by Calculated Risk on 4/12/2018 04:07:00 PM

Thursday, April 12, 2018

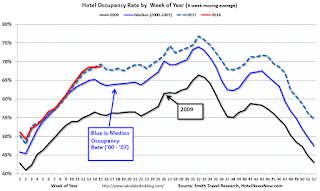

Hotels: Occupancy Rate Down Year-over-Year

From HotelNewsNow.com: STR: US hotel results for week ending 7 April

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 1-7 April 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 2-8 April 2017, the industry recorded the following:

• Occupancy: -2.7 to 68.3%

• Average daily rate (ADR): +0.7% to US$128.84

• Revenue per available room (RevPAR): -2.0% to US$88.03

STR analysts note that performance in many major markets was affected by a drop in group business due to the Easter holiday calendar shift.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is fourth overall - and behind the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Update: Predicting the Next Recession

by Calculated Risk on 4/12/2018 11:30:00 AM

CR April 2018 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and in the summer of 2015, in January 2016, in August 2016, and in April 2017) because of all the recession calls. In late 2015, the recession callers were out in force - arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - would lead to a global recession and drag the US into recession. I didn't think so - and I was correct.

I've added a few updates in italics by year. Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR April 2017 Update: Now it has been over four years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

[CR January 2018 Update: Now it has been five years!]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The recent recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2017 Update: Austerity was a mistake (obvious at the time). And it is possible that we will see serious policy mistakes from the new administration (a complete wildcard). And it is possible the Fed could tighten too quickly. ]

[CR April 2018 Update: We are seeing policy mistakes from the Trump administration on taxes, immigrations, and trade. See: When the Story Change, Be Alert. I'm watching for the impact of these policy mistakes.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR April 2018 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession in the immediate future (not in 2018). ]

Weekly Initial Unemployment Claims decrease to 233,000

by Calculated Risk on 4/12/2018 08:33:00 AM

The DOL reported:

In the week ending April 7, the advance figure for seasonally adjusted initial claims was 233,000, a decrease of 9,000 from the previous week's unrevised level of 242,000. The 4-week moving average was 230,000, an increase of 1,750 from the previous week's unrevised average of 228,250.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 230,000.

This was slightly higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, April 11, 2018

CoreLogic on New Tax Law: "No material house price effect so far"

by Calculated Risk on 4/11/2018 06:15:00 PM

From Frank Nothaft at CoreLogic: Tax Reform: Effect on Home Prices; No material price effect so far, though it is still early after reform

The Tax Cuts and Jobs Act enacted in December was the largest change to the U.S. tax code in more than three decades. Tax reform has touched every person and industry. Let’s examine how it affects housing decisions made by families.CR note: My view is there are certain segments of the housing market that might see a negative impact. I discussed this in Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Overall, tax reform has lowered personal income taxes, not necessarily for each taxpayer but in the aggregate. An increase in after-tax income, at the margin, generally increases the amount of shelter consumed and the likelihood of being a homeowner. Economists refer to this as the ‘income effect’. Thus, the increase in after-tax income should be a net plus for housing demand and homeownership, holding all else constant.

But all else is not constant. Tax reform also lowered the maximum loan size for interest deductibility on new first-mortgage debt to $750,000, eliminated deductibility for some second liens, and capped the annual deduction for state and local income and property taxes at $10,000. Further, the hike in the standard deduction will substantially reduce the number of tax filers who itemize, and lower marginal tax rates reduce the value of deductions for those who do itemize. By raising the after-tax cost of homeownership, tax reform is expected, at the margin, to lower the amount of shelter consumed by owner-occupants and tilt tenure choice toward renting rather than owning. Economists refer to this as the ‘price effect’ because the relative cost of owning versus renting has changed.

Whether the ‘income’ or the ’price’ effect is stronger will determine whether demand for shelter and homeownership rates rise, fall, or are largely left unchanged.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 242 thousand the previous week.

