by Calculated Risk on 4/20/2018 11:59:00 AM

Friday, April 20, 2018

Existing Home Sales: Lawler vs. the Consensus

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

The early consensus is that the NAR will report sales of 5.55 million. However, housing economist Tom Lawler estimates the NAR will report sales of 5.51 million on a seasonally adjusted annual rate (SAAR) basis.

The consensus is pretty close to Lawler's estimate for March. Note: The NAR is scheduled to report March Existing Home Sales on Monday, April 23rd at 10:00 AM ET.

Over the last eight years, the consensus average miss was 145 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | --- |

| 1NAR initially reported before revisions. | |||

BLS: Unemployment Rates Lower in 4 states in March; Kentucky and Maine at New Series Lows

by Calculated Risk on 4/20/2018 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in March in 4 states, higher in 1 state, and stable in 45 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Seventeen states had jobless rate decreases from a year earlier and 33 states and the District had little or no change. The national unemployment rate was unchanged from February at 4.1 percent but was 0.4 percentage point lower than in March 2017.Thirteen states have reached new all time lows since the end of the 2007 recession. These thirteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Kentucky, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas and Wisconsin.

...

Hawaii had the lowest unemployment rate in March, 2.1 percent. The rates in Kentucky (4.0 percent) and Maine (2.7 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Thursday, April 19, 2018

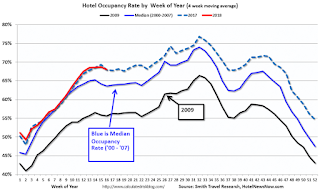

Hotels: Occupancy Rate Up Year-over-Year, Record Q1

by Calculated Risk on 4/19/2018 07:37:00 PM

From HotelNewsNow.com: STR: US hotels set Q1 performance record

The U.S. hotel industry reported record-breaking performance during the first quarter of 2018, according to data from STR.And from HotelNewsNow.com: STR: US hotel results for week ending 14 April

Compared with Q1 2017:

• Occupancy: +0.9% to 61.6%

• Average daily rate (ADR): +2.5% to US$127.37

• Revenue per available room (RevPAR): +3.5% to US$78.46

“The absolute levels for each of the three key performance metrics were the highest STR has ever benchmarked for a Q1,” said Bobby Bowers, STR’s senior VP of operations. “Supply (more than 460 million room nights available) and demand (more than 285 million room nights sold) also reached record levels for a Q1, but demand grew at a much higher rate (+3.0% vs. +2.0%).”

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 8-14 April 2018, according to data from STR. In comparison with the week of 9-15 April 2017, the industry recorded the following:The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

• Occupancy: +6.1% to 68.1%

• Average daily rate (ADR): +5.8% to US$130.57

• Revenue per available room (RevPAR): +12.2% to US$88.95

STR analysts note performance growth was boosted by a favorable comparison with the week of Easter in 2017.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/19/2018 02:21:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in March

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.51 million in March, down 0.5% from February’s preliminary pace and down 2.8% from last March’s seasonally adjusted pace. Unadjusted sales should show a larger YOY decline, reflecting this March’s lower business day count relative to last March’s.

Local realtor/MLS data indicate that the inventory of existing homes for sale in March was down from a year ago but that the YOY decline in March was less than that in February, and I project that the NAR’s estimate of the number of existing homes for sale at the end of March was 1.67 million, up 5.0% from February’s preliminary estimate and down 7.2% from last March.

Finally, local realtor/MLS data suggest the median US existing single-family home sales price last month was up about 7.1% from last March. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: Existing home sales for March are scheduled to be released by the NAR on Monday.

Black Knight: National Mortgage Delinquency Rate Decreased in March

by Calculated Risk on 4/19/2018 10:41:00 AM

From Black Knight: Black Knight’s First Look: Hurricane Impact Lingers, Drives Up Foreclosure Starts as Moratoria Lift; National Delinquencies Fall to 12-Month Low

• Seasonal effects and continued hurricane-related improvements contributed to a 13 percent decline in the national delinquency rate in MarchAccording to Black Knight's First Look report for March, the percent of loans delinquent decreased 13.2% in March compared to February, but increased 3.1% year-over-year.

• Nationally, there was a decline of 65,000 in serious delinquencies (90 or more days past due but not yet in foreclosure)

• Serious delinquencies attributable to Hurricanes Harvey and Irma saw a reduction of 19,500 loans

• However, as the hurricane impact shifts away from delinquencies, foreclosure starts rose by 12 percent

• More than two-thirds of that increase came from hurricane-affected areas of Texas and Florida

• Overall, active foreclosure inventory continues to improve, falling another 10,000 loans in March to its lowest level since late 2006

• Despite interest rates remaining above 4.4 percent, prepayment activity in March increased by 22 percent from February’s 4-year low

The percent of loans in the foreclosure process decreased 3.2% in March and were down 29.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.73% in March, down from 4.30% in February.

The percent of loans in the foreclosure process decreased in March to 0.63%.

