by Calculated Risk on 10/05/2018 11:50:00 AM

Friday, October 05, 2018

Comments on September Employment Report

The headline jobs number at 134,000 for September was below consensus expectations of 180 thousand, however the previously two months were revised up by a combined 87 thousand. The unemployment rate fell to the lowest since December 1969. Overall this was a solid report.

Earlier: September Employment Report: 134,000 Jobs Added, 3.7% Unemployment Rate

In September, the year-over-year employment change was 2.537 million jobs. This is solid year-over-year growth.

Average Hourly Earnings

Wage growth was above expectations in September. From the BLS:

"In September, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $27.24. Over the year, average hourly earnings have increased by 73 cents, or 2.8 percent."

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.8% YoY in September.

Wage growth has generally been trending up.

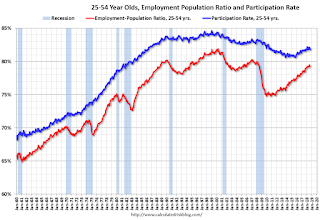

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in September to 81.8%, and the 25 to 54 employment population ratio was unchanged at 79.3%. .

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part- time workers) increased by 263,000 to 4.6 million in September. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons has been generally trending down, however the number increased in September. The number working part time for economic reasons suggests there is still a little slack in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.5% in September.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.384 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.332 million in August.

Summary:

The headline jobs number was below expectations, however the previous two months were revised up.

The headline unemployment rate declined to 3.7%, the lowest rate since 1969. And wage growth was slightly above expectations.

Overall, this was a solid report. For the first nine months of 2018, job growth has been solid, averaging 208 thousand per month.

Trade Deficit increased to $53.2 Billion in August

by Calculated Risk on 10/05/2018 11:23:00 AM

Earlier from the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $53.2 billion in August, up $3.2 billion from $50.0 billion in July, revised.

August exports were $209.4 billion, $1.7 billion less than July exports. August imports were $262.7 billion, $1.5 billion more than July imports.

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in August.

Exports are 27% above the pre-recession peak and up 7% compared to August 2017; imports are 13% above the pre-recession peak, and up 10% compared to August 2017.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $62.63 in August, down from $64.63 in July, and up from $44.13 in August 2017.

The trade deficit with China increased to $38.6 billion in August, from $35.0 billion in August 2017.

September Employment Report: 134,000 Jobs Added, 3.7% Unemployment Rate

by Calculated Risk on 10/05/2018 08:43:00 AM

From the BLS:

The unemployment rate declined to 3.7 percent in September, and total nonfarm payroll employment increased by 134,000, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, in health care, and in transportation and warehousing.

Hurricane Florence affected parts of the East Coast during the September reference periods for the establishment and household surveys. Response rates for the two surveys were within normal ranges.

...

The change in total nonfarm payroll employment for July was revised up from +147,000 to +165,000, and the change for August was revised up from +201,000 to +270,000. With these revisions, employment gains in July and August combined were 87,000 more than previously reported.

...

In September, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $27.24. Over the year, average hourly earnings have increased by 73 cents, or 2.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 134 thousand in September (private payrolls increased 121 thousand).

Payrolls for July and August were revised up by a combined 87 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September the year-over-year change was 2.537 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in September at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged in September at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio increased to 60.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate declined in September to 3.7%.

This was below consensus expectations of 180,000 jobs, however the previous two months combined were revised up by 87,000. A solid report.

I'll have much more later ...

Thursday, October 04, 2018

Friday: Employment Report, Trade Deficit and some Hiking Pictures

by Calculated Risk on 10/04/2018 07:06:00 PM

My September Employment Preview

Goldman: September Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for September. The consensus is for an increase of 180,000 non-farm payroll jobs in September, down from the 201,000 non-farm payroll jobs added in August. The consensus is for the unemployment rate to decline to 3.8%.

• At 8:30 AM, Trade Balance report for August from the Census Bureau. The consensus is for a deficit of $53.7 billion, from $50.1 billion deficit in July.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $15.0 billion in August.

