by Calculated Risk on 9/20/2018 12:26:00 PM

Thursday, September 20, 2018

Fed's Flow of Funds: Household Net Worth increased in Q2

The Federal Reserve released the Q2 2018 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q2 2018 to $106.9 Trillion, for $104.7 Trillion in Q1 2018:

The net worth of households and nonprofits rose to $106.9 trillion during the second quarter of 2018. The value of directly and indirectly held corporate equities increased $0.8 trillion and the value of real estate increased $0.6 trillion.The Fed estimated that the value of household real estate increased to $25.4 trillion in Q2. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2018, household percent equity (of household real estate) was at 59.9% - up from Q1, and the highest since 2002. This was because of an increase in house prices in Q2 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 59.9% equity - and about 2.2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $66 billion in Q2.

Mortgage debt has declined by $0.54 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, declined slightly in Q2, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

A Few Comments on August Existing Home Sales

by Calculated Risk on 9/20/2018 11:26:00 AM

Earlier: NAR: Existing-Home Sales Unchanged at 5.34 million in August

Two key points:

1) This is a reasonable level for existing home sales, and doesn't suggest any significant weakness in housing or the economy. The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

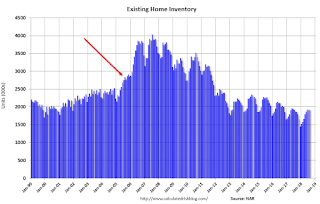

2) Inventory is still very low, but was up 2.7% year-over-year (YoY) in August. This was the first year-over-year increase since May 2015. (Note: Inventory for June was initially reported as up slightly year-over-year, but inventory was revised down).

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase significantly and still be at normal levels. No worries.

Sales NSA in August (539,000, red column) were slightly above sales in August 2017 (535,000, NSA).

Sales NSA through August (first eight months) are down about 1.2% from the same period in 2017.

This is a small YoY decline in sales to-date - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).

NAR: Existing-Home Sales Unchanged at 5.34 million in August

by Calculated Risk on 9/20/2018 10:11:00 AM

From the NAR: Existing-Home Sales Remain Flat Nationally, Mixed Results Regionally

Existing-home sales remained steady in August after four straight months of decline, according to the National Association of Realtors®. Sales gains in the Northeast and Midwest canceled out downturns in the South and West. Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, did not change from July and remained at a seasonally adjusted rate of 5.34 million in August. Sales are now down 1.5 percent from a year ago (5.42 million in August 2017).

...

Total housing inventory at the end of August also remained unchanged from July at 1.92 million existing homes available for sale, and is up from 1.87 million a year ago. Unsold inventory is at a 4.3-month supply at the current sales pace, consistent from last month and up from 4.1 months a year ago. Properties typically stayed on the market for 29 days in August, up from 27 days in July but down from 30 days a year ago. Fifty-two percent of homes sold in August were on the market for less than a month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (5.34 million SAAR) were unchanged from last month, and were 1.5% below the August 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was unchanged at 1.92 million in August from 1.92 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was unchanged at 1.92 million in August from 1.92 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 2.7% year-over-year in August compared to August 2017.

Inventory was up 2.7% year-over-year in August compared to August 2017. Months of supply was at 4.3 months in July.

Sales were at the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming. I'll have more later ...

Weekly Initial Unemployment Claims decreased to 201,000, Lowest Since 1969

by Calculated Risk on 9/20/2018 08:34:00 AM

The DOL reported:

In the week ending September 15, the advance figure for seasonally adjusted initial claims was 201,000, a decrease of 3,000 from the previous week's unrevised level of 204,000. This is the lowest level for initial claims since November 15, 1969 when it was 197,000. The 4-week moving average was 205,750, a decrease of 2,250 from the previous week's unrevised average of 208,000. This is the lowest level for this average since December 6, 1969 when it was 204,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 205,750.

This was lower than the the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, September 19, 2018

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg, Flow of Funds

by Calculated Risk on 9/19/2018 06:54:00 PM

Note: The weekly claims report will be for the week ending September 15th. Hurricane Florence impacted the Carolinas starting around September 13th, so there might be some increase in claims due to the hurricane, but it is more likely a bump in claims will happen this week (to be reported next week).

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 204 thousand the previous week.

• At 8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 19.2, up from 11.9.

• At 10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.34 million in July.

• At 12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Nine Years Ago: Fast or Sluggish Recovery?

by Calculated Risk on 9/19/2018 04:05:00 PM

This is my 14th year writing this blog, and sometimes it is fun to look back at earlier predictions.

