by Calculated Risk on 5/29/2018 01:31:00 PM

Tuesday, May 29, 2018

Update: A few comments on the Seasonal Pattern for House Prices

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

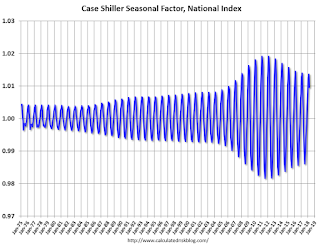

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

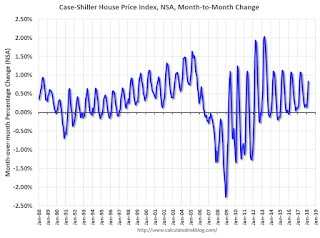

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Dallas Fed: "Texas Manufacturing Expansion Accelerates Notably"

by Calculated Risk on 5/29/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Accelerates Notably

Texas factory activity rose markedly in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, increased 10 points to a 12-year high of 35.2, signaling further acceleration in output growth.This was the last of the regional Fed surveys for May.

Most other indexes of manufacturing activity also indicated a sharp acceleration in May. The capacity utilization index rose notably from 18.7 to 32.2, and the shipments index jumped 20 points to 39.5. Demand growth picked up as the growth rate of orders index increased eight points to 26.5. All three measures reached their highest readings since 2006. Meanwhile, the new orders index held steady at 27.7.

Perceptions of broader business conditions were even more positive in May than in April. The general business activity index rose five points to 26.8, and the company outlook index rose four points to 28.0. These readings are far above their respective averages.

Labor market measures suggested stronger growth in employment and notably longer work hours in May. The employment index pushed up six points to 23.4, its highest reading in six years. Twenty-nine percent of firms noted net hiring, compared with 5 percent that noted net layoffs. The hours worked index shot up nine points to 23.2.

emphasis added

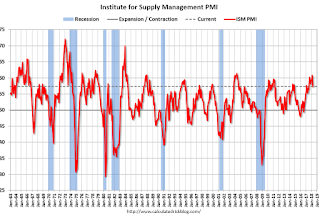

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

Based on these regional surveys, it is possible the ISM manufacturing index will be close to 60 in May (to be released on Friday, June 1st).

Case-Shiller: National House Price Index increased 6.5% year-over-year in March

by Calculated Risk on 5/29/2018 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Not Slowing Down According to S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.5% annual gain in March, the same as the previous month. The 10-City Composite annual increase came in at 6.5%, up from 6.4% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, no change from the previous month.

Seattle, Las Vegas, and San Francisco continue to report the highest year-over-year gains among the 20 cities. In March, Seattle led the way with a 13.0% year-over-year price increase, followed by Las Vegas with a 12.4% increase and San Francisco with an 11.3% increase. Twelve of the 20 cities reported greater price increases in the year ending March 2018 versus the year ending February 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.8% in March. The 10-City and 20-City Composites reported increases of 0.9% and 1.0%, respectively. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in March. The 10-City and 20-City Composites posted 0.4% and 0.5% month-over-month increases, respectively. All 20 cities reported increases in March before seasonal adjustment, while 19 of 20 cities reported increases after seasonal adjustment.

“The home price increases continue with the National Index rising at 6.5% per year,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Seattle continues to report the fastest rising prices at 13% per year, double the National Index pace. While Seattle has been the city with the largest gains for 19 months, the ranking among other cities varies. Las Vegas and San Francisco saw the second and third largest annual gains of 12.4% and 11.3%. A year ago, they ranked 10th and 16th. Any doubts that real, or inflation-adjusted, home prices are climbing rapidly are eliminated by considering Chicago; the city reported the lowest 12-month gain among all cities in the index of 2.8%, almost a percentage point ahead of the inflation rate.

“Looking across various national statistics on sales of new or existing homes, permits for new construction, and financing terms, two figures that stand out are rapidly rising home prices and low inventories of existing homes for sale. Months-supply, which combines inventory levels and sales, is currently at 3.8 months, lower than the levels of the 1990s, before the housing boom and bust. Until inventories increase faster than sales, or the economy slows significantly, home prices are likely to continue rising. Compared to the price gains of the last boom in the early 2000s, things are calmer today. Gains in the National Index peaked at 14.5% in September 2005, more quickly than Seattle is rising now.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 1.1% from the peak, and up 0.4% in March (SA).

The Composite 20 index is 1.8% above the bubble peak, and up 0.5% (SA) in March.

The National index is 8.8% above the bubble peak (SA), and up 0.4% (SA) in March. The National index is up 47.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.4% compared to March 2017. The Composite 20 SA is up 6.7% year-over-year.

