by Calculated Risk on 5/16/2018 09:25:00 AM

Wednesday, May 16, 2018

Industrial Production Increased 0.7% in April

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.7 percent in April for its third consecutive monthly increase. The rates of change for industrial production for previous months were revised downward, on net; for the first quarter, output is now reported to have advanced 2.3 percent at an annual rate. After being unchanged in March, manufacturing output rose 0.5 percent in April. The indexes for mining and utilities moved up 1.1 percent and 1.9 percent, respectively. At 107.3 percent of its 2012 average, total industrial production in April was 3.5 percent higher than it was a year earlier. Capacity utilization for the industrial sector climbed 0.4 percentage point in April to 78.0 percent, a rate that is 1.8 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

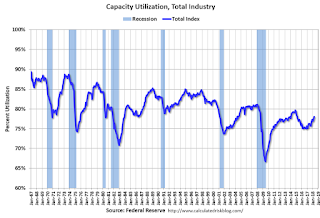

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.0% is 1.8% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 107.3. This is 23% above the recession low, and 2% above the pre-recession peak.

Housing Starts decreased to 1.287 Million Annual Rate in April

by Calculated Risk on 5/16/2018 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,287,000. This is 3.7 percent below the revised March estimate of 1,336,000, but is 10.5 percent above the April 2017 rate of 1,165,000. Single-family housing starts in April were at a rate of 894,000; this is 0.1 percent above the revised March figure of 893,000. The April rate for units in buildings with five units or more was 374,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,352,000. This is 1.8 percent below the revised March rate of 1,377,000, but is 7.7 percent above the April 2017 rate of 1,255,000. Single-family authorizations in April were at a rate of 859,000; this is 0.9 percent above the revised March figure of 851,000. Authorizations of units in buildings with five units or more were at a rate of 450,000 in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in April compared to March. Multi-family starts were up 18.7% year-over-year in April.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) increased slightly in April, and are up 7.2% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in April were below expectations, however starts for February and March were revised up (Combined).

I'll have more later ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refi Index lowest since August 2008

by Calculated Risk on 5/16/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 11, 2018.

... The Refinance Index decreased 4 percent from the previous week to its lowest level since August 2008. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.77 percent from 4.78 percent, with points remaining unchanged at 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, May 15, 2018

Wednesday: Housing Starts, Industrial Production

by Calculated Risk on 5/15/2018 07:34:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for April. The consensus is for 1.325 million SAAR, up from 1.319 million SAAR in March.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to decrease to 78.4%.

"Mortgage Rates Jump to 7-Year Highs"

by Calculated Risk on 5/15/2018 04:29:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump to 7-Year Highs

Mortgage rates spiked in a big way today, bringing some lenders to the highest levels in nearly 7 years (you'd need to go back to July 2011 to see worse). That heavy-hitting headline is largely due to the fact that rates were already fairly close to 7-year highs, although today did cover quite a bit more distance than other recent "bad days." [30YR FIXED - 4.75-4.875%]Here is a table from Mortgage News Daily:

emphasis added

Phoenix Real Estate in April: Sales down 9%, Inventory down 26% YoY

by Calculated Risk on 5/15/2018 03:29:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were down 9.3% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 25.7% year-over-year. In some cities, it appears the inventory decline might be ending, but not in Phoenix!

This is the eighteenth consecutive month with a YoY decrease in inventory.

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| Apr-16 | 8,437 | 0.8% | 2,008 | 23.8% | 27,232 | 4.9% |

| Apr-17 | 8,819 | 4.5% | 1,980 | 22.5% | 24,230 | -11.0% |

| Apr-18 | 8,002 | -9.3% | 1,836 | 22.9% | 18,007 | -25.7% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

Earlier from the NY Fed: Manufacturing "Business activity grew strongly in New York State"

by Calculated Risk on 5/15/2018 01:02:00 PM

Earlier for the NY Fed: Empire State Manufacturing Survey

Business activity grew strongly in New York State, according to firms responding to the May 2018 Empire State Manufacturing Survey. The headline general business conditions index climbed four points to 20.1, indicating a faster pace of growth than in April. The new orders index rose seven points to 16.0 and the shipments index was little changed at 19.1, suggesting ongoing growth in orders and shipments. ... Labor market indicators pointed to a modest increase in employment and longer workweeks.This was above the consensus forecast, and another solid reading.

emphasis added

NAHB: Builder Confidence Increases to 70 in May

by Calculated Risk on 5/15/2018 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 70 in May, up from 68 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Climbs to 70 in May

Builder confidence in the market for newly-built single-family homes rose two points to a level of 70 in May after a downwardly revised April reading on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the fourth time the HMI has reached 70 or higher this year.

“The solid May report shows that builders are buoyed by growing consumer demand for single-family homes,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “However, the record-high cost of lumber is hurting builders’ bottom lines and making it more difficult to produce competitively priced houses for newcomers to the market.”

“Tight housing inventory, employment gains and demographic tailwinds should continue to boost demand for newly-built single-family homes,” said NAHB Chief Economist Robert Dietz. “With these fundamentals in place, the housing market should improve at a steady, gradual pace in the months ahead.”

...

The HMI chart gauging current sales conditions increased two points to 76 in May while the indexes measuring buyer traffic and expectations in the next six months remained unchanged at 51 and 77, respectively.

Looking at the three-month moving averages for regional HMI scores, the West and Northeast held steady at 76 and 55, respectively. Meanwhile, the South and Midwest each edged down one point to respective levels of 72 and 65.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast, and another solid reading.

Retail Sales increased 0.3% in April

by Calculated Risk on 5/15/2018 08:42:00 AM

On a monthly basis, retail sales increased 0.3 percent from March to April (seasonally adjusted), and sales were up 4.7 percent from March 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $497.6 billion, an increase of 0.3 percent from the previous month, and 4.7 percent above April 2017. ... The February 2018 to March 2018 percent change was revised from up 0.6 percent to up 0.8 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.3% in April.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis.The increase in April was at expectations, and sales in February and March were revised up.

Monday, May 14, 2018

Tuesday: Retail Sales, NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 5/14/2018 06:55:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways But Market Says They Shouldn't Be

Mortgage rates were sideways to slightly higher today, and that's actually a strong showing considering what transpired in underlying bond markets. In fact, I'd wager tomorrow morning's rate sheets will be noticeably weaker if bonds are anywhere near their current levels. [30YR FIXED - 4.625%-4.75%]Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for April will be released. The consensus is for a 0.3% increase in retail sales.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 15.5, down from 15.8.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 70, up from 69 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.