by Calculated Risk on 10/10/2018 07:02:00 PM

Wednesday, October 10, 2018

Thursday: CPI, Unemployment Claims and 2019 COLA

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 207 thousand the previous week.

• At 8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

Note: Following the CPI release, Social Security will announce the 2019 cost-of-living adjustment (COLA) and 2019 contribution base (currently $128,400 in 2018).

"Inequality in and across Cities"

by Calculated Risk on 10/10/2018 05:55:00 PM

An interesting article by Jessie Romero and Felipe F. Schwartzman at the Richmond Fed: Inequality in and across Cities

Inequality in the United States has an important spatial component. More-skilled workers tend to live in larger cities where they earn higher wages. Less-skilled workers make lower wages and do not experience similar gains even when they live in those cities. This dynamic implies that larger cities are also more unequal. These relationships appear to have become more pronounced as inequality has increased. The evidence points to externalities among high-skilled workers as a significant contributor to those patterns.

Houston Real Estate in September: "Market Cools"

by Calculated Risk on 10/10/2018 02:47:00 PM

From the HAR: The Houston Housing Market Cools in September

After a sizzling summer of home sales and rentals, the Houston housing market cooled in September, showing no apparent lingering effects of Hurricane Harvey as it did in August.Another market with sales down and inventory up.

According to the latest monthly report from the Houston Association of REALTORS® (HAR), 6,548 single-family homes sold in September compared to 6,953 a year earlier. That represents a 5.8-percent decline. On a year-to-date basis, however, home sales are running 5.6 percent ahead of 2017’s record volume.…

...

September sales of all property types totaled 7,842, a 4.4-percent decrease over the same month last year.

...

Total active listings, or the total number of available properties, climbed 5.7 percent to 41,560.

emphasis added

Seattle Real Estate in September: Sales Down 29% YoY, Inventory up 78% YoY

by Calculated Risk on 10/10/2018 12:46:00 PM

The Northwest Multiple Listing Service reported Balance "finally returning" to housing market as buyers welcome more choices, moderating prices (ht Tom Lawler)

Housing inventory continued to improve during September while the pace of sales slowed in many counties served by Northwest Multiple Listing Service. "Balance is finally returning to the market, and with it, slowing home price growth," stated OB Jacobi, president of Windermere Real Estate.This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 2.8 months.

A new report from Northwest MLS shows double-digit increases in inventory in several of the 23 counties it serves, led by a 78 percent year-over-year gain in King County. Despite improving selection in the central Puget Sound region, a dozen counties reported drops in the number of active listings compared to last year.

System-wide, the month ended with 2.56 months of supply of single family homes and condos, well below the 4-to-6 months analysts use as an indicator of a balanced market between sellers and buyers. The current level is the highest since February 2015 when member-brokers reported 3.56 months of inventory. In King County, supply exceeded two months for the first time since January 2015.

…

Closed sales also reflected slower activity. Members reported 7,630 completed transactions during September, down 18.6 percent from the year-ago volume of 9,371. Through nine months, this year's closings are down 4.4 percent compared to 2017. [King County sales down 28.5% YoY]

emphasis added

Investment and Recessions

by Calculated Risk on 10/10/2018 10:10:00 AM

By request, here is an update to a previous post …

Twelve years ago I wrote Investment and Recessions, explaining the usefulness of New Home Sales as a leading indicator.

Here are some updated graphs. My view is new home sales and housing starts are two of the best leading indicators for the economy (but not always).

The first graph shows the change in real GDP and Private Fixed Investment over the preceding four quarters, shaded areas are recessions. (Source: BEA)

A couple of observations:

1) Since 1948, private fixed investment has fallen during every economic recession.

2) Private fixed investment has fallen 14 times since 1948, with only 11 recessions.

So what happened during the periods around 1951, 1967 and 1986 to keep the economy out of recession? These are the periods when private investment fell, but the economy didn't slide into recession. The answer is generally the same for all three periods: a surge in defense spending. The defense spending in the early '50s was due to the Korean war, in the mid '60s the Vietnam war, and in the mid '80s a general defense build-up helped offset a small decline in private investment. The mid '80s also saw a surge in MEW (mortgage equity withdrawal) that also contributed to GDP growth.

This graph shows something very interesting: in general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble.

But the most useful information is that typically recessions are preceded by declines in residential investment. Maybe we can use that information.

Note: the New Home Sales NSA data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. The one exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As noted earlier, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Conclusions:

1) New Home Sales appears to be an excellent leading indicator.

2) Currently new home sales (and housing starts) are up year-over-year, and this suggests there is no recession in sight.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 10/10/2018 07:00:00 AM

From the MBA: Mortgage Applications Decline in Latest MBA Weekly Survey

Mortgage applications decreased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 5, 2018

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since February 2011, 5.05 percent, from 4.96 percent, with points increasing to 0.51 from 0.49 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, October 09, 2018

Mortgage Rates Hold Above 5%

by Calculated Risk on 10/09/2018 06:08:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Improve Slightly Today, But Risks Remain

Mortgage rates recovered a small portion of their recent losses today, but the average loan applicant might not even notice. The 2 key ingredients of a mortgage rate (for the purposes of tracking their movement) are the rate itself (the "note rate") and the upfront costs tied to that rate. The note rate and associated costs make up what many refer to as an "effective rate" (a number, expressed in interest rate form, that adjusts the actual note rate based on the implications of upfront cost changes.Wednesday:

It takes big market movement to change note rates, largely because lenders tend to offer rates in 0.125% increments. As such, bond yields such as 10yr Treasuries need to be moving by about that much in order to see a similar change in mortgage rates. That was the case last week as 10yr yields moved up nearly 0.25% in just a few days last week. The average mortgage lender also moved up 0.25% on 30yr fixed rate quotes.

