by Calculated Risk on 10/16/2018 03:01:00 PM

Tuesday, October 16, 2018

Update: Real Estate Agent Boom and Bust

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 28% from the peak, and is increasing again (up 8.6% from low). The number of salesperson's licenses has increased to September 2004 levels.

Brokers' licenses are off 14.1% from the peak and have fallen to December 2005 levels, and are still slowly declining (down 1% year-over-year).

We are seeing a pickup in Real Estate licensees in California, although the number of Brokers is still declining.

BLS: Job Openings "reached a series high of 7.1 million" in August

by Calculated Risk on 10/16/2018 10:17:00 AM

Notes: In August there were 6.939 million job openings, and, according to the August Employment report, there were 6.234 million unemployed. So, for the fifth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015.

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings reached a series high of 7.1 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.8 million and 5.7 million, respectively. Within separations, the quits rate was unchanged at 2.4 percent and the layoffs and discharges rate was little changed at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in August at 3.6 million. The quits rate was 2.4 percent. The number of quits was little changed for total private and for government. Quits increased in wholesale trade (+24,000) but decreased in professional and business services (-82,000). The number of quits was little changed in all four regions.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in August to 7.136 million from 7.077 million in July.

The number of job openings (yellow) are up 18% year-over-year.

Quits are up 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a series high (started in 2001), and quits are increasing year-over-year. This was a strong report.

NAHB: Builder Confidence increased to 68 in October

by Calculated Risk on 10/16/2018 10:06:00 AM

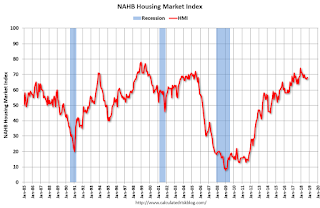

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in October, up from 67 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Rises One Point in October, Remains at Summer Levels

Builder confidence in the market for newly-built single-family homes rose one point to 68 in October on the NAHB/Wells Fargo Housing Market Index (HMI). Builder confidence levels have held in the high 60s since June.

“Builders are motivated by solid housing demand, fueled by a growing economy and a generational low for unemployment,” said NAHB Chairman Randy Noel. “Builders are also relieved that lumber prices have declined for three straight months from elevated levels earlier this summer, but they need to manage supply-side costs to keep home prices affordable.”

“Favorable economic conditions and demographic tailwinds should continue to support demand, but housing affordability has become a challenge due to ongoing price and interest rate increases,” said NAHB Chief Economist Robert Dietz. “Unless housing affordability stabilizes, the market risks losing additional momentum as we head into 2019.”

...

The HMI index measuring current sales conditions rose one point to 74 and the component gauging expectations in the next six months increased a single point to 75. Meanwhile, the metric charting buyer traffic registered a four-point uptick to 53.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose three points to 57 and the South edged up one point to 71. The West held steady at 74 and the Midwest fell two points to 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was slightly above the consensus forecast, and a solid reading.

Industrial Production Increased 0.3% in September

by Calculated Risk on 10/16/2018 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

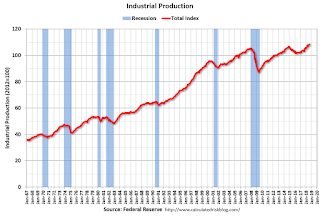

Industrial production increased 0.3 percent in September, about the same rate of change as in the previous two months. Output growth in September was held down slightly by Hurricane Florence, with an estimated effect of less than 0.1 percentage point. For the third quarter as a whole, total industrial production advanced at an annual rate of 3.3 percent. In September, manufacturing output moved up 0.2 percent for its fourth consecutive monthly increase, while the output of utilities was unchanged. The index for mining increased 0.5 percent and has moved up in each of the past eight months. At 108.5 percent of its 2012 average, total industrial production was 5.1 percent higher in September than it was a year earlier. Capacity utilization for the industrial sector was unchanged at 78.1 percent, a rate that is 1.7 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is 1.7% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 108.5. This is 24.6% above the recession low, and 3% above the pre-recession peak.

The increase in industrial production was slightly above the consensus forecast - however capacity utilization was below consensus.

