by Calculated Risk on 4/10/2018 12:35:00 PM

Tuesday, April 10, 2018

Philly Fed: State Coincident Indexes increased in 46 states in February

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2018. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. In the past month, the indexes increased in 46 states, decreased in two, and remained stable in two, for a one-month diffusion index of 88.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Once again, the map is all green on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

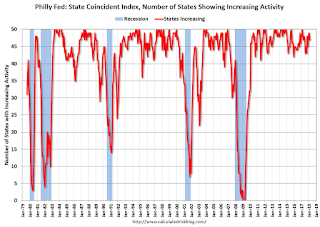

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In February, 47 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Small Business Optimism Index decreased in March, "Difficulty of finding qualified workers" is Top Problem

by Calculated Risk on 4/10/2018 09:40:00 AM

From the National Federation of Independent Business (NFIB): March 2018 Report: Small Business Optimism Index

The 104.7 March reading, down from 107.6 in February, remains among the highest in survey history and for the first time since 1982, taxes received the fewest number of votes as the number one problem.

..

Job creation remained solid in the small business sector as owners reported a seasonally-adjusted average employment change per firm of 0.36 workers, one of the best readings in survey history. ... Twenty-one percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, exceeding the percentage citing taxes or regulations. Thirty-five percent of all owners reported job openings they could not fill in the current period.

emphasis added

Click on graph for larger image.

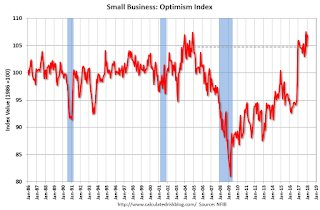

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.7 in March.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, April 09, 2018

Merle Hazard: "A trucking song for the information age"

by Calculated Risk on 4/09/2018 06:31:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 8:30 AM, The Producer Price Index for March from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

It has been almost five years, but long time readers will remember Merle Hazard - he provided us some welcome musical relief with his songs such as "Inflation or Deflation" and How Long (Will Interest Rates Stay Low)?

Merle has a new song out today: Dave's Song. Enjoy!

Hotels: Occupancy Rate Down Year-over-Year

by Calculated Risk on 4/09/2018 02:33:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 31 March

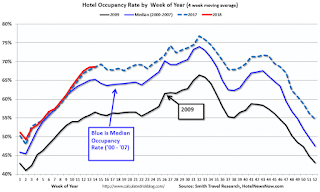

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 25-31 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 26 March through 1 April 2017, the industry recorded the following:

• Occupancy: -2.8 to 66.4%

• Average daily rate (ADR): +3.6% to US$130.81

• Revenue per available room (RevPAR): +0.7% to US$86.90

STR analysts note that performance in many major markets was affected by a drop in group business due to the Easter holiday.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is third overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com>

Weather Adjusted Employment

by Calculated Risk on 4/09/2018 11:14:00 AM

Note: Before the employment report is released each month, Chicago Fed economist Francois Gourio provides an estimate of the impact of weather on employment (this has been very useful).

After the employment report is released, the San Francisco Fed has a model that shows weather adjusted employment. See: Weather-Adjusted Employment Change

This page provides estimates of weather-adjusted employment change in the United States for the past six months. Beginning with the official Bureau of Labor Statistics (BLS) series on the monthly change in total nonfarm payroll employment, we adjust for deviations of weather from seasonal norms following the methodology described in Wilson (2016).

The approach involves estimating the short-run effects of unusual weather on employment growth at the county level using historical data from January 1990 through December 2015. We then use the statistical model to estimate the effect of unusual weather in recent months on employment growth at the county level. We aggregate these county-level effects to the national level, weighting counties by employment levels, to yield estimates of the effect of unusual weather around the country on national employment growth. Finally, we translate these growth effects into level effects using the level of employment in November 2015 as an initial base.

The figure and table present three employment change series for the past six months. The first (left) group is the official BLS series. The other two are alternative estimates of weather-adjusted employment change calculated using our county-level statistical model estimated over the January 1990–December 2015 period. The second set of bars is shows the most recent county-level series (also shown in Figure 2 of van der List and Wilson 2016). The third set of bars is an extension of the county-level model that allows for each weather variable to have different marginal effects in each of the Census Bureau’s nine regions. For example, an inch of snowfall can have a different effect on employment growth in the South Atlantic region than it does in New England.

Click on graph for larger image.

Click on graph for larger image.This graph from the San Francisco Fed show employment gains as reported by the BLS (left graph), and two weather adjusted graphs.

