by Calculated Risk on 4/03/2018 01:23:00 PM

Tuesday, April 03, 2018

Philly Fed: State Coincident Indexes increased in 47 states in January

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2018. Over the past three months, the indexes increased in 44 states, decreased in four, and remained stable in two, for a three-month diffusion index of 80. In the past month, the indexes increased in 47 states, decreased in two, and remained stable in one, for a one-month diffusion index of 90.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

There are a few red states on a three month basis now.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In January, 48 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the mid-to-late 2017 sharp decrease in the number of states with increasing activity was unclear.

Update: Framing Lumber Prices Up Sharply Year-over-year

by Calculated Risk on 4/03/2018 10:59:00 AM

Here is another monthly update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and now prices are above the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through March 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 23% from a year ago, and CME futures are up about 29% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Rising costs - both material and labor - will be headwinds for the building industry this year.

CoreLogic: House Prices up 6.7% Year-over-year in February

by Calculated Risk on 4/03/2018 09:43:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose 6.7 Percent Year Over Year, Increasing for the Seventh Consecutive Month in February

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally year over year by 6.7 percent — from February 2017 to February 2018 — and on a month-over-month basis, home prices increased by 1 percent in February 2018 — compared with January 2018 — according to the CoreLogic HPI.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 4.7 percent on a year-over-year basis from February 2018 to February 2019, with California leading the climb at a forecasted 10.3 percent year-over-year change. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“A number of western states have had hot housing markets,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Idaho, Nevada, Utah and Washington all had home prices up more than 11 percent over the last year. With the recent rise in mortgage rates, affordability has fallen sharply in these states. We expect home-price growth to slow over the next 12 months, dropping to 5 to 6 percent in Idaho, Utah and Washington, and slowing to 9.6 percent in Nevada.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the Year-over-year change in house prices since 2004.

CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is towards the top end of that range.

The year-over-year comparison has been positive for six consecutive years since turning positive year-over-year in February 2012.

Monday, April 02, 2018

"Mortgage Rates Begin April Near 2-Month Lows"

by Calculated Risk on 4/02/2018 07:20:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Begin April Near 2-Month Lows

Mortgage rates moved lower today as underlying bond markets generally followed a much bigger move in stocks. ...with rates already fairly close to recent lows and with lenders generally holding back ahead of the extended holiday weekend, all it took was that modest improvement in bond markets for mortgage rates to drop to the lowest levels since early February. [30YR FIXED - 4.5%]Tuesday:

emphasis added

• At 10:00 AM ET, Corelogic House Price index for February.

• All day, Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).

Black Knight Mortgage Monitor for February

by Calculated Risk on 4/02/2018 01:50:00 PM

Black Knight released their Mortgage Monitor report for February today. According to Black Knight, 4.30% of mortgages were delinquent in February, up from 4.21% in February 2017. The increase was primarily due to the hurricanes. Black Knight also reported that 0.65% of mortgages were in the foreclosure process, down from 0.93% a year ago.

This gives a total of 4.95% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Tappable Equity Sees Greatest Calendar-Year Rise on Record, Increasing $735 Billion in 2017; HELOC Market Share Poised to Rise

Today, the Data & Analytics division of Black Knight, Inc.released its latest Mortgage Monitor Report, based on data as of the end of February 2018. This month, Black Knight revisited the nation’s equity landscape, finding that as home prices continued to increase so has the amount of tappable, or lendable, equity available to Americans with mortgages. Black Knight defines tappable equity as the total amount of equity a homeowner with a mortgage has available to borrow against before reaching a maximum loan-to-value ratio (LTV) of 80 percent. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, rising home prices have pushed the total amount of such equity to a record high.

“As home prices continued their upward trajectory at the national level, the amount of tappable equity available to homeowners with mortgages continued to rise as well,” said Graboske. “Tappable equity rose by $735 billion over the course of 2017, the largest dollar-value calendar year increase on record. At $5.4 trillion, total tappable equity is also the highest on record and 10 percent above the previous, pre-recession peak in 2005. An estimated $262 billion in tappable equity was withdrawn in 2017 via cash-out refinances and home equity lines of credit (HELOCs), also reaching a new post-recession peak. Still, Americans seem more reserved in tapping their equity than in years past, withdrawing less than 1.25 percent of all tappable equity in Q4 2017 – a four-year low. Of that total, 55 percent was tapped via HELOCs, the lowest such share we’ve seen since the housing recovery began. However, as interest rates rise, it is likely that we will see the HELOC share of equity withdrawals increase as well.

