by Calculated Risk on 3/26/2018 05:57:00 PM

Monday, March 26, 2018

Tuesday: Case-Shiller House Prices

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher to Begin Shortened Week

Mortgage rates moved sideways to slightly higher today, keeping them in an exceptionally narrow range that's persisted for the entire month of March. As of last Thursday, rates looked like they might make an attempt to challenge the lower boundary of that range, but they quickly backed off (or backed "up" as the case may be). Friday and today have seen a fairly steady move back toward the middle of March's range.Tuesday:

Context is also important. While we can talk about "movement" in a literal sense in the past few days, for all practical purposes, the average mortgage seeker wouldn't be seeing much of a difference. [30YR FIXED - 4.5-4.625%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 6.2% year-over-year increase in the Comp 20 index for January.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

Vehicle Sales Forecast: Sales Under 17 Million SAAR in March

by Calculated Risk on 3/26/2018 02:56:00 PM

The automakers will report March vehicle sales on Tuesday, April 3rd.

Note: There were 28 selling days in March 2018, up from 27 in March 2017.

From WardsAuto: U.S. Light-Vehicle Forecast: Sales Down Slightly; Inventory Declines to Match Demand

A Wards Intelligence forecast calls for U.S. automakers to deliver 1.60 million light vehicles in March. ... The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, higher than last year’s 16.7 million but slightly under last month’s 17.0 million.Sales in March will probably be at the slowest sales rate since last August. After August, sales were boosted by the hurricanes.

emphasis added

Black Knight: National Mortgage Delinquency Rate Decreased Slightly in February

by Calculated Risk on 3/26/2018 12:42:00 PM

From Black Knight: Black Knight’s First Look at February 2018 Mortgage Data

• The national delinquency rate edged slightly downward in February, with hurricane-related delinquencies declining by a modest 5.0 percent for the monthAccording to Black Knight's First Look report for February, the percent of loans delinquent decreased 0.2% in February compared to January, and increased 2.1% year-over-year.

• Serious delinquencies (90 or more days past due) attributed to Hurricanes Harvey and Irma fell just 3.0 percent

• 128,000 hurricane-driven seriously delinquent mortgages remain in Texas, Florida, and Georgia

• After hitting a 12-month high in January, foreclosure starts fell 25 percent month-over-month

• Active foreclosure inventory rebounded from January’s increase, reaching a new post-recession low

• Rising interest rates pushed prepayment activity to the lowest level since 2014

The percent of loans in the foreclosure process decreased 1.8% in February and were down 30% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.30% in February, down from 4.31% in January.

The percent of loans in the foreclosure process decreased slightly in February to 0.65%.

The number of delinquent properties, but not in foreclosure, is up 63,000 properties year-over-year, and the number of properties in the foreclosure process is down 139,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2018 | Jan 2018 | Feb 2017 | Feb 2016 | |

| Delinquent | 4.30% | 4.31% | 4.21% | 4.45% |

| In Foreclosure | 0.65% | 0.66% | 0.93% | 1.30% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,198,000 | 2,202,000 | 2,135,000 | 2,252,000 |

| Number of properties in foreclosure pre-sale inventory: | 331,000 | 337,000 | 470,000 | 655,000 |

| Total Properties | 2,528,000 | 2,539,000 | 2,605,000 | 2,907,000 |

Dallas Fed: "Texas Manufacturing Expansion Continues but at a Slower Pace"

by Calculated Risk on 3/26/2018 10:36:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues but at a Slower Pace

Texas factory activity continued to expand in March, albeit at a markedly slower pace than last month, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell 15 points to 12.7, signaling a deceleration in output growth.This is still a solid report. So far all of the regional surveys have been solid in March.

Other indexes of manufacturing activity also remained positive but posted double-digit declines in March. The new orders and growth rate of orders indexes fell to 8.3 and 3.8, respectively. The capacity utilization index dropped to 9.6, and the shipments index plunged 23 points to 9.3. Although these indexes are down notably from their February readings, they remain well above their postrecession averages.

