by Calculated Risk on 6/19/2018 08:40:00 AM

Tuesday, June 19, 2018

Housing Starts increased to 1.350 Million Annual Rate in May

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,350,000. This is 5.0 percent above the revised April estimate of 1,286,000 and is 20.3 percent above the May 2017 rate of 1,122,000. Single-family housing starts in May were at a rate of 936,000; this is 3.9 percent above the revised April figure of 901,000. The May rate for units in buildings with five units or more was 404,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,301,000. This is 4.6 percent below the revised April rate of 1,364,000, but is 8.0 percent above the May 2017 rate of 1,205,000. Single-family authorizations in May were at a rate of 844,000; this is 2.2 percent below the revised April figure of 863,000. Authorizations of units in buildings with five units or more were at a rate of 421,000 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in May compared to April. Also Multi-family starts were up 25% year-over-year in May.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) increased in May, and were up 18% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in May were above expectations, however starts for March and April were revised down slightly (Combined).

I'll have more later ...

Monday, June 18, 2018

Tuesday: Housing Starts

by Calculated Risk on 6/18/2018 06:46:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Little-Changed to Begin Quiet Week

Mortgage rates were sideways to slightly higher today, depending on the lender. The underlying bond market (which dictates rates) was exceptionally quiet. On the heels of last week's important events and without much on the calendar this week, markets may take a couple days to relax.Tuesday:

To put that in context, rates have been holding somewhat steady just below long-term highs. [30YR FIXED - 4.625%]

emphasis added

• At 8:30 AM: Housing Starts for May. The consensus is for 1.309 million SAAR, up from 1.287 million SAAR in April.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/18/2018 03:13:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in May

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.47 million in May, little changed from April’s preliminary pace and down 2.3% from last May’s seasonally adjusted pace.

Local realtor/MLS data, as well as tracking sources, indicate that while the inventory of existing homes for sale in May was down from a year ago, the YOY decline in May was less than that in April. I project that the NAR’s estimate of the number of existing homes for sale at the end of May will be 1.87 million, up 3.9% from April’s preliminary estimate and down 5.1% from last May.

Finally, local realtor/MLS data suggest the median US existing single-family home sales price last month was up about 6.3% from last May. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: Existing home sales for May are scheduled to be released by the NAR on Wednesday, June 20th. The consensus is the NAR will report sales of 5.56 Million SAAR.

Phoenix Real Estate in May: Sales up 3%, Active Inventory down 16% YoY

by Calculated Risk on 6/18/2018 01:02:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in May were up 2.8% year-over-year.

2) Active inventory is down 15.5% year-over-year. In some cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the nineteenth consecutive month with a YoY decrease in inventory.

| May Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| 12-May | 8,435 | --- | 12,932 | --- |

| 13-May | 8,754 | 3.8% | 15,517 | 20.0% |

| 14-May | 7,659 | -12.5% | 26,245 | 69.1% |

| 15-May | 8,319 | 8.6% | 21,569 | -17.8% |

| 16-May | 8,676 | 4.3% | 18,975 | -12.0% |

| 17-May | 9,641 | 11.1% | 18,688 | -1.5% |

| 18-May | 9,913 | 2.8% | 15,795 | -15.5% |

NAHB: Builder Confidence Decreases to 68 in June

by Calculated Risk on 6/18/2018 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in June, down from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Slips Two Points as Lumber Prices Soar

Builder confidence in the market for newly built single-family homes fell two points to 68 in June on the NAHB/Wells Fargo Housing Market Index (HMI). The decline was due in large part to sharply elevated lumber prices, although sentiment remains on solid footing.

“Builders are optimistic about housing market conditions as consumer demand continues to grow,” said NAHB Chairman Randy Noel. “However, builders are increasingly concerned that tariffs placed on Canadian lumber and other imported products are hurting housing affordability. Record-high lumber prices have added nearly $9,000 to the price of a new single-family home since January 2017.”

