by Calculated Risk on 7/06/2018 12:13:00 PM

Friday, July 06, 2018

Trade Deficit decreased to $43.1 Billion in May

From the Department of Commerce reported:

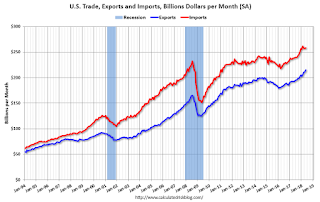

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in May, down $3.0 billion from $46.1 billion in April, revised. … May exports were $215.3 billion, $4.1 billion more than April exports. May imports were $258.4 billion, $1.1 billion more than April imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in May.

Exports are 30% above the pre-recession peak and up 12% compared to May 2017; imports are 11% above the pre-recession peak, and up 8% compared to May 2017.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $58.37 in May, up from $54.00 in April, and up from $45.04 in May 2017.

The trade deficit with China increased to $33.2 billion in May, from $31.9 billion in May 2017.

Comments on June Employment Report

by Calculated Risk on 7/06/2018 09:59:00 AM

The headline jobs number at 213,000 for June was above consensus expectations of 190 thousand, and the previously two months were revised up by a combined 37 thousand. Overall this was a strong report.

Earlier: June Employment Report: 213,000 Jobs Added, 4.0% Unemployment Rate

In June, the year-over-year employment change was 2.374 million jobs. This is solid year-over-year growth.

Average Hourly Earnings

Wage growth was slightly below expectations in June. From the BLS:

"In June, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $26.98. Over the year, average hourly earnings have increased by 72 cents, or 2.7 percent."

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.7% YoY in June.

Wage growth had been trending up, although growth has been moving more sideways recently.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in June to 82.0%, and the 25 to 54 employment population ratio increased to 79.3%.

The participation rate had been trending down for this group since the late '90s, however, with more younger workers (and fewer 50+ age workers), the prime participation rate might move up some more.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in June at 4.7 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons has been generally trending down, and the number decreased in June to the lowest level since December 2007. The number working part time for economic reasons suggests three is still a little slack in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.8% in June.

Unemployed over 26 Weeks

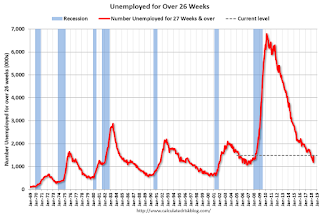

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.478 million workers who have been unemployed for more than 26 weeks and still want a job. This was up sharply from 1.189 million in May.

Summary:

The headline jobs number was solid and the previous two months were revised up.

There were a few negatives: The headline unemployment rate increased to 4.0%, and U-6 increased to 7.8%. Wages growth was below expectations, and the number of workers unemployed over 26 weeks increased sharply.

However, overall, this was a strong report. For the first six months of 2018, job growth has been solid averaging 215 thousand per month.

June Employment Report: 213,000 Jobs Added, 4.0% Unemployment Rate

by Calculated Risk on 7/06/2018 08:41:00 AM

From the BLS:

Total nonfarm payroll employment increased by 213,000 in June, and the unemployment rate rose to 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in professional and business services, manufacturing, and health care, while retail trade lost jobs.

...

The change in total nonfarm payroll employment for April was revised up from +159,000 to +175,000, and the change for May was revised up from +223,000 to +244,000. With these revisions, employment gains in April and May combined were 37,000 more than previously reported.

...

In June, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $26.98. Over the year, average hourly earnings have increased by 72 cents, or 2.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 213 thousand in June (private payrolls increased 202 thousand).

Payrolls for March and April were revised up by a combined 37 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June the year-over-year change was 2.374 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in June to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate increased in June to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio was unchanged at 60.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in June to 4.0%.

This was above the consensus expectations of 190,000 jobs, and the previous two months combined were revised up by 37,000. A strong report.

I'll have much more later ...

Thursday, July 05, 2018

Friday: Employment Report, Trade Deficit

by Calculated Risk on 7/05/2018 08:42:00 PM

My June Employment Preview

Goldman: June Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for June. The consensus is for an increase of 190,000 non-farm payroll jobs added in June, down from the 223,000 non-farm payroll jobs added in May. The consensus is for the unemployment rate to be unchanged at 3.8%.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.5 billion in May from $46.2 billion in April.

Goldman: June Payrolls Preview

by Calculated Risk on 7/05/2018 04:47:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 200k in June, slightly above consensus. Our forecast reflects strong employment surveys across both manufacturing and services. Our forecast also embeds solid summer hiring of students and recent graduates, and we note that job growth tends to accelerate in June when the labor market is tight.