I've returned from my hiking trip in Peru. As part of the trip, my friends and I hiked the Old Inka Trail to Machu Picchu (with an amazing group of people from around the world).

I've returned from my hiking trip in Peru. As part of the trip, my friends and I hiked the Old Inka Trail to Machu Picchu (with an amazing group of people from around the world).

It was an incredible journey, and the engineering effort to build the trail was stunning (over 500 years ago).

Here are a few pictures from my Trip. The first picture is from an overlook of Machu Picchu.

The views in every direction were amazing. Machu Picchu is at an elevation of 7,792', and is surrounded by lush vegetation and soaring peaks. We climbed the peak in the back shrouded in clouds (Waynapicchu, elevation 8,752')

For those who want to hike the trail, I recommend Alpaca Expeditions (our lead guide, Yoel, was very knowledgeable and funny)!

For those who aren't excited by hiking, you can take the train to Agua Caliente, and the bus up the hill to Machu Picchu (we took the bus down and train back). There are many other things to see in Peru (like the colonial city of Cusco, Rainbow mountain and much more)

For those who aren't excited by hiking, you can take the train to Agua Caliente, and the bus up the hill to Machu Picchu (we took the bus down and train back). There are many other things to see in Peru (like the colonial city of Cusco, Rainbow mountain and much more)

The second photo is at the top of Dead Woman's Pass. This is the high point of the trail at 4,215 meters above sea level (about 13,800').

There are two high passes on the trail (both on Day 2), and on night 2 we slept at close to 13,000'.

This pass is named after a mountain formation that looks like a woman lying on her back, not because of some tragedy.

The third photo is of some ruins we passed along the way.

The third photo is of some ruins we passed along the way.

There are frequent Inka ruins along the trail; each amazing.

We had a great trip, and I'm looking forward to returning to Peru and South America.

Now back to blogging, Best to all.

Goldman: September Payrolls Preview

by Calculated Risk on 10/04/2018 03:03:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 175k in September, compared to consensus of +184k. While we believe the underlying pace of job growth likely accelerated from the +185k average pace this summer, our forecast reflects a temporary drag of around 33k from Hurricane Florence, which struck the Carolinas during the payroll reference week. ...CR: Note that Goldman is expecting Hurricane Florence to reduce employment by 33,000 in September.

We estimate the unemployment rate edged down one tenth to 3.8% … we expect average hourly earnings to increase 0.3% month over month in tomorrow’s report ... We estimate the year-on-year rate fell by two tenths to 2.7% ...

emphasis added

September Employment Preview

by Calculated Risk on 10/04/2018 01:01:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for an increase of 180,000 non-farm payroll jobs in September (with a range of estimates between 150,000 to 195,000), and for the unemployment rate to decline to 3.8%.

The BLS reported 201,000 jobs added in August.

Here is a summary of recent data:

• The ADP employment report showed an increase of 230,000 private sector payroll jobs in August. This was well above consensus expectations of 179,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in September to 58.8%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 30,000 in September. The ADP report indicated manufacturing jobs increased 7,000 in September.

The ISM non-manufacturing employment index increased in September to 62.4%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased significantly in September (this is a very high reading, and with the only other reading recently in this range, the BLS report only 139 thousand non-manufacturing jobs added).

Combined, the ISM indexes suggests employment gains of over 300,000. This suggests employment growth well above expectations.

• Initial weekly unemployment claims averaged 207,000 in September, down from 209,500 in July. For the BLS reference week (includes the 12th of the month), initial claims were at 202,000, down from 210,000 during the reference week in August.

The decrease during the reference week suggests a solid employment report in September. Note: Based on unemployment claims, it appears there will be little or no impact from Hurricane Florence on the employment report.

• The final September University of Michigan consumer sentiment index increased to 100.1 from the August reading of 96.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 234,000 in September, and this suggests employment growth above expectations.

• Looking back at the three previous years:

In September 2017, the consensus was for 100,000 jobs, and the BLS reported 33,000 jobs lost (Hurricane impacted and revised up later).

