by Calculated Risk on 4/25/2018 09:50:00 AM

Wednesday, April 25, 2018

Chemical Activity Barometer "Eases" in April

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Eases Following Six Consecutive Monthly Gains; Trends Suggest Growth into Early 2019

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), slipped 0.1 percent in April to 121.6 percent on a three-month moving average (3MMA) basis. This follows six consecutive monthly gains and a dip from the barometer’s highest point since modeling began. The barometer remains up 3.8 percent on a 3MMA compared to a year earlier.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has been solid over the last year, suggesting further gains in industrial production in 2018.

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey

by Calculated Risk on 4/25/2018 07:00:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 20, 2018.

... The Refinance Index decreased 0.3 percent from the previous week. The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 11 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since September 2013, 4.73 percent, from 4.66 percent, with points increasing to 0.49 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 11% year-over-year.

Tuesday, April 24, 2018

"Mortgage Rates Push Farther Into 4-Year Highs"

by Calculated Risk on 4/24/2018 09:26:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Push Farther Into 4-Year Highs

Mortgage rates moved somewhat higher again today, thus pushing them farther into the highest levels in more than 4 years. [30YR FIXED - 4.625%-4.75%]Here is a table from Mortgage News Daily:

emphasis added

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2017

by Calculated Risk on 4/24/2018 05:17:00 PM

IMPORTANT NOTE: The data below is based on the Census 2017 estimates. Housing economist Tom Lawler has pointed out some questions about the Census estimates, see: Lawler: "New Long-Term Population Projections Show Slower Growth than Previous Projections but Are Still Too High"

Four years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

In 2016, I followed up with Largest 5-year Population Cohorts are now "20 to 24" and "25 to 29" and

U.S. Demographics: Ten most common ages in 2010, 2015, 2020, and 2030.

Note: For the impact on housing, also see: Demographics: Renting vs. Owning

Last week the Census Bureau released the population estimates for 2017, and I've updated the table from the previous post (replacing 2015 with 2017 data).

The table below shows the top 11 cohorts by size for 2010, 2017 (released this month), and Census Bureau projections for 2020 and 2030.

By the year 2020, 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age group is now increasing.

This is positive for housing and the economy.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2017 | 2020 | 2030 |

| 1 | 45 to 49 years | 25 to 29 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 20 to 24 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 55 to 59 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 30 to 34 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 50 to 54 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 35 to 39 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 15 to 19 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 45 to 49 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | 60 to 64 years | 50 to 54 years | 50 to 54 years |

Click on graph for larger image.

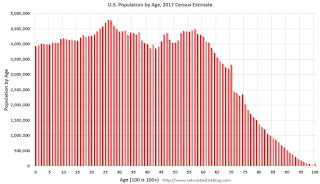

This graph, based on the 2017 population estimate, shows the U.S. population by age in July 2017 according to the Census Bureau.

Note that the largest age groups are all in their mid-20s.

And below is a table showing the ten most common ages in 2010, 2017, 2020, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2017 the millennials have taken over. And by 2020, the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2017 | 2020 | 2030 | |

| 1 | 50 | 26 | 29 | 39 |

| 2 | 49 | 27 | 30 | 40 |

| 3 | 20 | 25 | 28 | 38 |

| 4 | 19 | 28 | 27 | 37 |

| 5 | 47 | 24 | 31 | 36 |

| 6 | 46 | 23 | 26 | 35 |

| 7 | 48 | 57 | 32 | 41 |

| 8 | 51 | 29 | 25 | 30 |

| 9 | 18 | 56 | 35 | 34 |

| 10 | 52 | 32 | 34 | 33 |

Real House Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/24/2018 02:20:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.3% year-over-year in February

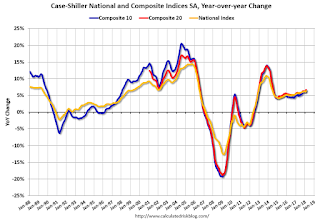

It has been eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 8.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 10.8% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In February, the index was up 6.3% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $284,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

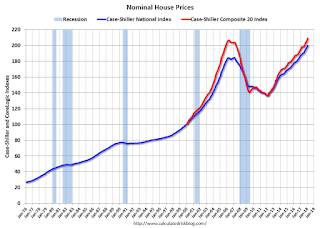

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to November 2004 levels, and the Composite 20 index is back to May 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004 - and the price-to-rent ratio has been increasing slowly.