The National index SA is up 6.5% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, May 28, 2018

Tuesday: Case-Shiller House Prices, Dallas Fed Mfg

by Calculated Risk on 5/28/2018 09:39:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. The consensus is for a 6.4% year-over-year increase in the Comp 20 index for March.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

Hotels: Occupancy Rate decreases Year-over-Year, Close to Record Annual Pace

by Calculated Risk on 5/28/2018 10:44:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 19 May

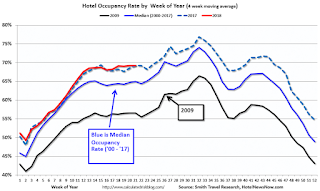

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 13-19 May 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 14-20 May 2017, the industry recorded the following:

• Occupancy: -0.5% to 70.2%

• Average daily rate (ADR): +3.5% to US$132.36

• Revenue per available room (RevPAR): +3.0% to US$92.92

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

On a seasonal basis, the occupancy rate will pick up soon when the summer travel season starts.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, May 27, 2018

May 2018: Unofficial Problem Bank list; Which Bank is the "Mystery" Problem Bank?

by Calculated Risk on 5/27/2018 08:12:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2018. The list had a net decline of two insured institutions to 92 banks after three additions and five removals. After the net changes to the list and updating asset with 2018Q1 figures, aggregate assets declined during the month by $911 million to $18.0 billion. A year ago, the list held 140 institutions with assets of $34.2 billion.CR Note: When the unofficial weekly was list was first published on August 7, 2009 it had 389 institutions. The list peaked at just over 1,000 institutions in 2011. Now there are only 92 banks on the unofficial list (the FDIC reported 92 banks on the official problem bank list at the end of 2017).

Actions were terminated against HomeStar Bank and Financial Services, Manteno, IL ($359 million); Freedom Bank of Oklahoma, Tulsa, OK ($156 million); and Superior Bank, Hazelwood, MO ($29 million). Finding their way off the list through merger were Indus American Bank, Edison, NJ ($231 million) and Wawel Bank, Wallington, NJ ($73 million).

Additions this month were Maryland Financial Bank, Towson, MD ($66 million); Sunrise Bank Dakota, Onida, SD ($65 million); and The First National Bank of Sedan, Sedan, KS ($64 million).

Name and location changes made this month include Saigon National Bank (Cert #57974), Westminster, CA with a name change to California International Bank, N.A. and a headquarters move to Rosemead, CA; First State Bank (Cert #9502), Danville, VA with a name change to Movement Bank; Covenant Bank (Cert #34460), Leeds, AL with a name change to Millennial Bank; California Business Bank (Cert #58037), Los Angeles, CA with a headquarters move to Irvine, CA; and BNB Hana Bank, National Association (Cert #26790), Fort Lee, NJ with a name change to KEB Hana Bank USA, National Association.

This week the FDIC released their official Problem Bank figures for the end of the first quarter of 2018, with their list holding 92 institutions with assets of $56.4 billion. At the end of the fourth quarter of 2017, the FDIC reported the 95 institutions with assets of $13.9 billion were on the official Problem Bank List. So if we understand the FDIC correctly, over the past 90 days, the official Problem Bank List has declined by three institutions but aggregate assets increased by a whopping $42.5 billion.

During the press conference this week and its press release, the FDIC highlighted the decline in the number of problem banks being the lowest since the first quarter of 2008, but there was no mention of the significant jump in problem bank assets. In the question and answer section of the press conference, an intrepid reporter asked FDIC Chairman Gruenberg about the increase. In response, Chairman Gruenberg, consistent with normal protocol, said he would not comment about the condition of an open institution.

Given that the FDIC does not disclose the contents of its official Problem Bank List, we are left to ponder what large-sized institution they added. Because of the small change in the number of banks on the list, our first guess is that a single institution with assets in the $40 billion to $46 billion range was added to the list. We have scoured all available information sources such as the enforcement action search engines of the Federal Reserve, FDIC, and OCC and SEC disclosures of publicly traded bank/bank holding companies without finding any recent safety & soundness actions issued against banks with asset sizes in the $40 billion to $46 billion range. There are six institutions with assets in this range, with five being controlled by a parent company whose stock is publicly traded. Obviously, receiving an enforcement action that should be issued to a bank that is on the Problem Bank List, is worthy of an 8-K disclosure. There is only one institution in that asset range, without an ultimate domestic parent, which would not have to disclose issuance of an enforcement action. We will continue to monitor the banking regulator websites and other information sources. Ideally, this mystery is solved by our next update.

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

Saturday, May 26, 2018

Schedule for Week of May 27, 2018

by Calculated Risk on 5/26/2018 08:12:00 AM

The key reports this week are the May employment report on Friday, and the second estimate of Q1 GDP on Wednesday.

Other key indicators include Personal Income and Outlays for April, the May ISM manufacturing index, and May auto sales.

