by Calculated Risk on 6/15/2018 05:51:00 PM

Friday, June 15, 2018

Goldman: "Upside Risk to Home Prices"

This is an interesting note today from Goldman Sachs economists Daan Struyven and Marty Young: Upside Risk to Home Prices (A few excerpts):

Home prices are growing at a 6.5% annual rate, the fastest pace since 2013. ... we review trends in housing demand, supply, and financing fundamentals and analyze their importance using city-level data.CR Note: It is important to note that this is an "upside risk" to Goldman's fairly low 3% forecast for 2018. My view was house prices would slow this year to the low-to-mid single digit range from the 6.2% annual gain in 2016 (Case-Shiller National Index). That was based on more inventory (it appears inventory has bottomed at a low level) and a little headwind from higher mortgage rates and tax changes.

On the demand side, we find that home prices are rising most rapidly in the strongest regional labor markets and we think a firm national job market will continue to be a tailwind. On the supply side, price growth is higher in the lowest vacancy markets and we expect national supply to remain constrained. On the financing side, we expect only a limited impact on home prices from higher interest rates—which mostly reflect strong growth—in the near term and find little evidence of a drag from reduced tax benefits of homeownership.

... Overall, we see the risks to our 3% home price growth forecast over the next year as skewed to the upside.

Q2 GDP Forecasts

by Calculated Risk on 6/15/2018 11:50:00 AM

From Merrill Lynch:

The data weighed on GDP tracking, with 1Q edging down to 2.4% qoq saar. 2Q held at 3.7%. [June 15 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.8 percent on June 14, up from 4.6 percent on June 8. [June 14 estimate]From the NY Fed Nowcasting Report

he New York Fed Staff Nowcast stands at 3.0% for 2018:Q2 and 2.8% for 2018:Q3. [June 15 estimate]CR Note: This is quite a range. These estimates suggest real annualized GDP in the 3% to 4.8% range in Q2.

BLS: Unemployment Rates Lower in 14 states in May

by Calculated Risk on 6/15/2018 10:21:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in May in 14 states and stable in 36 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eleven states had jobless rate decreases from a year earlier and 39 states and the District had little or no change. The national unemployment rate edged down from April to 3.8 percent and was 0.5 percentage point lower than in May 2017.

...

Hawaii had the lowest unemployment rate in May, 2.0 percent. Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Industrial Production Decreased 0.1% in May

by Calculated Risk on 6/15/2018 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged down 0.1 percent in May after rising 0.9 percent in April. Manufacturing production fell 0.7 percent in May, largely because truck assemblies were disrupted by a major fire at a parts supplier. Excluding motor vehicles and parts, factory output moved down 0.2 percent. The index for mining rose 1.8 percent, its fourth consecutive month of growth; the output of utilities moved up 1.1 percent. At 107.3 percent of its 2012 average, total industrial production was 3.5 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.9% is 1.9% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in May to 107.3. This is 23% above the recession low, and 2% above the pre-recession peak.

NY Fed: Manufacturing "Business activity continued to grow strongly in New York State"

by Calculated Risk on 6/15/2018 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity expanded at a faster pace than in May. The general business conditions index rose five points to 25.0, its highest level in several months. … The index for number of employees climbed ten points to 19.0, its highest level thus far in 2018, pointing to a pickup in employment levels.This was above the consensus forecast and a strong reading.

emphasis added

Thursday, June 14, 2018

Friday: Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 6/14/2018 06:56:00 PM

Friday:

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 19.6, down from 20.1.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.0%.

• At 10:00 AM: State Employment and Unemployment (Monthly) for May 2018

• Also at 10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

LA area Port Traffic Increases YoY in May

by Calculated Risk on 6/14/2018 01:06:00 PM

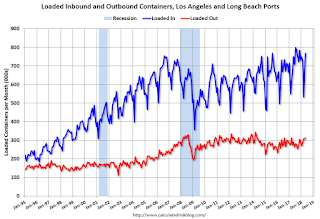

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.2% compared to the rolling 12 months ending in April. Outbound traffic was up 0.7% compared to the rolling 12 months ending in April.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have picked up recently.

Duy: FOMC Recap

by Calculated Risk on 6/14/2018 11:09:00 AM

A few excerpts from Tim Duy at Fed Watch: FOMC Recap

The Federal Open Market Committee (FOMC) completed their June meeting with a 25 basis point rate hike, bringing the target range for the federal funds rate to 1.75-2.0 percent. The accompanying Summary of Economic Projections (SEP) revealed a modestly more optimistic outlook, as expected. The improving outlook prompted an upward revision to rate hike expectations with the median policymaker anticipating four rate hikes this year, up from three in March. The Fed dropped the explicit forward guidance language in the statement as they work to encourage market participants to undertake a more nuanced, data-driven approach to assessing the future path of rate hikes.

With the economy chugging along at a respectable clip that could exceed 4 percent in the second quarter, the Federal Reserve upgraded its assessment of growth from “moderate” to “solid.” Expected growth for 2018 as a whole rose from 2.7 to 2.8 percent while the unemployment forecast fell from 3.8 percent to 3.6 percent. If history is any guide, that forecast remains too pessimistic given the expected pace of growth this year.

…

Bottom Line: Pay attention to the interplay of the rate and economic forecasts and the flow of data. The pace of data will almost certainly not slow sufficiently to prevent the Fed from hiking in September and probably December. I would say September is essentially a lock at this point. I also think you need to pencil in rate hikes in March and June of 2019. Recognize though that by mid-2019 the data might reflect the lagged impact of past tightening and the yield curve is likely to be fairly flat; both factors would slow the pace of rate hikes. The Fed will face a more difficult choice if the data holds strong while the yield curve inverts.

Retail Sales increased 0.8% in May

by Calculated Risk on 6/14/2018 08:48:00 AM

On a monthly basis, retail sales increased 0.8 percent from April to May (seasonally adjusted), and sales were up 5.9 percent from May 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $502.0 billion, an increase of 0.8 percent from the previous month, and 5.9 percent above May 2017. ... The March 2018 to April 2018 percent change was revised from up 0.2 percent to up 0.4 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.The increase in May was above expectations, and sales in March and April, combined, were revised up.

Weekly Initial Unemployment Claims decrease to 218,000

by Calculated Risk on 6/14/2018 08:33:00 AM

The DOL reported:

In the week ending June 9, the advance figure for seasonally adjusted initial claims was 218,000, a decrease of 4,000 from the previous week's unrevised level of 222,000. The 4-week moving average was 224,250, a decrease of 1,250 from the previous week's unrevised average of 225,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,250.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.