by Calculated Risk on 3/07/2018 10:59:00 AM

Wednesday, March 07, 2018

Las Vegas Real Estate in February: Sales Down 4% YoY, Inventory down 31%

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices warming up while sales cooling down; GLVAR housing statistics for February 2018

Local home prices rose again in February while sales slowed down amid a shrinking housing supply, according to a report released today by the Greater Las Vegas Association of REALTORS®(GLVAR).1) Overall sales were down 4% year-over-year from 2,815 in February 2017 to 2,704 in February 2018.

...

Meanwhile, the total number of existing local homes, condos and townhomes sold during February fell to 2,704. Compared to one year ago, February sales were down 5.4 percent for homes, but up 1.8 percent for condos and townhomes.

“Our shrinking housing supply may finally be catching up to us and slowing down our home sales,” said 2018 GLVAR President Chris Bishop, a longtime local REALTOR®. “Sales have continued to go up over the last few years, even as our inventory has been going down. But with fewer homes on the market each month, it seems like it was only a matter of time before it started to affect sales.”

He said Southern Nevada still has less than a two-month supply of existing homes available for sale when a six-month supply is considered a balanced market.

By the end of February, GLVAR reported 3,653 single-family homes listed for sale without any sort of offer. That’s down 34.3 percent from one year ago. For condos and townhomes, the 679 properties listed without offers in February represented a 10.4 percent drop from one year ago. The inventory of condos and townhomes listed for sale is as low as it has been since 2004, Bishop added.

...

GLVAR reported that 32.4 percent of all local properties sold in February were purchased with cash, compared to 31.4 percent one year ago. That’s well below the February 2013 peak of 59.5 percent, indicating that cash buyers and investors are still active, but are playing a much smaller role in the local housing market than they were five years ago.

At the same time, the number of so-called distressed sales continues to decline. GLVAR reported that short sales and foreclosures combined accounted for 3.8 percent of all existing local home sales in February, compared to 10.6 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago, from a total of 6,322 in February 2017 to 4,352 in February 2018.

3) Fewer distressed sales.

Trade Deficit at $56.6 Billion in January

by Calculated Risk on 3/07/2018 08:46:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $56.6 billion in January, up $2.7 billion from $53.9 billion in December, revised. ... January exports were $200.9 billion, $2.7 billion less than December exports. January imports were $257.5 billion, down less than $0.1 billion from December imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in January.

Exports are 21% above the pre-recession peak and up 5% compared to January 2017; imports are 11% above the pre-recession peak, and up 7% compared to January 2017.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $54.76 in January, up from $52.10 in December, and up from $43.94 in January 2016.

The petroleum deficit increased in January, and this is the main reason the overall trade deficit increased in January.

The trade deficit with China increased to $36.0 billion in January, from $31.3 billion in January 2016.

ADP: Private Employment increased 235,000 in February

by Calculated Risk on 3/07/2018 08:21:00 AM

Private sector employment increased by 235,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 203,000 private sector jobs added in the ADP report.

...

“The labor market continues to experience uninterrupted growth,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “We see persistent gains across most industries with leisure and hospitality and retail leading the way as consumer spending kicked up. At this pace of job growth employers will soon become hard-pressed to find qualified workers.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is red hot and threatens to overheat. With government spending increases and tax cuts, growth is set to accelerate.”

The BLS report for February will be released Friday, and the consensus is for 205,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Increase Slightly in Latest Weekly Survey

by Calculated Risk on 3/07/2018 07:00:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 2, 2018. The previous week’s results included an adjustment for the Washington’s Birthday (Presidents’ Day) holiday.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 1 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since January 2014, 4.65 percent, from 4.64 percent, with points decreasing to 0.58 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 1% year-over-year.

Tuesday, March 06, 2018

Wednesday: ADP Employment, Trade Deficit, Beige Book

by Calculated Risk on 3/06/2018 06:33:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 203,000 payroll jobs added in February, down from 234,000 added in January.

• At 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to be at $55.1 billion in January from $53.1 billion in December.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.8 billion in January.