The San Francisco Fed estimates weather reduced March employment by about 100,000 jobs.

There is also a table at the weather adjusted website.

Goldman: Economic Environment "Becoming Less Pleasant"

by Calculated Risk on 4/09/2018 09:31:00 AM

A few brief excerpts from a note by Goldman Sachs chief economist Jan Hatzius: Less Pleasant

The 103k jobs gain in March was well below expectations. Part of the miss reflects a greater-than-expected payback for prior strength in weather-sensitive sectors such as construction and retail. But other industries were also soft, prior months were revised down on net ... While growth is looking softer, it remains far from soft. ...

We view the widening of the LIBOR/OIS spread as a technical and mostly temporary consequence of the international provisions in the new tax law, rather than a sign of banking stress. ... Even if the LIBOR move is technical, one might worry about its direct impact on private-sector borrowing costs and hence aggregate demand. ...

...

Following President Trump’s threat of tariffs on another $100bn of imports from China, the risk of a broader trade confrontation has grown. ... it is harder to rule out continued escalation to a level that does ultimately have a first-order impact on the economy, either directly or (more likely) via tighter financial conditions.

In the end, we think the environment is becoming less pleasant but the baseline outlook for the economy and monetary policy hasn’t really changed much. Growth is a bit weaker, inflation is a bit higher, financial markets are definitely more volatile, and economic imbalances (especially in government finance) are starting to become more visible.

Sunday, April 08, 2018

Sunday Night Futures

by Calculated Risk on 4/08/2018 08:12:00 PM

Weekend:

• Schedule for Week of Apr 8, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 10, and DOW futures are up 90 (fair value).

Oil prices were down over the last week with WTI futures at $62.16 per barrel and Brent at $67.24 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.65 per gallon. A year ago prices were at $2.39 per gallon - so gasoline prices are up 26 cents per gallon year-over-year.

Leading Index for Commercial Real Estate Increases in March

by Calculated Risk on 4/08/2018 09:54:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Climbs in March

The Dodge Momentum Index moved 6.1% higher in March, rising to 155.0 (2000=100) from the revised February reading of 146.0. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. March’s gain was the result of a 9.6% increase in the commercial component – more than erasing the 5.1% decline it had seen the previous month. The gain in the institutional sector meanwhile was milder, moving 1.6% higher, following an 8.1% gain in February. During the first nine months of 2017, the overall Momentum Index made little progress. However, planning activity shot up in the fourth quarter, with that impetus continuing into the first three months of 2018. In the latest quarter the Momentum Index gained 5.1%.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 155.0 in March, up from 146.0 in February.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth in 2018.

Saturday, April 07, 2018

Schedule for Week of Apr 8, 2018

by Calculated Risk on 4/07/2018 08:11:00 AM

The key economic report this week is the Consumer Price Index (CPI) on Wednesday.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

2:00 PM: FOMC Minutes for the Meeting of March 20-21, 2018

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 242 thousand the previous week.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 6.312 million from 5.667 in December.

The number of job openings (yellow) were up 15.9% year-over-year, and Quits were up 3.2% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April). The consensus is for a reading of 100.8, down from 101.4.

Friday, April 06, 2018

AAR: Rail Carloads Up 3.6% YoY, Best March Ever for Intermodal

by Calculated Risk on 4/06/2018 06:13:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

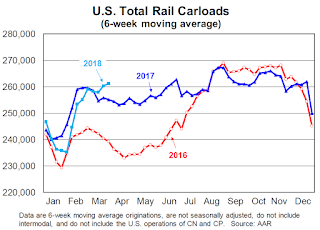

Intermodal did great in March: container plus trailer volume was up 6.5% (66,151 units) over last year, the 14th straight year-over-year monthly gain. Average weekly intermodal volume in March 2018 was easily the most for any March in history. Total U.S. rail carloads were up 3.6% (36,157 carloads) in March 2018 over March 2017, the best percentage gain in nine months.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,050,653 carloads in March 2018, up 36,157 carloads, or 3.6%, over March 2017. That’s just the second year-over-year monthly gain in the past nine months (December 2017 was the other). Weekly average carloads in March 2018 were 262,663, the most for March since 2014.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,082,239 containers and trailers in March 2018, up 6.5%, or 66,151 units, over March 2017. It was easily the best March in history for U.S. intermodal.

For the first three months of 2018, U.S. intermodal volume was up 5.5%, or 181,304 units, over the same period in 2017. At this point, there’s no reason to think this won’t be a record year for intermodal, breaking the record set last year.