All US markets will be closed in observance of Memorial Day.

9:00 AM ET: S&P/Case-Shiller House Price Index for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for March.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2018 report (the Composite 20 was started in January 2000).

The consensus is for a 6.4% year-over-year increase in the Comp 20 index for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 186,000 payroll jobs added in May, down from 204,000 added in April.

8:30 AM: Gross Domestic Product, 1st quarter 2018 (Second estimate). The consensus is that real GDP increased 2.2% annualized in Q1, down from the advance estimate of 2.3% in Q1.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, down from 234 thousand the previous week.

8:30 AM: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 58.1, up from 57.6 in April.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.7% increase in the index.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April. The consensus is for the unemployment rate to be unchanged at 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In April the year-over-year change was 2.280 million jobs.

A key will be the change in wages.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April.Here is a long term graph of the ISM manufacturing index.

The PMI was at 57.3% in April, the employment index was at 54.2%, and the new orders index was at 61.2%.

10:00 AM: Construction Spending for April. The consensus is for a 0.8% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

Friday, May 25, 2018

Oil Rigs: "Big rig add reversing last week"

by Calculated Risk on 5/25/2018 06:19:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 25, 2018:

• Total US oil rigs were up 15 to 859

• Horizontal oil rigs added 9 to 755

...

• The gains this week were largely a catch-up on last week’s flat numbers

• Oil prices moved down sharply on Friday as traders sold their positions heading into the Memorial Day weekend and on news OPEC may add volumes

• We do not believe OPEC will add material volumes

• The Brent spread advanced to $8.65 and the futures curve remains in pronounced backwardation, suggesting demand remains robust

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: "US Deaths Jumped in 2017"

by Calculated Risk on 5/25/2018 03:16:00 PM

From housing economist Tom Lawler: US Deaths Jumped in 2017

Provisional estimates from the National Center for Health Statistics (NCHS) indicate that the number of US deaths increased sharply last year, both in absolute terms and adjusted for age. According to the NCHS’ “mortality dashboard”, the “crude” US death rate (deaths per 100,000 of population) averaged 866.2 in 2017, up from 839.3 in 2016. The NCHS’ “age-adjusted” death rate (which adjusts for the changing age distribution of the population) for 2017 was 733.6, up from 728.8 in 2017 and the highest age-adjusted death rate since 2011. These data suggest that the total number of US deaths last year was around 2.821 million, compared to 2.744 million in 2016.

While data on deaths by age (or full-year deaths by cause) are not yet available, these data suggest that the recent alarming trend of significantly higher death rates among teenagers and non-elderly adults (shown in the table below) continued last year.

| US Death Rates (deaths per 100,000 population), Total and Selected Age Groups (NCHS) | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | |

| All Ages | 866.2 | 839.3 | 844.0 | 823.7 | 821.5 | 810.2 | 807.3 | 799.5 |

| <1 | 587.0 | 589.6 | 588.0 | 594.7 | 599.3 | 600.1 | 623.4 | |

| 1-4 | 25.2 | 24.9 | 24.0 | 25.5 | 26.3 | 26.3 | 26.5 | |

| 5-14 | 13.4 | 13.2 | 12.7 | 13.0 | 12.6 | 13.2 | 12.9 | |

| 15-24 | 74.9 | 69.5 | 65.5 | 64.8 | 66.4 | 67.7 | 67.7 | |

| 25-34 | 129.0 | 116.7 | 108.4 | 106.1 | 105.4 | 104.7 | 102.9 | |

| 35-44 | 192.2 | 180.1 | 175.2 | 172.0 | 170.7 | 172.0 | 170.5 | |

| 45-54 | 405.5 | 404.0 | 404.8 | 406.1 | 405.4 | 409.8 | 407.1 | |

| 55-64 | 883.8 | 875.3 | 870.3 | 860.0 | 854.2 | 849.4 | 851.9 | |

| 65-74 | 1788.6 | 1796.8 | 1786.3 | 1802.1 | 1802.5 | 1846.2 | 1875.1 | |

| 75-84 | 4474.8 | 4579.2 | 4564.2 | 4648.1 | 4674.5 | 4753.0 | 4790.2 | |

| 85+ | 13392.1 | 13673.9 | 13407.9 | 13660.4 | 13678.6 | 13779.3 | 13934.3 | |

| Age Adjusted | 733.6 | 728.8 | 733.1 | 724.6 | 731.9 | 732.8 | 741.3 | 747.0 |

What is especially striking about this table is the substantial increase in death rates for the 15-44 year old age groups from 2014 to 2016.

