in 2019, but will likely come to an end after that ... the growth effect comes from the change in the deficit ... some of the recent deficit expansion relates to changes unlikely to be repeated, such as the temporarily large effect of certain tax provisions.

emphasis added

Current fiscal policy is really in "uncharted territory".

Phoenix Real Estate in January: Sales up 3%, Inventory down 11% YoY

by Calculated Risk on 2/18/2018 10:04:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in January were up 2.8% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 10.7% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller. With flat inventory in 2016, prices were up 4.8%.

This is the fifteenth consecutive month with a YoY decrease in inventory, and prices rose a little faster in 2017 compared to 2016 (5.0% through November or 5.5% annual rate).

| January Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jan-08 | 2,907 | --- | 553 | 19.0% | 56,8741 | --- |

| Jan-09 | 4,736 | 62.9% | 1,625 | 34.3% | 53,581 | -5.8% |

| Jan-10 | 5,789 | 22.2% | 2,475 | 42.8% | 41,506 | -22.5% |

| Jan-11 | 6,539 | 13.0% | 3,263 | 49.9% | 42,881 | 3.3% |

| Jan-12 | 6,455 | -1.3% | 3,198 | 49.5% | 25,025 | -41.6% |

| Jan-13 | 5,790 | -10.3% | 2,555 | 44.1% | 22,090 | -11.7% |

| Jan-14 | 4,799 | -17.1% | 1,740 | 36.3% | 28,630 | 29.6% |

| Jan-15 | 4,785 | -0.3% | 1,529 | 32.0% | 27,238 | -4.9% |

| Jan-16 | 5,199 | 8.7% | 1,425 | 27.4% | 25,736 | -5.5% |

| Jan-17 | 6,028 | 15.9% | 1,631 | 27.1% | 23,762 | -7.7% |

| Jan-18 | 6,197 | 2.8% | 1,668 | 26.9% | 21,226 | -10.7% |

| 1 January 2008 probably included pending listings | ||||||

Saturday, February 17, 2018

Schedule for Week of Feb 18, 2018

by Calculated Risk on 2/17/2018 08:11:00 AM

The key economic report this week is January existing home sales.

All US markets are closed in observance of the Presidents' Day holiday.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.65 million SAAR, up from 5.57 million in December.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.65 million SAAR, up from 5.57 million in December.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.48 million SAAR for January.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of January 30-31, 2018

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, unchanged from 230 thousand the previous week.

11:00 AM: the Kansas City Fed manufacturing survey for February.

No major economic releases scheduled.

Friday, February 16, 2018

Oil Rigs "Continued gains in rig counts"

by Calculated Risk on 2/16/2018 07:42:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Feb 16, 2018:

• Total US oil rigs saw another solid week, +7 to 798

• Horizontal oil rigs were up even better, +10 to 696

...

• All the action was in the inscrutable ‘Other’ plays, which added 12 horizontal oil rigs, compared to a loss of 2 across the major plays

• The oil price stabilized this past week, and the Brent spread has recovered a bit to about $3.30 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/16/2018 03:35:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.48 million in January, down 1.6% from December’s preliminary estimate and down 3.7% from last January’s seasonally-adjusted pace. Unadjusted sales should show a much smaller YOY decline, reflecting the higher business day count this January compared to last January.

(Note that the January EHS report will include updated seasonal factors which will result in revisions to the seasonally-adjusted data for the past several years. I have attempted to incorporate seasonal factor revisions in my forecast).

On the inventory front, realtor/MLS data suggest that home listings showed a smaller YOY decline last month compared to December, and my “best guess” is that the NAR’s estimate of the inventory of existing homes for sale in January will be 1.54 million, up 4.1% from the December estimate and down 8.3% from a year ago.

Finally, local realtor/MLS data would be consistent with a YOY increase in the NAR’s estimate of the median existing SF home sales price of about 6.5%.

CR Note: Existing home sales for December are scheduled to be released on Wednesday, February 21st. The consensus is for sales of 5.60 million SAAR.