We expect the unemployment to round down to 3.7% in tomorrow’s report. ... We estimate a 0.3% month-over-month increase in average hourly earnings, reflecting favorable calendar effects. This would boost the year-over-year rate by a tenth to 2.8%.

emphasis added

FOMC Minutes: "Concern about the possible adverse effects of tariffs"

by Calculated Risk on 7/05/2018 02:06:00 PM

Still on pace for 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, June 12-13, 2018:

In their discussion of the economic situation and the outlook, meeting participants agreed that information received since the FOMC met in May indicated that the labor market had continued to strengthen and that economic activity had been rising at a solid rate. Job gains had been strong, on average, in recent months, and the unemployment rate had declined. Recent data suggested that growth of household spending had picked up, while business fixed investment had continued to grow strongly. On a 12-month basis, overall inflation and core inflation, which excludes changes in food and energy prices, had both moved close to 2 percent. Indicators of longer-term inflation expectations were little changed, on balance.

Participants viewed recent readings on spending, employment, and inflation as suggesting little change, on balance, in their assessments of the economic outlook. Incoming data suggested that GDP growth strengthened in the second quarter of this year, as growth of consumer spending picked up after slowing earlier in the year. Participants noted a number of favorable economic factors that were supporting above-trend GDP growth; these included a strong labor market, stimulative federal tax and spending policies, accommodative financial conditions, and continued high levels of household and business confidence. They also generally expected that further gradual increases in the target range for the federal funds rate would be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. Participants generally viewed the risks to the economic outlook as roughly balanced.

Participants reported that business fixed investment had continued to expand at a strong pace in recent months, supported in part by substantial investment growth in the energy sector. Higher oil prices were expected to continue to support investment in that sector, and District contacts in the industry were generally upbeat, though supply constraints for labor and infrastructure were reportedly limiting expansion plans. By contrast, District reports regarding the construction sector were mixed, although here, too, some contacts reported that supply constraints were acting as a drag on activity. Conditions in both the manufacturing and service sectors in several Districts were reportedly strong and were seen as contributing to solid investment gains. However, many District contacts expressed concern about the possible adverse effects of tariffs and other proposed trade restrictions, both domestically and abroad, on future investment activity; contacts in some Districts indicated that plans for capital spending had been scaled back or postponed as a result of uncertainty over trade policy. Contacts in the steel and aluminum industries expected higher prices as a result of the tariffs on these products but had not planned any new investments to increase capacity. Conditions in the agricultural sector reportedly improved somewhat, but contacts were concerned about the effect of potentially higher tariffs on their exports.

Participants agreed that labor market conditions strengthened further over the intermeeting period. Nonfarm payroll employment posted strong gains in recent months, averaging more than 200,000 per month this year. The unemployment rate fell to 3.8 percent in May, below the estimate of each participant who submitted a longer-run projection. Participants pointed to other indicators such as a very high rate of job openings and an elevated quits rate as additional signs that labor market conditions were strong. With economic growth anticipated to remain above trend, participants generally expected the unemployment rate to remain below, or decline further below, their estimates of its longer-run normal rate. Several participants, however, suggested that there may be less tightness in the labor market than implied by the unemployment rate alone, because there was further scope for a strong labor market to continue to draw individuals into the workforce.

Contacts in several Districts reported difficulties finding qualified workers, and, in some cases, firms were coping with labor shortages by increasing salaries and benefits in order to attract or retain workers. Other business contacts facing labor shortages were responding by increasing training for less-qualified workers or by investing in automation. On balance, for the economy overall, recent data on average hourly earnings indicated that wage increases remained moderate. A number of participants noted that, with the unemployment rate expected to remain below estimates of its longer-run normal rate, they anticipated wage inflation to pick up further.

Participants noted that the 12-month changes in both overall and core PCE prices had recently moved close to 2 percent. The recent large increases in consumer energy prices had pushed up total PCE price inflation relative to the core measure, and this divergence was expected to continue in the near term, resulting in a temporary increase in overall inflation above the Committee's 2 percent longer-run objective. In general, participants viewed recent price developments as consistent with their expectation that inflation was on a trajectory to achieve the Committee's symmetric 2 percent objective on a sustained basis, although a number of participants noted that it was premature to conclude that the Committee had achieved that objective. The generally favorable outlook for inflation was buttressed by reports from business contacts in several Districts suggesting some firming of inflationary pressures; for example, many business contacts indicated that they were experiencing rising input costs, and, in some cases, firms appeared to be passing these cost increases through to consumer prices. Although core inflation and the 12-month trimmed mean PCE inflation rate calculated by the Federal Reserve Bank of Dallas remained a little below 2 percent, many participants anticipated that high levels of resource utilization and stable inflation expectations would keep overall inflation near 2 percent over the medium term. In light of inflation having run below the Committee's 2 percent objective for the past several years, a few participants cautioned that measures of longer-run inflation expectations derived from financial market data remained somewhat below levels consistent with the Committee's 2 percent objective. Accordingly, in their view, investors appeared to judge the expected path of inflation as running a bit below 2 percent over the medium run. Some participants raised the concern that a prolonged period in which the economy operated beyond potential could give rise to heightened inflationary pressures or to financial imbalances that could lead eventually to a significant economic downturn.

