by Calculated Risk on 10/08/2018 07:54:00 PM

Monday, October 08, 2018

Tuesday: Small Business Survey

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for September.

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 10/08/2018 02:08:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined further in September from the recent record highs, and are now down year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through October 5, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 12% from a year ago, and CME futures are also down 12% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Las Vegas Real Estate in September: Sales Down 16% YoY, Inventory up 33% YoY

by Calculated Risk on 10/08/2018 10:49:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices bounce back to hit $300,000 mark, GLVAR housing statistics for September 2018

After a sluggish summer, Southern Nevada home prices bounced back in September to hit $300,000 for the first time in more than 11 years, according to a report released today by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 15.9% year-over-year from 3,571 in September 2017 to 3,881 in August 2018.

...

The total number of existing local homes, condos and townhomes sold during September was 3,005. Compared to one year ago, September sales were down 16.4 percent for homes and down 13.4 percent for condos and townhomes.

...

For the first time in years, Bishop said Southern Nevada now has more than a two-month supply of existing homes available for sale. A six-month supply would be a more balanced market, he added. By the end of September, GLVAR reported 6,148 single-family homes listed for sale without any sort of offer. That’s up 23.7 percent from one year ago. For condos and townhomes, the 1,356 properties listed without offers in September represented a hefty 99.4 percent increase from one year ago.

...

The number of so-called distressed sales continues to drop. GLVAR reported that short sales and foreclosures combined accounted for just 2.5 percent of all existing local home sales in September, down from 5.2 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 5,649 in September 2017 to 7,504 in September 2018. Note: Total inventory was up 32.8% year-over-year. This is a significant change in inventory.

3) Fewer distressed sales.

Black Knight Mortgage Monitor for August

by Calculated Risk on 10/08/2018 08:37:00 AM

Black Knight released their Mortgage Monitor report for August today. According to Black Knight, 3.52% of mortgages were delinquent in August, down from 3.93% in August 2017. Black Knight also reported that 0.54% of mortgages were in the foreclosure process, down from 0.76% a year ago.

This gives a total of 4.06% delinquent or in foreclosure.

Press Release: Black Knight: 474,000 Mortgaged Properties in FEMA-Declared Disaster Areas

Resulting from Hurricane Florence; VA Loans Disproportionately Represented

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of August 2018. This month, in light of the devastating flooding experienced in North and South Carolina as a result of Hurricane Florence, Black Knight examined the potential mortgage-related impact that could follow. Looking at the 34 counties in those states declared disaster areas by the Federal Emergency Management Agency (FEMA) as of Sept. 28, and using last year’s hurricanes as a model, Black Knight’s analysis shows approximately 474,000 mortgaged properties in the impacted zone. As Ben Graboske, executive vice president of Black Knight’s Data & Analytics division explained, if the post-storm trajectory follows that of Hurricanes Harvey and Irma, thousands of Americans affected by Hurricane Florence could become past-due in the coming months.

“Although the situation in the Carolinas continues to evolve as we speak, we are beginning to get a sense of the potential scope of the storm’s impact from a mortgage performance aspect,” said Graboske. “As those affected by the storm begin recovery efforts, recent history suggests many will have some difficulty remaining current on their mortgages. Of the nearly 1.2 million properties in the 34 counties in the Carolinas thus far declared disaster areas by FEMA, approximately 474,000 have at least one mortgage. The majority – 80 percent – of these properties are in North Carolina, and account for more than 20 percent of the homes in that state. The remainder are in South Carolina. In general, while average home prices in these areas run $100,000 below the national average, they tend to be more heavily leveraged. Nationally, the average combined loan-to-value (CLTV) ratio is 51 percent, while in these FEMA-declared areas the average is 63 percent. As a whole, the area also had a higher-than-average delinquency rate of 4.4 percent going into the storm, as compared to the national average of 3.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor showing mortgage payment to income ratio.

From Black Knight:

• Interest rates hit 4.72% in the last week of September, a 7.5-year high [CR Note: Now above 5%]There is much more in the mortgage monitor.

• As of September, it now requires a $1,238 monthly P&I payment to purchase the average-priced home with a 20% down payment

• That marks a $168 increase to the average monthly payment since the start of the year

• The monthly payment needed to purchase the average home has risen by 16% so far in 2018, compared to just 3% for all of 2017, marking the fourth highest single year jump in 22 years, with 3 months still remaining in the year

• Factoring in income growth, it now requires 23.2% of median income to make the monthly payments on the average home purchase, up from 20.9% entering the year

• This is the first time the payment-to-income ratio has breached the 23% mark since August 2009, although it is still more affordable than the long-term average (1995-2003) of 25%

Sunday, October 07, 2018

Sunday Night Futures

by Calculated Risk on 10/07/2018 07:30:00 PM

Weekend:

• Schedule for Week of October 7, 2018

Monday:

• Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 40 (fair value).

