by Calculated Risk on 4/18/2018 07:00:00 AM

Wednesday, April 18, 2018

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 13, 2018.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.66 percent, with points unchanged at 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

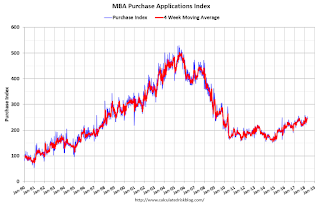

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, April 17, 2018

Wednesday: Beige Book, Architecture Billings Index

by Calculated Risk on 4/17/2018 07:23:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Comments on March Housing Starts

by Calculated Risk on 4/17/2018 11:59:00 AM

Earlier: Housing Starts increased to 1.319 Million Annual Rate in March

The housing starts report released this morning showed starts were up 1.9% in March compared to February, and starts were up 10.9% year-over-year compared to March 2017.

The increase in starts was mostly due to the volatile multi-family sector.

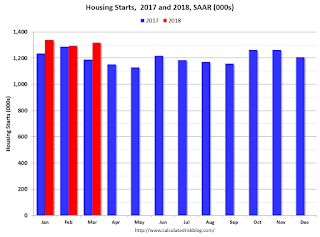

This first graph shows the month to month comparison between 2018 (blue) and 2017 (red).

Starts were up 10.9% in March compared to March 2017.

Note that starts in March, April and May of 2017 were weaker than other months, so this was a fairly easy comparison.

Through three months, starts are up 8.0% year-to-date compared to the same period in 2017.

Single family starts were up 5.2% year-over-year, and down 3.7% compared to February.

Multi-family starts were down 23.7% year-over-year, and up 16.1% compared to February (multi-family is volatile month-to-month).

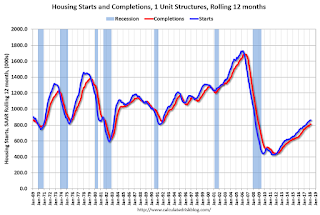

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in a year or so.

As I've been noting for a few years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Industrial Production Increased 0.5% in March

by Calculated Risk on 4/17/2018 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.5 percent in March after increasing 1.0 percent in February; the index advanced 4.5 percent at an annual rate for the first quarter as a whole. After having climbed 1.5 percent in February, manufacturing production edged up 0.1 percent in March. Mining output rose 1.0 percent, mostly as a result of gains in oil and gas extraction and in support activities for mining. The index for utilities jumped 3.0 percent after being suppressed in February by warmer-than-normal temperatures. At 107.2 percent of its 2012 average, total industrial production was 4.3 percent higher in March than it was a year earlier. Capacity utilization for the industrial sector moved up 0.3 percentage point in March to 78.0 percent, a rate that is 1.8 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.0% is 1.8% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 107.2. This is 23% above the recession low, and 2% above the pre-recession peak.

Housing Starts increased to 1.319 Million Annual Rate in March

by Calculated Risk on 4/17/2018 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,319,000. This is 1.9 percent above the revised February estimate of 1,295,000 and is 10.9 percent above the March 2017 rate of 1,189,000. Single-family housing starts in March were at a rate of 867,000; this is 3.7 percent below the revised February figure of 900,000. The March rate for units in buildings with five units or more was 439,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,354,000. This is 2.5 percent above the revised February rate of 1,321,000 and is 7.5 percent above the March 2017 rate of 1,260,000. Single-family authorizations in March were at a rate of 840,000; this is 5.5 percent below the revised February figure of 889,000. Authorizations of units in buildings with five units or more were at a rate of 473,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in March compared to February. Multi-family starts were up 23.8% year-over-year in March.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years (although moving up over the last few months)

Single-family starts (blue) decreased in March, and are up 5.2% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in March were above expectations, and starts for January and February were revised up.

I'll have more later ...

Monday, April 16, 2018

Tuesday: Housing Starts, Industrial Production

by Calculated Risk on 4/16/2018 08:29:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back to Unchanged After Starting Higher

Mortgage rates began the day at higher levels, as bond markets lost ground overnight. Bonds dictate rates, and "losing ground" means bond prices are falling. When bond prices fall, rates move higher.Tuesday:

...

