by Calculated Risk on 5/23/2018 02:14:00 PM

Wednesday, May 23, 2018

FOMC Minutes: "A temporary period of inflation modestly above 2 percent would be consistent with inflation objective"

Still on pace for 3 or 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, May 1-2, 2018:

With regard to the medium-term outlook for monetary policy, all participants reaffirmed that adjustments to the path for the policy rate would depend on their assessments of the evolution of the economic outlook and risks to the outlook relative to the Committee's statutory objectives. Participants generally agreed with the assessment that continuing to raise the target range for the federal funds rate gradually would likely be appropriate if the economy evolves about as expected. These participants commented that this gradual approach was most likely to be conducive to maintaining strong labor market conditions and achieving the symmetric 2 percent inflation objective on a sustained basis without resulting in conditions that would eventually require an abrupt policy tightening. A few participants commented that recent news on inflation, against a background of continued prospects for a solid pace of economic growth, supported the view that inflation on a 12-month basis would likely move slightly above the Committee's 2 percent objective for a time. It was also noted that a temporary period of inflation modestly above 2 percent would be consistent with the Committee's symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective.

emphasis added

A few Comments on April New Home Sales

by Calculated Risk on 5/23/2018 11:59:00 AM

New home sales for April were reported at 662,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months were revised down.

Sales in April were up 11.6% year-over-year compared to April 2017, however, this was a fairly easy comparison.

Earlier: New Home Sales decrease to 662,000 Annual Rate in April.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 7.2% through April compared to the same period in 2017. Decent growth so far, and the next four months will also be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors.

AIA: "Architecture Firm Billings Strengthen in April"

by Calculated Risk on 5/23/2018 11:11:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Firm Billings Strengthen in April

The American Institute of Architects (AIA) is reporting today that architecture firm billings rose for the seventh consecutive month, with the pace of growth in April increasing modestly from March.

Overall, the AIA’s Architecture Billings Index (ABI) score for April was 52.0 (any score over 50 is billings growth), which indicates the business environment continues to be healthy for architecture firms despite continued labor shortages, growing inflation in building materials costs and rising interest rates. The ABI also revealed that business conditions remained strong at firms located in the West, while billings softened slightly at Midwest firms.

“While there was slower growth in April for new project work coming into architecture firms, business conditions have remained healthy for the first four months of the year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Although growth in regional design activity was concentrated at firms in the sunbelt, there was balanced growth so far this year across all major construction sectors.”

...

• Regional averages: West (55.1), Midwest (49.6), South (51.8), Northeast (50.3)

• Sector index breakdown: multi-family residential (50.7), institutional (52.0), commercial/industrial (52.7), mixed practice (50.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in April, up from 51.0 in March. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018.

New Home Sales decrease to 662,000 Annual Rate in April

by Calculated Risk on 5/23/2018 10:16:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 662 thousand.

The previous three months were revised down, combined.

"Sales of new single-family houses in April 2018 were at a seasonally adjusted annual rate of 662,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent below the revised March rate of 672,000, but is 11.6 percent above the April 2017 estimate of 593,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 5.4 months from 5.3 months in March.

The months of supply increased in April to 5.4 months from 5.3 months in March. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April was 300,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2018 (red column), 64 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was below expectations of 677,000 sales SAAR, and the previous months were revised down. I'll have more later today.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refi Index lowest since December 2000

by Calculated Risk on 5/23/2018 07:00:00 AM

From the MBA: Mortgage Rates Increase, Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 18, 2018.

... The Refinance Index decreased 4 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.77 percent from 4.78 percent, with points remaining unchanged at 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, May 22, 2018

Wednesday: New Home Sales, FOMC Minutes

by Calculated Risk on 5/22/2018 07:24:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM: New Home Sales for April from the Census Bureau. The consensus is for 677 thousand SAAR, down from 694 thousand in March.

• During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM: FOMC Minutes for the Meeting of May 1-2, 2018

FDIC: Fewer Problem banks, Residential REO Declined in Q1

by Calculated Risk on 5/22/2018 03:51:00 PM

The FDIC released the Quarterly Banking Profile for Q1 today:

Aggregate net income for the 5,606 FDIC-insured commercial banks and savings institutions reporting first quarter performance totaled $56 billion in first quarter 2018, an increase of $12.1 billion (27.5 percent) from a year earlier. Improvement in net income was attributable to higher net operating revenue (the sum of net interest income and noninterest income) and a lower effective tax rate, but was offset in part by higher loan-loss provisions and noninterest expense.

