by Calculated Risk on 9/18/2018 07:30:00 PM

Tuesday, September 18, 2018

Wednesday: Housing Starts

From Matthew Graham at Mortgage News Daily: Mortgage Rates Officially Highest in at Least 5 Years

Things are slightly worse for mortgage rates, which only generally follow the 10yr Treasury yield … today's rates are the highest in at least 5 years for some lenders (there were a few days in the middle of September 2013 that were worse) and the highest in 7 years for any other lenders. In both cases, we're talking about average conventional 30yr fixed quotes of 4.75% to 4.875% for top tier scenarios.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for August. The consensus is for 1.240 million SAAR, up from 1.168 million SAAR.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

Phoenix Real Estate in August: Sales down 1% YoY, Active Inventory down 8% YoY

by Calculated Risk on 9/18/2018 05:16:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in August were down 0.9% year-over-year.

2) Active inventory is down 7.8% year-over-year. This is the smallest YoY decrease in almost two years. In many cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the twenty-second consecutive month with a YoY decrease in inventory in Phoenix.

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| Aug-13 | 7,055 | --- | 18,176 | --- |

| Aug-14 | 6,428 | -8.9% | 24,220 | 33.3% |

| Aug-15 | 7,010 | 9.1% | 19,113 | -21.1% |

| Aug-16 | 7,843 | 11.9% | 19,570 | 2.4% |

| Aug-17 | 8,113 | 3.4% | 17,360 | -11.3% |

| Aug-18 | 8,036 | -0.9% | 16,010 | -7.8% |

"Inactive, Disconnected, and Ailing: A Portrait of Prime-Age Men Out of the Labor Force"

by Calculated Risk on 9/18/2018 01:03:00 PM

Some new research on our of the labor force prime age men: Inactive, Disconnected, and Ailing: A Portrait of Prime-Age Men Out of the Labor Force (ht Noah Smith)

This report is intended to enrich our understanding of who these prime-age "inactive" men are. It summarizes evidence from past research and fills out our picture of these men, providing some details about their past and present social and emotional lives. We introduce an under-utilized dataset little-known to economists and sociologists, the "National Epidemiological Survey on Alcohol and Related Conditions-III," or NESARC-III.CR Note: This is a reason why considering both demographics AND long term trends is important when trying to forecast the Labor Force Participation Rate (LFPR) and to estimate the remaining slack in the labor market. See: Labor Slack and the Participation Rate (Spreadsheet included)

Consistent with other survey data, the NESARC-III indicates that in 2013, 11 percent of prime-age men were outside the labor force. Roughly 45 percent of them indicate that their current situation involves illness or disability. Roughly 15 percent of inactive men are in school, 5 to 10 percent are retired, and another 5 to 10 percent are homemakers or caregivers. About a quarter of prime-age inactive men do not fit any of these categories. Contrary to the common view that most of these men have "dropped out" of the labor force after becoming discouraged by the job market, few prime-age inactive men indicate this to be true, and only 12 percent of able-bodied prime-age inactive men indicate in household surveys that they want a job or are open to taking one.

We confirm research by other scholars that a large number of inactive men are unambiguously and seriously sick or disabled. We provide new information, showing that many inactive men have poor physical health, poor mental health, or both. Over one-third of them (and nearly three in five disabled inactive men) are in the bottom quarter, nationally, of both physical and mental health.

Inactive men have fewer skills than employed men and live in poorer homes, often relying on public safety nets to get by. Two-thirds of inactive men personally received government assistance in the preceding year. One-third of inactive men have been incarcerated (including nearly half of disabled inactive men). Along with other evidence presented here on mobility-impeding behavior, such high incarceration rates suggest employment challenges.

emphasis added

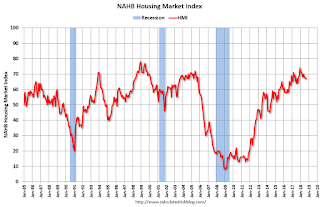

NAHB: Builder Confidence at 67 in September

by Calculated Risk on 9/18/2018 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 67 in September, unchanged from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Remains Firm in September

Builder confidence in the market for newly-built single-family homes remained unchanged at a solid 67 reading in September on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Despite rising affordability concerns, builders continue to report firm demand for housing, especially as millennials and other newcomers enter the market,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “The recent decline in lumber prices from record-high levels earlier this summer is also welcome relief, although builders still need to manage construction costs to keep homes competitively priced.”

“A growing economy and rising incomes combined with increasing household formations should boost demand for new single-family homes moving forward,” said NAHB Chief Economist Robert Dietz. “However, housing affordability is becoming a challenge, as builders face overly burdensome regulations and rising material costs exacerbated by an escalating trade skirmish. Interest rates are also forecasted to keep rising.”

...

The HMI index measuring current sales conditions rose one point to 74 and the component gauging expectations in the next six months increased two points to 74. Meanwhile, the metric charting buyer traffic held steady at 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 54 and the South remained unchanged at 70. The West edged down a single point to 73 and the Midwest fell three points to 59.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast, and a solid reading.

