by Calculated Risk on 10/23/2018 07:00:00 PM

Tuesday, October 23, 2018

Wednesday: New Home Sales, Beige Book

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for August 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for 625 thousand SAAR, down from 629 thousand in August.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

"Mortgage Rates Barely Budge Despite Market Volatility"

by Calculated Risk on 10/23/2018 05:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Barely Budge Despite Market Volatility

Mortgage rates didn't move much for the second day this week. Unlike yesterday, there was a relatively massive amount of volatility in underlying financial markets. This was especially true for stocks and the US Treasury market (which sets the tone for the broader bond market where mortgages operate). Even if we look specifically at mortgage-backed securities (MBS), we see some of the best gains this month.

In fact, mortgage rates likely would have ended the day with more noticeable improvement if the gains had remained intact. Unfortunately, the strength began to erode in the late morning hours. Bonds had benefited from massive stock losses, but starting just after 10am, stocks began to bounce back while bonds weakened (weaker bonds = higher rates). Momentum kicked into higher gear later in the day and several lenders who had offered decent improvements this morning were forced to recall rates sheets and reissue new, higher rates.

The net effect is that the average lender is now showing only modestly lower rates compared to yesterday's latest offerings. Like yesterday the change is only measurable in terms of upfront costs. Actual NOTE rates are unchanged (lower upfront costs imply lower "effective rates"). [30YR FIXED - 5.0%]

emphasis added

Quarterly Housing Starts by Intent

by Calculated Risk on 10/23/2018 11:52:00 AM

Here is a graph I haven't updated in some time. From the Census Bureau "Started and Completed by Purpose of Construction" through Q2 2018.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 8% in Q2 2018 compared to Q2 2017.

Owner built starts were unchanged year-over-year. And condos built for sale not far above the record low, but up 11% compared to Q2 2017.

The 'units built for rent' (blue) had increased significantly following the great recession, but are now moving mostly sideways.

Richmond Fed: "Fifth District Manufacturing Activity Expanded Moderately in October"

by Calculated Risk on 10/23/2018 10:04:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Expanded Moderately in October

Fifth District manufacturing activity expanded moderately in October, according to the results from the most recent survey by the Federal Reserve Bank of Richmond. The composite index fell from 29 in September to 15 in [October], as indexes for shipments and new orders dropped, while the third component, employment, rose. However, survey respondents were optimistic, expecting to see positive growth across most measures in the coming months.Still solid, but slower growth in October.

While the employment index rose in October, the indexes for wages and workweek dropped but remained positive, indicating continued but weaker growth. Firms were unable to find workers with skills they needed, as the skills index dropped to an all-time low of −22. Respondents expect this struggle to continue in the next six months.

emphasis added

Monday, October 22, 2018

California: "California Housing Market Experiencing Shift as Home Sales Continue Descent in September"

by Calculated Risk on 10/22/2018 05:49:00 PM

The CAR reported: California Housing Market Experiencing Shift as Home Sales Continue Descent in September

The California housing market posted its largest year-over-year sales decline since March 2014 and remained below the 400,000-level sales benchmark for the second consecutive month in September, indicating that the market is slowing as many potential buyers put their homeownership plans on hold, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Notice inventory is really increasing year-over-year in California.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 382,550 units in September, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

September's sales figure was down 4.3 percent from the revised 399,600 level in August and down 12.4 percent compared with home sales in September 2017 of 436,920.

"The housing market continued to deteriorate and the decline in sales worsened as interest rates remained on an upward trend. More would-be buyers are self-sidelining as they believe home prices will start to come down soon, making housing more affordable despite rising interest rates," said C.A.R. President Steve White. "Tax reform, which increases the cost of homeownership, also is contributing to the decline, especially in high-cost areas such as the San Francisco Bay Area and Orange County."

...

Statewide active listings rose for the sixth consecutive month following 33 straight months of declines, increasing 20.4 percent from the previous year. September's listings increase was the biggest in nearly four years.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

NMHC: Apartment Market Tightness Index remained negative for 12th Consecutive Quarter

by Calculated Risk on 10/22/2018 03:35:00 PM

The National Multifamily Housing Council (NMHC) released their October report: October Apartment Market Conditions Experience Headwinds

The Market Tightness Index was below 50 (looser conditions) for the 12th consecutive month. The Index came in at 41 in October.

This index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. And it also helped me call the bottom in vacancy rate more recently.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

This is the twelfth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

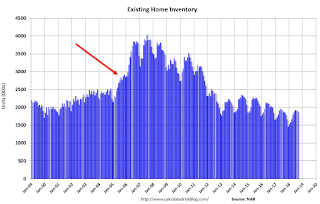

Housing Inventory Tracking

by Calculated Risk on 10/22/2018 10:02:00 AM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 1.1% year-over-year (YoY) in September, this the second consecutive YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento, and Phoenix (through September) and total existing home inventory as reported by the NAR (also through September). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 33% YoY in Las Vegas in September (red), the third consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 6% year-over-year in Houston in September.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still to be somewhat low).

Also note that inventory in Seattle was up 78% year-over-year in September (not graphed)!

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year like in 2005).

So the current increase in inventory is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble.

Also inventory is still very low. In cities like Las Vegas and Sacramento, inventory has finally moved above 2 months supply - but still historically low.

Chicago Fed "Index Points to a Moderation in Economic Growth in September"

by Calculated Risk on 10/22/2018 08:39:00 AM

From the Chicago Fed: Index Points to a Moderation in Economic Growth in September

The Chicago Fed National Activity Index (CFNAI) decreased to +0.17 in September from +0.27 in August. Two of the four broad categories of indicators that make up the index decreased from August, but three of the four categories made positive contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, moved down to +0.21 in September from +0.27 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in September (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, October 21, 2018

Sunday Night Futures

by Calculated Risk on 10/21/2018 08:09:00 PM

Weekend:

• Schedule for Week of October 21, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 11 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $69.25 per barrel and Brent at $79.87 per barrel. A year ago, WTI was at $52, and Brent was at $58 - so oil prices are up about 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.44 per gallon, so gasoline prices are up 40 cents per gallon year-over-year.

Hotels: Occupancy Rate Declined Slightly Year-over-year

by Calculated Risk on 10/21/2018 09:17:00 AM

From HotelNewsNow.com: US hotel results for week ending 13 October

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 7-13 October 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 8-14 October 2017, the industry recorded the following:

• Occupancy: -0.7% to 71.9%

• Average daily rate (ADR): +1.6% to US$132.76

• Revenue per available room (RevPAR): +0.8% to US$95.42

…

Due to difficult-to-match year-over-year comparisons, Houston, Texas, experienced the steepest declines in occupancy (-25.0% to 63.9%) and RevPAR (-31.3% to US$67.70). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes. There will be some boost to hotel occupancy in the Carolina and Florida regions following hurricanes Florence and Michael, but I expect the overall occupancy to be lower in 2018 than in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com