FOMC Minutes: "Monetary policy eventually would likely gradually move from an accommodative stance to being a neutral or restraining"

by Calculated Risk on 4/11/2018 02:05:00 PM

Still on pace for 3 or 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, March 20-21, 2018:

With regard to the medium-term outlook for monetary policy, all participants saw some further firming of the stance of monetary policy as likely to be warranted. Almost all participants agreed that it remained appropriate to follow a gradual approach to raising the target range for the federal funds rate. Several participants commented that this gradual approach was most likely to be conducive to maintaining strong labor market conditions and returning inflation to 2 percent on a sustained basis without resulting in conditions that would eventually require an abrupt policy tightening. A number of participants indicated that the stronger outlook for economic activity, along with their increased confidence that inflation would return to 2 percent over the medium term, implied that the appropriate path for the federal funds rate over the next few years would likely be slightly steeper than they had previously expected. Participants agreed that the longer-run normal federal funds rate was likely lower than in the past, in part because of secular forces that had put downward pressure on real interest rates. Several participants expressed the judgment that it would likely become appropriate at some point for the Committee to set the federal funds rate above its longer-run normal value for a time. Some participants suggested that, at some point, it might become necessary to revise statement language to acknowledge that, in pursuit of the Committee's statutory mandate and consistent with the median of participants' policy rate projections in the SEP, monetary policy eventually would likely gradually move from an accommodative stance to being a neutral or restraining factor for economic activity. However, participants expressed a range of views on the amount of policy tightening that would likely be required over the medium term to achieve the Committee's goals. Participants agreed that the actual path of the federal funds rate would depend on the economic outlook as informed by incoming data.

emphasis added

Key Measures Show Inflation increased in March

by Calculated Risk on 4/11/2018 11:36:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

ccording to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.0% annualized rate) in March. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for March here. Motor fuel was down 45% annualized in March.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.1% (-0.8% annualized rate) in March. The CPI less food and energy rose 0.2% (2.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.1%. Core PCE is for February and increased 1.5% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized, trimmed-mean CPI was at 1.7% annualized, and core CPI was at 2.1% annualized.

Using these measures, inflation increased in March. Overall, these measures are close to the Fed's 2% target.

BLS: CPI decreased 0.1% in March, Core CPI increased 0.2%

by Calculated Risk on 4/11/2018 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1 percent in March on a seasonally adjusted basis after rising 0.2 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.4 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was close to the consensus forecast of no change for CPI, and a 0.2% increase in core CPI.

A decline in the gasoline index more than outweighed increases in the indexes for shelter, medical care, and food to result in the slight seasonally adjusted decline in the all items index. The energy index fell sharply due mainly to the 4.9-percent decrease in the gasoline index. The index for food rose 0.1 percent over the month, with the indexes for food at home and food away from home both increasing

The index for all items less food and energy increased 0.2 percent in March, the same increase as in February. ... The all items index rose 2.4 percent for the 12 months ending March, the largest 12-month increase since the period ending March 2017 and higher than the 1.6-percent average annual rate over the past 10 years. The index for all items less food and energy rose 2.1 percent, its largest 12-month increase since the period ending February 2017.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index Down YoY

by Calculated Risk on 4/11/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 6, 2018.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 0.5 percent lower than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.66 percent from 4.69 percent, with points increasing to 0.46 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is DOWN 0.5% year-over-year.

Tuesday, April 10, 2018

Wednesday: CPI, FOMC Minutes

by Calculated Risk on 4/10/2018 07:54:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still Sideways Ahead of Key Inflation Data

Mortgage rates were roughly unchanged again today. Some lenders were slightly higher in rate, but not enough to affect the average. Underlying bond markets (which dictate rates) have been eerily calm so far this week, ostensibly with an eye on tomorrow morning's big inflation report. [30YR FIXED - 4.5%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

• At 2:00 PM, FOMC Minutes for the Meeting of March 20-21, 2018

Port of Long Beach: Record Port Traffic in Q1 2018

by Calculated Risk on 4/10/2018 04:52:00 PM

From the Port of Long Beach: Port of Long Beach Breaks 1st Quarter Record

The Port of Long Beach has completed its best-ever first quarter, with marine terminals handling almost 1.9 million twenty-foot equivalent units (TEUs) January through March. The quick start is 19.4 percent more than the first quarter of 2017, the Port’s busiest year ever.CR Notes: Exports were up sharply in March. I'll have more on the LA area port traffic once Los Angeles releases their March statistics.

The previous first quarter record was set in 2007.

March throughput reached 575,258 TEUs, an increase of 13.8 percent compared to the same month last year.

“Our March cargo jumped despite the shipping slowdown during the Lunar New Year holiday in China,” said Port of Long Beach Executive Director Mario Cordero.