In September 2016, the consensus was for 168,000 jobs, and the BLS reported 156,000 jobs added.

In September 2015, the consensus was for 203,000 jobs, and the BLS reported 142,000 jobs added.

Even excluding September 2017 due to the hurricanes, it looks like the consensus is frequently too high for the month of September.

• Conclusion: These reports suggest a strong employment report in September. Only the previous history (last three years) would suggest a somewhat disappointing report. My guess is the report will be above expectations.

Reis: Regional Mall Vacancy Rate increased Sharply in Q3 2018

by Calculated Risk on 10/04/2018 11:59:00 AM

Reis reported that the vacancy rate for regional malls was 9.1% in Q3 2018, up from 8.6% in Q2 2018, and up from 8.3% in Q2 2017. This is down from a cycle peak of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.2% in Q3, unchanged from 10.2% in Q2, and up from 10.0% in Q3 2017. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

Following months of announcements, a number of Sears and Bon-Ton stores closed their doors in the third quarter pushing the mall vacancy rate to 9.1% from 8.6% in the second quarter and a low of 7.8% in the fourth quarter of 2016. It had earlier peaked at 9.4% in the third quarter of 2011.

The jump in vacancy does not account for a number of owner-occupied Sears and Bon-Ton stores that also closed but are not included in the Reis for-rent mall inventory. While we are tracking all of the closures, we only aggregate the stores that are for-lease in our vacancy and rent numbers.

The average rent at malls declined 0.3% to $43.25 per square foot in the third quarter. Rent growth had been sluggish over the last few quarters but had remained positive. In 10 years, the average mall rent has cumulatively grown 6.5% from $40.62 per square foot in Q3 2008, which was the peak rate in the last cycle.

For the neighborhood and community shopping center sector, the vacancy was unchanged at 10.2% after climbing 20 basis points in the second quarter from 10.0% where it had held steady for four straight quarters. The national average asking rent increased 0.4% in the third quarter as did the effective rent which nets out landlord concessions. At $21.11 per square foot (asking) and $18.48 per square foot (effective), the average rents have increased 1.7% and 1.8%, respectively, since the third quarter of 2017.

…

Conclusion

The third quarter saw the brunt of the big department store closings as the vacancy jumped due to Sears and Bon-Ton stores. Our numbers show that more owner-occupied Sears stores closed than for-lease stores which are accounted for in our statistics, yet more of the Bon-Ton stores that closed were leased and thus were included in our statistics. Only time will tell if the significant closings in the third quarter will affect other tenants in malls and shopping centers. Some landlords have indicated that they have redevelopment plans underway for these closed stores which could stave off further vacancies.

As for the neighborhood and community shopping center numbers, we had reported last quarter that most of the Toys “R” Us stores closed in the second quarter and that things would settle this quarter which proved to be accurate. We still believe that most of the negative net absorption is behind us. Although, we do not expect the vacancy rate to improve significantly in the near future, nor do we expect rent growth to increase above the lackluster rates seen over the last few quarters.

In short, the retail sector is still correcting. The growth of e-commerce has rendered a number of older retailers obsolete. Other retailers have survived only after developing an omni-channel approach to selling that includes an online presence. Proprietors that have added entertainment options and/or overhauled food and restaurant offerings to their properties have helped maintain foot traffic that their tenants need to survive. While there are a few new construction projects in the pipeline, a number of obsolete shopping centers have sold as development sites. We expect to see more conversions, demolitions and major renovations as this sector continues to adapt to the changes induced by e-commerce.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

Reis: Office Vacancy Rate unchanged in Q3 at 16.6%

by Calculated Risk on 10/04/2018 10:58:00 AM

Reis reported that the office vacancy rate was unchanged at 16.6% in Q3, from 16.6% in Q2 2018. This is up from 16.4% in Q3 2017, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

Defying employment trends, the U.S. office market was flat in the third quarter at 16.6%. Once again, leasing activity remains tepid compared to previous expansions. Net absorption, or occupancy growth, was 3.54 million square feet, up from 3.48 million square feet last quarter, but down from an average of 5.9 million square feet absorbed per quarter in 2017. New completions fell to 5.93 million square feet, down from an average of 11.2 million square feet added per quarter in 2017.