Participants commented on a number of risks and uncertainties associated with their outlook for economic activity, the labor market, and inflation over the medium term. Most participants noted that uncertainty and risks associated with trade policy had intensified and were concerned that such uncertainty and risks eventually could have negative effects on business sentiment and investment spending. Participants generally continued to see recent fiscal policy changes as supportive of economic growth over the next few years, and a few indicated that fiscal policy posed an upside risk. A few participants raised the concern that fiscal policy is not currently on a sustainable path. Many participants saw potential downside risks to economic growth and inflation associated with political and economic developments in Europe and some EMEs.

Meeting participants also discussed the term structure of interest rates and what a flattening of the yield curve might signal about economic activity going forward. Participants pointed to a number of factors, other than the gradual rise of the federal funds rate, that could contribute to a reduction in the spread between long-term and short-term Treasury yields, including a reduction in investors' estimates of the longer-run neutral real interest rate; lower longer-term inflation expectations; or a lower level of term premiums in recent years relative to historical experience reflecting, in part, central bank asset purchases. Some participants noted that such factors might temper the reliability of the slope of the yield curve as an indicator of future economic activity; however, several others expressed doubt about whether such factors were distorting the information content of the yield curve. A number of participants thought it would be important to continue to monitor the slope of the yield curve, given the historical regularity that an inverted yield curve has indicated an increased risk of recession in the United States. Participants also discussed a staff presentation of an indicator of the likelihood of recession based on the spread between the current level of the federal funds rate and the expected federal funds rate several quarters ahead derived from futures market prices. The staff noted that this measure may be less affected by many of the factors that have contributed to the flattening of the yield curve, such as depressed term premiums at longer horizons. Several participants cautioned that yield curve movements should be interpreted within the broader context of financial conditions and the outlook, and would be only one among many considerations in forming an assessment of appropriate policy.

In their consideration of monetary policy at this meeting, participants generally agreed that the economic expansion was progressing roughly as anticipated, with real economic activity expanding at a solid rate, labor market conditions continuing to strengthen, and inflation near the Committee's objective. Based on their current assessments, almost all participants expressed the view that it would be appropriate for the Committee to continue its gradual approach to policy firming by raising the target range for the federal funds rate 25 basis points at this meeting. These participants agreed that, even after such an increase in the target range, the stance of monetary policy would remain accommodative, supporting strong labor market conditions and a sustained return to 2 percent inflation. One participant remarked that, with inflation having run consistently below 2 percent in recent years and market-based measures of inflation compensation still low, postponing an increase in the target range for the federal funds rate would help push inflation expectations up to levels consistent with the Committee's objective.

With regard to the medium-term outlook for monetary policy, participants generally judged that, with the economy already very strong and inflation expected to run at 2 percent on a sustained basis over the medium term, it would likely be appropriate to continue gradually raising the target range for the federal funds rate to a setting that was at or somewhat above their estimates of its longer-run level by 2019 or 2020. Participants reaffirmed that adjustments to the path for the policy rate would depend on their assessments of the evolution of the economic outlook and risks to the outlook relative to the Committee's statutory objectives.

emphasis added

June Employment Preview

by Calculated Risk on 7/05/2018 12:19:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for an increase of 190,000 non-farm payroll jobs in May (with a range of estimates between 144,000 to 212,000), and for the unemployment rate to be unchanged at 3.9%.

The BLS reported 223,000 jobs added in May.

Here is a summary of recent data:

• The ADP employment report showed an increase of 177,000 private sector payroll jobs in June. This was below consensus expectations of 188,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat below expectations.

• The ISM manufacturing employment index decreased in June to 56.0%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 13,000 in June. The ADP report indicated manufacturing jobs increased 12,000 in June.

The ISM non-manufacturing employment index decreased in June to 53.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 170,000 in June.