The number of delinquent properties, but not in foreclosure, is up 81,000 properties year-over-year, and the number of properties in the foreclosure process is down 127,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2018 | Feb 2018 | Mar 2017 | Mar 2016 | |

| Delinquent | 3.73% | 4.30% | 3.62% | 4.08% |

| In Foreclosure | 0.63% | 0.65% | 0.88% | 1.25% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,912,000 | 2,198,000 | 1,831,000 | 2,062,000 |

| Number of properties in foreclosure pre-sale inventory: | 321,000 | 331,000 | 448,000 | 631,000 |

| Total Properties | 2,232,000 | 2,528,000 | 2,279,000 | 2,693,000 |

Philly Fed Manufacturing Survey Showed "Continued Growth" in April

by Calculated Risk on 4/19/2018 09:30:00 AM

From the Philly Fed: April 2018 Manufacturing Business Outlook Survey

Results from the April Manufacturing Business Outlook Survey suggest continued growth for the region’s manufacturing sector. Although the survey’s indexes for general activity and employment improved slightly, the indexes for new orders and shipments moderated. The firms also reported higher prices for both inputs and their own manufactured goods this month. The survey’s future indexes, measuring expectations for the next six months, reflected continued optimism.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity edged 1 point higher, from 22.3 in March to 23.2 this month ... The firms continued to report overall increases in employment. Over 31 percent of the responding firms reported increases in employment, while 4 percent reported decreases this month. The current employment index edged 2 points higher to 27.1, its highest reading in six months. The firms also reported a longer average workweek this month: The current average workweek index increased 9 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

This suggests the ISM manufacturing index will show solid expansion again in April, but perhaps lower than in March.

Weekly Initial Unemployment Claims decrease to 232,000

by Calculated Risk on 4/19/2018 08:33:00 AM

The DOL reported:

In the week ending April 14, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 1,000 from the previous week's unrevised level of 233,000. The 4-week moving average was 231,250, an increase of 1,250 from the previous week's unrevised average of 230,000.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,250.

This was slightly higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, April 18, 2018

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 4/18/2018 05:28:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Inch Higher as Bonds Suggest More Trouble Ahead

Mortgage rates moved higher today as bond markets continued a mildly weaker trend for the month of April. Bonds (which underlie rates) are under pressure for a variety of reasons. The most notable headwinds are longer-term and bigger-picture. Rates responded to these headwinds in a fairly big way in Jan/Feb and have basically been "taking a break" since then.Thursday:

Rates have moved very little during this "break," with most borrowers being quoted the same NOTE rate on any given day in the past 2 months. Upfront costs have been the only way the modulate the EFFECTIVE rate of the average lender's 30yr fixed quote. [30YR FIXED - 4.5%]

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 233 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 20.1, down from 22.3.

Fed's Beige Book: "Modest to moderate" expansion, "concern about tariffs"

by Calculated Risk on 4/18/2018 02:31:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Dallas based on information collected on or before April 9, 2018."

Economic activity continued to expand at a modest to moderate pace across the 12 Federal Reserve Districts in March and early April. Outlooks remained positive, but contacts in various sectors including manufacturing, agriculture, and transportation expressed concern about the newly imposed and/or proposed tariffs. Consumer spending rose in most regions, with gains noted for nonauto retail sales and tourism, but mixed results for vehicle sales. Manufacturing activity grew moderately, and demand for nonfinancial services was mostly solid. Residential construction and real estate activity expanded further, although low home inventories continued to constrain sales in several Districts. Loan demand increased, and commercial real estate activity and construction improved since the last report. Transportation services activity expanded in over half of the reporting Districts, buoyed by increases in port traffic and/or air, rail and/or trucking shipments. Agricultural conditions were little changed or worsened on net, in part due to persistent drought conditions. Contacts in the energy sector cited a pickup in activity, except in the Richmond District, where coal production was flat and natural gas production dipped slightly.

...

Widespread employment growth continued, with most Districts characterizing growth as modest to moderate. Labor markets across the country remained tight, restraining job gains in some regions. Contacts continued to note difficulty finding qualified candidates across a broad array of industries and skill levels. Reports of labor shortages over the reporting period were most often cited in high-skill positions, including engineering, information technology, and health care, as well as in construction and transportation. Businesses were responding to labor shortages in a variety of ways, from raising pay to enhancing training to increasing their use of overtime and/or automation, among other strategies. Upward wage pressures persisted but generally did not escalate; most Districts reported wage growth as only modest.

emphasis added

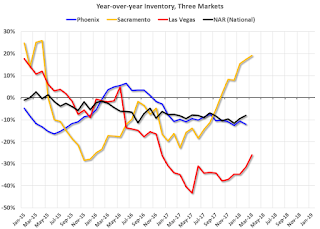

Housing Inventory Tracking

by Calculated Risk on 4/18/2018 01:47:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas and Sacramento (through March), and also Phoenix and total existing home inventory as reported by the NAR (both through February 2018).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 19% year-over-year in March (inventory still very low), and has increased year-over-year for six consecutive months.

Also note the inventory is still down sharply in Las Vegas (red), but the YoY decline has been getting smaller.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.