Quarterly Housing Starts by Intent, Q4 2017

by Calculated Risk on 2/16/2018 01:22:00 PM

In addition to housing starts for January, the Census Bureau also released the Q4 "Started and Completed by Purpose of Construction" report today.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released today showed there were 149,000 single family starts, built for sale, in Q4 2017, and that was above the 139,000 new homes sold for the same quarter, so inventory increased in Q4 (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 8% compared to Q4 2016.

Owner built starts were mostly unchanged year-over-year. And condos built for sale not far above the record low. (this is curious).

The 'units built for rent' (blue) has increased significantly in recent years, but is now moving more sideways.

Comments on January Housing Starts

by Calculated Risk on 2/16/2018 10:50:00 AM

Earlier: Housing Starts increased to 1.326 Million Annual Rate in January

The housing starts report released this morning showed starts were up 9.7% in January compared to December, and starts were up 7.3% year-over-year compared to January 2017.

This first graph shows the month to month comparison between 2017 (blue) and 2017 (red).

Starts were up 7.3% in January compared to January 2017.

Total starts are up 18.1% compared to January 2016 (two years ago). That is solid growth.

Single family starts were up 7.6% year-over-year, and up 3.6% compared to December.

Multi-family starts were up 6.7% year-over-year, and up 23.7% compared to December (multi-family is volatile month-to-month).

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in a year or so.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Housing Starts increased to 1.326 Million Annual Rate in January

by Calculated Risk on 2/16/2018 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,326,000. This is 9.7 percent above the revised December estimate of 1,209,000 and is 7.3 percent above the January 2017 rate of 1,236,000. Single-family housing starts in January were at a rate of 877,000; this is 3.7 percent above the revised December figure of 846,000. The January rate for units in buildings with five units or more was 431,000.

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,396,000. This is 7.4 percent above the revised December rate of 1,300,000 and is 7.4 percent above the January 2017 rate of 1,300,000. Single-family authorizations in January were at a rate of 866,000; this is 1.7 percent below the revised December figure of 881,000. Authorizations of units in buildings with five units or more were at a rate of 479,000 in January.

emphasis added

Click on graph for larger image.

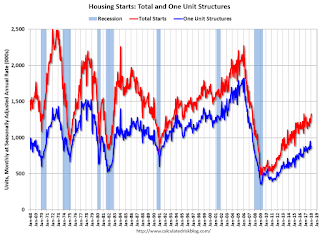

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply in January compared to December. Multi-family starts were up 6.7% year-over-year in January.

Multi-family is volatile month-to-month, but has been mostly moving sideways the last few years.

Single-family starts (blue) increased in January, and are still up 7.6% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in January were above expectations, mostly due to a sharp increase in multi-family starts. However starts for November were revised down, and December revised up slightly.

I'll have more later ...

Thursday, February 15, 2018

Friday: Housing Starts

by Calculated Risk on 2/15/2018 08:43:00 PM

Friday:

• At 8:30 AM ET, Housing Starts for January. The consensus is for 1.230 million SAAR, up from 1.192 million SAAR.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 95.5, down from 95.7.

Fannie and Freddie: REO inventory declined in Q4, Down 30% Year-over-year

by Calculated Risk on 2/15/2018 02:35:00 PM

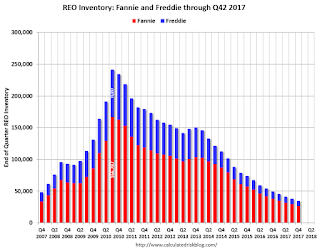

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 8,299 at the end of Q4 2017 compared to 11,418 at the end of Q4 2016.

For Freddie, this is down 89% from the 74,897 peak number of REOs in Q3 2010. For Freddie, this is the lowest since at least 2007.

Fannie Mae reported the number of REO declined to 26,311 at the end of Q4 2017 compared to 38,093 at the end of Q4 2016.

For Fannie, this is down 84% from the 166,787 peak number of REOs in Q3 2010. For Fannie, this is the lowest since at least 2007.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 for both Fannie and Freddie, and combined inventory is down 30% year-over-year.

There are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states - but this is close to normal levels of REOs.