by Calculated Risk on 5/11/2018 09:25:00 AM

Friday, May 11, 2018

Merrill: "Retail spending stalls again"

A few excerpts from a Merrill Lynch research note: Retail spending stalls again

According to BAC aggregated credit and debit card data, retail sales ex-autos declined 0.1% mom seasonally adjusted in April. This suggests that the better momentum in consumer spending seen in March failed to carry over to start the second quarter. We saw two headwinds for the consumer in April: weather and higher gasoline prices.CR Note: Retail sales for April are scheduled to be released on Tuesday, May 15th. The consensus is retail sales increased 0.3% in April.

We find evidence that unseasonably cold weather conditions likely played a role in holding back consumer activity. Specifically, the Midwest and the Northeast experienced below average temperatures ...

Higher gasoline prices also likely dampened overall consumer spending. According to the Energy Information Administration, retail gasoline prices jumped 6.4% mom in April as crude oil prices rose on negative supply shock and solid global demand. This led to a surge in spend at gasoline stations and a shift away from other categories. ...

...

Bottom line: Retail spending softened in April. The weather impact should prove temporary but rising gasoline prices is likely to persist, eating away some of the positive impact from higher after-tax wages seen post tax reform.

Thursday, May 10, 2018

Sacramento Housing in April: Sales Increase 5% YoY, Active Inventory up 18% YoY

by Calculated Risk on 5/10/2018 06:58:00 PM

From SacRealtor.org: April 2018 Statistics – Sacramento Housing Market – Single Family Homes

April closed with 1,587 sales, a 13.8% increase from March’s 1,395. Compared April 2017 (1,512) the current figure is up 5%. Of the 1,587 sales this month, 227 (14.3%) used cash financing, 958 (60.4%) used conventional, 274 (17.3%) used FHA, 64 (4%) used VA and 64 (4%) used Other† types of financing.CR Note: Inventory is still low, but now increasing year-over-year in Sacramento.

...

Active Listing Inventory increased 14.6% from 1,817 to 2,082 units, but the Months of Inventory remained at 1.3 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [CR Note: Active inventory is up 17.6% year-over-year]

The Average DOM (days on market) dropped from 25 to 23 month to month and the Median DOM dropped from 11 to 10. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,587 sales this month, 78.8% (1,251) were on the market for 30 days or less and 90.2% (1,431) were on the market for 60 days or less.

emphasis added

The statistics for April are here.

Hotels: Occupancy Rate increases Year-over-Year, On Pace for Record Year

by Calculated Risk on 5/10/2018 02:12:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 5 May

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 29 April through 5 May 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 30 April through 6 May 2017, the industry recorded the following:

• Occupancy: +0.5% to 68.2%

• Average daily rate (ADR): +2.7% to US$130.14

• Revenue per available room (RevPAR): +3.3% to US$88.77

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Key Measures Show Inflation increased YoY in April

by Calculated Risk on 5/10/2018 11:09:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for April here. Motor fuel was up 43% annualized in April.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.7% annualized rate) in April. The CPI less food and energy rose 0.1% (1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.6%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 2.1%. Core PCE is for February and increased 1.9% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.2% annualized.

Using these measures, inflation increased year-over-year in April. Overall, these measures are close to the Fed's 2% target.

Weekly Initial Unemployment Claims at 211,000, 4-week average lowest since 1969

by Calculated Risk on 5/10/2018 08:35:00 AM

The DOL reported:

In the week ending May 5, the advance figure for seasonally adjusted initial claims was 211,000, unchanged from the previous week's unrevised level of 211,000. The 4-week moving average was 216,000, a decrease of 5,500 from the previous week's unrevised average of 221,500. This is the lowest level for this average since December 20, 1969 when it was 214,500.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 216,000.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

BLS: CPI increased 0.2% in April, Core CPI increased 0.1%

by Calculated Risk on 5/10/2018 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in April on a seasonally adjusted basis after falling 0.1 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.5 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was slightly lower than the consensus forecast of a 0.3% for CPI, and a 0.2% increase in core CPI.

The indexes for gasoline and shelter were the largest factors in the seasonally adjusted increase in the all items index, although the food index increased as well. The gasoline index increased 3.0 percent, more than offsetting declines in other energy component indexes and led to a 1.4-percent rise in the energy index. The food index rose 0.3 percent, with the food at home index rising 0.3 percent and the index for food away from home increasing 0.2 percent.

The index for all items less food and energy rose 0.1 percent in April. ... The all items index rose 2.5 percent for the 12 months ending April; this figure has been mostly trending upward since it was 1.6 percent for the period ending June 2017. The index for all items less food and energy rose 2.1 percent for the 12 months ending April.

emphasis added

Wednesday, May 09, 2018

"Mortgage Rates Back at 4-Year Highs Ahead of Inflation Data"

by Calculated Risk on 5/09/2018 06:03:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back at 4-Year Highs Ahead of Inflation Data

Mortgage rates moved higher today as bond markets braced for impact from several upcoming events. ... [T]omorrow's Consumer Price Index--a key inflation report that can have an immediate impact on the bond market. If inflation is lower than expected, rates could recover. But if it's as strong as expected (or higher), rates could easily continue higher. That would be unfortunate as today's rate sheets are very close to being the worst in more than 4 years, depending on the lender. [30YR FIXED - 4.625%-4.75%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 211 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

Las Vegas: Convention Attendance Sluggish in Q1 2018, Visitor Traffic off Slightly

by Calculated Risk on 5/09/2018 02:31:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2017, visitor traffic declined 1.7% compared to 2016, but was still 8% above the pre-recession peak.

Convention attendance set a new record in 2017, but is off to a sluggish start in 2018. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance was down 7.5% in Q1 2018 compared to Q1 2017.

Visitor traffic was down 1.6% in Q1 2018 compared to Q1 2017.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the sluggish start to 2018 is a little concerning for the Vegas area.

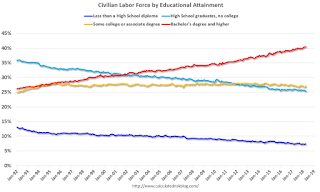

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 5/09/2018 10:39:00 AM

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through April 2018.

Unfortunately this data only goes back to 1992 and includes only two recessions (the stock / tech bust in 2001, and the housing bust/financial crisis). Clearly education matters with regards to the unemployment rate - and all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Note: Thanks to Tim Duy, Economics Professor at the University of Oregon, and Josh Lehner, at the Oregon Office of Economic Analysis.

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up. "Some college" has been steady, and both "high school" and "less than high school" have been trending down.

Based on current trends, probably more than half the labor force will have at least a bachelor's degree sometime in the next decade (2020s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, this is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in fewer weekly claims (I haven't seen data on unemployment claims by education).

A more educated labor force is one of the reasons I remain optimistic about the future.

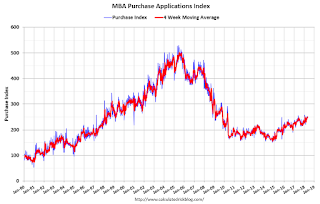

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey, Refi Index lowest since 2008

by Calculated Risk on 5/09/2018 07:00:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 4, 2018.

... The Refinance Index decreased 1 percent from the previous week to its lowest level since October 2008. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index increased 0.4 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.78 percent from 4.80 percent, with points decreasing to 0.50 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.