Lawler: Population Outlook: Uncertainty Not Just Related to Immigration Assumptions, But Also Death Rates

by Calculated Risk on 3/06/2018 02:03:00 PM

From housing economist Tom Lawler: Population Outlook: Uncertainty Not Just Related to Immigration Assumptions, But Also Death Rates

In its latest “Tip Sheet” Census said that it will release new long-term population projections sometime this month. The last official Census long-term population projections were released at the end of 2014, and since then “actual” population estimates have fallen way short of those projections. As I documented in a previous report, the population shortfall from that projection was the result of lower births, higher deaths, and (especially) lower net international migration. I also noted that updated net international migration projections going forward are likely to be massively lower than those shown in the 2014 projections, and that analysts should not just look at the overall population projections but also the net international migration assumptions in assessing the “reasonableness” of the projections.

Another factor that will almost certainly result in lower population projections relative to those from 2014 will be deaths. The 2014 Census population projections assumed that the “death rates” for most age groups, and especially the young to middle age groups, would gradually decline over time. In fact, however, death rates for young and middle age adults have increased considerably since 2014, for some age groups at an alarming rate. As a result, despite lower overall population counts from lower net international migration, the number of deaths has considerably exceeded the Census 2014 projections.

Annual (calendar year) data on US deaths are compiled by the National Center for Health Statistics (NCHS), though data are only available with a considerable lag. For example, the NCHS released a “data brief” on mortality in the US for 2016 last December, and detailed data on US deaths for 2015 were released last year. The NCHS data are used by the Census Bureau to estimate and project the overall US population and the characteristics of the population, though Census must make assumptions for the most recent years. Also, Census death estimates are for the 12-month period ending on June 30th, as opposed to the NCHS calendar-year estimates. Below is a table showing annual deaths from the NCHS; death assumptions from the Census 2014 population projections; and the death estimates from the latest Census population estimates (Vintage 2017).

| 12-month period ending: | NCHS 31-Dec | CB Vintage 2017 30-Jun | CB 2014 Projection 30-Jun |

|---|---|---|---|

| 2014 | 2,626,418 | 2,582,448 | 2,582,858 |

| 2015 | 2,712,630 | 2,699,826 | 2,619,062 |

| 2016 | 2,744,248 | 2,728,714 | 2,649,979 |

| 2017 | 2,744,040 | 2,680,555 |

As the table indicates, Census projections for US deaths have been well south of “actual” deaths. While Census does not release its assumptions about deaths by age group (or other characteristics) in its current “estimates” report, it does show its assumptions for deaths by age in its periodic long-term population projections. The NCHS also releases data on deaths by age groups. Below is a comparison of NCHS deaths by selected age groups with the death assumptions from the Census 2014 population projections.

| NCHS Data on Deaths by Selected Age Groups (Calendar Year) | ||||

|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2016 vs. 2014 | |

| Total | 2,626,255 | 2,712,630 | 2,744,248 | 117,993 |

| 15-24 | 28,791 | 30,494 | 32,575 | 3,784 |

| 25-34 | 47,177 | 51,517 | 57,616 | 10,439 |

| 35-44 | 70,996 | 73,088 | 77,792 | 6,796 |

| 45-54 | 175,917 | 174,494 | 173,516 | -2,401 |

| 55-64 | 348,808 | 357,785 | 366,445 | 17,637 |

| 65-74 | 471,541 | 495,016 | 512,080 | 40,539 |

| 75-84 | 624,504 | 637,566 | 636,916 | 12,412 |

| 85+ | 826,226 | 859,701 | 854,462 | 28,236 |

| Census 2014 Projections of Deaths by Selected Age Group (12-month period ending 6/30) | ||||