In the early stages of the recovery (September 2009), a number of analysts were predicting a rapid recovery (see: A couple of Bullish Views). My view was that the recovery would be sluggish. First, I quoted from some optimistic views, and then wrote:

I disagree with these views. … Although I started the year expecting a bottom in new home sales and single family housing starts (and it appears that has happened), there is still too much existing home inventory for much of an increase in the short term.Note: Housing starts did bottom in 2009, and then mostly moved sideways for the next couple of years.

...

[C]onsumers will remain under pressure as they repair their household balance sheets … This time housing will remain under pressure until the number of excess housing units (both owner occupied and rentals) decline to more normal levels.

So I think an "Immaculate Recovery" is very unlikely.

House prices didn't bottom for a few more years (from February 2012: The Housing Bottom is Here).

Click on graph for larger image.

Click on graph for larger image.And, according to the NY Fed, household debt didn't bottom until Q2 2013.

This graph shows aggregate consumer debt. Household debt previously peaked in 2008, and bottomed in Q2 2013.

Housing and household debt were drags on the economy for several years, and the recovery was sluggish. In addition, demographics weren't favorable (see: Demographics and GDP: 2% is the new 4%)

[U]sually following a recession, there is a brief period of above average growth - but not this time due to the financial crisis and need for households to deleverage. So we didn't see a strong bounce back (sluggish growth was predict on the blog for the first years of the recovery). … And overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis.For 2018, most analysts (including me) predicted a pickup in growth, for example on Jan 1, 2018, I wrote:

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.Recently the discussion has turned to the causes and timing of the next recession. See my Update: Predicting the Next Recession and Professor Krugman's column today: A Smorgasbord Recession? (Wonkish) . For now, the economy is fine (I'm not on recession watch).

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

AIA: "August architecture firm billings rebound"

by Calculated Risk on 9/19/2018 12:30:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: August architecture firm billings rebound as building investment spurt continues

Architecture firm billings rebounded solidly in August, posting their eleventh consecutive month of growth, according to a report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for August was 54.2 compared to 50.7 in July (any score over 50 represents billings growth). Most of the growth continues to come from the South and the multi-family residential sector.

“Billings at architecture firms in the South continue to lead the healthy increase in design activity that we’ve seen across the profession in recent months,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Nationally, growth across all building sectors remains solidly positive.”

...

• Regional averages: West (54.2), Midwest (52.5), South (57.0), Northeast (46.9)

• Sector index breakdown: multi-family residential (55.6), institutional (52.3), commercial/industrial (53.6), mixed practice (51.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.2 in August, up from 50.7 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018 and into 2019.

Comments on August Housing Starts

by Calculated Risk on 9/19/2018 09:33:00 AM

Earlier: Housing Starts Increased to 1.282 Million Annual Rate in August

Housing starts in August were above expectations, and starts for June and July were revised up. Most of the increase, and upward revisions, were due to the multi-family starts that are volatile month-to-month.

The housing starts report released this morning showed starts were up 9.2% in August compared to July (and August starts were revised up), and starts were up 9.4% year-over-year compared to August 2017.

Multi-family starts were up 38% year-over-year, and single family starts were down slightly year-over-year.

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were up 9.4% in August compared to August 2017.

Through eight months, starts are up 6.9% year-to-date compared to the same period in 2017. That is a decent increase.

Note that 2017 finished strong, so the year-over-year comparisons will be more difficult in Q4.

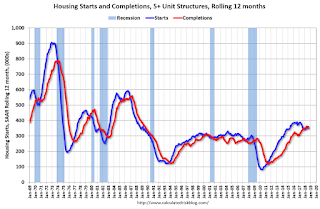

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a couple more years, or more, of increasing single family starts and completions.

Note: Two months ago, in response to numerous articles discussing the "slowing housing market" and some suggesting "housing has peaked", I wrote: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2). My view - that there will be further growth in housing starts - remains the same.

Housing Starts Increased to 1.282 Million Annual Rate in August

by Calculated Risk on 9/19/2018 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,282,000. This is 9.2 percent above the revised July estimate of 1,174,000 and is 9.4 percent above the August 2017 rate of 1,172,000. Single-family housing starts in August were at a rate of 876,000; this is 1.9 percent above the revised July figure of 860,000. The August rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,229,000. This is 5.7 percent below the revised July rate of 1,303,000 and is 5.5 percent below the August 2017 rate of 1,300,000. Single-family authorizations in August were at a rate of 820,000; this is 6.1 percent below the revised July figure of 873,000. Authorizations of units in buildings with five units or more were at a rate of 370,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply in August compared to July. Multi-family starts were up 38% year-over-year in August.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years. This is the middle of the range.

Single-family starts (blue) increased in August, and were down slightly year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in August were above expectations, and starts for June and July were both revised up.

I'll have more later ...

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 9/19/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 14, 2018. Last week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since April 2011, 4.88 percent, from 4.84 percent, with points decreasing to 0.44 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.