Rent growth had accelerated a bit earlier in the year but fell to 0.4% in the third quarter, down from 0.7% in the second quarter. Both the average asking rent and average effective rent (that nets out landlord concessions) grew at the same rate in the quarter as they did in the prior six quarters. This suggests that landlord concessions have seen little change over the last year. One year ago, the average asking and effective rent growth was also 0.4%. At $33.20 per square foot (asking) and $26.94 per square foot (effective), the average rents have increased 2.5% and 2.6%, respectively, since the third quarter of 2017.

...

The sluggishness in the office market is nothing new, but the deceleration contrasts an otherwise healthy economy as office employment growth has picked up in 2018 from rates seen in 2017 (1.8% in 2018 vs. 1.6% in 2017). The recent higher rent growth had suggested that landlords were gaining confidence in leasing conditions, but net absorption has persistently trailed new completions over the last seven quarters as tenants have been hesitant to take on added space which has kept a lid on rent growth.

The office market statistics still reflect the gap between the haves and the have-nots: larger markets in the West, South Atlantic and larger Northeast cities with healthy occupancy and rent growth offset by tepid growth or declines in smaller, suburban markets in the Midwest or in less densely populated areas. However, the numbers show that the gap is narrowing.

We still await the announcement of Amazon’s selection for its HQ2. Will the news come before Reis releases its fourth quarter statistics? Or will the suspense kill us all.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.6% in Q3. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased slightly recently.

Office vacancy data courtesy of Reis.

Reis: Apartment Vacancy Rate increased in Q3 to 4.8%

by Calculated Risk on 10/04/2018 09:49:00 AM

Reis reported that the apartment vacancy rate was at 4.8% in Q3 2018, up from 4.7% in Q2, and up from 4.4% in Q3 2017. This is the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment vacancy rate increased in the quarter to 4.8% from 4.7% last quarter and 4.4% in the third quarter of 2017. The vacancy rate has now increased 70 basis points from a low of 4.1% in Q3 2016.

The national average asking rent increased 1.2% in the third quarter while the average effective rent, which nets out landlord concessions, also increased 1.2%. At $1,424 per unit (market) and $1,356 per unit (effective), the average rents have increased 4.5% and 4.2%, respectively, from the third quarter of 2017.

Net absorption was 35,683 units, lower than the previous quarter’s absorption of 57,988 units and below the average quarterly absorption of 2017 of 46,685 units. Construction was 50,475 units, also below the second quarter’s 67,417 units and below the 2017 quarterly average of 61,535 units.

...

The apartment market had slowed at the end of 2017 and early 2018 as the housing market started to accelerate. However, the passing of the Tax Reform and Jobs Act in December that doubled the standard deduction and cut the deductibility of state and local taxes reduced the incentive to buy a home. This has helped the apartment market, especially in high-taxed localities.

We expect construction to remain robust for the rest of 2018 and in the first half of 2019 before completions drop off in subsequent periods. Occupancy is expected to remain positive, although vacancy rates are expected to increase, as new supply will outpace demand growth. Still, as long as job growth holds steady, we expect rent growth to remain positive over the next few quarters.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last several years. However, the vacancy rate has bottomed and is now increasing. With more supply coming on line - and less favorable demographics - the vacancy rate will probably continue to increase over the next year.

Apartment vacancy data courtesy of Reis.

Weekly Initial Unemployment Claims decreased to 207,000

by Calculated Risk on 10/04/2018 08:33:00 AM

The DOL reported:

In the week ending September 29, the advance figure for seasonally adjusted initial claims was 207,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 207,000, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 206,250 to 206,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 207,000.

This was lower than the the consensus forecast. The low level of claims suggest few layoffs.