by Calculated Risk on 3/05/2018 10:03:00 AM

Monday, March 05, 2018

ISM Non-Manufacturing Index decreased to 59.5% in February

The February ISM Non-manufacturing index was at 59.5%, down from 59.9% in January. The employment index decreased in February to 55.0%, from 61.6%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2018 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 97th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 59.5 percent, which is 0.4 percentage point lower than the January reading of 59.9 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 62.8 percent, 3 percentage points higher than the January reading of 59.8 percent, reflecting growth for the 103rd consecutive month, at a faster rate in February. The New Orders Index registered 64.8 percent, 2.1 percentage points higher than the reading of 62.7 percent in January. The Employment Index decreased 6.6 percentage points in February to 55 percent from the January reading of 61.6 percent. The Prices Index decreased by 0.9 percentage point from the January reading of 61.9 percent to 61 percent, indicating that prices increased in February for the 24th consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector reflected the second consecutive month of strong growth in February. The decrease in the Employment Index possibly prevented an even stronger reading for the NMI® composite index. The majority of respondents’ continue to be positive about business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slightly slower expansion in February than in January.

Black Knight Mortgage Monitor: Recent Increase in Rates Cuts Potential Refinance Population by 40%

by Calculated Risk on 3/05/2018 08:47:00 AM

Black Knight released their Mortgage Monitor report for January today. According to Black Knight, 4.31% of mortgages were delinquent in January, up from 4.25% in January 2017. The increase was primarily due to the hurricanes. Black Knight also reported that 0.66% of mortgages were in the foreclosure process, down from 0.94% a year ago.

This gives a total of 4.97% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Homes in Lowest Price Tiers Continue to See Greatest Appreciation, Tightest Affordability

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of January 2018. This month, Black Knight looked at the impact of recent interest rate rises on home affordability. While affordability remains better than long-term averages nationally, home prices at the lower end of the market are less affordable than the national average, particularly for those in lower income levels. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the root of the issue has been the consistently higher-than-market-average rate of home price appreciation among properties in the lowest 20 percent of home prices nationally.

“Prices on Tier 1 properties – those in the lowest 20 percent of home values – have been appreciating at a faster rate than all other tiers for 67 consecutive months,” said Graboske. “The annual rate of appreciation for these homes is 1.9 percent higher than the market average, and more than 3.6 percent higher than that of properties in the top 20 percent of prices (Tier 5). Larger overall increases in value among lower-priced homes is not just a recent trend, though; the same dynamic is observed when looking back over the past 15 years. While the nearly 50 percent increase in the median home price over that period has significantly outpaced the approximately 40 percent growth in the median income, lower interest rates today have more than offset that difference. However, according to Census Bureau data, income growth in the lower quintiles has not kept up with the higher ends of the market. This has clear implications for home affordability in this segment of the population, even more so in light of the 43 BPS increase in interest rates seen in just the first six weeks of 2018.

“Overall affordability remains better than long-term historical averages, even taking the recent rate jump into consideration. Currently, it takes 23 percent of the median income to purchase the median home nationally, which is still 1.9 percent below the averages seen from 1995-2003. But those in lower income levels are much closer – if not above – such long-term benchmarks. It seems evident that further affordability reductions from rising interest rates could put more pressure on lower-income buyers by increasing competition for lower priced homes, as borrowers’ overall buying power is diminished.”

The spike in 30-year fixed mortgage interest rates also had the effect of cutting the population of borrowers with interest rate incentive to refinance by nearly 40 percent in 40 days. Approximately 1.4 million borrowers lost the interest rate incentive to refinance in just the first six weeks of 2018. This leaves 2.65 million potential candidates who could still both benefit from and likely qualify for a refinance at today’s rates, the smallest that population has been since late 2008, prior to the initial decline in rates during the recession. This represents another challenge to a consistently shrinking refinance market. Refinance lending declined significantly in 2017, with the total number of originations down 29 percent, and total volume down by $355 billion, a 34 percent year-over-year decline.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight's estimate of the number of refinance candidates.

From Black Knight:

• Closing out a very steady second half of the year, the population of refinance candidates varied by less than 3.0 percent over the final 12 weeks of 2017There is much more in the mortgage monitor.

