by Calculated Risk on 5/31/2018 10:03:00 AM

Thursday, May 31, 2018

NAR: Pending Home Sales Index Decreased 1.3% in April, Down 2.1% Year-over-year

From the NAR: Pending Home Sales Lose Steam in April, Decline 1.3 Percent

After two straight months of modest increases, pending home sales dipped in April to their third-lowest level over the past year, according to the National Association of Realtors. All major regions saw no gain in contract activity last month.This was well below expectations of a 0.7% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.3 percent to 106.4 in April from an upwardly revised 107.8 in March. With last month’s decrease, the index is down on an annualized basis (2.1 percent) for the fourth straight month.

...

The PHSI in the Northeast remained at 90.6 in April, and is 2.1 percent below a year ago. In the Midwest the index decreased 3.2 percent to 98.5 in April, and is 5.1 percent lower than April 2017.

Pending home sales in the South declined 1.0 percent to an index of 127.3 in April, but is still 2.7 percent higher than last April. The index in the West inched backward 0.4 percent in April to 94.4, and is 4.6 percent below a year ago.

emphasis added

Personal Income increased 0.3% in April, Spending increased 0.6%

by Calculated Risk on 5/31/2018 08:39:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $49.5 billion (0.3 percent) in April according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $60.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $79.8 billion (0.6 percent).The April PCE price index increased 2.0 percent year-over-year and the April PCE price index, excluding food and energy, increased 1.8 percent year-over-year.

Real DPI increased 0.2 percent in April and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

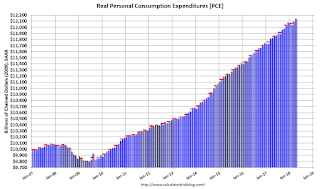

The following graph shows real Personal Consumption Expenditures (PCE) through April 2018 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, and the increase in PCE was above expectations.

Weekly Initial Unemployment Claims decrease to 221,000

by Calculated Risk on 5/31/2018 08:33:00 AM

The DOL reported:

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 13,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 222,250, an increase of 2,500 from the previous week's unrevised average of 219,750.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 222,250.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, May 30, 2018

Thursday: Unemployment Claims, Personal Income and Outlays, Pending Home sales and more

by Calculated Risk on 5/30/2018 07:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher After Yesterday's Big Drop

Mortgage rates were somewhat higher today as politicians struck a more conciliatory tone in Italy. To be clear, we are indeed talking about mortgage rates in the United States in relation to European politics. It's not the first time and it likely won't be the last. [30YR FIXED - 4.5-4.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, down from 234 thousand the previous week.

• At 8:30 AM, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 58.1, up from 57.6 in April.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.7% increase in the index.

Fed's Beige Book: "Economic activity expanded moderately", "concern about trade policy"

by Calculated Risk on 5/30/2018 02:07:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Cleveland based on information collected on or before May 21, 2018."

Economic activity expanded moderately in late April and early May with few shifts in the pattern of growth. The Dallas District was an exception, where overall economic activity sped up to a solid pace. Manufacturing shifted into higher gear with more than half of the Districts reporting a pickup in industrial activity and a third of the Districts classifying activity as "strong." Fabricated metals, heavy industrial machinery, and electronics equipment were noted as areas of strength. Rising goods production led to higher freight volumes for transportation firms. By contrast, consumer spending was soft. Nonauto retail sales growth moderated somewhat and auto sales were flat, although there was considerable variation by District and vehicle type. In banking, demand for loans ticked higher and banks reported that increased competition had led to higher deposit rates. Delinquency rates were mostly stable at low levels. Homebuilding and home sales increased modestly, on net, and nonresidential construction continued at a moderate pace. Contacts noted some concern about the uncertainty of international trade policy. Still, outlooks for near term growth were generally upbeat.

...

Employment rose at a modest to moderate rate across most Districts. Again, the Dallas District was the exception, where solid and widespread employment growth was reported. Labor market conditions remained tight across the country, and contacts continued to report difficulty filling positions across skill levels. Shortages of qualified workers were reported in various specialized trades and occupations, including truck drivers, sales personnel, carpenters, electricians, painters, and information technology professionals. Many firms responded to talent shortages by increasing wages as well as the generosity of their compensation packages. In the aggregate, however, wage increases remained modest in most Districts. Contacts in some Districts expected similar employment and wage gains in the coming months.

emphasis added

Q1 GDP Revised down to 2.2% Annual Rate

by Calculated Risk on 5/30/2018 08:35:00 AM

From the BEA: National Income and Product Accounts Gross Domestic Product: First Quarter 2018 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.2 percent in the first quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2017, real GDP increased 2.9 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.1% to 1.0%. Residential investment was revised down from no change to -2.0%. Most revisions were small. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.3 percent. With this second estimate for the first quarter, the general picture of economic growth remains the same; downward revisions to private inventory investment, residential fixed investment, and exports were partly offset by an upward revision to nonresidential fixed investment.

emphasis added

ADP: Private Employment increased 178,000 in May

by Calculated Risk on 5/30/2018 08:24:00 AM

Private sector employment increased by 178,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly below the consensus forecast for 186,000 private sector jobs added in the ADP report.

...

“The hot job market has cooled slightly as the labor market continues to tighten,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Healthcare and professional services remain a model of consistency and continue to serve as the main drivers of growth in the services sector and the broader labor market as well.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions. Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses number one problem.”

The BLS report for May will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in May.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refi Index lowest since December 2000

by Calculated Risk on 5/30/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 25, 2018.

... The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.77 percent from 4.78 percent, with points remaining unchanged at 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is at the lowest level since December 2000.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, May 29, 2018

Wednesday: GDP, ADP Employment, Beige Book

by Calculated Risk on 5/29/2018 06:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 186,000 payroll jobs added in May, down from 204,000 added in April.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2018 (Second estimate). The consensus is that real GDP increased 2.2% annualized in Q1, down from the advance estimate of 2.3% in Q1.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Real House Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/29/2018 04:14:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.5% year-over-year in March

It has been eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 8.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 10.0% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 6%. In March, the index was up 6.5% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $284,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to December 2004 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to December 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.