by Calculated Risk on 9/27/2018 06:43:00 PM

Thursday, September 27, 2018

Friday: Personal Income and Outlays

CR Note: Gone hiking! I will return on Thursday, Oct 4th. See the links below for the official releases.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for August from the BEA. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 62.0, down from 63.6 in August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 100.8.

From 2007 and 2008: The Compleat UberNerd

by Calculated Risk on 9/27/2018 01:01:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. There will be a few posts on Tanta today.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

As an example, here is a brief excerpt from Foreclosure Sales and REO For UberNerds

The following is not an exhaustive discussion of all of the issues involved in foreclosures and REO. It’s a start at unpacking some of the concepts and definitions. We have been seeing, and are going to continue to see, a lot of information presented on foreclosure sales, REO sales, and their impacts on existing home transaction volumes and prices in various market areas. As always with “UberNerd” posts, this is long and excruciating. Proceed with typical motivation as you may consider your own best interest in an open market in blog postings.And an excerpts from Mortgage Servicing for UberNerds

StillLearning asked in the comments about mortgage servicing, and since y’all are nerds, not dummies, here’s my highly-selective occasionally-oversimplified summary for you that skips the boring parts like how your check gets out of the “lockbox” and that stuff. We can discuss extra-credit issues like “excess servicing” and “subservicing” and “SFAS 144 meets MSR” and “negative convexity” and other kinds of inside baseball in the comments. There is a lot that can be said about loan servicing, but let’s start with the basics:Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Servicers have two major types of servicing portfolio: loans they service for themselves and loans they service for other investors. In accounting terms, the “compensation” is the same, meaning that even if you are the noteholder, you pay yourself to service the loans in the same way that an outside investor would pay you, and it shows on the books that way. The differences in compensation stem from the basic fact that one is generally more motivated to do a good job servicing (particularly collecting and efficiently liquidating REO) for one’s own investment than for someone else’s.

December 2006: Tanta joined CR!

by Calculated Risk on 9/27/2018 10:02:00 AM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. There will be a few posts on Tanta today.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

When some people say that here are few women bloggers in finance and economics, I remind them that Tanta was the best of all of us!

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

Here are excerpts from her first two posts:

From December 2006: Let Slip the Dogs of Hell

I still haven’t gotten over the fact that there’s a “capital management” group out there having named itself “Cerberus”. Those of you who were not asleep in Miss Buttkicker’s Intro to Western Civ will recognize Cerberus; the rest of you may have picked up the mythological fix from its reprise as “Fluffy” in the first Harry Potter novel. Wherever you get your culture, Cerberus is the three-headed dog who guards the gates of Hell. It takes three heads to do that, of course, because it’s never clear, in theology or finance, whether the idea is to keep the righteous from falling into the pit or the demons from escaping out of it (the third head is busy meeting with the regulators). Cerberus is relevant not just because it supplies me with today’s metaphor, but because it was the Biggest Dog of three (including Citigroup and Aozora, a Japanese bank) who in April bought a 51% stake in GMAC’s mega-mortgage operation, GM having, of course, once been renowned as one of the Big Three Automakers until it became one of the Big Three Financing Outfits With A Sideline In Cars. I tried to find a link for you to Aozora Bank’s announcement of the purchase, but the only press release I could find for that day involved the loss of customer data. They must have been so busy letting GMAC into the underworld that the dog head keeping the deposit tickets from getting out got distracted.And from December 2006: On Hybrids, Teasers, and Other Mortgage Guidance Problems

...

Now, I’m just a Little Mortgage Weenie, not a Big Finance Dog, but bear with me while I ask some stupid questions. Like: how do the Big Dogs maintain “diverse and flexible production channels” (i.e., little mortgage banker Puppies to sell you correspondent business and little broker Puppies to sell you wholesale business) when “market share currently held by top-tier players” expands to two-thirds (meaning less diverse off-load strategies for the Little Puppies in the “production channels,” putting them at further pipeline/counterparty risk unless they become Bigger Puppies, which makes them competitors instead of “channels,”), while at the same time watching some of the Little Puppies (in whom the Big Dogs have a major equity stake) crawl under the porch to die? I know Citi doesn’t seem to have noticed that the “increased regulatory scrutiny” is not just of “products” but of “wholesale operational/management controls,” but I did.

First of all, a “hybrid ARM” is called a “hybrid” because it is, basically, a cross between a fixed rate and adjustable rate mortgage. Before the early 90s, an “ARM” basically meant a one-year ARM. The initial interest rate was set for one year, and the rate adjusted every year. The only real variations on this theme involved shortening the adjustment frequency: you could get an ARM that adjusted every six months instead of one year.CR Note: If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

Around the early 90s, the “hybrid ARM” was introduced. It had an initial period in which the rate was “fixed” that didn’t match the subsequent adjustment frequency: this is the classic 3/1, 5/1, 7/1, and even 10/1 ARM. The whole idea of the hybrid ARM was to provide a kind of medium-range risk/reward tradeoff for borrowers and lenders.

Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Wednesday, September 26, 2018

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 9/26/2018 04:36:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. See the links below for the official releases.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 201 thousand the previous week. Note: Look for the impact of Hurricane Florence.

• At 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2018 (Third estimate) from the BEA. The consensus is that real GDP increased 4.3% annualized in Q2, up from the second estimate of 4.2%.

• Early, Reis Q3 2018 Apartment Survey of rents and vacancy rates.

• At 10:00 AM, Pending Home Sales Index for August from the NAR. The consensus is 0.2% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

FOMC Statement, Projections, and Press Conference

by Calculated Risk on 9/26/2018 02:00:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th.

The FOMC Statement is here. (all FOMC statements are here)

You can watch the Powell press conference video here.

The updated projections are here.

For excellent commentary, please see Tim Duy's Fed Watch.

A few Comments on August New Home Sales

by Calculated Risk on 9/26/2018 11:59:00 AM

New home sales for August were reported at 629,000 on a seasonally adjusted annual rate basis (SAAR). This was close to the consensus forecast, however the three previous months were revised down significantly.

Sales in August were up 12.7% year-over-year compared to August 2017. This was strong YoY growth, however this was an easy comparison since new home sales were soft in mid-year 2017.

On Inventory: Months of inventory is now close to the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch.

Earlier: New Home Sales increase to 629,000 Annual Rate in August.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Note that new home sales have been up year-over-year every month this year (so far).

Sales are up 6.9% through August compared to the same period in 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors. And new home sales had a strong last few months in 2017, so the comparisons will be more difficult.

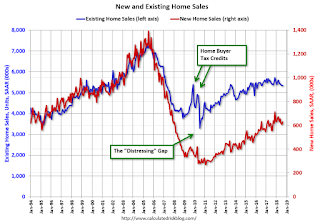

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 629,000 Annual Rate in August

by Calculated Risk on 9/26/2018 10:12:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 629 thousand.

The previous three months were revised down singnificantly.

"Sales of new single-family houses in August 2018 were at a seasonally adjusted annual rate of 629,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent above the revised July rate of 608,000 and is 12.7 percent above the August 2017 estimate of 558,000. "

emphasis added

Click on graph for larger image.

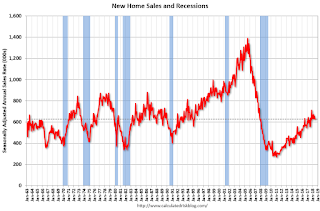

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

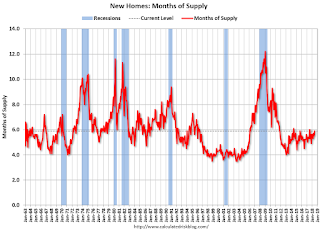

The second graph shows New Home Months of Supply.

The months of supply decreased in August to 6.1 months from 6.2 months in July.

The months of supply decreased in August to 6.1 months from 6.2 months in July. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of August was 318,000. This represents a supply of 6.1 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

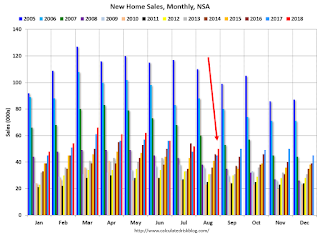

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2018 (red column), 53 thousand new homes were sold (NSA). Last year, 45 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was close to expectations of 630,000 sales SAAR, however the previous months were revised down significantly. I'll have more later today.

Zillow Case-Shiller Forecast: Slower House Price Gains in August

by Calculated Risk on 9/26/2018 08:20:00 AM

The Case-Shiller house price indexes for July were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Melissa Allison at Zillow: July Case-Shiller Results and August Forecast: Autumn Chill

A slight autumn chill has fallen over the housing market, and after an incredibly hot past few years, it’s probably fair to say the cooldown is a welcome development for many would-be home buyers.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in August than in July.

...

Seasons, just like the housing market, change slowly as environmental conditions shift. Winter in the housing market is certainly not here yet, but it’s increasingly clear that the end of the hot season is rapidly approaching.

Zillow forecasts a further annual slowdown in August, of 5.7 percent. Those Case-Shiller results will be available on Tuesday, Oct. 30.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 9/26/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 21, 2018.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since April 2011, 4.97 percent from 4.88 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 25, 2018

Wednesday: FOMC Announcement, New Home Sales

by Calculated Risk on 9/25/2018 08:21:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM: New Home Sales for August from the Census Bureau. The consensus is for 630 thousand SAAR, up from 627 thousand in July.

• At 2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• At 2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.