by Calculated Risk on 4/26/2018 07:11:00 PM

Thursday, April 26, 2018

Friday: Q1 GDP

A few GDP forecasts:

From Merrill Lynch:

[T]he data added 0.2pp to 1Q GDP tracking, bringing it up to 1.9% qoq saar heading into tomorrow's advance release. [April 26 estimate].And from the Altanta Fed: GDPNow

emphasis added

The final GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.0 percent on April 26, unchanged from April 17.[April 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.9% for 2018:Q1 and 3.0% for 2018:Q2. [April 20 estimate]Friday:

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2018 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.9% in Q4.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 98.0, up from 97.8.

Vehicle Sales Forecast: Sales Around 17 Million SAAR in April

by Calculated Risk on 4/26/2018 05:48:00 PM

The automakers will report April vehicle sales on Tuesday, May 1st.

Note: There were 24 selling days in April 2018, down from 26 in April 2017.

From WardsAuto: U.S. Light-Vehicle Forecast: April Sets Stage for Strong Q2

The Wards Intelligence forecast calls for U.S. automakers to deliver 1.35 million light vehicles in April. ... The report puts the seasonally adjusted annual rate of sales for the month at 17.1 million units, below last month’s 17.4 million but slightly above year-ago’s 17.0It appears April will be another solid month. So far sales in 2018 are running at about the same rate as in 2017.

emphasis added

Zillow Case-Shiller Forecast: More Solid House Price Gains in March

by Calculated Risk on 4/26/2018 02:38:00 PM

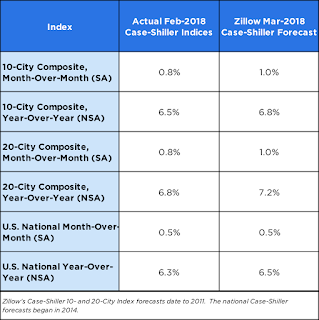

The Case-Shiller house price indexes for February were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: February Case-Shiller Results and March Forecast: Home Prices Pushed Higher by Inventory Crunch

The kind of sustained, rapid home price growth we’ve been seeing in Case-Shiller and other indices for the past few years is enough to give home buyers of all stripes a headache. And don’t expect things to slow down any time soon.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be larger in March than in February.

...

The pain this rapid growth is causing is widespread, but is especially acute for first-time and lower-income buyers at the bottom end of the market in search of entry-level homes that are appreciating the fastest, in large part because they are in the most demand.

Competition is fierce, offer windows are short and tensions will inevitably run high for many buyers as the spring shopping season unfolds.

More inventory is the one cure sure to take this edge off, and there are some faint signals in more recent data that a shift may be coming – inventory of existing homes has risen for the past three months, and construction activity is at its highest point in a decade.

But buyers in the market now shouldn’t hold their breath. Even if inventory does begin to recover, it will be rising from incredibly low levels and will likely take years to get back to a more ‘normal’ level.

Zillow predicts the March S&P/Case-Shiller U.S. national index, which will not be released until May 29, will climb 6.5 percent year-over year.

Kansas City Fed: Regional Manufacturing Activity "Expanded More Rapidly" in April

by Calculated Risk on 4/26/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded More Rapidly

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded more rapidly in April, and optimism remained high for future activity.So far most of the regional Fed surveys have been solid in April, although Richmond showed some slowing.

“Factory activity accelerated in April despite concerns among many firms about changes in international trade policy,” said Wilkerson. “Price indexes also continued to rise.”

...

The month-over-month composite index was 26 in April, up from readings of 17 in March and 17 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity accelerated at both durable and nondurable goods plants, particularly for machinery, plastics, and chemicals. Month-over-month indexes increased considerably. The production index jumped from 20 to 33, and the shipments, new orders, and order backlog indexes also rose. The employment and new orders for exports indexes were unchanged. The raw materials inventory index increased from 11 to 17, while the finished goods inventory index fell slightly.

emphasis added

HVS: Q1 2018 Homeownership and Vacancy Rates

by Calculated Risk on 4/26/2018 10:06:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2018.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was unchanged at 64.2% in Q1, from 64.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Weekly Initial Unemployment Claims decrease to 209,000

by Calculated Risk on 4/26/2018 08:33:00 AM

The DOL reported:

In the week ending April 21, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 24,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 229,250, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 231,250 to 231,500.The previous week was revised up.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 229,250.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, April 25, 2018

Thursday: Unemployment Claims, Durable Goods, Housing Vacancies and Homeownership

by Calculated Risk on 4/25/2018 08:17:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 232 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

• At 10:00 AM, the Q1 2018 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

NMHC: Apartment Market Tightness Index remained negative for Tenth Consecutive Quarter

by Calculated Risk on 4/25/2018 02:29:00 PM

From the National Multifamily Housing Council (NMHC): April NMHC Quarterly Survey Shows Greater Supply Improving Affordability

Apartment market conditions were uneven, according to results from the April National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The Market Tightness (38), Sales Volume (43) and Debt Financing (36) Indexes landed below the breakeven level of 50, while the Equity Financing Index decreased to 54.

“Apartment markets continue to send mixed signals,” said NMHC Chief Economist Mark Obrinsky. “While respondents indicated more markets are loosening than tightening, this was focused in markets that have experienced greater supply. So, the message is clear, if unsurprising: Increasing supply improves affordability.”

The Market Tightness Index increased two points to 38. This was the tenth consecutive quarter of overall declining conditions. Thirty-eight percent of respondents reported looser market conditions than three months prior, compared to only 14 percent who reported tighter conditions. Meanwhile, nearly half of respondents (47 percent) felt that conditions were no different from last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the tenth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 4/25/2018 01:40:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through February 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Philly Fed: State Coincident Indexes increased in 47 states in March

by Calculated Risk on 4/25/2018 11:29:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2018. Over the past three months, the indexes increased in 49 states and decreased in one, for a three-month diffusion index of 96. In the past month, the indexes increased in 47 states, decreased in one, and remained stable in two, for a one-month diffusion index of 92.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Once again, the map is mostly green on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

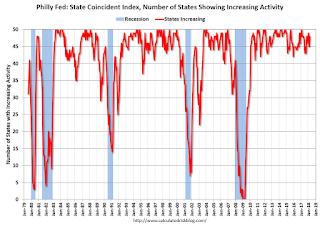

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In March, 48 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.