by Calculated Risk on 3/09/2018 11:20:00 AM

Friday, March 09, 2018

Comments on February Employment Report

The headline jobs number at 313,000 for February was well above consensus expectations of 205 thousand, and the previously two months were revised up a combined 54 thousand. Overall this was a very strong employment report.

There was probably a boost from weather in February. According to Chicago Fed economist Francois Gourio: "February was significantly warmer than usual - positive weather effect in today's NFP of about 80k according to our state model". Even if weather boosted the NFP report by 80,000 jobs, this was still a strong report. If weather was a factor, we might see some payback in the March report.

Earlier: February Employment Report: 313,000 Jobs Added, 4.1% Unemployment Rate

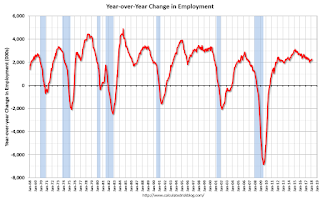

In February, the year-over-year employment change was 2.281 million jobs. This has been generally trending down, but is still solid year-over-year growth.

Average Hourly Earnings

Wage growth was disappointing in February, and hourly wages for both December and January were revised down. From the BLS:

"In February, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $26.75, following a 7-cent gain in January. Over the year, average hourly earnings have increased by 68 cents, or 2.6 percent."

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.6% YoY in February.

Wage growth had been trending up, although growth has been moving sideways recently.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 5.2 million in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut or because they were unable to find full-time jobs."The number of persons working part time for economic reasons has been generally trending down, however the number increased in February. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 8.2% in February.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.397 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.421 million in January.

This is the lowest level since April 2008.

This is trending down, but remains a little elevated.

The headline jobs number was strong, and the unemployment rate unchanged at a low level, overall a very strong report.

February Employment Report: 313,000 Jobs Added, 4.1% Unemployment Rate

by Calculated Risk on 3/09/2018 08:42:00 AM

From the BLS:

Total nonfarm payroll employment increased by 313,000 in February, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment rose in construction, retail trade, professional and business services, manufacturing, financial activities, and mining.

...

The change in total nonfarm payroll employment for December was revised up from +160,000 to +175,000, and the change for January was revised up from +200,000 to +239,000. With these revisions, employment gains in December and January combined were 54,000 more than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $26.75, following a 7-cent gain in January. Over the year, average hourly earnings have increased by 68 cents, or 2.6 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 313 thousand in February (private payrolls increased 287 thousand).

Payrolls for December and January were revised up by a combined 54 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February the year-over-year change was 2.281 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased in February to 63.0%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate was increased in February to 63.0%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio was increased to 60.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

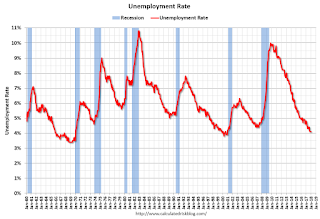

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in February at 4.1%.

This was well above the consensus expectations of 205,000 jobs, and the previous two months combined were revised up 54,000.

A strong report.

I'll have much more later ...

Thursday, March 08, 2018

Friday: Jobs, Jobs, Jobs and Wages

by Calculated Risk on 3/08/2018 08:04:00 PM

My February Employment Preview

Goldman: February Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for February. The consensus is for an increase of 205,000 non-farm payroll jobs added in February, up from the 200,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to decrease to 4.0%.

Lawler: More on Deaths ... And Some Thoughts About Next Week’s Release of Census Long-Term Population Projections

by Calculated Risk on 3/08/2018 04:41:00 PM

From housing economist Tom Lawler: More on Deaths ...

In discussing available data on deaths earlier this week, I noted that data are deaths are only available with a considerable lag. While that is the case for detailed data on deaths, the National Center for Health Statistics does release provisional estimates for selected indicators of mortality – including both crude and age-adjusted death rates – that are relatively timely. E.g., aggregate crude and age-adjusted death rates are available through the third quarter of 2017, and these data suggested that both crude and age-adjusted death rates increased from 2016 to 2017. For those who track death assumptions in the Census population estimates (which reflect deaths over the 12 month period ending in June), the NCHS provisional death rate estimates imply that US deaths totaled about 2.785 million over the 12-months ended in June 2017, about 41,000 higher than the “Vintage 2017” assumption, and 104,000 above the projection from Census’s 2014 long-term population projection.