“At the start of 2018, some 55 percent of all tappable equity was held by borrowers with first-lien interest rates below the going 30-year rate. Following the nearly 50 basis points rise in interest rates we’ve seen since the start of the year, that share has ballooned to 75 percent. While rising rates tend to dampen utilization of equity in general, the market is poised for a strong shift toward HELOC utilization, as they allow borrowers to take advantage of growing equity while holding on to historically low first-lien interest rates. Sixty-five percent of total tappable equity – approximately $2.8 trillion – is held by borrowers with credit scores of 760 or higher and first-lien interest rates below today’s prevailing rate, which creates a large pocket of low-risk HELOC candidates.”

The data also showed that risk remains relatively low among cash-out refinance originations as well. The average cash-out refinance borrower in 2017 had an average credit score of 744 (down from 750 in 2016) and pulled $68,000 in equity (up from $64,000) with a resulting loan-to-value ratio (LTV) of 66 percent. Approximately 40 percent of remaining cash-out refinance candidates – those borrowers with both tappable equity and current first-lien rates of 4.5 percent or higher – have credit scores above 760. As borrowers with higher credit scores tend to have higher average equity amounts, approximately 50 percent of all tappable equity among borrowers with first-lien rates of 4.5 percent or higher is held by that group.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight's estimate of "tappable equity".

From Black Knight:

• 2017 saw the greatest calendar-year rise in lendable/tappable equity on record, increasing by $735 billion over the course of the yearThere is much more in the mortgage monitor.

• Tappable equity grew by $78B in Q4, resulting in a 16 percent year-over-year increase in total available equity

• Q4 increased a modest 1.5 percent — not uncommon in the final quarter of the year as home price appreciation slows — and outpaced Q4 gains in 2016 and 2015

• $5.4 trillion in total tappable equity is the highest dollar amount on record and 10 percent above the prior 2005 peak

...

• While rising rates tend to dampen utilization of equity in general, the market is poised for a strong shift toward HELOCs, as they allow borrowers to take advantage of growing equity while holding on to historically low first lien interest rates

Construction Spending increased 0.1% in February

by Calculated Risk on 4/02/2018 10:50:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in February:

Construction spending during February 2018 was estimated at a seasonally adjusted annual rate of $1,273.1 billion, 0.1 percent above the revised January estimate of $1,272.2 billion. The February figure is 3.0 percent above the February 2017 estimate of $1,235.7 billion.Private spending increased and public spending decreased in February:

Spending on private construction was at a seasonally adjusted annual rate of $982.0 billion, 0.7 percent above the revised January estimate of $974.8 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $291.1 billion, 2.1 percent below the revised January estimate of $297.4 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 21% below the bubble peak.

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 11% below the peak in March 2009, and 11% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5%. Non-residential spending is up 1% year-over-year. Public spending is up 2% year-over-year.

This was below the consensus forecast of a 0.5% increase for February, however spending for the previous two months was revised up.

ISM Manufacturing index decreased to 59.3 in March

by Calculated Risk on 4/02/2018 10:04:00 AM

The ISM manufacturing index indicated expansion in March. The PMI was at 59.3% in March, down from 60.8% in February. The employment index was at 57.3%, down from 59.7% last month, and the new orders index was at 61.9%, down from 64.2%.

From the Institute for Supply Management: March 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March, and the overall economy grew for the 107th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The March PMI® registered 59.3 percent, a decrease of 1.5 percentage points from the February reading of 60.8 percent. The New Orders Index registered 61.9 percent, a decrease of 2.3 percentage points from the February reading of 64.2 percent. The Production Index registered 61 percent, a 1 percentage point decrease compared to the February reading of 62 percent. The Employment Index registered 57.3 percent, a decrease of 2.4 percentage points from the February reading of 59.7 percent. The Supplier Deliveries Index registered 60.6 percent, a 0.5 percentage point decrease from the February reading of 61.1 percent. The Inventories Index registered 55.5 percent, a decrease of 1.2 percentage points from the February reading of 56.7 percent. The Prices Index registered 78.1 percent in March, a 3.9 percentage point increase from the February reading of 74.2 percent, indicating higher raw materials prices for the 25th consecutive month. Comments from the panel reflect continued expanding business strength. Demand remains robust, with the New Orders Index at 60 or above for the 11th straight month, and the Customers’ Inventories Index at its lowest level since July 2011. The Backlog of Orders Index continued a 14-month expansion with its highest reading since May 2004, when it registered 63 percent. Consumption, described as production and employment, continues to expand, with indications that labor and skill shortages are affecting production output. Inputs, expressed as supplier deliveries, inventories and imports, were negatively impacted by weather conditions; Asian holidays; lead time extensions; steel and aluminum disruptions across many industries; supplier labor issues; and transportation difficulties due to driver and equipment shortages. Export orders remained strong, supported by a weaker U.S. currency. The Prices Index is at its highest level since April 2011, when it registered 82.6 percent. In March, price increases occurred across 17 of 18 industry sectors. Demand remains robust, but the nation’s employment resources and supply chains are still struggling to keep up.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 60.0%, and suggests manufacturing expanded at a slower pace in March than in February.