Oil prices were up over the last week with WTI futures at $74.08 per barrel and Brent at $83.71 per barrel. A year ago, WTI was at $50, and Brent was at $55 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.91 per gallon. A year ago prices were at $2.47 per gallon, so gasoline prices are up 44 cents per gallon year-over-year.

Catching Up: Construction Spending increased 0.1% in August

by Calculated Risk on 10/07/2018 12:59:00 PM

Earlier - while I was hiking in Peru - the Census Bureau reported that overall construction spending increased slightly in August:

Construction spending during August 2018 was estimated at a seasonally adjusted annual rate of $1,318.5 billion, 0.1 percent above the revised July estimate of $1,317.4 billion. The August figure is 6.5 percent (±2.0 percent) above the August 2017 estimate of $1,237.5 billion.Private spending decreased and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $1,001.7 billion, 0.5 percent below the revised July estimate of $1,006.9 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $316.7 billion, 2.0 percent above the revised July estimate of $310.5 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined slightly recently - and is still 19% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 3% below the peak in March 2009, and 21% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 4%. Non-residential spending is up 5% year-over-year. Public spending is up 14% year-over-year.

This was another disappointing construction spending report, especially for residential (although public spending has picked up recently).

Saturday, October 06, 2018

Schedule for Week of October 7, 2018

by Calculated Risk on 10/06/2018 08:11:00 AM

The key economic report this week is the September Consumer Price Index (CPI).

Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

6:00 AM: NFIB Small Business Optimism Index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 207 thousand the previous week.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for October).

Friday, October 05, 2018

AAR: September Rail Carloads Up 2.6% YoY, Intermodal Up 6.2% YoY

by Calculated Risk on 10/05/2018 05:33:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Weakness in a few commodity categories notwithstanding, rail traffic in September 2018 was consistent with the economy we have today in which fundamentals like industrial output and consumer spending are solid. Total U.S. carloads were up 2.6%, or 26,826 carloads, in September 2018 over September 2017, their seventh straight year-over-year increase.

…

Intermodal volume in September was up 6.2%, their 20th straight monthly increase. The last two weeks of September 2018 were the two highest-volume U.S. intermodal weeks in history.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,066,826 carloads in September 2018, up 2.6%, or 26,826 carloads, over September 2017 and the seventh straight year-over-year monthly increase for total carloads. Carloads averaged 266,707 per week in September 2018, the most for September since 2015.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):September 2018 was another good month for intermodal, with total container and trailer originations totaling 1,127,385 — up 6.2%, or 65,801 units, over September 2017. Average weekly intermodal volume in September 2018 was 281,846 units, easily an all-time record for September.2018 will be another record year for intermodal traffic.

Q3 GDP Forecasts

by Calculated Risk on 10/05/2018 03:51:00 PM

From Merrill Lynch:

We continue to track 3Q GDP at 3.7% qoq saar as stronger than expected vehicle sales were offset by weaker core capital goods shipments [Oct 5 estimate].From Goldman Sachs:

emphasis added

We boosted our Q3 GDP tracking estimate by two tenths to +3.3% (qoq ar) [Oct 5 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.1 percent on October 5, unchanged from October 1. [Oct 5 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.3% for 2018:Q3 and 2.8% for 2018:Q4. [Oct 5 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

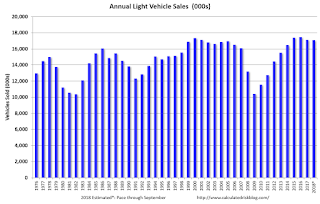

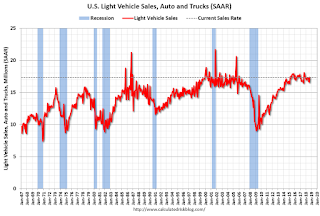

Annual Vehicle Sales: On Pace to decline in 2018

by Calculated Risk on 10/05/2018 02:37:00 PM

The BEA released their estimate of September vehicle sales. The BEA estimated sales of 17.36 million SAAR in September 2018 (Seasonally Adjusted Annual Rate), up 4.5% from the August sales rate, and down 4.0% from September 2017 (Sales in September 2017 were strong following the hurricanes).

Through September, light vehicle sales are on pace to be down slightly in 2018 compared to 2017.

This would make 2018 the sixth best year on record after 2016, 2015, 2000, 2017 and 2001.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first nine months.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

My guess is vehicle sales will finish the year with sales lower than in 2017 (sales in late 2017 were boosted by buying following the hurricanes), and will probably be at or below 17 million for the year (the lowest since 2014).

A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).