...

The Deposit Insurance Fund (DIF) balance increased by $2.3 billion, to $95.1 billion, during the first quarter. … No banks failed during the quarter. ... The DIF’s reserve ratio (the fund balance as a percent of estimated insured deposits) was 1.30 percent on March 31, 2018, unchanged from year-end 2017 due primarily to strong first quarter growth in estimated insured deposits. The reserve ratio increased by ten basis points from one year earlier.

emphasis added

Click on graph for larger image.

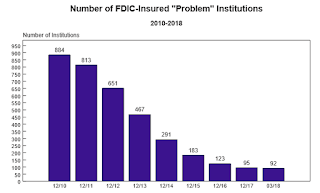

Click on graph for larger image.The FDIC reported the number of problem banks declined slightly.

This graph from the FDIC shows the number of problem banks declined to 92 institutions from 95 at the end of 2017.

Note: The number of assets for problem banks increased significantly, suggesting a fairly large bank was added to the list (more on this when we update the unofficial list at the end of the month).

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $2.92 billion in Q4 2017 to $2.84 billion in Q1. This is the lowest level of REOs since Q3 2006.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $2.92 billion in Q4 2017 to $2.84 billion in Q1. This is the lowest level of REOs since Q3 2006.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, it is unlikely FDIC institution REOs will get back to the $2.0 to $2.5 billion range back that happened in 2003 to 2005. FDIC REOs will probably bottom close to the current level.

Existing Home Sales: Take the Under for April

by Calculated Risk on 5/22/2018 02:01:00 PM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8+ years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

As an example, last month (March 2018) the consensus was for sales of 5.28 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated 5.51 million, and the NAR reported 5.60 million (the consensus missed by 320 thousand compared to 90 thousand for Lawler).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

For April 2018, the consensus is that the NAR will report sales of 5.60 million SAAR. However, housing economist Tom Lawler estimates the NAR will report sales of 5.48 million.

Lawler's estimate is a little below the consensus, so I'd take the under for April. Note: The NAR is scheduled to report April Existing Home Sales on Thursday, May 24th at 10:00 AM ET.

Over the last eight years, the consensus average miss was 145 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | --- |

| 1NAR initially reported before revisions. | |||

Richmond Fed: "Fifth District Manufacturing Firms Reported Robust Growth in May"

by Calculated Risk on 5/22/2018 10:05:00 AM

From the Richmond Fed: Fifth District Manufacturing Firms Reported Robust Growth in May

Fifth District manufacturing firms saw robust growth in May, according to survey results from the Federal Reserve Bank of Richmond. The composite index swung from −3 in April to 16 in May, boosted by growth in the indexes for shipments, new orders, and employment. Local business conditions also moved back into expansionary territory, after weakening in April, and firms remained optimistic that growth would continue in coming months.All of the regional manufacturing reports for May have been solid so far.

Survey results indicate that both employment and wages rose among manufacturing firms in May [Index for number of employees increased from 12 to 18], however, firms still struggled to find the skills they needed. They expect this struggle to continue in the next six months and also expect employment and wages to increase further.

Many manufacturing firms continued to increase spending in May. The growth rate of prices paid continued to rise, on average, but firms seemed able to pass some of change through to customers, as prices received also grew at a faster rate.

emphasis added

The Changing Mix of Light Vehicle Sales

by Calculated Risk on 5/22/2018 09:18:00 AM

Whenever I'm driving, it seems like I'm surrounded by more and more SUVs and trucks. So I thought I'd look at the changing mix of vehicle sales over time (between passenger cars and light trucks / SUVs).

The first graph below shows the mix of sales since 1976 (Blue is cars, Red is light trucks and SUVs).

Click on graph for larger image.

The mix has changed significantly. Back in 1976, most light vehicles were passenger cars - however car sales have trended down over time.

Note that the big dips in sales are related to economic recessions (early '80s, early '90s, and the Great Recession of 2007 through mid-2009).

Over time the mix has changed toward more and more light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

Recently oil prices have been fairly low (now increasing), and the percent of light trucks and SUVs is almost up to 70%.