A few Comments on March New Home Sales

by Calculated Risk on 4/24/2018 11:44:00 AM

New home sales for March were reported at 694,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the three previous months were revised up, combined.

Earlier: New Home Sales increase to 694,000 Annual Rate in March.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 10.3% through March compared to the same period in 2017. Solid growth, and the next five months will be an easy comparison to 2017.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 694,000 Annual Rate in March

by Calculated Risk on 4/24/2018 10:14:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 694 thousand.

The previous three months were revised up, combined.

"Sales of new single-family houses in March 2018 were at a seasonally adjusted annual rate of 694,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.0 percent above the revised February rate of 667,000 and is 8.8 percent above the March 2017 estimate of 638,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in March to 5.2 months from 5.4 months in February.

The months of supply decreased in March to 5.2 months from 5.4 months in February. The all time record was 12.1 months of supply in January 2009.

This is at the top end of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of March was 301,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2018 (red column), 68 thousand new homes were sold (NSA). Last year, 61 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was well above expectations of 630,000 sales SAAR, and the previous months were revised up, combined. I'll have more later today.

Case-Shiller: National House Price Index increased 6.3% year-over-year in February

by Calculated Risk on 4/24/2018 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Home Prices: Cities in the West Continue to Lead Housing Momentum

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.3% annual gain in February, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.5%, up from 6.0% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, up from 6.4% in the previous month.

Seattle, Las Vegas, and San Francisco continue to report the highest year-over-year gains among the 20 cities. In February, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with an 11.6% increase and San Francisco with a 10.1% increase. Thirteen of the 20 cities reported greater price increases in the year ending February 2018 versus the year ending January 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in February. The 10-City and 20-City Composites both reported increases of 0.7%. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in February. The 10-City and 20-City Composites both posted 0.8% month-over-month increases. All 20 cities reported increases in February before and after seasonal adjustment.

“Home prices continue to rise across the country,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index is up 6.3% in the 12 months through February 2018. Year-over-year prices measured by the National index have increased continuously for the past 70 months, since May 2012. Over that time, the price increases averaged 6% per year. This run, which is still ongoing, compares to the previous long run from January 1992 to February 2007, 182 months, when prices averaged 6.1% annually. With expectations for continued economic growth and further employment gains, the current run of rising prices is likely to continue.

“Increasing employment supports rising home prices both nationally and locally. Among the 20 cities covered by the S&P CoreLogic Case-Shiller Indices, Seattle enjoyed both the largest gain in employment and in home prices over the 12 months ended in February 2018. At the other end of the scale, Chicago was ranked 19th in both home price and employment gains; Cleveland ranked 18th in home prices and 20th in employment increases. In San Francisco and Los Angeles, home price gains ranked much higher than would be expected from their employment increases, indicating that California home prices continue to rise faster than might be expected. In contrast, Miami home prices experienced some of the smaller increases despite better than average employment gains.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 1.6% from the peak, and up 0.7% in February (SA).

The Composite 20 index is 1.3% above the bubble peak, and up 0.8% (SA) in February.

The National index is 8.2% above the bubble peak (SA), and up 0.5% (SA) in February. The National index is up 46.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.5% compared to February 2017. The Composite 20 SA is up 6.8% year-over-year.

The National index SA is up 6.3% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, April 23, 2018

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 4/23/2018 08:16:00 PM

From Matthew Graham at Mortgage News Daily: NOW Mortgage Rates Are at 4-Year Highs

Mortgage rates moved markedly higher today, officially leaving them at new 4-year highs.Tuesday:

...

The average lender is quoting very well-qualified borrowers with huge downpayments something north of 4.5% on conventional 30yr fixed mortgages today. Let's call it 4.625%. Up until Friday, that number hadn't been over 4.5% except for on a few of those ill-fated February days. [30YR FIXED - 4.625%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 6.2% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 630 thousand SAAR, up from 618 thousand in February.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

Housing Inventory Tracking

by Calculated Risk on 4/23/2018 04:48:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Here is a table from housing economist Tom Lawler showing the year-over-year (YoY) change for National inventory from the NAR, and the YoY change for California from the CAR.

It appears the YoY declines are slowing, and especially in California.

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (through March), and also total existing home inventory as reported by the NAR (also through March 2018).

Click on graph for larger image.

Click on graph for larger image.This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 19% year-over-year in March (inventory still very low), and has increased year-over-year for six consecutive months.

Also note the inventory is still down sharply in Las Vegas (red), but the YoY decline has been getting smaller.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.