Monday, October 15, 2018

Tuesday: Industrial Production, Job Openings, Homebuilder Survey

by Calculated Risk on 10/15/2018 06:28:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Stay Steady, Waiting For a Sign

Mortgage rates were sideways to slightly higher today, prolonging a 3-day trend of exceptionally light volatility. The 5 days before that (beginning on Wednesday, October 3rd) were completely different, with a huge move higher at first followed by a moderate recovery at the beginning of last week. That recovery largely followed the stock market weakness. [30YR FIXED - 5.0%]Tuesday:

emphasis added

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

• At 10:00 AM, The October NAHB homebuilder survey. The consensus is for a reading of 67, unchanged from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings increased in July to 6.939 million from 6.822 million in June. The number of job openings were up 12% year-over-year in July, and Quits were up 1% year-over-year.

LA area Port Traffic in September

by Calculated Risk on 10/15/2018 01:02:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.2% compared in September to the rolling 12 months ending in August. Outbound traffic was up 0.4% compared to the rolling 12 months ending in August.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 6 or 7 years.

It is still too early to tell about the impact of the tariffs.

House Prices and Inventory

by Calculated Risk on 10/15/2018 11:27:00 AM

This is an interesting year for housing. With rising mortgage rates (now above 5%), the tax changes, and immigration and trade policies, a key question is: What will be the impact on housing?

The answer is no one knows for sure. It is difficult to measure demand directly, but inventory is fairly easy to track. Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

I don't have a crystal ball, but watching inventory helps understand the housing market. And it appears inventory is increasing nationally, and increasing sharply in some areas (although still somewhat low historically). For example:

• Seattle Real Estate in September: Sales Down 29% YoY, Inventory up 78% YoY

• Las Vegas Real Estate in September: Sales Down 16% YoY, Inventory up 33% YoY

• Houston Real Estate in September: "Market Cools"

• Sacramento Housing in September: Sales Down 15.5% YoY, Active Inventory up 23% YoY

Note: I'm trying to gather data for other areas.

This graph below shows existing home months-of-supply (from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999).

There is a clear relationship, and this is no surprise (but interesting to graph).

If months-of-supply is high, price decline. If months-of-supply is low, prices rise.

For August, the NAR reported months-of-supply at 4.3 months. Based on recent reports, I expect months-of-supply to increase further in September (the NAR is scheduled to release September data this week). Based on the historical relationship, months-of-supply could increase 50% before house prices start declining.

Retail Sales increased 0.1% in September

by Calculated Risk on 10/15/2018 08:42:00 AM

On a monthly basis, retail sales increased 0.1 percent from August to September (seasonally adjusted), and sales were up 6.6 percent from August 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2018, adjusted for seasonal variation and holiday and trading‐day differences, but not for price changes, were $509.0 billion, an increase of 0.1 percent from the previous month, and 4.7 percent above September 2017.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.The increase in September was well below expectations, and sales in July and August were revised down.

Sunday, October 14, 2018

Monday: Retail Sales, NY Fed Mfg Survey

by Calculated Risk on 10/14/2018 09:08:00 PM

Weekend:

• Schedule for Week of October 14, 2018

Monday:

• At 8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.6% increase in retail sales.

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 19.3, up from 19.0.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 6 and DOW futures are down 53 (fair value).

Oil prices were down over the last week with WTI futures at $72.26 per barrel and Brent at $81.70 per barrel. A year ago, WTI was at $51, and Brent was at $57 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.88 per gallon. A year ago prices were at $2.46 per gallon, so gasoline prices are up 42 cents per gallon year-over-year.

Sacramento Housing in September: Sales Down 15.5% YoY, Active Inventory up 23% YoY

by Calculated Risk on 10/14/2018 11:40:00 AM

From SacRealtor.org: September 2018 Statistics – Sacramento Housing Market – Single Family Homes, September sees sales dip 21%, inventory continues rise

The month ended with 1,318 sales, a 21.4% decrease from the 1,676 sales of August. Compared to September last year (1,560), the current figure is a 15.5% decrease. Of the 1,318 sales this month, 183 (13.9%) used cash financing, 800 (60.7%) used conventional, 225 (17.1%) used FHA, 75 (5.7%) used VA and 35 (2.7%) used Other† types of financing.CR Note: Inventory is still low - months of inventory is at 2.5 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory continued an upwards trend, increasing 2.2% month-to-month, from 3,167 to 3,236 units [Up 23% YoY]. The Months of Inventory followed, increasing from 1.9 to 2.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart to the right reflects the Months of Inventory in each price range.

...

The Average DOM (days on market) continued its increase, rising from 24 to 26 from August to September. The Median DOM also increased, rising from 14 to 15. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,318 sales this month, 71.5% (943) were on the market for 30 days or less and 89.2% (1,176) were on the market for 60 days or less.

emphasis added