While full-year provisional estimates of deaths by cause are not yet available, here are some death rates by selected causes for the four-quarters ending in the second quarter.

| Death Rate (per 100,000 population) by Selected Cause | |||

|---|---|---|---|

| Four Quarter Period Ended: | Drug Overdose | Firearm Injury | Suicide |

| Q2/2017 | 21.0 | 14.1 | 11.6 |

| Q2/2016 | 17.8 | 13.8 | 12.2 |

With respect to drug overdose deaths, the “trending” quarterly data suggest that drug overdose deaths in 2017 were probably around 70,000. Here is a table showing recent history

| Drug Overdose Deaths by Selected Age Groups, NCHS | ||||||||

|---|---|---|---|---|---|---|---|---|

| 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Total | ||

| 2012 | 3,518 | 8,508 | 8,948 | 11,895 | 6,423 | 2,094 | 41,386 | |

| 2013 | 3,664 | 8,947 | 9,320 | 12,045 | 7,551 | 2,344 | 43,871 | |

| 2014 | 3,798 | 10,055 | 10,134 | 12,263 | 8,122 | 2,568 | 46,940 | |

| 2015 | 4,235 | 11,880 | 11,505 | 12,974 | 8,901 | 2,760 | 52,255 | |

| 2016 | 5,376 | 15,443 | 14,183 | 14,771 | 10,632 | 3,075 | 63,480 | |

| 2017 | 70,0001 | |||||||

| 1estimate | ||||||||

For folks who rely on Census population projections to forecast other variables such as labor force growth, household growth, etc., these recent death statistics suggest that they should not do so. The latest Census long-term population projections not only did not reflect the increased death rates for certain age groups from 2014 to 2016, but also assumed that death rates for most age groups would decline from the assumed rates for 2017. E.g., here is a table showing the projected deaths in the Census population projections (released earlier this year) for the year ended 6/30/2017 compared to the NCHS data for deaths for calendar year 2016.

| Age Group | Census 2017 Projections 7/1/15-6/30/17 | NCHS 2016 (Calendar Year) | Difference |

|---|---|---|---|

| <1 | 39,741 | 23,161 | 16,580 |

| 1-4 | 8,482 | 4,045 | 4,437 |

| 5-9 | 2,422 | 2,490 | -68 |

| 10-14 | 2,883 | 3,013 | -130 |

| 15-24 | 23,543 | 32,575 | -9,032 |

| 25-34 | 43,981 | 57,616 | -13,635 |

| 35-44 | 62,599 | 77,792 | -15,193 |

| 45=54 | 151,976 | 173,516 | -21,540 |

| 55-64 | 330,420 | 366,445 | -36,025 |

| 65-74 | 493,422 | 512,080 | -18,658 |

| 75-84 | 619,610 | 636,916 | -17,306 |

| >85 | 909,723 | 854,462 | 55,261 |

| N/A | 137 | -137 | |

| Total | 2,688,802 | 2,744,248 | -55,446 |

Note that the latest Census population projections were dramatically too high for infant deaths (they made a mistake) and too high for the very elderly, but way too low for the 15-84 year old groups.

Here is another table comparing the death assumptions in the latest Census population projection to NCHS data.

| Census 2017 Projections 12 month period ended 6/30 | NCHS Calendar Year | |

|---|---|---|

| 2016 | 2,744,248 | |

| 2017 | 2,688,802 | 2,821,379* |

| 2018 | 2,717,297 | |

| 2019 | 2,744,661 | |

| 2020 | 2,772,160 |

If death rates by age were to move back down to 2016 levels from 2018 to 2020, then deaths from 2018 to 2020 would cumulatively be about 260,000 higher than those in the Census’ latest projection. However, deaths of 15-84 year olds would be whopping 496,000 higher over this three year period than what is shown in the Census’ latest projections, while deaths of 85 year olds and older would be about 180,000 fewer. These are actually fairly large number.

Net, the latest provisional data on US deaths is bad news from a societal perspective. They also indicate that the latest Census population projections are of limited usefulness, and analysts relying on population projection to forecast other key variables must actually produce their own population projections based on reasonable assessments of population growth’s key drivers – births, deaths, and net international migration – the latter of which is an even thornier issue, which I won’t touch on today.

Sometime in the near future I will produce updated population projections by age incorporating the recently release “Vintage 2017” estimates, more realistic death assumptions, and different scenarios for net international migration.

Q2 GDP Forecasts

by Calculated Risk on 5/25/2018 11:18:00 AM

From Merrill Lynch:

On balance, today's data added a tenth to 2Q GDP tracking, to 3.5% qoq saar [May 25 estimate].From Goldman Sachs:

emphasis added

[W]e are lowering our Q2 GDP tracking estimate by one tenth to +3.4% (qoq ar). [May 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.0 percent on May 25, down from 4.1 percent on May 16. [May 25 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.0% for 2018:Q2. [May 25 estimate]CR Note: These early estimates suggest real annualized GDP in the 3% to 4% in Q2.