As bonds improved, most lenders ended up releasing positively-revised rate sheets. After the revisions, today's mortgage rates ended up in substantially similar territory to last Friday's. [30YR FIXED - 4.5%]

emphasis added

• At 8:30 AM ET, Housing Starts for March. The consensus is for 1.269 million SAAR, up from 1.236 million SAAR in February.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to decrease to 78.0%.

Sacramento Housing in March: Sales Decrease Slightly YoY, Active Inventory up 19% YoY

by Calculated Risk on 4/16/2018 03:45:00 PM

From SacRealtor.org: Spring Surge: sales volume, median sales price increase for the month

March ended with 1,395 sales, marking a 23.3% increase from the 1,131 sales of February. Compared with one year ago (1,407), however, the current figure is a .9% decrease. Of the 1,395 sales this month, 192 (13.8%) cash financing, 809 (58%) used conventional, 249 (17.8%) used FHA, 89 (6.4%) used VA and 56 (4%) used Other types of financing.CR Note: Inventory is still low, but now increasing year-over-year in Sacramento.

Active Listing Inventory increased 5.4% from 1,724 to 1,817. The Months of Inventory, however, decreased from 1.5 to 1.3 Months. A year ago the Months of inventory was 1.1 and Active Listing Inventory stood at 1,525 listings (19.1% below the current figure).

The Average DOM (days on market) dropped from 31 to 25 month to month and the Median DOM dropped from 13 to 11.

“Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” 75% of all homes sold this month (1,046) were on the market for 30 days or less and 87.5% (1,222) of all homes sold in 60 days or less. Compare this to March 2014 where 79.1% of all homes sold (1,075) sold in 60 days or less.

emphasis added

The statistics for March are here.

Earlier from the NY Fed: Manufacturing "Business activity grew at a solid clip in New York State"

by Calculated Risk on 4/16/2018 12:10:00 PM

Earlier for the NY Fed: Empire State Manufacturing Survey

Business activity grew at a solid clip in New York State, according to firms responding to the April 2018 Empire State Manufacturing Survey. The headline general business conditions index, at 15.8, remained firmly in positive territory, although its seven-point decline from its March level pointed to a somewhat slower pace of growth. Similarly, the new orders index and the shipments index suggested ongoing, albeit more measured, growth, with the first index falling eight points to 9.0 and the second declining ten points to 17.5. Delivery times continued to lengthen, and inventories moved higher. Labor market indicators pointed to a small increase in employment and significantly longer workweeks.This was below the consensus forecast, but still a solid reading.

emphasis added

NAHB: Builder Confidence Declines to 69 in April

by Calculated Risk on 4/16/2018 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 69 in April, down from 70 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Slips One Point, Remains in Solid Territory

Builder confidence in the market for newly-built single-family homes edged down one point to a level of 69 in April on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) but remains on firm ground.

“Strong demand for housing is keeping builders optimistic about future market conditions,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “However, builders are facing supply-side constraints, such as a lack of buildable lots and increasing construction material costs. Tariffs placed on Canadian lumber and other imported products are pushing up prices and hurting housing affordability.”

“Ongoing employment gains, rising wages and favorable demographics should spur demand for single-family homes in the months ahead,” said NAHB Chief Economist Robert Dietz. “The minor dip in builder confidence this month is likely due to winter weather effects, which may be slowing housing activity in some pockets of the country. As we head into the spring home buying season, we can expect the market to continue to make gains at a gradual pace.”

...

The HMI index gauging buyer traffic held steady at 51, the chart measuring sales expectations in the next six months fell a single point to 77, and the component gauging current sales conditions dropped two points to 75.

Looking at the three-month moving averages for regional HMI scores, the South remained unchanged at 73, the Northeast fell one point to 55, the Midwest declined two points to 66, and the West dropped three points to 76.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast, and another solid reading.

Retail Sales increased 0.6% in March

by Calculated Risk on 4/16/2018 08:38:00 AM

On a monthly basis, retail sales increased 0.6 percent from February to March (seasonally adjusted), and sales were up 4.5 percent from March 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $494.6 billion, an increase of 0.6 percent from the previous month, and 4.5 percent above March 2017. ... The January 2018 to February 2018 percent change was unrevised from down 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis.The increase in March was above expectations, however sales in January and February were revised down slightly.