|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2016 vs. 2014 | |

| Total | 2,582,858 | 2,619,062 | 2,649,979 | 67,121 |

| 15-24 | 27,542 | 26,966 | 26,150 | -1,392 |

| 25-34 | 43,783 | 43,490 | 43,107 | -676 |

| 35-44 | 66,534 | 64,991 | 63,159 | -3,375 |

| 45-54 | 170,644 | 165,999 | 160,879 | -9,765 |

| 55-64 | 326,669 | 328,230 | 328,830 | 2,161 |

| 65-74 | 453,167 | 469,548 | 485,155 | 31,988 |

| 75-84 | 621,098 | 625,385 | 630,841 | 9,743 |

| 85+ | 840,781 | 861,957 | 879,520 | 38,739 |

As the above table show, the Census 2014 population projections assumed that deaths of people aged 15-44 years old would decline from 2014 to 2016 – reflecting an assumption of declining death rates in those age groups – while NCHS data indicate that deaths in these age groups rose significantly over this period, reflecting sizable increases in death rates. On the next page is a table showing some historical NCHS data on death rates by selected age groups. Note that these death rates are from past reports using available population estimates at the time of the report, and that death rates using revised population estimates would be slightly different for past years. Note also that for 2016 NCHS has only released death rates for newborns and for 10-year age groups, and I have “guesstimated” 5-year age group death rates for 2016 based on the 10-year death rate estimates.

| Deaths per 100,000 population, Selected 5-year Age Groups, NCHS | |||||||

|---|---|---|---|---|---|---|---|

| Age Group | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 (est) |

| 15-19 | 49.4 | 48.9 | 47.2 | 44.8 | 45.5 | 48.3 | 49.0 |

| 20-24 | 86.5 | 86.1 | 84.6 | 83.4 | 83.8 | 89.3 | 90.3 |

| 25-29 | 96.0 | 96.7 | 98.1 | 97.6 | 99.7 | 106.4 | 110.2 |

| 30-34 | 110.2 | 113.0 | 112.9 | 114.8 | 117.3 | 127.4 | 129.7 |

| 35-39 | 138.8 | 140.2 | 140.5 | 141.9 | 147.2 | 154.2 | 157.1 |

| 40-44 | 201.1 | 201.7 | 198.7 | 200.3 | 202.4 | 206.1 | 216.0 |

| 45-49 | 324.0 | 323.5 | 315.7 | 315.1 | 311.3 | 308.7 | 312.5 |

| 50-54 | 491.7 | 494.6 | 491.5 | 491.6 | 491.3 | 493.0 | 493.1 |

| 55-59 | 711.7 | 712.3 | 717.2 | 721.8 | 730.6 | 731.8 | 737.7 |

| 60-64 | 1015.8 | 1005.5 | 1014.0 | 1021.7 | 1032.2 | 1039.3 | 1042.2 |

| 65-69 | 1527.6 | 1502.9 | 1470.2 | 1468.4 | 1454.0 | 1465.6 | 1447.4 |

| 70-74 | 2340.9 | 2306.2 | 2266.7 | 2261.7 | 2246.1 | 2260.1 | 2235.8 |

| 75-79 | 3735.4 | 3685.0 | 3630.9 | 3611.9 | 3560.5 | 3574.1 | 3479.3 |

| 80-84 | 6134.1 | 6116.8 | 6026.1 | 6027.4 | 5944.6 | 5986.2 | 5809.1 |

| 85+ | 13934.3 | 13779.3 | 13678.6 | 13660.4 | 13407.9 | 13637.9 | 13392.1 |

As the table indicates, death rates for all 5-year age groups under 45 years old increased significantly from 2014 to 2016 (especially for 25-34 year olds), while death rates for the elderly actually declined somewhat. This contrasts sharply with the CB 2014 population projections, which assumed that death rates would decline for all age groups save the very elderly.