If the higher-than-projected death rates remained constant over the next three years (i.e., though 2020), then US deaths over the four-year period ending in 2020 would be over 600,000 higher than the number of deaths assumed in the Census 2014 population projection, with the most of this increase in deaths coming in the 15-44 year old age groups.

| US Deaths Per 100,000, 12-month period ending at end of quarter | ||

|---|---|---|

| Crude | Age Adjusted | |

| Q1/2016 | 837.5 | 724.0 |

| Q2/2016 | 839.3 | 723.6 |

| Q3/2016 | 842.0 | 724.4 |

| Q4/2016 | 849.3 | 728.8 |

| Q1/2017 | 855.7 | 731.0 |

| Q2/2017 | 858.4 | 731.7 |

| Q3/2017 | 859.2 | 730.0 |

| Source: NCHS | ||

... And Some Thoughts About Next Week’s Release of Census Long-Term Population Projections

I got confirmation today that Census is on track to release its updated long-term population projections sometime next week. Here are a few things analysts should consider in evaluating/using these projections.

1. The starting point for the projections is “Vintage 2016,” and the latest population estimates (Vintage 2017) are different (though not massively so).

2. The latest data on deaths used for this projection were those for 2015, and I’m guessing the projection does not allow for rising death rates among teenagers and young/middle aged adults that we observed in 2016 and (apparently) 2017. I am guessing that the updated projections may significantly understate deaths for these age groups, and competent analysts should check this.

3. The updated assumptions on net international migration will be “model based,” and will not incorporate any probable or even possible policy changes on immigration. In terms of the immigration component of net international migration, these models look at recent inflows by country relative to their populations, and assume that future immigration will rise proportionately to projections of these countries’ populations. These models will almost certainly over-predict “likely” net international migration over the next few years, and analysts should check the NIM assumptions.

4. My understanding is that Census only plans to release its “baseline” projections next week, but that some alternative scenarios may be released sometime later (though I’m not positive about this).

What I and any competent analyst will do when these new population projections are released is to dig deeply into the key “component of change” assumptions, compare these assumptions either (1) to updated data (e.g., deaths), or (2) to what I believe are “reasonable” assumptions about net international migration, and produce a different set of population projections if the Census assumptions seem “off.” I and competent analysts will also probably produce alternative population projection using different but plausible assumptions about deaths and net international migration.

Goldman: February Payrolls Preview

by Calculated Risk on 3/08/2018 02:15:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 210k in February, 5k above consensus. We believe warmer weather and unseasonably light snow during the survey week boosted job growth in the month. Labor market fundamentals also appear solid and may have improved further, given new cycle records for initial claims and Conference Board job availability.

...

we estimate the unemployment rate fell to 4.0% in February ... We estimate a 0.3% month-over-month increase in average hourly earnings ... we estimate the year-over-year rate fell a tenth to +2.8%. ...

emphasis added

February Employment Preview

by Calculated Risk on 3/08/2018 11:52:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus, according to Bloomberg, is for an increase of 205,000 non-farm payroll jobs in February (with a range of estimates between 152,000 to 230,000), and for the unemployment rate to decline to 4.0%.

The BLS reported 200,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 235,000 private sector payroll jobs in February. This was well above consensus expectations of 203,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in February to 59.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 30,000 in February. The ADP report indicated manufacturing jobs increased 14,000 in February.

The ISM non-manufacturing employment index decreased in February to 55.0%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 200,000 in February.

Combined, the ISM indexes suggests employment gains of about 230,000. This suggests employment growth slightly above expectations.

• Initial weekly unemployment claims averaged 222,500 in February, down from 234,500 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 220,000, up from 216,000 during the reference week in January.

The slight increase during the reference week suggests a slightly weaker employment report in February than in January.