• However, the recent spike in interest rates cut the population of borrowers with an interest rate incentive to refinance by nearly 40 percent in 40 days

• Approximately 1.4 million borrowers lost the interest rate incentive to refinance in just the first six weeks of 2018

• 2.65 million potential candidates could still both benefit from and likely qualify for a refinance at today’s rates

• That is the smallest this population has been since late 2008, prior to the initial decline in rates during the recession

• Though the population is only 10 percent off its February 2017 mark, rate/term refinance production could see a more significant impact than this might suggest due to increasing burnout in the market

• A corresponding drop in the average credit score of refinance originations is typically observed when rates rise

Sunday, March 04, 2018

Sunday Night Futures

by Calculated Risk on 3/04/2018 08:09:00 PM

Weekend:

• Schedule for Week of Mar 4, 2018

• Housing Industry Concerned about Tariffs

Monday:

• 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 58.8 from 59.9 in January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down6, and DOW futures are down 20 (fair value).

Oil prices were down over the last week with WTI futures at $61.62 per barrel and Brent at $64.75 per barrel. A year ago, WTI was at $53, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.52 per gallon. A year ago prices were at $2.31 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

Housing Industry Concerned about Tariffs

by Calculated Risk on 3/04/2018 10:28:00 AM

On Thursday, NAR chief economist was quoted in Inman News: Trump tariffs on steel and aluminum will be a blow to the construction industry

“Tariffs could measurably raise the cost of building materials and hinder home construction of affordable homes,” said Yu. “But more importantly, tariffs and restrictions to international trade will hold back economic growth and job creations. A better way to raise GDP growth is to produce more homes. Job growth and additional housing inventory will greatly help American workers and American consumers.”And from the NAHB: Statement from NAHB Chairman Randy Noel on New Steel and Aluminum Tariffs

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.As a noted in When the Story Changes, Be Alert, housing is facing several headwinds in 2018: higher mortgage rates, a negative impact from tax changes, higher labor costs, and higher material costs (especially lumber), and now tariffs on steel and aluminum.

“Tariffs hurt consumers and harm housing affordability."

Saturday, March 03, 2018

Schedule for Week of Mar 4, 2018

by Calculated Risk on 3/03/2018 08:11:00 AM

The key report this week is the February employment report on Friday.

Other key indicators include the January Trade deficit, and the February ISM non-manufacturing index and the February ADP employment report.

10:00 AM: the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 58.8 from 59.9 in January.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 203,000 payroll jobs added in February, down from 234,000 added in January.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $55.1 billion in January from $53.1 billion in December.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.8 billion in January.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Employment Report for February. The consensus is for an increase of 205,000 non-farm payroll jobs added in February, up from the 200,000 non-farm payroll jobs added in January.

The consensus is for the unemployment rate to decrease to 4.0%.

The consensus is for the unemployment rate to decrease to 4.0%.This graph shows the year-over-year change in total non-farm employment since 1968.

In January the year-over-year change was 2.114 million jobs.

A key will be the change in wages.

Friday, March 02, 2018

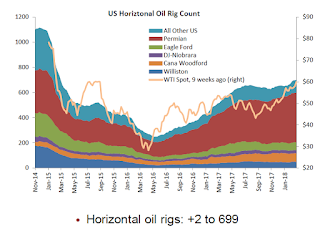

Oil Rigs "A Small Rise in Rig Counts"

by Calculated Risk on 3/02/2018 03:45:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 2, 2018:

• Total US oil rigs came in soft this week, +1 to 800

• Horizontal oil rigs were up, +2 to 699

...

• Rig additions should be accelerating through the coming weeks. If we do not see a substantial rise in the horizontal oil rig count in the next two weeks, we will once again be looking at an inflection point

• For the week as a whole, oil prices were not much changed over the previous week, holding around $61 / barrel WTI.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Merrill on Housing

by Calculated Risk on 3/02/2018 01:58:00 PM

A few brief excerpts on taxes from a note by Merrill Lynch economist Michelle Meyer: Housing: the top five questions (Overall Merrill is positive on housing).