Perceptions of broader business conditions remained positive on net, but the share of firms reporting an improvement declined from last month. The general business activity index fell 16 points to 21.4, and the company outlook index declined 12 points to 19.6. While both of these March readings represent the lowest this year, they are on par with last year’s average indexes and far above their postrecession average levels.

Labor market measures suggested growth was weaker for employment and workweek length. The employment index came in at 10.8, down eight points from February. Twenty percent of firms noted net hiring, compared with 9 percent noting net layoffs. The hours worked index moved down to 9.4.

emphasis added

Chicago Fed "Index points to a pickup in economic growth in February"

by Calculated Risk on 3/26/2018 09:28:00 AM

From the Chicago Fed: Index points to a pickup in economic growth in February

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.88 in February from +0.02 in January. All four broad categories of indicators that make up the index increased from January, and three of the four categories made positive contributions to the index in February. The index’s three-month moving average, CFNAI-MA3, increased to +0.37 in February from +0.16 in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in February (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, March 25, 2018

Sunday Night Futures

by Calculated Risk on 3/25/2018 07:20:00 PM

Weekend:

• Schedule for Week of Mar 25, 2018

Monday:

• At 8:30 AM ET Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7, and DOW futures are up 80 (fair value).

Oil prices were up over the last week with WTI futures at $65.86 per barrel and Brent at $70.50 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.61 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 32 cents per gallon year-over-year.

Hotels: Occupancy Rate Up Year-over-Year

by Calculated Risk on 3/25/2018 08:41:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 17 March

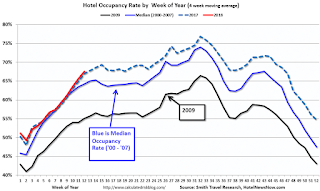

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 11-17 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 March 2017, the industry recorded the following:

• Occupancy: +1.0 at 70.7%

• Average daily rate (ADR): +2.8% to US$133.76

• Revenue per available room (RevPAR): +3.9% to US$94.55

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is fifth overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 24, 2018

Schedule for Week of Mar 25, 2018

by Calculated Risk on 3/24/2018 11:11:00 AM

The key economic reports this week are the third estimate of Q4 GDP, Personal Income and Outlays for February, and Case-Shiller house prices.

Also the Q1 quarterly Reis surveys for office and malls will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for January.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for January.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q1 2018 Apartment Survey of rents and vacancy rates.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Third estimate). The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the second estimate of 2.3%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 2.7% increase in the index.

Early: Reis Q1 2018 Office Survey of rents and vacancy rates.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 229 thousand the previous week.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 63.2, up from 61.9 in February.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 102.0, unchanged from 102.0 in February.

Early: Reis Q1 2018 Mall Survey of rents and vacancy rates.

Off-topic: "March, Vote, Change the World!"

by Calculated Risk on 3/24/2018 08:11:00 AM

To find a local march, here is the March for Our Lives website. Make a difference today!

A stunning article from the WaPo: U.S. School Shootings

Beginning with Columbine in 1999, more than 187,000 students attending at least 193 primary or secondary schools have experienced a shooting on campus during school hours, according to a year-long Washington Post analysis. This means that the number of children who have been shaken by gunfire in the places they go to learn exceeds the population of Eugene, Ore., or Fort Lauderdale, Fla.March. Vote. Change the World.

Friday, March 23, 2018

Oil Rigs "Signs of life in the minor plays"

by Calculated Risk on 3/23/2018 06:58:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 23, 2018:

• Total US oil rigs were up this week, +4 to 804

• Horizontal oil rigs were up, +1 to 708

...

• The Permian continues to perform relatively well overall, although only one horizontal rig has been added there in the last six weeks.

• The Cana Woodford was absolutely hammered again, now below its July peak

• The minor ‘Other’ plays have come back to life, with horizontal oil rigs there above last July’s peak for the first time

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.