Still a solid report.

Monday: ISM Manufacturing, Construciton Spending

by Calculated Risk on 4/02/2018 01:41:00 AM

Weekend:

• Schedule for Week of Apr 1, 2018

Monday:

• At 10:00 AM ET ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February. The PMI was at 60.8% in February, the employment index was at 59.7%, and the new orders index was at 64.2%.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 0.5% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down slightly, and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $65.17 per barrel and Brent at $69.67 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.66 per gallon. A year ago prices were at $2.33 per gallon - so gasoline prices are up 33 cents per gallon year-over-year.

Sunday, April 01, 2018

March 2018: Unofficial Problem Bank list declines to 98 Institutions, Q1 2018 Transition Matrix

by Calculated Risk on 4/01/2018 08:19:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for March 2018. During the month, the list fell by three institutions to 98 after four removals and one addition. Assets declined to $19.9 billion from $20.5 billion a month earlier. A year ago, the list held 151 institutions with assets of $41.3 billion.

This month, actions were terminated against The National Capital Bank of Washington, Washington, DC, ($430 million); First Bank and Trust Company of Illinois, Palatine, IL ($192 million); Grand Mountain Bank, FSB, Granby, CO ($109 million); and State Bank of Nauvoo, Nauvoo, IL ($31 million). Added this month was The Citizens State Bank, Okemah, OK ($126 million).

With it being the end of the first quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,727 institutions have appeared on a weekly or monthly list at some point. Only 5.7 percent of the banks that have appeared on a list remain today. In all, there have been 1,629 institutions that have transitioned through the list. Departure methods include 952 action terminations, 406 failures, 254 mergers, and 17 voluntary liquidations. Of the 389 institutions on the first published list, only 9 or 2.3 percent still remain in a designated troubled status more than eight years later. The 406 failures represent 23.5 percent of the 1,727 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 178 | (65,500,762) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | (310,473) | ||

| Still on List at 3/31/2018 | 9 | 3,702,304 | |

| Additions after 8/7/2009 | 89 | 16,170,780 | |

| End (3/31/2018) | 98 | 19,873,084 | |

| Intraperiod Removals1 | |||

| Action Terminated | 774 | 319,115,959 | |

| Unassisted Merger | 214 | 81,811,303 | |

| Voluntary Liquidation | 13 | 2,515,855 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,249 | 528,595,327 | |

| 1Institution not on 8/7/2009 or 3/31/2018 list but appeared on a weekly list. | |||

Saturday, March 31, 2018

Schedule for Week of Apr 1, 2018

by Calculated Risk on 3/31/2018 08:11:00 AM

The key report this week is the March employment report on Friday.

Other key indicators include the February Trade deficit, March ISM manufacturing and non-manufacturing indexes, March auto sales, and the March ADP employment report.

Fed Chair, Jerome Powell, will speak on the Economic Outlook on Friday.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February.Here is a long term graph of the ISM manufacturing index.

The PMI was at 60.8% in February, the employment index was at 59.7%, and the new orders index was at 64.2%.

10:00 AM: Construction Spending for February. The consensus is for a 0.5% increase in construction spending.

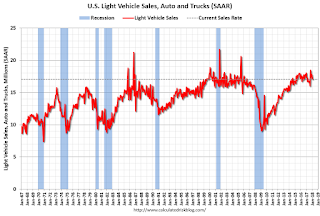

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

10:00 AM: Corelogic House Price index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in March, down from 235,000 added in February.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 59.0 from 59.5 in February.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 215 thousand the previous week.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $56.8 billion in February from $56.8 billion in January.

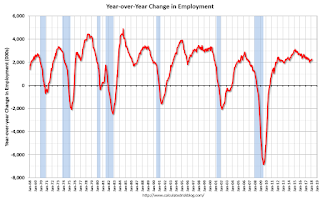

8:30 AM: Employment Report for March. The consensus is for an increase of 167,000 non-farm payroll jobs added in March, down from the 313,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to decrease to 4.0%.

The consensus is for the unemployment rate to decrease to 4.0%.This graph shows the year-over-year change in total non-farm employment since 1968.

In February the year-over-year change was 2.281 million jobs.

A key will be the change in wages.

1:30 PM: Speech by Fed Chair Jerome Powell, Economic Outlook, At the Economic Club of Chicago, Chicago, Illinois

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $15.0 billion in February.