California: "Housing market falters for fourth straight month", Inventory up 17.2% YoY

by Calculated Risk on 9/18/2018 08:46:00 AM

The CAR reported: California’s housing market falters for fourth straight month as high home prices take toll on demand, C.A.R. reports

California’s housing market dropped below the 400,000-level sales benchmark for the first time in more than two years as high home prices and eroding affordability combined to cut into housing demand, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some data from the NAR and CAR (ht Tom Lawler)

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 399,600 units in August, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the August pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

August’s sales figure was down 1.8 percent from the revised 406,920 level in July and down 6.6 percent compared with home sales in August 2017 of 427,630.

“Home sales activity remained on a downward trend for the fourth straight month as uncertainty about the housing market continues to mount,” said C.A.R. President Steve White. “Buyers are being cautious and reluctant to make a commitment as they are concerned that home prices may have peaked and instead are waiting until there’s more clarity in the market.”

…

“While home prices continued to rise modestly in August, the deceleration in price growth and the surge in housing supply suggest that a market shift is underway,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “We are seeing active listings increasing and more price reductions in the market, and as such, the question remains, ‘How long will it take for the market to close the price expectation gap between buyers and sellers?’”

...

Statewide active listings rose for the fifth consecutive month after 33 straight months of declines, increasing 17.2 percent from the previous year. August’s listings increase was the biggest in nearly four years.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | --- | 17.2% |

Monday, September 17, 2018

Lawler: Spotlight Seattle: Inventory Shortage Abating Rapidly

by Calculated Risk on 9/17/2018 06:36:00 PM

Tuesday:

At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 67, unchanged from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From housing economist Tom Lawler: Spotlight Seattle: Inventory Shortage Abating Rapidly

Here are some August residential sales and listings statistics for the City of Seattle as compiled by the Northwest MLS.

| Residential Listings and Sales, City of Seattle, August 2018 | |||

|---|---|---|---|

| August-18 | August-17 | % Change | |

| Active Listings | 1,464 | 715 | 104.8% |

| Closed Sales | 875 | 1083 | -19.2% |

| Pending Sales | 875 | 1136 | -23.0% |

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/17/2018 04:11:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.36 million, up 0.4% from July’s preliminary pace (which I believe was too low), and down 1.1% from last August’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale in August was up a bit last August, mainly driven by big gains in previous “hot’ markets where inventory levels were very low a year ago. I project that the NAR’s estimate of the number of existing homes for sale as the end of August will be 1.92 million, unchanged from July’s preliminary estimate and up 2.7% from last August.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up about 5.5% from last August. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: The NAR is scheduled to released August existing home sales on Thursday. The consensus is also for sales of 5.36 million SAAR, up from 5.34 million in July.

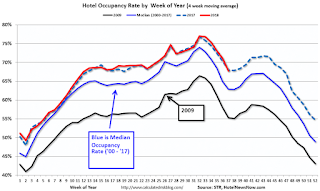

Hotels: Occupancy Rate Declines Year-over-year

by Calculated Risk on 9/17/2018 12:49:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 8 September

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 2-8 September 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 September 2017, the industry recorded the following:

• Occupancy: -3.5% to 61.7%

• Average daily rate (ADR): +1.0% to US$121.95

• Revenue per available room (RevPAR): -2.4% to US$75.25

STR analysts note that performance percentage changes in several major markets were significantly affected by the comparison with the post-Hurricane Harvey and pre-Hurricane Irma time period in 2017.

…

Houston, Texas, reported the steepest decreases in each of the three key performance metrics: occupancy (-42.2% to 50.0%), ADR (-19.6% to US$90.73) and RevPAR (-53.6% to US$45.36). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes. There will be some boost to hotel occupancy in the Carolina region following hurricane Florence, but I expect the overall occupancy to be lower in 2018 than in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

LA area Port Traffic in August

by Calculated Risk on 9/17/2018 10:00:00 AM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.3% compared in August to the rolling 12 months ending in July. Outbound traffic was up 0.2% compared to the rolling 12 months ending in July.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 6 or 7 years.

It is still too early to tell about the impact of the tariffs.

Fom the NY Fed: Manufacturing "Business activity continued to grow at a solid clip in New York State"

by Calculated Risk on 9/17/2018 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity continued to grow at a solid clip in New York State, according to firms responding to the September 2018 Empire State Manufacturing Survey. The headline general business conditions index showed ongoing strength, but moved down seven points to 19.0, pointing to a slower pace of growth than last month. New orders and shipments grew moderately. Delivery times continued to lengthen, and inventories moved higher. Labor market indicators pointed to an increase in employment levels and longer workweeks. Price indexes were little changed and remained elevated, suggesting ongoing significant increases in both input prices and selling prices. Looking ahead, firms remained fairly optimistic about the six-month outlook.This was below the consensus forecast, but still a solid reading.

…

The index for number of employees held steady at 13.3 and the average workweek index was 11.5, indicating a modest increase in both employment levels and hours worked.

emphasis added