While it is beyond the scope of this report to discuss why death rates among all but the very old have risen sharply rather than decline as assumed in the CB 2014 population projections (though drug overdose deaths are a significant component – see below), it seems almost certain that the updated population projections will incorporate substantially higher death rates for most of the population – and especially for the “prime” working age population. And, as discussed in an earlier report, the updated population projections will almost certainly assume much lower net international migration assumptions than was the case in the 2014 population projections. This, too, will have a “disproportionate” impact on projections for “young” adults and the “prime” working age population.

| Drug Overdose Deaths by Selected Age Groups, NCHS | |||||||

|---|---|---|---|---|---|---|---|

| 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Total | |

| 2012 | 3,518 | 8,508 | 8,948 | 11,895 | 6,423 | 2,094 | 41,386 |

| 2013 | 3,664 | 8,947 | 9,320 | 12,045 | 7,551 | 2,344 | 43,871 |

| 2014 | 3,798 | 10,055 | 10,134 | 12,263 | 8,122 | 2,568 | 46,940 |

| 2015 | 4,235 | 11,880 | 11,505 | 12,974 | 8,901 | 2,760 | 52,255 |

| 2016 | 5,376 | 15,443 | 14,183 | 14,771 | 10,632 | 3,075 | 63,480 |

Q1 GDP Forecasts

by Calculated Risk on 3/06/2018 11:18:00 AM

It is just early March, but here are few Q1 GDP forecast.

From Merrill Lynch:

1Q GDP tracking edged down a tenth to 1.8% qoq saar, while 4Q ticked up to 2.7% [March 6 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 3.5 percent on March 1, up from 2.6 percent on February 27.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q1 stands at 3.0%. [March 2 estimate]

CoreLogic: House Prices up 6.6% Year-over-year in January

by Calculated Risk on 3/06/2018 08:51:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose More Than 6 Percent Year Over Year for the Sixth Consecutive Month in January

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2018, which shows home prices rose both year over year and month over month. Home prices nationally increased year over year by 6.6 percent from January 2017 to January 2018, and on a month-over-month basis home prices increased by 0.5 percent in January 2018 compared with December 2017,* according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is towards the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to increase by 4.8 percent on a year-over-year basis from January 2018 to January 2019, with a 12-month increase of more than 7 percent projected for California, Florida, Nevada and Oregon. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Entry-level homes have been in particularly short supply, leading to more rapid home-price growth compared with more expensive homes,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Homes with a purchase price less than 75 percent of the local area median had price growth of 9.0 percent during the year ending January 2018. Homes that sold for more than 125 percent of median appreciated 5.3 percent over the same 12-month period. Thus, first-time buyers are facing acute affordability challenges in some high-cost areas.”

emphasis added

The year-over-year comparison has been positive for almost six consecutive years since turning positive year-over-year in February 2012.

Monday, March 05, 2018

30 Year Mortgage Rates at 4.5% to 4.625%

by Calculated Risk on 3/05/2018 04:49:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Strong, But End The Day Higher

Mortgage rates ended higher today, after financial markets reacted to developments in last week's tariff-related news. Last Thursday, stock prices and interest rates fell in response to the tariff announcement because investors figured it ran the risk of doing more economic harm than good. In general, economic weakness/risks/fear tends to push rates lower.Here is a table from Mortgage News Daily:

Today, congressional leaders made statements that effectively opposed the tariffs as written. In fact, one Republican source said not to rule out "potential action" in the near future if Trump continues with the Tariff plan. Much like the initial news hurt stocks and helped rates last week, the potential reversal or mitigation of that news did the opposite today. Stocks prices and bond yields rose in concert. In general, when bond yields rise enough during the day, mortgage lenders will adjust their rate sheets for the worse (a so-called "negative reprice). Most lenders repriced today, taking rates to higher levels in the early afternoon. [30YR FIXED - 4.5-4.625%]

emphasis added

Update: Framing Lumber Prices Up Sharply Year-over-year, At Record Prices

by Calculated Risk on 3/05/2018 12:58:00 PM

Here is another monthly update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and now prices are above the bubble highs.

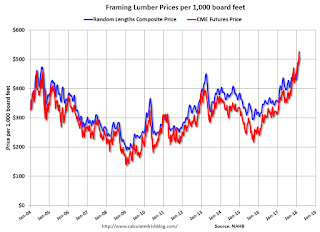

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through February 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 25% from a year ago, and CME futures are up about 45% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Rising costs - both material and labor - will be headwinds for the building industry this year.