by Calculated Risk on 7/19/2018 08:33:00 AM

Thursday, July 19, 2018

Weekly Initial Unemployment Claims decreased to 207,000

The DOL reported:

In the week ending July 14, the advance figure for seasonally adjusted initial claims was 207,000, a decrease of 8,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 220,500, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 223,000 to 223,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,500.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, July 18, 2018

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 7/18/2018 08:31:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 214 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 22.0, up from 19.9.

Phoenix Real Estate in June: Sales down 3%, Active Inventory down 10% YoY

by Calculated Risk on 7/18/2018 03:49:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in June were down 3.3% year-over-year.

2) Active inventory is down 10.4% year-over-year. This is the smallest YoY decrease this year. In some cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the twentieth consecutive month with a YoY decrease in inventory.

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| Jun-13 | 8,228 | --- | 15,752 | --- |

| Jun-14 | 7,219 | -12.3% | 24,462 | 55.3% |

| Jun-15 | 8,674 | 20.2% | 19,596 | -19.9% |

| Jun-16 | 8,861 | 2.2% | 20,138 | 2.8% |

| Jun-17 | 9,391 | 6.0% | 17,682 | -12.2% |

| Jun-18 | 9,079 | -3.3% | 15,851 | -10.4% |

Fed's Beige Book: Economic Growth "moderate or modest", "concern about tariffs", "Shrinking Margins"

by Calculated Risk on 7/18/2018 02:07:00 PM

Concern about tariffs. Shrinking margins. Slow growth in existing home sales.

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Boston based on information collected on or before July 9, 2018. "

Economic activity continued to expand across the United States, with 10 of the 12 Federal Reserve Districts reporting moderate or modest growth. The outliers were the Dallas District, which reported strong growth driven in part by the energy sector, and the St. Louis District where growth was described as slight. Manufacturers in all Districts expressed concern about tariffs and in many Districts reported higher prices and supply disruptions that they attributed to the new trade policies. All Districts reported that labor markets were tight and many said that the inability to find workers constrained growth. Consumer spending was up in all Districts with particular strength in Dallas and Richmond. Contacts reported higher input prices and shrinking margins. Six Districts specifically mentioned trucking capacity as an issue and attributed it to a shortage of commercial drivers. Contacts in several Districts reported slow growth in existing home sales but were not overly concerned about rising interest rates. Commercial real estate was largely unchanged.

...

Employment continued to rise at a modest to moderate pace in most Districts. Labor markets were described as tight, with most Districts reporting firms had difficulty finding qualified labor. ... On balance, wage increases were modest to moderate, with some differences across sectors; a couple of Districts cited a pickup in the pace of wage growth.

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/18/2018 11:55:00 AM

Earlier: Housing Starts decreased to 1.173 Million Annual Rate in June

Housing starts in June were disappointing, and starts for April and May were revised down. However this was just one month, and most of the decline was in multi-family starts that are volatile month-to-month.

The housing starts report released this morning showed starts were down 12.3% in June compared to May, and starts were down 4.2% year-over-year compared to June 2017.

Both multi-family and single family starts were down year-over-year.

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 4.2% in June compared to June 2017.

Through six months, starts are up 7.8% year-to-date compared to the same period in 2017. That is still a solid increase.

Single family starts were down 0.2% year-over-year, and down 9.1% compared to May 2018.

Multi-family starts were down 15.3% year-over-year, and down 20.2% compared to May 2018 (multi-family is volatile month-to-month).

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but has turned down recently. Completions (red line) had lagged behind - however completions have passed starts (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significantly growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a couple more years, or more, of increasing single family starts and completions.

AIA: "June architecture firm billings stay positive"

by Calculated Risk on 7/18/2018 10:09:00 AM

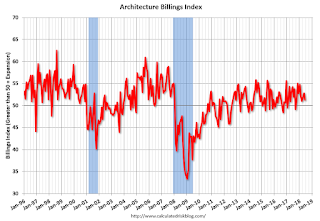

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: June architecture firm billings stay positive

Architecture firm billings slowed in June but remained positive for the ninth consecutive month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for June was 51.3 compared to 52.8 in May; it remains positive since any score over 50 represents billings growth. As a result, June’s ABI shows that demand for architecture firm services continues to improve across all sectors.

“Architects continue to see increases in demand for their services this summer, with new project work coming in at a healthy pace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, business conditions are beginning to vary across the country. While essentially remaining flat in the Northeast and Midwest, billings jumped in the South while dropping in the West.”

...

• Regional averages: West (46.9), Midwest (49.8), South (57.4), Northeast (50.2)

• Sector index breakdown: multi-family residential (54.6), institutional (51.6), commercial/industrial (53.4), mixed practice (49.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.3 in June, down from 52.8 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018 and early 2019.

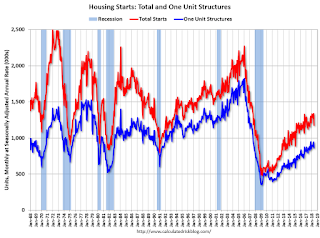

Housing Starts decreased to 1.173 Million Annual Rate in June

by Calculated Risk on 7/18/2018 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,173,000. This is 12.3 percent below the revised May estimate of 1,337,000 and is 4.2 percent below the June 2017 rate of 1,225,000. Single-family housing starts in June were at a rate of 858,000; this is 9.1 percent below the revised May figure of 944,000. The June rate for units in buildings with five units or more was 304,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,273,000. This is 2.2 percent below the revised May rate of 1,301,000 and is 3.0 percent below the June 2017 rate of 1,312,000. Single-family authorizations in June were at a rate of 850,000; this is 0.8 percent above the revised May figure of 843,000. Authorizations of units in buildings with five units or more were at a rate of 387,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in June compared to May. Also Multi-family starts were down 14% year-over-year in June.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) decreased in June, and were up 0.2% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in June were well below expectations, and starts for April and May were both revised down.

I'll have more later ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/18/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 13, 2018. Last week’s results included an adjustment for the Fourth of July holiday.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 19 percent compared with the previous week and was 1 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.77 percent from 4.76 percent, with points increasing to 0.46 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 1% year-over-year.

Tuesday, July 17, 2018

Wednesday: Housing Starts, Fed Chair Powell, Beige Book

by Calculated Risk on 7/17/2018 08:41:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for June. The consensus is for 1.320 million SAAR, down from 1.350 million SAAR in May.

• During the day, The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/17/2018 04:51:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in June

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.35 million in June, down 1.5% from May’s preliminary pace and down 2.7% from last June’s seasonally adjusted rate. Unadjusted sales should show a larger YOY decline, reflecting this June’s lower business-day count compared to last June.

Local realtor/MLS data, as well as tracking sources, indicate that while the inventory of existing homes for sale in June was down from a year ago, the YOY decline in June was less than it was in May. I project that the NAR’s estimate of the number of existing homes for sale at the end of June will be 1.85 million, unchanged from May and down 4.1% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up about 6.0% from last June. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: Existing home sales for June are scheduled to be released by the NAR on Wednesday, July 23rd.