• The final February University of Michigan consumer sentiment index increased to 99.7 from the January reading of 95.7. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 136,000 in February, and this suggests employment growth below expectations.

• Conclusion: In general, these reports suggest a solid employment report. My guess - probably influenced by the new Merrill Lynch tracker, and the slight increase in unemployment claims during the reference week - is that the employment report will be below the consensus in February.

Weekly Initial Unemployment Claims increase to 231,000

by Calculated Risk on 3/08/2018 08:34:00 AM

The DOL reported:

In the week ending March 3, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 21,000 from the previous week's unrevised level of 210,000. The 4-week moving average was 222,500, an increase of 2,000 from the previous week's unrevised average of 220,500.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 222,500.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, March 07, 2018

Thursday: Unemployment Claims

by Calculated Risk on 3/07/2018 07:37:00 PM

A couple of February NFP forecasts (will be released Friday), from Merrill Lynch:

[W]e look for nonfarm payrolls to increase by 160k ... We look for the unemployment rate to be unchanged at 4.1% in February ... We forecast a trend-like 0.2% mom in average hourly earnings which will allow the yoy rate to slip to 2.8%.And from Nomura:

We expect a strong, 210k increase in nonfarm payroll employment in February ... we expect a 0.2% (0.19%) m-o-m increase in February’s average hourly earnings (AHE). ... Our forecast of 0.2% mo-m corresponds to a 2.8% y-o-y increase, a slight dip from the 2.9% reading in January. Finally, we expect the unemployment rate to decline 0.1pp to 4.0% in February...Thursday:

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 210 thousand the previous week.

Leading Index for Commercial Real Estate Increases Slightly in February

by Calculated Risk on 3/07/2018 04:45:00 PM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Tepid Rise for Dodge Momentum Index in February

The Dodge Momentum Index increased 0.5% in February to 146.9 (2000=100) from the revised January reading of 146.2. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move higher in February was the result of an 8.2% increase in the institutional component, while the commercial component contracted 4.8%. The commercial component has declined for two consecutive months, and while this should not lead to an outright decline in construction activity, it is an additional sign that commercial building construction growth could ease in 2018 in response to rising vacancy rates for offices and warehouses. On the other hand, institutional building construction continues to feed off the massive number of state and local bonds issued for schools and other institutional buildings over the past few election cycles.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 146.9 in February, up from 146.2 in January.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth in 2018.

Fed's Beige Book: "Modest to moderate" expansion, "worker shortages across most sectors"

by Calculated Risk on 3/07/2018 03:13:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of San Francisco based on information collected on or before February 26, 2018. "

Economic activity expanded at a modest to moderate pace across the 12 Federal Reserve Districts in January and February. Consumer spending was mixed, as non-auto retail sales increased in just over half of the Districts while auto sales declined or were flat in every District. Tourism activity was broadly solid, with Atlanta and Richmond recording robust growth in this sector. On balance, Districts reported modest growth in home sales and construction, with the latter constrained by shortages of labor and materials. Conditions in the nonresidential real estate market improved moderately since the previous report, with robust construction activity noted in three Districts. Commercial rents in and around New York City were up significantly, according to contacts in the area. Increases in production were broad based across manufacturing sectors, with all but one District noting at least modest growth in activity. Loan volumes were generally flat, with a handful of Districts noting a modest decrease in delinquency rates. Among reporting Districts, agricultural sector activity was mixed but flat overall. Contacts in natural resource sectors saw modestly improving industry conditions, except in the Minneapolis District, where energy and mining activity was robust.

...

On balance, employment grew at a moderate pace since the previous report. Across the country, contacts observed persistent labor market tightness and brisk demand for qualified workers, as well as increased activity at staffing placement services. Several Districts reported continued worker shortages across most sectors, with contacts often mentioning shortages in the construction, information technology, and manufacturing sectors. In many Districts, wage growth picked up to a moderate pace. Most Districts saw employers raise wages and expand benefit packages in response to tight labor market conditions. Contacts in a few Districts conveyed reports of modest increases in compensation following passage of the Tax Cuts and Jobs Act.

emphasis added