How does the tax legislation impact the housing market?CR Note: There are several headwinds for housing this year including: higher mortgage rates, impact of tax legislation, higher labor costs, higher material costs (Lumber prices are up sharply), and overall affordability. I think housing will be OK this year, but I'm watching for any slowing.

On the one hand, tax reform is supportive of the housing market as it increases disposable income for households. The average household will see tax-home pay increase by $1,610 this year according to the Joint Committee of Taxation, which helps affordability and increases confidence.

On the other hand, it reduces the incentive for homeownership by doubling the standard deduction, reducing the cap for the mortgage interest deduction (MID) to 750k and limiting property tax deductions along with state and local income taxes to $10k. This results in fewer households who will itemize deductions, thereby making homeownership less attractive from a tax perspective. The biggest challenge is for markets where there is a double whammy of high home prices and property/income taxes....

In our view, the winners from tax reform are conventional buyers who are below the MID cap and likely to see a net windfall of cash from lower taxes. However, the high priced markets on the coast could struggle. The consequence: we expect to see strong new home sales growth, particularly for lower priced properties, but slower growth in high priced existing home sales.

When the Story Changes, Be Alert

by Calculated Risk on 3/02/2018 11:48:00 AM

There is an axiom in investing that when the story changes, pay attention. As an example, if a company changes their focus, reconsider your investment.

Over the last several years, the economic story has been consistent: Strong employment growth, steady economic growth (solid given demographics), low inflation, and an accommodative monetary policy - with no fiscal stimulus. I noted several times that the future was bright, and in late 2016, I pointed out that the cupboard is full.

With minimal policy changes in 2017, and a stronger global economy, the US economic expansion continued, pretty much as expected.

But in 2018, the story is changing. We are seeing some economic tailwinds and some headwinds. Although the tax changes are poorly conceived, and mostly benefit high income earners, there should be some short term boost to economic growth. That might lead the Federal Reserve to raise rates a little quicker than anticipated.

And, for housing, the tax changes could negatively impact a segment of the housing market, and rising mortgage rates are another headwind. Note: I'm tracking housing inventory this year to see if there is an impact.

And now the Trump administration is proposing tariffs and talking openly talking of a trade war. That is a downside risk to the economy.

As economists at Nomura noted this morning: "A sharp deterioration in financial conditions and aggressive trade policies by the Trump administration present notable risks."

I still think the economy will be fine in 2018, but the story is changing.

Zillow Case-Shiller Forecast: More Solid House Price Gains in January

by Calculated Risk on 3/02/2018 08:58:00 AM

The Case-Shiller house price indexes for December were released on Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: December Case-Shiller Results and January Forecast: Why 2018 Looks A Lot Like 2017

The familiar patterns in the housing market that emerged in the second half of 2017 – lots of demand from home buyers, limited supply of homes available to buy, quickly rising prices and slow but steadily deteriorating affordability – are continuing to shape the start to 2018 as well.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be slightly larger in January than in December. Zillow is forecasting a smaller year-over-year increase for both the 10-city index, and the 20-city index in January.

Zillow predicts the S&P/Case-Shiller national index will show a 6.4 percent gain in national home prices in January, a slight increase from the 6.3 percent annual gain home prices posted for December. The December increase was greater than November’s 6.1 percent annual gain. Case-Shiller will release January data on Tuesday, March 27.

Case-Shiller’s 20-city composite index rose 6.3 percent year-over-year in December, a slight slowdown from November’s 6.4 percent annual growth. The 10-city composite index climbed 6 percent, the same rate as the prior month.

Among cities included in the 20-city index, Seattle, Las Vegas and San Francisco reported the highest year-over-year gains in December, at 12.7 percent, 11.1 percent and 9.2 percent, respectively.

Thursday, March 01, 2018

Market Update

by Calculated Risk on 3/01/2018 06:37:00 PM

Friday:

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 99.5, down from 99.9 in January.

Click on graph for larger image.

By request - following the market sell off today - here is a stock market graph. This graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today.

The market is close to unchanged year-to-date, and off 6.8% from the all time high.

Not very scary - at least not yet.