Combined, the ISM indexes suggests employment gains of about 183,000. This suggests employment growth slightly below expectations.

• Initial weekly unemployment claims averaged 224,500 in June, slightly higher than in May. For the BLS reference week (includes the 12th of the month), initial claims were at 218,000, down from 223,000 during the reference week in May.

The slight decrease during the reference week suggests a slightly stronger employment report in June than in May.

• The final June University of Michigan consumer sentiment index increased to 98.2 from the May reading of 98.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 203,000 in June, and this suggests employment growth slightly above expectations.

• Looking back at the three previous years:

In June 2017, the consensus was for 170,000 jobs, and the BLS reported 222,000 jobs added. In June 2016, the consensus was for 180,000 jobs, and the BLS reported 287,000 jobs added. In June 2015, the consensus was for 230,000 jobs, and the BLS reported 223,000 jobs added.

• Conclusion: In general, these reports suggest a solid employment report, and probably close to expectations. The ADP report and ISM surveys suggests a report slightly below expectations, but the reference week for unemployment claims, and the Merrill payrolls tracker suggest a stronger report. My guess is that the employment report will be close to the consensus in June.

Reis: Office Vacancy Rate increased in Q2 to 16.6%

by Calculated Risk on 7/05/2018 10:59:00 AM

Reis released their Q2 2018 Office Vacancy survey this morning. Reis reported that the office vacancy rate increased to 16.6% in Q2, from 16.5% in Q1 2018. This is up from 16.4% in Q2 2017, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

Showing mixed signs of the current state of the office market, the office vacancy rate increased for the second straight quarter to 16.6%. Heading into the ninth year of the recovery, the office market has never seen the robust leasing activity of previous expansions, maintaining a steady but low level of absorption despite healthy office job growth. Net absorption, or occupancy growth, trailed previous quarters at 2.817 million square feet, down from an average of 5.78 million square feet absorbed per quarter in 2017. New completions fell to 8.07 million square feet, down from an average of 10.9 million square feet added per quarter in 2017.

Rent growth, in contrast, was healthier in the last two quarters than in the previous seven as a number of metros had rent growth of 1% or more in the quarter and 4% for the year. The national average asking rent increased 0.7% in the second quarter as did the effective rent which nets out landlord concessions. At $33.07 per square foot (asking) and $26.83 per square foot (effective), the average rents have increased 2.5% and 2.6%, respectively, since the second quarter of 2017.

...

In short, the office market statistics reflect the net growth between the haves and the have-nots: larger markets in the West, South Atlantic, Texas, Boston and New York with healthy occupancy and rent growth offset by tepid growth or declines in smaller, suburban markets mostly in less densely populated areas. Much of the growth can be attributed to gains in technology: 9.6% of the added office jobs this year were in the Computer Systems Design industry that should continue to fuel office gains in most of these cities.

The next big question is: What city will Amazon select for its HQ2? The answer to this could come before Reis releases its third quarter statistics. That news will certainly generate considerable discussion not only about the “winning” city but on the reasons why the others lost out.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.6% in Q2. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased recently.

Office vacancy data courtesy of Reis.

ISM Non-Manufacturing Index increased to 59.1% in June

by Calculated Risk on 7/05/2018 10:05:00 AM

The June ISM Non-manufacturing index was at 59.1%, up from 58.6% in May. The employment index decreased in June to 53.6%, from 54.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2018 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 101st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 59.1 percent, which is 0.5 percentage point higher than the May reading of 58.6 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index increased to 63.9 percent, 2.6 percentage points higher than the May reading of 61.3 percent, reflecting growth for the 107th consecutive month, at a faster rate in June. The New Orders Index registered 63.2 percent, 2.7 percentage points higher than the reading of 60.5 percent in May. The Employment Index decreased 0.5 percentage point in June to 53.6 percent from the May reading of 54.1 percent. The Prices Index decreased by 3.6 percentage points from the May reading of 64.3 percent to 60.7 percent, indicating that prices increased in June for the 28th consecutive month. According to the NMI®, 17 non-manufacturing industries reported growth. Respondents continue to be optimistic about business conditions and the overall economy. There is a continuing concern relating to tariffs, capacity constraints and delivery.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in June than in May.

Weekly Initial Unemployment Claims increased to 231,000

by Calculated Risk on 7/05/2018 08:32:00 AM

The DOL reported:

In the week ending June 30, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 227,000 to 228,000. The 4-week moving average was 224,500, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 222,000 to 222,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 224,500.

This was higher than the consensus forecast. The low level of claims suggest few layoffs.