If rates took the elevator up, they're taking the stairs down. Most borrowers will see a small adjustment toward lower upfront costs with the same interest rate they would have seen on Friday afternoon. [30YR FIXED - 5.0-5.125%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for September from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

Q3 Review: Ten Economic Questions for 2018

by Calculated Risk on 10/09/2018 12:41:00 PM

At the end of last year, I posted Ten Economic Questions for 2018. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2018 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q3 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.There isn't any clear evidence of an impact from the new tax law, although many areas are now seeing a year-over-year increase in inventory - and that suggests that price growth will slow.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

9) Question #9 for 2018: Will housing inventory increase or decrease in 2018?

I was wrong on inventory last year (and the previous year), but right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent changes to the tax law.According to the August NAR report on existing home sales, inventory was up 2.7% year-over-year in August, and the months-of-supply was at 4.3 months. Some areas, like Las Vegas, are reporting inventory up sharply year-over-year in September. It appears inventory will be up year-over-year this year.

8) Question #8 for 2018: What will happen with house prices in 2018?

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.If is early, but the CoreLogic data released last week showed prices up 5.5% year-over-year in August. This was the slowest appreciation in nearly two years. It appears likely that price appreciation will slow as expected.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

7) Question #7 for 2018: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.Through August, starts were up about 7% year-over-year compared to the same period in 2017, and on pace for about 1.3 million this year. New home sales were also up about 7% year-over-year and on pace for about 640 thousand in 2018.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

6) Question #6 for 2018: How much will wages increase in 2018?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.Through September 2018, nominal hourly wages were up 2.8% year-over-year. This is slightly faster than last year, and it appears wages will increase at a slightly faster rate in 2018 than in 2017.

5) Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

My current guess is the Fed will hike three times in 2018.The Fed has already hiked three times in 2018, and it now appears there will be four hikes this year.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

4) Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.As of August, inflation has moved up to the Fed's target.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

3) Question #3 for 2018: What will the unemployment rate be in December 2018?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the high 3's by December 2018 from the current 4.1%. My guess is based on the participation rate declining about 0.2 percentage points in 2018, and for decent job growth in 2018, but less than in 2017.The unemployment rate was at 3.7% in September.

2) Question #2 for 2018: Will job creation slow further in 2018?

So my forecast is for gains of around 150,000 to 167,000 payroll jobs per month in 2018 (about 1.8 million to 2.0 million year-over-year) . Lower than in 2017, but another solid year for employment gains given current demographics.Through September 2018, the economy has added 1,875,000 thousand jobs, or 208,000 per month. This is above my forecast, and it appears the economy will add more jobs in 2018 than in 2017 although still below gains for the years 2014 through 2015.

1) Question #1 for 2018: How much will the economy grow in 2018?

It is possible that there will be a pickup in growth in 2018 due to a combination of factors.GDP growth was at 2.2% in Q1, and 4.2% in Q2. Most estimates suggest growth in the mid to high 3s in Q3. This would put GDP growth in the low 3s through Q3.

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

Currently it looks like 2018 is unfolding about as expected, although, employment gains will be somewhat higher than I originally expected.

Fannie Mae: Mortgage Serious Delinquency rate decreased in August, Lowest since Sept 2007

by Calculated Risk on 10/09/2018 10:26:00 AM

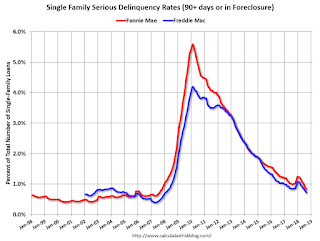

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 0.82% in August, down from 0.88% in July. The serious delinquency rate is down from 0.99% in August 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency for Fannie Mae since September 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.71% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.74% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.34% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Small Business Optimism Index decreased slightly in September

by Calculated Risk on 10/09/2018 08:25:00 AM

CR Note: Most of this survey is ideological noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): September 2018 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index continued its historic 23-month positive trend, with a reading of 107.9 in September, the third highest reading in the survey’s 45-year history.

..

A record net 37 percent of owners reported raising overall compensation, as reported in last week’s NFIB monthly jobs report. This surpasses the previous record of a net 35 percent in May 2018. Twenty-four percent plan to increase total compensation at their firm and six percent plan reductions. Sixty-one percent of owners reported hiring or trying to hire, with 87 percent of those reporting few or no qualified workers. Thirty-eight percent of owners reported job openings they could not fill in the current period, unchanged from last month.

…

Twenty-two percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, down 3 points but historically very high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 107.9 in September.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.