“Improved economic growth, continued job creation and solid housing demand should spur additional single-family construction in the months ahead,” said NAHB Chief Economist Robert Dietz. “However, builders do need access to lumber and other construction materials at reasonable costs in order to provide homes at competitive price points, particularly for the entry-level market where inventory is most needed.”

...

All three HMI indexes inched down a single point in June. The index measuring current sales conditions fell to 75, the component gauging expectations in the next six months dropped to 76, and the metric charting buyer traffic edged down to 50.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose two points to 57 while the West and Midwest remained unchanged at 76 and 65, respectively. The South fell one point to 71.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast, but still a solid reading.

Hotels: Occupancy Rate decreased slightly Year-over-Year, On Record Annual Pace

by Calculated Risk on 6/18/2018 08:11:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 9 June

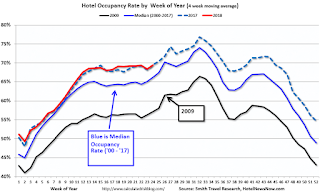

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 3-9 June 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 June 2017, the industry recorded the following:

• Occupancy: -0.2% to 72.9%

• Average daily rate (ADR): +2.5% to US$131.38

• Revenue per available room (RevPAR): +2.3% to US$95.82

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

On a seasonal basis, the occupancy rate will be solid during the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, June 17, 2018

Sunday Night Futures

by Calculated Risk on 6/17/2018 07:23:00 PM

Weekend:

• Schedule for Week of June 17, 2018

Monday:

• 10:00 AM ET, The June NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $64.33 per barrel and Brent at $73.06 per barrel. A year ago, WTI was at $45, and Brent was at $46 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.89 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 60 cents per gallon year-over-year.

Oil Rigs: "A quiet week for rigs counts"

by Calculated Risk on 6/17/2018 08:11:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 15, 2018:

• Total oil rig counts rose 1 to 863

• Horizontal oil rigs added 2 to 765

...

• After a heady gain last week, the Permian gave back 4 rigs

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Saturday, June 16, 2018

Schedule for Week of June 17, 2018

by Calculated Risk on 6/16/2018 08:15:00 AM

The key economic reports this week are May Housing Starts and Existing home sales.

For manufacturing, the Philly Fed manufacturing survey will be released this week.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for May.

8:30 AM: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.309 million SAAR, up from 1.287 million SAAR in April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:30 AM: Panel Discussion, Fed Chair Jerome Powell, Monetary Policy at a Time of Uncertainty and Tight Labor Markets, At the ECB Forum on Central Banking, Linhó Sintra, Portugal

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.56 million SAAR, up from 5.46 million in April.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.56 million SAAR, up from 5.46 million in April.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.47 million SAAR for May and that inventory will be down 5.2% year-over-year.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 218 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 26.0, down from 34.4.

9:00 AM: FHFA House Price Index for April 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

No major economic releases scheduled.

Friday, June 15, 2018

Goldman: "Upside Risk to Home Prices"

by Calculated Risk on 6/15/2018 05:51:00 PM

This is an interesting note today from Goldman Sachs economists Daan Struyven and Marty Young: Upside Risk to Home Prices (A few excerpts):

Home prices are growing at a 6.5% annual rate, the fastest pace since 2013. ... we review trends in housing demand, supply, and financing fundamentals and analyze their importance using city-level data.CR Note: It is important to note that this is an "upside risk" to Goldman's fairly low 3% forecast for 2018. My view was house prices would slow this year to the low-to-mid single digit range from the 6.2% annual gain in 2016 (Case-Shiller National Index). That was based on more inventory (it appears inventory has bottomed at a low level) and a little headwind from higher mortgage rates and tax changes.

On the demand side, we find that home prices are rising most rapidly in the strongest regional labor markets and we think a firm national job market will continue to be a tailwind. On the supply side, price growth is higher in the lowest vacancy markets and we expect national supply to remain constrained. On the financing side, we expect only a limited impact on home prices from higher interest rates—which mostly reflect strong growth—in the near term and find little evidence of a drag from reduced tax benefits of homeownership.

... Overall, we see the risks to our 3% home price growth forecast over the next year as skewed to the upside.