by Calculated Risk on 9/23/2018 07:22:00 PM

Sunday, September 23, 2018

Sunday Night Futures

Weekend:

• Schedule for Week of September 23, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 8 and DOW futures are down 80 (fair value).

Oil prices were up over the last week with WTI futures at $71.48 per barrel and Brent at $79.73 per barrel. A year ago, WTI was at $52, and Brent was at $59 - so oil prices are up about 30% to 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.55 per gallon (jumped last year due to hurricane Harvey) - so gasoline prices are up 29 cents per gallon year-over-year.

FOMC Preview

by Calculated Risk on 9/23/2018 08:11:00 AM

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week, and the tone will remain upbeat.

Assuming the expected happens, the focus will be on the wording of the statement, the projections, and Fed Chair Jerome Powell's press conference to try to determine how many rate hikes to expect in 2018 (probably four) and in 2019.

Here are the June FOMC projections.

Current projections for Q3 GDP are in mid-3% range. GDP increased at a 2.2% real annual rate in Q1, and 4.2% in Q2. This puts GDP, so far in 2018, above the expected range, and GDP projections might be revised up.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

| Mar 2018 | 2.6 to 3.0 | 2.2 to 2.6 | 1.8 to 2.1 |

The unemployment rate was at 3.9% in August. So the unemployment rate projection for 2018 will probably be mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

| Mar 2018 | 3.6 to 3.8 | 3.4 to 3.7 | 3.5 to 3.8 |

As of July, PCE inflation was up 2.3% from July 2017. So PCE inflation might be revised up for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

PCE core inflation was up 2.0% in July year-over-year. Core PCE inflation might also be revised up for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

In general the data has been somewhat firmer than the FOMC's June projections, so it seems likely the FOMC will be on track for four rate hikes in 2018.

Saturday, September 22, 2018

Schedule for Week of September 23, 2018

by Calculated Risk on 9/22/2018 08:11:00 AM

The key reports this week are August New Home sales, and the third estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for August and Case-Shiller house prices for July.

For manufacturing, the Dallas, Richmond, and Kansas City Fed manufacturing surveys will be released this week.

Also, the FOMC meets this week, and is expected to raise the Fed Funds rate 25bps.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.3% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

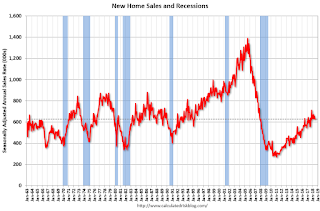

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 630 thousand SAAR, up from 627 thousand in July.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 201 thousand the previous week.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Third estimate). The consensus is that real GDP increased 4.3% annualized in Q2, up from the second estimate of 4.2%.

Early: Reis Q3 2018 Apartment Survey of rents and vacancy rates.

10:00 AM: Pending Home Sales Index for August. The consensus is 0.2% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 62.0, down from 63.6 in August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 100.8.

Friday, September 21, 2018

Oil Rigs Decline Slightly

by Calculated Risk on 9/21/2018 07:15:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on September 21, 2018:

• Oil rigs declined, -1 to 866

• Horizontal oil rigs fell, -3 to 766

...

• Horizontal oil rigs are essentially unchanged in the last 14 weeks

• The Permian added 3 rigs, the Cana Woodford was hammered with a loss of 6 rigs

• The breakeven oil price to add horizontal oil rigs is now $70 WTI, about the same as WTI.

• The model suggests horizontal oil rig counts will decline again next week.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 9/21/2018 03:25:00 PM

From Merrill Lynch:

We are tracking robust 3.7% qoq saar growth for 3Q and 4.4% for 2Q. [Sept 21 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.4 percent on September 19, unchanged from September 14. [Sept 19 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.3% for 2018:Q3 and 2.7% for 2018:Q4. [Sept 21 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Merrill: "Existing Home Sales have Peaked"

by Calculated Risk on 9/21/2018 02:48:00 PM

A few excerpts from a Merrill Lynch research note:

We are calling it: existing home sales have peaked. We believe that the peak was at 5.72 million, reached in November last year. From here on, sales should trend sideways. If this is indeed the peak, it would be comparable to the rate we last saw in the early 2000s before the bubble set in. Here is the catch — while existing home sales have likely peaked, we do not think we have seen the same for new home sales. New home sales have lagged existing in this recovery and we believe there is room to run for new home sales, leaving builders to add more single family homes to the market.CR Note: As I noted in July (see: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2)

The peak in existing home sales can largely be explained by the decline in affordability. With housing prices hovering close to bubble highs and mortgage rates on the rise, affordability has been declining.

emphasis added

First, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

If new home sales and single family starts have peaked that would be a significant warning sign. Although housing is under pressure from policy (negative impact from tax, immigration and trade policies), I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

BLS: Unemployment Rates in Idaho, Oregon, South Carolina and Washington at New Lows

by Calculated Risk on 9/21/2018 10:25:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in August in 13 states, higher in 3 states, and stable in 34 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eleven states had jobless rate decreases from a year earlier and 39 states and the District had little or no change. The national unemployment rate was unchanged from July at 3.9 percent but was 0.5 percentage point lower than in August 2017.

...

Hawaii had the lowest unemployment rate in August, 2.1 percent. The rates in Idaho (2.8 percent), Oregon (3.8 percent), South Carolina (3.4 percent), and Washington (4.5 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue).

Mortgage Equity Withdrawal slightly positive in Q2

by Calculated Risk on 9/21/2018 08:01:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2018, the Net Equity Extraction was a positive $9 billion, or a 0.2% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 8 of the last 11 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $66 billion in Q2.

The Flow of Funds report also showed that Mortgage debt has declined by $0.546 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Thursday, September 20, 2018

Earlier: Philly Fed Manufacturing Survey Suggested Faster Growth in September

by Calculated Risk on 9/20/2018 06:05:00 PM

Earlier: From the Philly Fed: September 2018 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to grow in September, according to results from this month’s Manufacturing Business Outlook Survey. The survey’s broad indicators for general activity, new orders, shipments, and employment remained positive and increased from their readings in August. The survey’s respondents reported diminished price pressures this month. Expectations for the next six months remained optimistic, but most broad future indicators showed some moderation.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased 11 points this month to 22.9, returning the index to near its average reading for 2018. … The firms continued to report overall higher employment. Over 26 percent of the responding firms reported increases in employment this month, up from 18 percent last month, while nearly 9 percent of the firms reported decreases in employment. The current employment index increased 3 points to 17.6.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

This suggests the ISM manufacturing index will show solid expansion again in September.

CoreLogic: 2.2 million Homes still in negative equity at end of Q2 2018

by Calculated Risk on 9/20/2018 02:01:00 PM

From CoreLogic: Homeowner Equity Q2 2018

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63 percent of all properties) have seen their equity increase by a total of nearly $981 billion since the second quarter 2017, an increase of 12.3 percent, year over year.CR Note: A year ago, in Q2 2017, there were 2.8 million properties with negative equity - now there are 2.2 million. A significant change.

Homeowners Emerge from the Negative Equity Trap: In the second quarter 2018, the total number of mortgaged residential properties with negative equity decreased 9 percent from the first quarter 2017 to 2.2 million homes, or 4.3 percent of all mortgaged properties. Compared to the second quarter 2017, negative equity decreased 20.1 percent from 2.8 million homes, or 5.4 percent of all mortgaged properties.

...

Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

emphasis added